An Economic Catastrophe Is Coming, and Despite What People Will Have You Believe, Your Bitcoin Isn’t Safe.

You’ll see why a price recovery is tricking you.

Photo by Matthew Osborn on Unsplash

Doomsday recession porn makes my stomach churn.

Worryingly, it’s looking less like a lousy role-play on adult TV and becoming a dire reality.

We tried to build an economy on zero per cent interest rates for a decade, racking up a national debt bill that’s turning the dollar into toilet paper.

Then for good measure, governments dealt a knockout blow to the economy by locking us in our houses and flooding every Tom, Dick and Harry with free bat virus money.

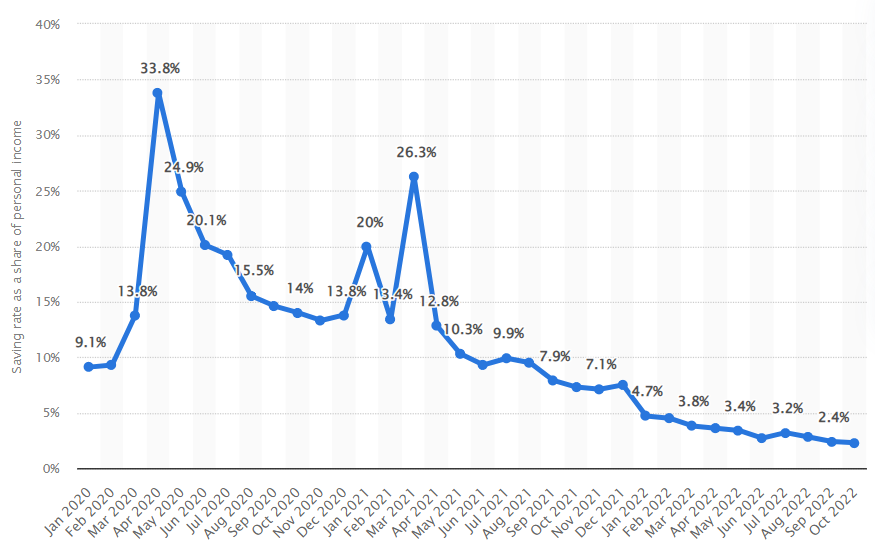

Savings went up.

Interest rates came down.

And everything became overpriced.

When the doors to the economy opened, we started spending erratically.

Travel.

Eating out.

Online Shopping.

Buying cars on finance.

We even filled our shopping carts with sh*tcoins.

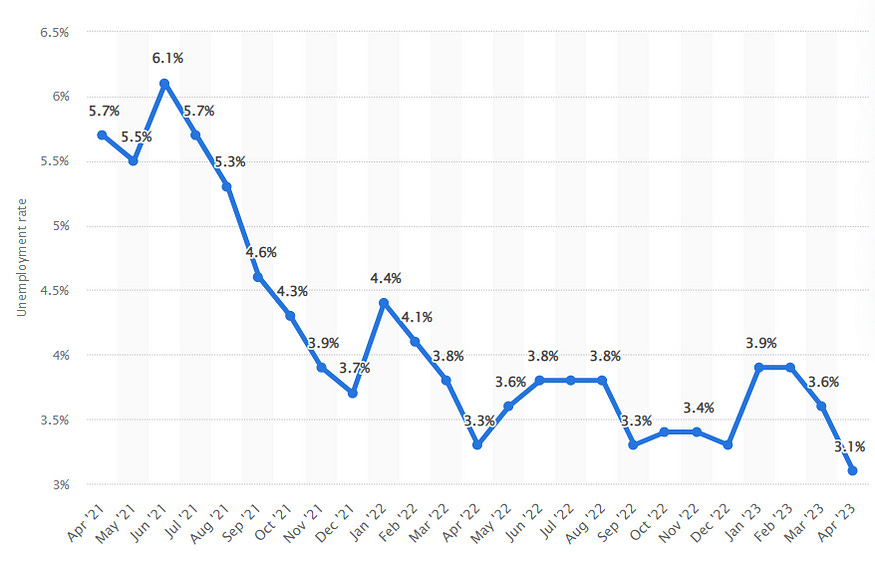

Now we’re all paying the price. U.S. Inflation Rate is at 4.93%, compared to 4.98% last month and 8.26% last year. It’s coming down slowly, but unemployment is going in the wrong direction.

If fewer people lose their jobs, more money for consumer spending will only add to inflation.

The job market’s durability has left Fed Chair Jerome Powell mystified. The figures are concerning because a strong job market also puts upward pressure on demand for wage increases.

Powell aims to achieve a “soft landing” by cooling down the economy and labour market to control inflation without causing a recession.

Unemployment is going down, and it’s not a good sign. The Fed’s target unemployment rate is 5%, currently at 3.1%.

In other words, we need more job losses.

Bitcoin Is Living on Another Planet at the Moment.

Blissfully unaware of the chaos.

Bitcoin is going through a rally amid record inflation and high-interest rates, which is unusual because its price correlates with liquidity and business cycles. So you’d think it would be down in the dumps.

It’s not.

Bitcoin’s price is back up to where it was in December 2020, right in the eye of the storm of the pandemic, where people had excessive savings for speculative investing.

Let’s also remember how incredibly bored we were.

People started saving much more money because the government made us stay home. As a result, we spent way less.

The U.S. household savings rate increased significantly in April 2020 and peaked at 33.8 per cent, which is money still flushing around the system.

As of October 2022, personal savings in the United States amounted to only 2.4 per cent of Americans’ disposable income (currently, it’s 4.1%).

It’s taking a little time, but people’s savings are drying up.

Despite What You Hear on Social Media, Bitcoin Isn’t Safe Either.

Heck, every investment is about to lose value.

You’ll hear headlines that people are changing sentiment around cryptocurrency because of its decentralised nature and losing trust in Banks amid a crisis of failures.

It’s all true.

But when you run out of money, and the invisible force of inflation and cost of living infiltrates your everyday living, buying bread over Bitcoin becomes the priority.

The current situation for Bitcoin looks everything like a bear market rally or a “dead-cat bounce”. The term describes a temporary and minor price increase of an asset that has experienced a significant price drop.

It’s called a “dead cat bounce” because even a dead cat will bounce slightly if it falls from a great height.

I am very bullish on Bitcoin long-term, but we’ve seen nowhere near enough failure in the economy to consider calling ‘a bottom’. And while I agree with the popular sentiment that crypto forward looks by six to nine months and prices future events in, when the event happens, we’ll likely see at least one flash crash followed by a slow uptick in price.

Raoul Pal calls it a “buy the rumour, sell the fact”.

The next major event in crypto will be when the Fed pivots and starts to drop interest rates which will be counterintuitive, but the price when the event happens could crash as it did during a similar event in 2018.

As shown in the Bitcoin chart below. The blue arrow represents the market’s anticipation of rate cuts, and the red line marks their implementation.

Final Thoughts

I don’t particularly enjoy writing about the short-term dynamics of the market, but I reverse engineer your comments and look at trends of what people are talking about on Twitter.

People are excited about the recent price recovery, which I understand.

But It’s compelled me to write something with a dose of reality. Most people are getting sucked into a rally ahead of a likely recession.

Heck, I could also be wrong myself.

Bitcoin was born out of a crisis (2008) and has been battle-tested recently. I believe in its long-term thesis. But if you’re using the money you need in the short term, you’re playing with a hot potato.

I cannot predict the future.

Nor can any of these YouTubers with made-up 90-day chart analysis.

There is, however, every indication more pain is ahead.