2 Easy Investing Tips from Theodore Johnson’s Straightforward Stock Market Strategy

Simplify your stock market investment approach with this famous U.P.S. worker’s simple strategy.

Photo by Bruno Martins on Unsplash

Theodore Johnson was a retired U.P.S. employee who managed to amass significant wealth through disciplined investing.

Despite earning a modest salary, Johnson taxed himself 20% of every paycheck and invested the funds in U.P.S. stock, his only investment.

Throughout his life, Johnson’s wealth grew to over $700,000, and he donated over $36 million to education-related causes upon his death.

Johnson’s story teaches two key lessons: the importance of “paying yourself first” and the value of “delayed gratification.”

By consistently setting aside a portion of his income and investing it wisely, Johnson built significant wealth over time.

His story also demonstrates the value of staying disciplined and focused on long-term goals, even when faced with tempting opportunities to spend or invest in other ways.

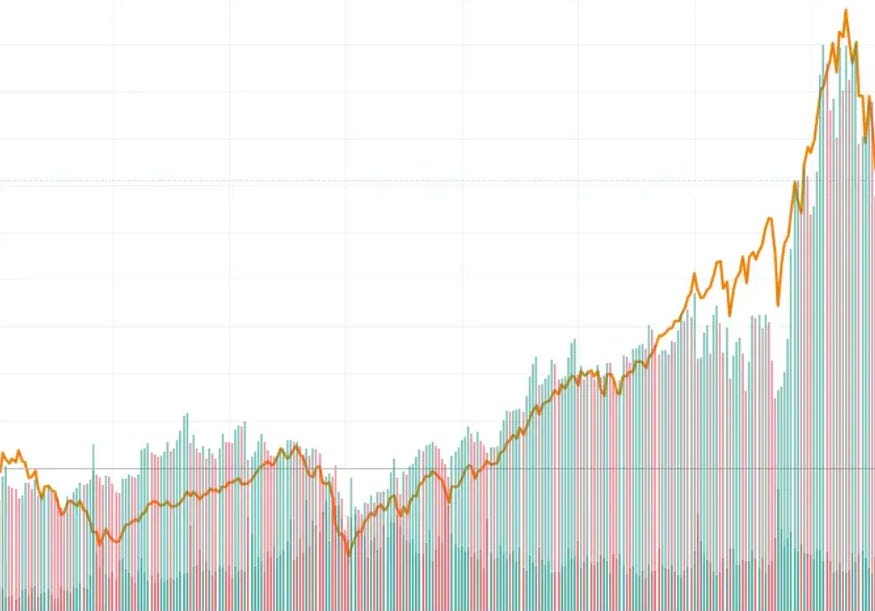

U.P.S. went public in 1999, six years after Johnson passed away. Since then, the company’s stock price and the S&P 500 have steadily grown.

It is unclear what Johnson’s estate is worth today, but it will likely be more than $70 million.

The orange line on the chart represents the S&P 500, while the candle chart shows the performance of U.P.S. stock from 1999 to 2022.

Theodore Johnson accumulated significant wealth through his disciplined investing strategy and left a lasting legacy through charitable donations.

By consistently setting aside a portion of his income and investing it in something he understood and believed in, Johnson could achieve financial success and fulfil his desire to help others.

Theodore Johnson:

“I wanted to do something with the money to help with education as so many kids can’t go to college, and I wanted to do something to help the deaf too.”

Johnson’s story inspires those looking to build wealth and positively impact the world.

Tip 1 — Pay Yourself First

“Pay yourself first” is a personal finance strategy that involves setting aside a portion of your income for savings or investment before covering your monthly expenses.

This approach, often implemented through automated transfers into a savings or investment account, can help you build a financial cushion and protect yourself against unexpected costs.

