A 99-Year-Old Billionaire Investor Issued an Alarming Prediction About the Stock Market and Your Investments Over the Next Decade.

Not everyone agrees that the good times are over.

Source — Commons Image Wiki Media

Charlie Munger might seem like an unimposing and modest intellect good at spotting winning investments.

He goes beyond that.

He’s the epitome of resilience.

Munger watched his son slowly die of cancer at age nine. He experienced the harsh realities of the Great Depression and lived through World War II’s devastation and chaos.

At 30, he was divorced and broke.

Despite earning similar incomes over their lifetimes, Munger’s more famous business partner Warren Buffett emerged substantially wealthier.

While both have enjoyed successful investing careers, Buffett’s early start at 19 has been attributed to his more substantial wealth.

Over the years, people have inevitably compared the two renowned investors. Munger has a wealth of knowledge when it comes to money.

Charlie Munger donated most of his wealth in his earlier years to various charities losing out on the compounding effects of interest, leaving his net worth at around $2.3 billion against Warren Buffett’s net worth of $107 billion.

During their annual Berkshire Hathaway meeting, Munger expressed concerns that the future of value investing has become significantly more challenging, and you, as an investor, will most likely get fewer returns.

Value investing is a strategy focused on finding undervalued assets or stocks. It involves buying something for less than its actual worth based on the belief that the market will eventually recognise its value.

Munger says there is intense competition within the field. The number of wealth managers has dramatically increased over the past few decades as more individuals seek to profit from the stock market’s inefficiencies.

This influx includes professionals and a broader range of people with access to trading and investing technologies through the Internet. As a result, the game has become highly competitive and easily accessible.

He also says the overall pool of investment opportunities has shrunk.

The Internet has revolutionised company information and data access, making identifying and analysing stocks easier.

Consequently, undervalued stocks or those with significant discrepancies in price are becoming less common. The availability of extensive information has led to more efficient markets, making it more challenging to find mispriced stocks.

The landscape makes making money more difficult for you as an investor.

Charlie Munger — Source

“Value investing has become significantly more challenging. As more investors have access to extensive information, the anomalies that value investors typically seek are becoming less prominent.

Consequently, value investors should anticipate making smaller returns in the future.

It is essential to recognise that the market dynamics have shifted, with many intelligent individuals competing against each other, aiming to outsmart and extract money from one another.

It’s a far cry from the environment in which we initially started. As an investor, I have observed the diminishing frequency of attractive opportunities over time, and it is essential to adjust our expectations accordingly.”

Munger Is Right, but He’s Also Wrong.

Eugene Fama and Kenneth French (Fama and French) are renowned economists and researchers in finance.

They developed the Fama/French Three-Factor Model by incorporating additional factors that affect stock returns.

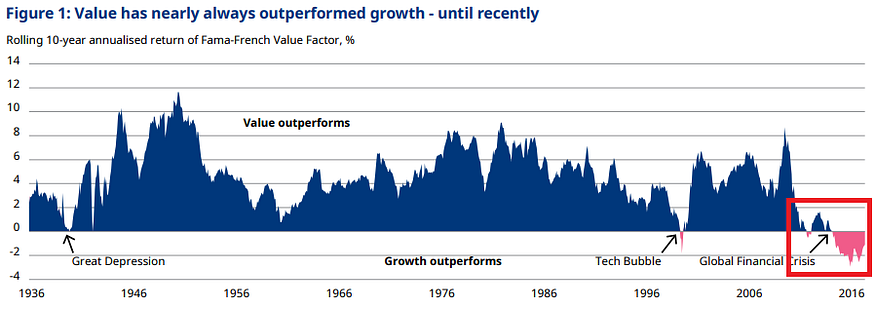

The US Fama/French HML (High Minus Low) Factor compares the performance of Value stocks and Growth stocks.

It calculates the difference in returns between a portfolio of high-value stocks and a portfolio of low-value stocks. The value of a stock is determined using a metric called “book to market,” which compares a company’s book value (its assets minus liabilities) to its market value (its stock price).

By subtracting the returns of the low-value portfolio from the high-value portfolio, we can see how value stocks have performed relative to growth stocks over time.

Charlie Munger and Warren Buffett’s famous Value Investing strategy has struggled over the last decade compared to growth investing (companies expected to grow faster than the market) due to slow economic growth and low-interest rates.

We’ve seen recent increases in interest rates give the stock market a pounding. There is potential for market conditions and value stocks to bounce back.

Warren Buffet Says Munger Is Wrong; the Reason Is Inherent in People and Never Changes.

People who are world-class at what they do often have a way of explaining complex topics in simple terms.

Charlie Munger’s senior partner, Warren Buffett, says what gives you opportunities is other people doing dumb things.

While there’s higher access to information and intelligent people are investing in markets, it’s still a place where individuals make choices, and humans will never completely overcome irrationality.

The existence of irrationality means there will be opportunities.

Warren Buffett — Source

“There’s going to be plenty of opportunities.

The tech makes no difference if you look at how the world has changed since 1942.

New things coming along don’t take away the opportunities. What gives you opportunities is other people doing dumb things.

And I would say that in the 58 years we’ve been running Berkshire, there’s been a significant increase in the number of people doing dumb things.

They do big dumb things, and they do it to some extent because they can get money from other people so much easier than when we started.

You could start 10 or 15 dumb insurance companies in the last ten years and become wealthy if you were adept at it, whether the business succeeded.

You couldn’t get the money to do some of the dumb things that we wanted to do, fortunately.

So, investing has disappeared from this huge capitalistic market to something anybody can play in.”

Final Thoughts

I like digging into the thought process of some of the most successful people of our time.

Their advice is timeless.

With the rise of Alternative investments as a legitimate way to store value, e.g. Cryptocurrency, Digital Art, Card Collectables, Sneakers etc. You’re now seeing a surge in Millennials and Generation Z coming into their peak earning power. They would rather invest in Bitcoin, Ethereum and alternative assets vs dollar-cost-averaging into the S&P 500.

While the landscape changes, the age-old principle of leaving room for profit by purchasing something valuable at a price lower than its market value, thus ensuring a safety net, can be applied to any asset you own and plan to sell.

I lean towards Buffetts’s view that there will always be opportunities to find value regardless of technology and information improvement.

It’s because humans have shown time and again that we are irrational.

We consistently do “dumb things” when it comes to money.