A Quirky, Free-Thinking Billionaire Issued an Alarming Prediction About the Stock Market That’s Hard To Ignore

He’s seeing what most people aren’t.

The world watches with bated breath when Michael Burry makes a significant move.

The renowned Investor and hedge fund manager is no stranger to adversity after losing his left eye to a rare form of cancer at age two.

It’s strange to think he was only 37 (my age now) during the 2008 housing crisis, which catapulted him into the spotlight, making investors in his firm Scion Asset Management $725 million.

The event was so significant Hollywood turned it into a movie.

I’ve lost count of how often I’ve watched the “Big Short”. What I love about the film, which features Christian Bale, who plays Burry, is that it simplifies a subject you’d find obscure and complex.

It portrays Burry as a rare breed of human who revels in chaos and has monk-like instincts regarding risk.

At first, Burry’s bet against the booming housing market appeared doomed to fail.

My favourite scene is where he’s in the office with no shoes, blaring a heavy metal song called “Darkest Hour”. With an air of nonchalance, he strolls up to a whiteboard in front of the entire staff and writes beside “Scions Value,” in bold “, minus -11.3%.”

Then Burry casually walks back into his office, shuts the door and screams “Fuuuuuuuuuuuck” at the top of his voice.

It all took two years to play out, but initially, Investors thought he had lost his mind, and he also clearly had some self-doubt as the sh*t hit the fan while Scion Capital’s value dropped because the housing crisis took longer than anticipated.

The scriptwriters included a scene depicting Burry coldly disregarding calls from angry investors after his $8.4 billion hedge against the housing market, and it wasn’t just to spice up the movie.

The hyper-focused investor who’s on the autism spectrum hardly ever features in interviews but has explained that his confidence in the housing trade “ticked off a few people”, but he finds it “remarkable he made investors tens of millions of dollars off this and they’re still pretty upset.”

Now, the same man who profited from the 2008 housing crisis is betting against the entire stock market with 93% of his fund’s portfolio.

People view it as a signal that the Stock market is about to get nuked.

Let’s dive in.

Home runs.

I’ve written countless articles and done over 50 hours of research on Burry, and it’s clear his forte is short-selling.

His core strategy is to bet against the market, which is more straightforward than it sounds.

Imagine you borrow a toy from your friend (the toy represents the stock). You decide to sell the borrowed toy at the market value of $100. When, or if, the toy’s value drops, you repurchase it at the lower market value, say at $80, and return the toy to your friend, meaning you’ve pocketed the $20 difference.

That’s what Burry does with his stocks, minus some fees.

A part of me questions the moral compass of someone making money based on willing something to fail.

When you dig under the hood, there’s a darker reason his investors stopped speaking to him. It was cited that investors enquired about who was on the receiving end of his trades.

If Burry made $100 million when the subprime mortgage bonds he hand-picked defaulted, someone lost $100 million.

Heck, people lost their homes.

Throughout his career, Michael Burry has a knack for getting things right, perhaps not immediately, but eventually, they play out.

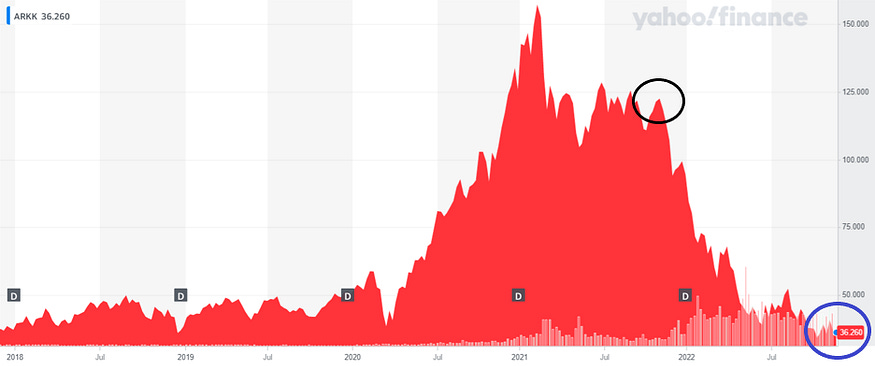

More recently, his bets against Elon’s Tesla and Cathie Wood’s Ark Innovation last year show he’s more than just a drunken sailor at a roulette wheel or Christain Bales look alike.

