99-Year-Old Billionaire’s Startling Stock Market Prediction for the Next Decade

The open market of more investors and better technology has changed the landscape for your investments — not everyone agrees.

Thanks to readers like you, this content is free.

If you enjoyed today's letter, please support my writing with a coffee-priced subscription.

You backing me fuels better content. Thank you!

Charlie Munger once said, “If I can be optimistic about life when I’m nearly dead, surely the rest of you can handle a little inflation.” Lol.

He embodies what happens when immense wealth and age collide — a person unfiltered, speaking their mind.

Munger might seem like a measured, softly-spoken intellect with doses of clever humour, but he’s more resilient than a desert cactus.

Before amassing wealth and fame as one of the most significant investors ever to walk the planet, the Billionaire has faced some of the harshest adversity life can throw at a person.

At 29, he divorced when it was socially unacceptable, leaving him broke. A year later, Teddy, Charlie’s 8-year-old son, was diagnosed with incurable leukaemia.

In the early days, Rick Guerin, Charlie and Warren Buffet’s lesser-known business partner said, “When Teddy was in bed and slowly dying, Charlie would hold him for a while, then go out walking the streets of Pasadena crying.”

Munger recalls that he and his ex-wife would sit in the leukaemia ward with the other parents, watching their children waste away. It was devasting.

Munger reflected on this time in his life — “I lost my first son to Leukemia, a miserable slow death. At the end, he kinda knew it was coming, and I’d been lying to him all along. It was just pure agony.”

When Charlie lost his left eye to cancer at 52, the voracious reader and wisdom-absorbing magnet could have easily felt sorry for himself for losing his most important asset.

Instead, he nonchalantly said with an undertone of humour, “It’s time for me to learn braille.”

Munger, worth $2.3 billion compared to Warren Buffett’s $107 billion, is worried that his successful value investing strategy that once propelled his wealth is getting more complex.

Charlie Munger — Source

“There is so much money now in the hands of so many smart people all trying to outsmart one another and out-promote one another at getting more money out of other people.”

He says it’s why you’ll most likely get fewer returns if you are a value investor.

Let’s dive in.

Where’s the value in value investing?

I first came across this concept through one of the many Warren Buffett videos where he strongly endorses reading a book called The Intelligent Investor by Benjamin Graham.

The book’s premise in one sentence is “Buy cheap and sell dear.”

Value investing does what it says on the tin and became a strategy Munger and Buffet made famous by finding undervalued stocks.

It involves buying something for less than its actual worth based on the belief that the market will eventually recognise its value.

Here’s a brief excerpt from the book explaining the strategy.

Benjamin Graham — Source

“You must thoroughly analyse a company and the soundness of its underlying businesses before you buy its stock — you must deliberately protect yourself against serious losses — you must aspire to “adequate,” not extraordinary, performance.”

Munger is still determining if this strategy will hold much weight in the future because of the increasingly intense investing competition.

Being an “investor” has almost become pop culture. It’s far more popular today than ever because anyone can do it with a few taps on a keyboard or a phone pad.

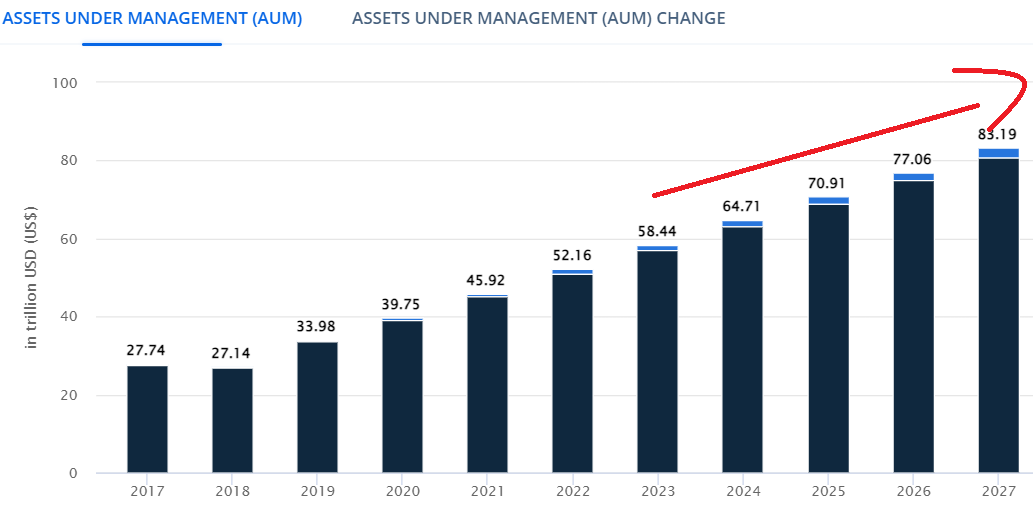

Wealth managers have increased over the past few decades as more professionals and individuals seek to profit from the stock market’s inefficiencies.

According to Statista, assets under management in the wealth management market will reach US$ 83.19 trillion by 2027 — financial advisory will dominate with a projected market volume of US$ 80.87 trillion. (Current — US$57.03tn)

It’s dog-eat-dog when intelligent people compete against each other.

Munger says a broader range of people are accessing trading and investing technologies online.

As a result, the investing game has become significantly more competitive and easily accessible, and the overall pool of investment opportunities has shrunk.

According to the expert investor, identifying and analysing stocks is more accessible, and undervalued stocks with significant discrepancies in price are becoming less common because faster information has led to more efficient markets, making mispriced stocks harder to find.

Charlie Munger — Source

“It’s essential to recognise that the market dynamics have shifted, with many intelligent individuals competing against each other, aiming to outsmart and extract money from one another.

