A New Crypto Meta Is Rising From the Rubble Left by Liquidated Traders.

Very few will spot what is actually happening (Before it's too late).

Haven’t upgraded to a paid or Founding plan yet?

You’re missing out on daily trade ideas, live calls, NFT giveaways, and the kind of insights that don’t get shared publicly, all inside a community that’s actually winning together.

Don’t just watch from the sidelines. Join us.

The late billionaire and iconic investor Charlie Munger famously said:

“Smart men go broke three ways: ladies, liquor, and leverage”

This week, nearly $19 billion in leverage went up in smoke.

Around 1.6 million traders were wiped out, courtesy of one post from the US president.

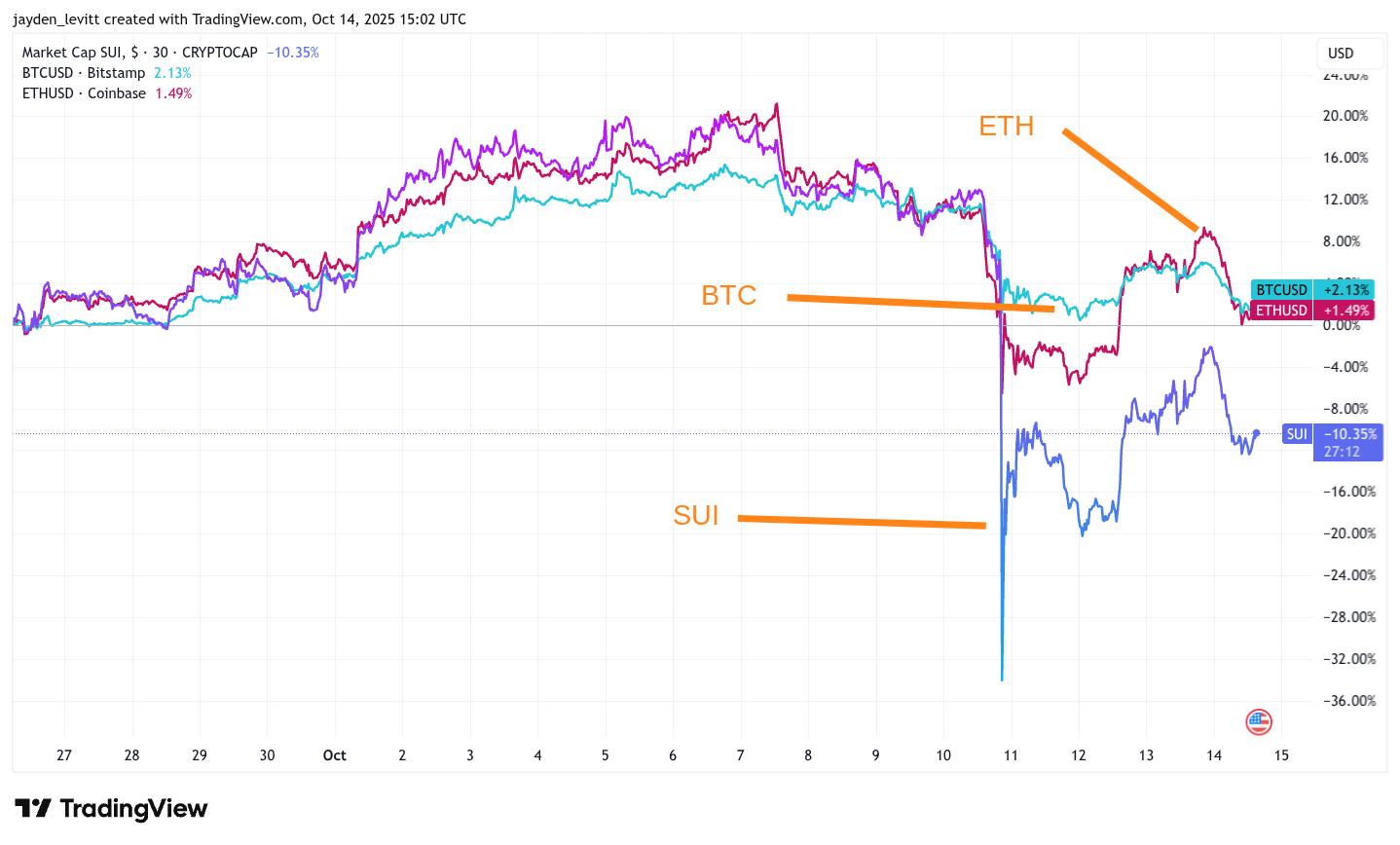

Within 30 minutes of Trump hitting “Publish,” Bitcoin nosedived 10%, slipping under $105K. Ether dropped 12% to $3,500. Solana, Hyperliquid, and SUI got absolutely smoked, down 17% and 45%.

People often scoff at Tweets moving markets, but the funny thing is, the president’s follow-up post is what actually stopped the bleeding.

President Trump: “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!! President DJT”

It stopped the six majors we track in this newsletter from completely free-falling like a broken elevator.

