3 BlackRock Analyst's Quietly Released a Paper Telling You How Much of Your Wealth Should Be in Bitcoin

Once you grasp the concept, you’ll realise how enormous this can become.

I'm here at my dining room table, watching the rain pour down in England, and I've already had three cups of coffee. This week, I'm experimenting with posting at different times, so hang in there, folks! Expect the next post on Friday at lunchtime and again on Sunday. I hope you enjoy this piece and savour every bit of Larry Fink's 180-degree turn!

Here’s the short answer.

84.9% of your wealth should be in Bitcoin.

The study’s release surprised people like a deer caught in the headlights because how can a once Crypto sceptical company like BlackRock become so bullish on the world’s leading digital asset?

Highflying finance experts are getting “orange pilled”, and it’s magnificent to watch.

Getting orange pilled is where you take a non-believer and turn them into a believer in Bitcoin. It’s akin to the crypto community’s “red-pilled” version, inspired by “The Matrix” movie. Taking the red pill in the film symbolised waking up to the truth of the real world.

If this sounds all too culty, that’s because it is. Sometimes, Bitcoiners can come across as Vegan activists ready to (forcibly) make you quit eating anything with a pulse.

I’m neither of them nor here to convince you of anything. However, seeing the penny dropping for some of these traditional finance behemoths is pretty satisfying.

From discrediting Bitcoin as a tool for money laundering in 2017, Larry Fink, BlackRock’s CEO with control over $9 trillion in assets, now praises it. He believes Bitcoin is a valuable asset, digitalising Gold, capable of revolutionising finance, and serving as a hedge against inflation and currency devaluation — quite the change of heart, Larry.

BlackRock researchers Andrew Ang, Tom Morris, and Raffaele Savi have conducted an asset allocation study focusing on the “typical portfolio” (comprising Stocks and Bonds) and exploring the potential of what would happen by adding Bitcoin.

Let’s dive in.

Here’s the best-performing asset.

When you first start in Crypto, you feel like a 12-year-old at a buffet, dipping your greasy fingers into anything that’ll fit onto your plate.

Heck, half the food you can’t even name. It’s how people go through their financial lives investing.

Very few people who aren’t professional investors do a money allocation exercise, like deciding how much to put into different investments.

The tried and true way of deploying capital is to use the “modern portfolio theory”, where you don’t have more than 20% of your money tied up in a single sector and no more than 5% tied up in a single stock or investment. It helps you ride out volatility, diversify well and reduce risk.

BlackRock has recently chucked out that playbook and turned everything into custard pie with a convincing and well-detailed research study saying that you should be going whole hog on Bitcoin.

Suppose you have a mix of 60% stocks (like company shares) and 40% bonds (like loans to governments or companies) in your investment portfolio, which they say is standard, and you’re looking to add Bitcoin. In that case, they say you should look at how your stocks and bonds have performed in the past and use the same math to find the right amount of Bitcoin to add. Simple.

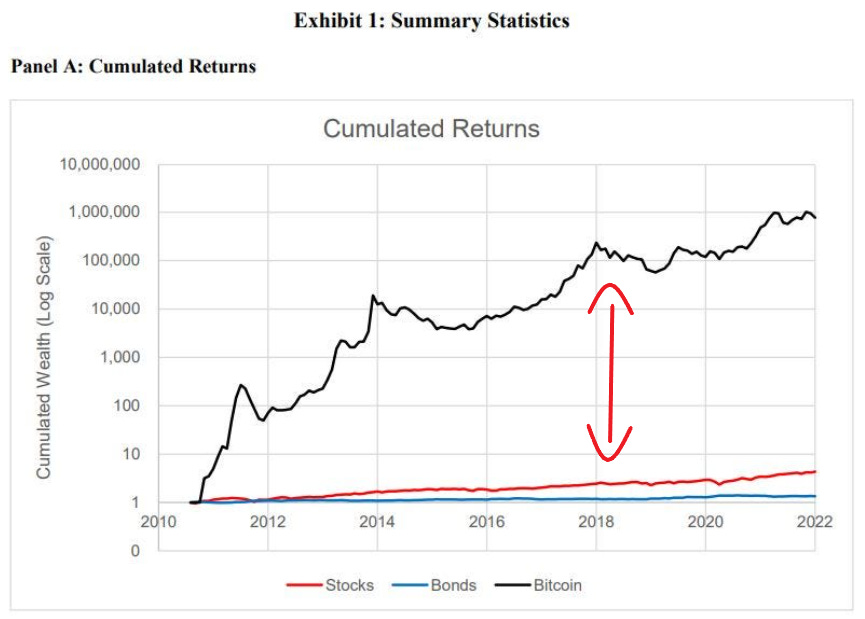

Here are the performances of each over the last 12 years on a logarithmic chart so you can visually see their performances.

Since 2010, Bitcoin returns have outperformed stocks and bonds by a country mile.

It’s All About Risk vs. Reward.

In the research paper, BlackRock uses math that includes a “risk aversion coefficient”, which helps us understand how much risk you’re comfortable with when investing.

Using a moderately risk-averse value, they calculate the best amount of Bitcoin to add to your portfolio is, surprisingly, 84.9% of the entire portfolio.

So, most of your money would be in Bitcoin. The remaining 15.1% would be divided equally between stocks and bonds.

The researchers looked at how well Bitcoin performed as an investment from July 2010 to December 2021, checking its performance every month. They wanted to see how it could fit into a portfolio like a mix of different investments.