It’s a far cry from the environment in which we initially started. As an investor, I have observed the diminishing frequency of attractive opportunities over time, and it is essential to adjust our expectations accordingly.”

Not everyone agrees.

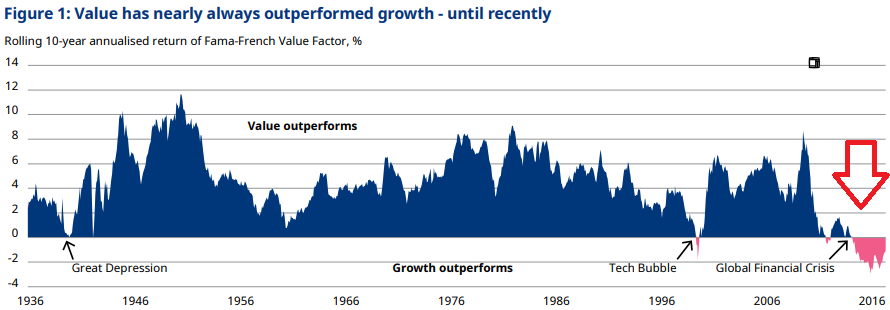

Charlie Munger and Warren Buffett’s famous Value Investing strategy has struggled over the last decade compared to growth investing (companies expected to grow faster than the market — think tech stocks)

One research study suggested the poor performance of value stocks is because the economy has been growing slowly. It’s hard for companies to increase earnings during sluggish and uncertain times.

Hence, “Investors prefer investing their money into faster-growing companies like Facebook, Apple, Amazon, Netflix, and Google (FAANG stocks) because they are more confident in their ability to make profits.”

In the same study, they use the Fama—French Three-Factor Model created by World-renowned economists and researchers in finance Eugene Fama and Kenneth French.

The model compares two groups of stocks each month: those with low book-to-market ratios (the value of assets minus liabilities compared to its market value) and those with high book-to-market ratios.

The model was designed to help investors determine which category, whether value (low book-to-market) or growth (high book-to-market), performed better for that month.

It’s clear value stocks have underperformed for close to eight years.

The Oracle of Omaha says — “People never change”.

Since society put entrepreneurship and investing on a pedestal, I’ve been captivated by Munger and Buffett’s advice and their famous friendship.

I particularly love how they often have healthy disagreements mixed in with good humour, which, if I’m honest, injects a little excitement into a topic that can be a snooze-fest for the general public.

Buffett has said in an interview, “We’ve never had an argument in the entire time we’ve known each other, which is almost 60 years. We knew we were sort of made for each other”.

Buffett also says what gives you opportunities is “other people doing dumb things”.

Regardless of intelligence or access to information, the stock market is still a place where humans make choices, which means calls will always be irrational, resulting in opportunities.

Warren Buffett — Source

“Investing has disappeared from this huge capitalistic market to something anybody can play in.

In the years we’ve been running Berkshire, there’s been a significant increase in the number of people doing dumb things because they can get money from other people so much easier than when we started.

You could start 15 dumb companies in the last ten years and become wealthy, whether the business succeeded or not.

You couldn’t get the money to do some of the dumb things that we wanted to do, fortunately.”

Final Thoughts.

Investing in markets requires people to make decisions, so it makes sense that we’ll never overcome irrational choices.

It will always result in opportunities.

As Buffett eloquently said, “Regarding money, we’ll always do dumb things”.

Using the value-based investment strategy is as clear as day. However, it’s not commonly practised, possibly due to a lack of patience or where people source their information.

With Millennials and Gen Z coming into their peak earning power and investing being less “capitalistic,” and something we all do now, I believe it’ll open up a cascade of inefficiency.

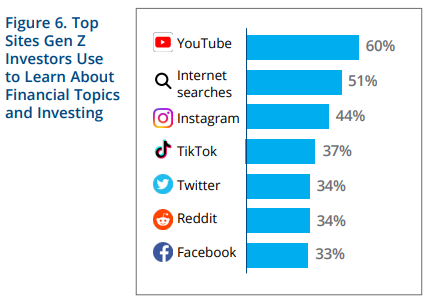

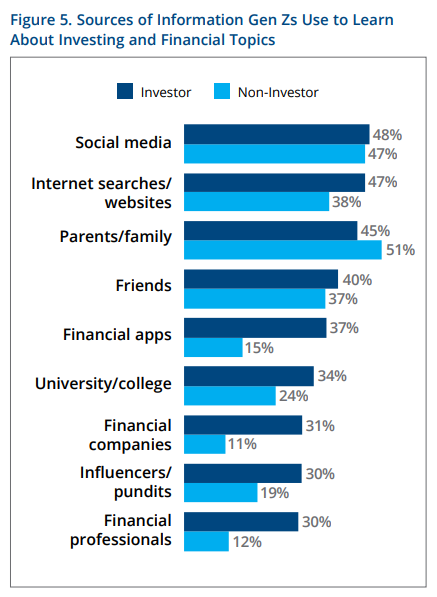

A research study delved into where Gen Z investors were sourcing their financial information.

It revealed that YouTube is the primary hub, with 60% of non-professional investors relying on it. Other sources include Instagram, TikTok, Twitter, Reddit, and Facebook.

Perhaps more worryingly, 51% of all Gen Z non-investors sourced their financial knowledge through a friend or family member.

If that doesn’t signal inefficiency, I don’t know what does.

Thanks to readers like you, this content is free.

If you enjoyed today's letter, please support my writing with a coffee-priced subscription.

You backing me fuels better content. Thank you!