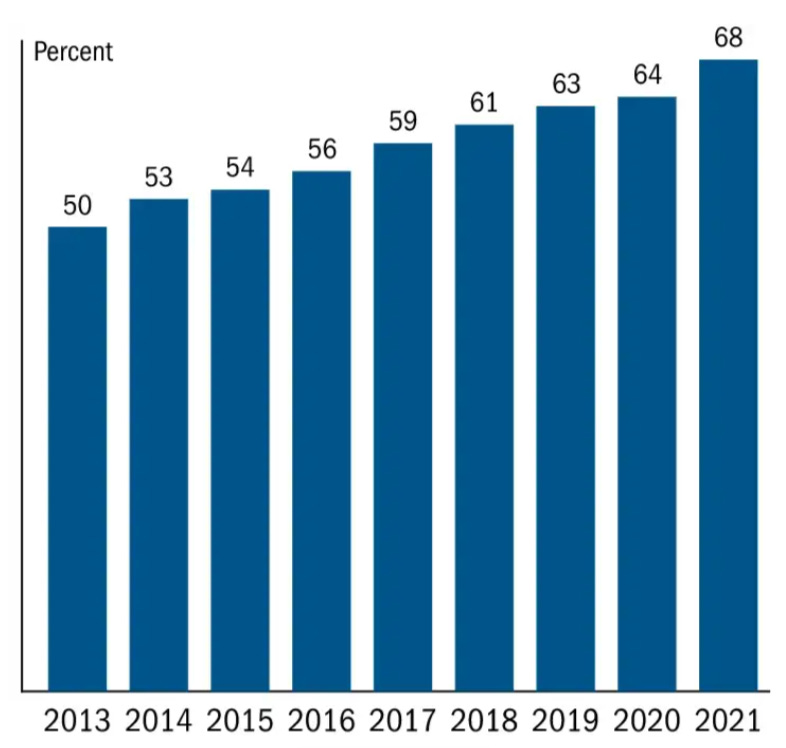

Research shows that as of 2021, only 68% of Americans follow this strategy and can cover a $400 emergency in cash without relying on borrowing.

However, a significant minority cannot cover such an expense, often relying on credit cards, loans, or support from family members.

The “pay yourself first” approach can help increase your savings and investing consistency, enabling you to build wealth over time.

Tip 2 — Delayed Gratification

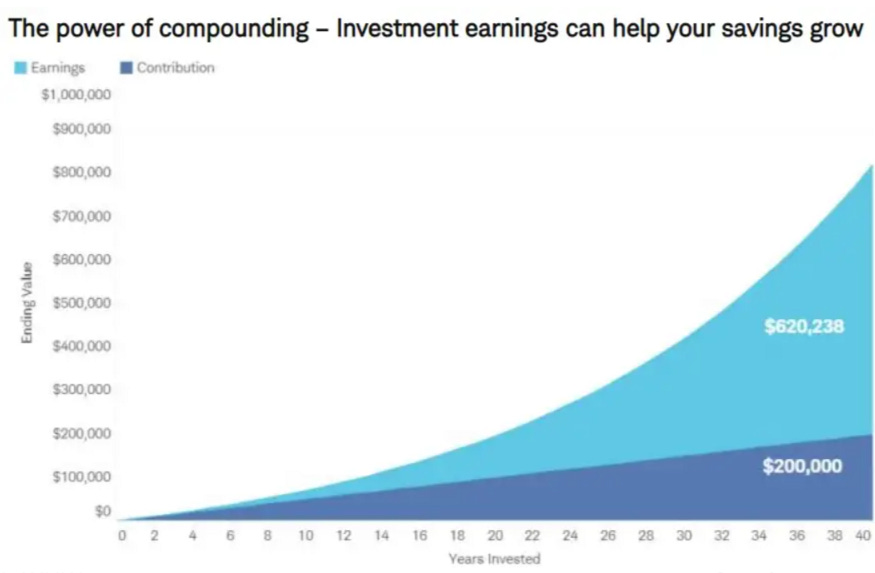

Delayed gratification played a crucial role in Johnson’s ability to take advantage of compound interest and build significant wealth over time.

By reinvesting the dividends from his U.P.S. stock and continuing to set aside 20% of his salary, even after receiving raises, Johnson was able to compound his investments and grow his wealth.

The compounding effect occurred when the initial investment and the income earned grow together, creating a snowball effect that can produce significant returns over time.

The “Rule of 72” can be used to estimate how long it will take for your savings or dividend income to double your original capital.

For example, if your investments return 11% annually, it will take approximately 6.5 years to double your investment.

The chart below illustrates the potential impact of consistent investing over 40 years, assuming a hypothetical interest rate of 6% per year and excluding taxes and fees.

In this scenario, investing $5,000 per year for 40 years would total $620,238.

Final Thoughts

Some may question the value of accumulating considerable wealth if you don’t spend it. However, Johnson’s story illustrates the potential benefits of a disciplined approach to saving and investing.

By consistently setting aside a portion of his income and reinvesting it, Johnson built significant wealth over time. While his method may not be suitable for everyone, Johnson’s story shows what is possible by paying yourself first and delaying gratification.

This strategy can provide an emotional cushion of savings to fall back on in times of need. Managing your money is up to you and should be based on your individual goals and circumstances.

One potential counterargument to Johnson’s investing strategy is that he lacked diversification in his portfolio.

By investing only in U.P.S. stock, Johnson put all his eggs in one basket and did not spread his investments across multiple asset classes or industries.

In contrast, a diversified portfolio would have been better able to withstand a decline in the company’s financial performance or changes in the broader economy affecting the transportation industry.

Diversifying could have provided more consistent returns over time.

Investing in a range of asset classes and industries can help smooth out the effects of market fluctuations, reducing the impact of short-term volatility on your investments.

While Johnson’s approach to investing may have been successful, a more diversified portfolio may be a better option for many investors.

Paying yourself first and delaying gratification are sound principles, but it’s essential to consider the potential risks of investing in a single company or asset class.