He bought 2,355 “put contracts” betting against Ark Innovation, which led to huge profits.

His company’s short position is circled in black, while the stock price of Ark Innovation dropped as low as 80% from all-time highs, which was majestic for Burry’s short position. Not so good for Cathie Wood.

AI hype is propping up the market.

The Federal Reserve and Jerome Powow, the knight in shining armour sent to save us from the rising cost of living, have increased interest rates to a 22-year high of 5.5%.

It’s leaving people with eyewatering mortgage payments and businesses unable to grow.

We’re seeing the Fed tackle inflation with an old sports hall fire extinguisher and their only tool, interest rate hikes, and to be fair, it’s working because inflation has come down from 8.2% to 3.7% in the last year.

Even though it’s Armageddon out there, we’re seeing the markets rally, but there are money managers who say we’re not entirely out of the Woods yet.

Cathie Wood is one of them.

Her concerns are that even though the stock market has shown an overall recovery, it’s narrowing like we’re walking toward the tip of an icy ledge because only a small subsection of the stocks are producing growth.

She says it’s mostly down to the “excitement” around AI.

Cathie Wood — Source

“There’ll be a harder landing in the economy than most expect. The equity market has narrowed to just a few stocks, with mega-cap tech stocks accounting for 75 % of the market’s move.

Narrowing tends to be, if sustained, very negative. It means we’re setting up for a bear market. We’re going into a harder landing than most expect.

It’ll be uncomfortable enough for companies that are losing pricing power and experiencing margin pressure and will force them to adopt these new technologies faster than otherwise would be the case”.

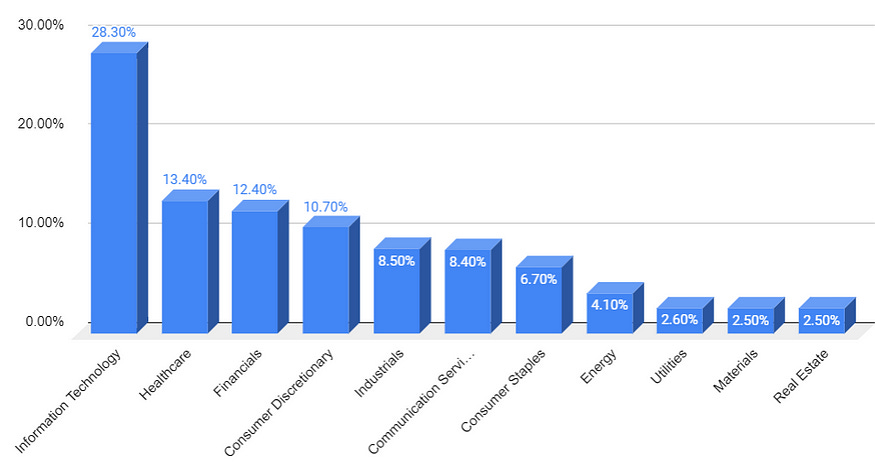

When you do a little digging into the S&P500 using a detailed breakdown of the top 10 companies in the index, eight out of the top ten are tech stocks; collectively, they make up 30.84% of the entire market.

The data backs up her claim because eight of the top 10 performing stocks are tech companies promising us the future of AI. Below is another chart showing the disparity in growth between tech and other sectors.

Apple (AAPL): 7.70%

Microsoft (MSFT): 6.89%

Amazon (AMZN): 3.11%

NVIDIA (NVDA): 2.82%

Tesla (TSLA): 2.02%

Alphabet Class A (GOOGL): 1.94%

Meta (META), formerly Facebook, Class A: 1.75%

Alphabet Class C (GOOG): 1.68%

Berkshire Hathaway (BRK.B): 1.65%

UnitedHealth Group (UNH): 1.18%

Burry sees something worse on the horizon.