Bitcoin and Ethereum held up better, thanks to their deeper institutional capital and larger spot positions.

Volatility, though, is a funny thing. It’s either a gift that lets you catch up or a gut punch if you’re leveraged like a drunken sailor.

Amidst the carnage, a new meta is emerging around NFT projects.

Call it the convergence of coins and NFTs. We all knew this was coming in some form, but few would’ve guessed it’d happen through PNKSTR.

The coin, created by TokenWorks and big brain founder Adam Levick, seeks to arbitrage the price appreciation of the most iconic NFT collection, CryptoPunks.

What’s fascinating about this project is that the satellite launches, which have improved over time, actually held up better than most assets during the market capitulation.

Take Good Vibes Club, for example. They launched their Vibestr token through TokenWorks and later announced they’d be using the Strategy token as their native coin.

This is a friggin big deal. GVC was the only NFT project to show notable price performance during the brutal NFT bear market.

The decision sparked criticism from Spencer, the relatively new project owner of Moonbirds, who had this to say:

Spencer: “GVC I think it’s cool how fast they moved but I strongky disagree with this implementation, they should have at least deployed a fork, 1% of trading volume going towards buying and burning punkstr leaks 50% of the value capture exterior to their direct ecosystem. This seems like a miss especially if this is your official token. I also think official tokens should be in Some way given to the community versus just sold to them and likely there’s more emergent value if they can be exchange listed which I don’t think that str tokens can be.”

90% of people in the comments (not a good litmus test) shat on him from a very great height following his remarks.

It drew a direct response from Tylor, the owner of Goodvibes Club.

He argued that launching a native token creates a conflict of interest, so his team avoided it. Instead, they bought in alongside the community through a fair launch platform with built-in liquidity safeguards.

Tylor: “There are far too many holes here to go point counter point. You are missing one of the primary issues with native tokens though, which is a conflict of interest. The biggest disruptor here is the fair launch platform which naturally given prior commitments you are challenging. We could have launched a native and personally netted handsomely. We chose not to because we all know this conflict of interest exists, despite the spins and justifications for it. We market bought with our community. It has liquidity guardrails that act as a net positive for collectors. Case in point the biggest liquidation event in market history, and the protocol is still deploying over 415E as we speak. Everything red except us. We have enforced royalties on the NFT side, and we chose to give back our 1% protocol fee to collectors. Ongoing Rewards Pool vs one singular airdrop to have them abandon the community and ecosystem assets as a result. That also artificially inflates the eco assets on the way up. And FWIW I’m fine with the fee structure, punks gave us NFTs. As an ecosystem we are stronger together. I think you can do some good for your collectors if you have an open mind, happy to have a chat.”

To borrow a couple of tired old lines, the proof’s in the pudding, and the data never lies.

Look at the 30-day chart below. You’ll see that even during crypto’s biggest liquidation event ever (approximately 10 times larger than the FTX meltdown that sent Sam Bankman-Fried to a concrete cell), the strategy token barely flinched.

That’s wild when you think about it.

Price stability like this is a magnet for fresh capital because more winners at the table draw a larger crowd.

Through the rubble of the biggest liquidation event in crypto history, a new meta is emerging, and it’s showing up in the strength of these Strategy Tokens, all pegged to one of the most stable assets in the space: CryptoPunks.

Here’s the silent signal everyone is missing:

Each new project that launches a Strategy Token brings its community with it. And with every new launch, PNKSTR grows stronger as a serious trade for this cycle.

It’s Metcalfe’s Law playing out right in our faces. The more users join, the stronger the network becomes.

NFT collectors who’ve been underwater now also have this perpetual buying, selling, and burning machine scooping up their NFTs. The game theory behind it is driving sustained attention, and attention is what fuels the buying flows.

Best of all, the PNKSTR token allows ordinary people who’ve been priced out of blue-chip NFTs to still participate in the ecosystem. Even if it’s driven mainly by price speculation right now, it’s giving everyone a seat at the table.

And everyone is getting fed, as Psuedoannymouos DGMD.6529 explained:

“They unlock an entirely new pool of liquidity that accrues to the collection through the mechanisms, thousands of holders who either want to speculate and have lots of capital, want to be part of the ecosystem but not enough capital for an NFT, or some combination of both.”

The punchline here is that memecoins have a market cap of around $70 billion, while NFTs sit at roughly $7 billion.

That gap exists because coins have a lower barrier to entry and attract more participation, whereas NFTs often run up to astronomical prices that end up squeezing people out.

These Strategy tokens are a hybrid of the two.

The real genius behind TokenWorks isn’t just creating a permissionless protocol that runs on a perpetual loop and benefits everyone. It’s that they figured out a fairer way to launch a token. But the true masterstroke was when they launched it.

Right at the start of an NFT bull run.

It’s a new crypto meta rising from the rubble left by liquidated traders.

PNKSTR is definitely not a trade I’d want to be out of.

“The proof of the pudding is in the tasting.” 😉