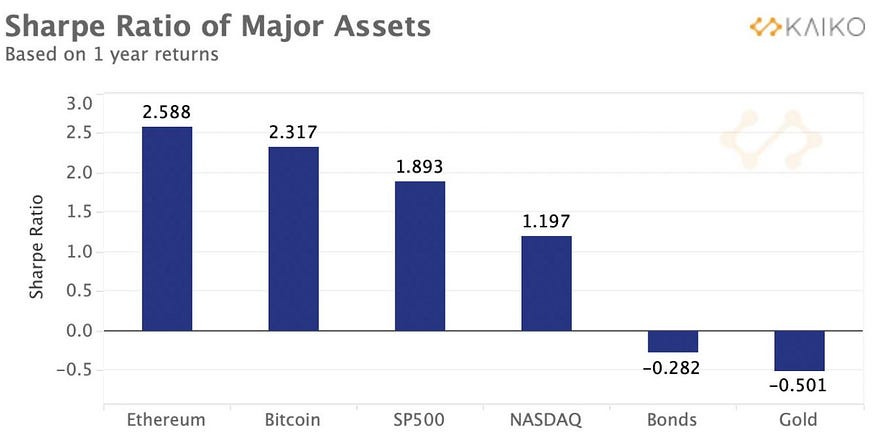

When they added Bitcoin to the portfolio, they discovered it improved the overall performance, especially when considering risk. Risk is subjective, but they used a “Sharpe Ratio” to gauge this.

The Sharpe Ratio is a measure commonly used to evaluate the risk-adjusted return of an investment or portfolio. It helps investors assess how much return they are getting for the amount of risk they are taking.

A higher Sharpe Ratio indicates a better risk-adjusted return. It means that the investment or portfolio generates a higher return for every unit of risk (volatility or uncertainty). A lower Sharpe Ratio suggests that the investment is not providing adequate returns for the amount of risk it carries.

Investors generally view a Sharpe ratio greater than 1.0 as acceptable to good. If the ratio surpasses 2.0, it’s rated as very good, and a ratio of 3.0 or higher is considered excellent. On the other hand, if the ratio falls below 1.0, it’s considered mediocre.

Bitcoin and Ethereum have significantly outperformed traditional and so-called “safe” assets like Gold & Bonds regarding risk-adjusted returns.

Final Thoughts.

At first glance, BlackRock’s recommended allocation to Bitcoin might seem relatively high.

Some even perceive it as potentially a sinister PR campaign, especially in light of their Bitcoin ETF application. It does to me, anyway.

But they’ve crunched the numbers, giving you insight into the gravity of the Bitcoin opportunity.

Stop.

For a second, I want you to imagine something.

Today, the combined global assets reach a staggering (estimated) $850 trillion across a wide range of categories:

$12 trillion in Gold

$250 trillion in real estate,

$300 trillion in debt,

$90 trillion in equities

$100 trillion in fiat currency

$100 trillion in bonds

Let’s have fun with a hypothetical thought experiment inspired by BlackRock’s research.

Imagine if the world took BlackRock’s advice and reallocated its assets to Bitcoin. But instead of 85%, they opted for a more modest 8.5% allocation, still a significant shift.

The global demand for Bitcoin would be around $72 trillion in this imaginary scenario.

Assuming that every $1 of demand raises Bitcoin’s market cap by $1, in this scenario, the market cap for Bitcoin would be $72 trillion, making each Bitcoin worth an astonishing $3.4 million.

In this hypothetical rebalancing, the world’s wealth would now look like $72 trillion in Bitcoin and $778 trillion in everything else. But there’s more to this story — let’s talk about the Bitcoin multiplier effect.

Contrary to popular belief, not all 21 million Bitcoins are available for sale. Over 78% of the total supply has yet to be moved in the past year, leading to growing scarcity.

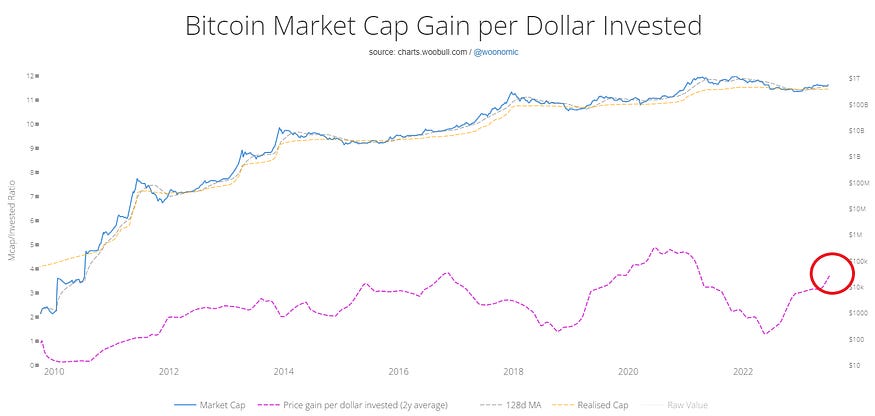

It creates a fascinating phenomenon known as “The Bitcoin Multiplier Effect,” where every $1 of demand currently results in a $3.7 increase in the market cap.

When people want to buy or invest in Bitcoin, their demand can cause the price to rise much more than the amount of money they put in.

In simple terms, imagine you have a favourite toy that’s rare and valuable. If people suddenly want to buy that toy, its price will likely increase because the demand exceeds the available supply.

Now, let’s add this multiplier to our hypothetical scenario. With a demand of $72 trillion for Bitcoin and a 3.7 x multiplier (Glassnode Data), the market cap would rise to $266 trillion.

If the world achieved an 8.5% Bitcoin allocation (which may not be likely for a very long time) with this multiplier effect intact, each Bitcoin would be valued at approximately $12.6 million. Insane.

Whether BlackRock is right or wrong is not the focal point here.

It’s irrelevant.

Whichever conservative or kamikaze way you’re looking to allocate capital is up to you.

But it spells one thing out to me

We’re still early.