As well as his view AI hype will die down, he believes there is a far more significant issue: The return of inflation.

That’ll be the worst-case scenario because it’ll mean Jerome won’t pivot on interest rates while inflation is still hovering at 3.67%, higher than the long-term average of 3.38%.

Michael Burry — Source

“Inflation appears in spikes. When the spike resolves, it won’t be because of Biden or Powell. It will be because that is the essence, the nature of inflation.It resolves, fools people and then comes back.

When it comes back, neither the POTUS nor the Fed will take credit”.

$1.6 Billion bet.

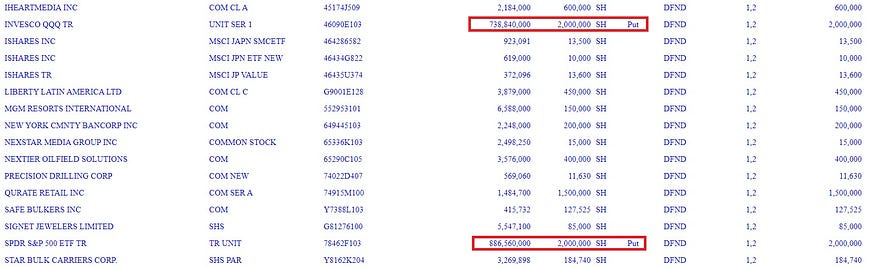

Burry made bearish bets against the S&P 500 and Nasdaq 100, which has melted the internet.

His Scion Asset Management fund bought $866 million in “put options” that track the S&P 500 and $739 million in “put options” against a fund that tracks the Nasdaq 100.

It represents 93% of his portfolio.

From the outside looking in, this seems ludicrous. But if you were savvy enough to follow his SEC filling each time he bought a stock or opened a short position over the last three years, you would have generated annualised total returns of 38.4%.

In comparison, the S&P 500 ETF (SPY) generated annualised returns of 9.3% over the same period.

13F SEC filling of “put options” below.

Not everyone agrees

Macroeconomic expert Raoul Pal, who I’ve also studied religiously, believes we’ve already seen the bottom of the stock market and the business cycle is set to turn as early as Q1 or Q2 2024.

He says, “It’s simple”; when there’s more money in circulation, the stock market goes up. When you put the S&P500 and M2 money (all the money in circulation) together, they mirror each other.

“When liquidity changes, everything changes.”

Pal thinks it’s unlikely we’ll see further catastrophic failure because there are too many reasons for liquidity to return to the system.

Raoul Pal — Source

“If I’m right in what I’ve laid out, the economy is slow right now. We’re in a recession. It’ll recover next year, and we’ll be in the sweet spot where the economy is recovering and earnings are coming back in early 2024.

Earnings are coming back, but inflation is falling, and unemployment is rising, which leaves the Central Bank injecting liquidity in an election year where the government will stimulate, creating a powerful boost for the markets”.

Closing Thoughts.

A popular YouTuber said recently that Michael Burry has “predicted 60 of the last three recessions.”

While hilarious, it subtly speaks to the reality that no one knows what’ll happen.

It’s all calculated guesswork.

I believe there is still far too much pain ahead; people are still spending the overflow money from their “stimmy checks” from when it rained bat virus money on us, and until that dries up, the threat of inflation will come back like Tom Brady out of retirement.

Interest rates will likely stay high, leaving too much downward pressure on business and stock market growth.

Fed chair Powell signalled that he was prepared to “keep rates above 5% well into 2024”.

It all plays into Michael Burry’s thesis.

His recent prediction is alarming because what he’s saying by his actions is that the stock market is set to capitulate.

When he bets the farm on it happening, it’s a message that’s hard to ignore.

One way is to bet on stock market crashing.

The other one is investing in arising cyber opportunities.

Money will shift from one to another.