Billionaire Investor Tim Draper: You’d Get Excited About the Enormous Bitcoin Opportunity if You Understood the “I” and “S” Technology Curve.

Bitcoin can go to a place you never imagined.

Photo By Crypto News on Flikr

Tim Draper has a reputation for being a risk-taker.

He owned a pet lion.

He’s a certified scuba diver.

And he’s unafraid of controversy, which reflects his entrepreneurial spirit.

Draper is a serial investor who likes to look at the whites of people’s eyes to see a spark flying at him before departing with his hard-earned money. And he’s incredibly good at spotting winning investments.

Bitcoin doesn’t have a founder. There’s no management team you can call when the price tanks.

Draper was an early investor in Bitcoin, and in 2014 he won an auction to buy 30,000 Bitcoins that the U.S. Marshals Service from the Silk Road marketplace had seized (worth $19 million).

Silk Road was an online black market Drug dealers used to distribute massive quantities of illicit goods and launder funds which operated from 2011 to 2013.

Draper, an early investor in Hotmail, which most of us use, famously credits himself as the inventor of “viral marketing.”

The acclaim was from an idea he gave the founders of Hotmail to automatically attach an advertising message to the bottom of each outgoing Hotmail email.

After taking a chance on funding Hotmail — Draper suggested that they send a message to people on the web with the words “PS I love you” to attract more users.

The Hotmail team thought he was crazy.

Tim Draper — Source

“When we funded Hotmail, they told me they had a web-based email running. I thought we could send a message to all those people on the web saying, ‘PS I love you. Get your free email at Hotmail’.

They looked at me like I was crazy.

But I kept pushing, and finally, they agreed to add a small message at the bottom of every email saying, ‘Get your free email at Hotmail’.

This was the beginning of viral marketing, spreading to 11 million users in 18 months.

However, I still believe this world would be more loving and peaceful if they kept the ‘PS I love you’.”

People Need To Realise the Scale Bitcoin Can Reach.

According to Draper, Bitcoin can impact the biggest industries in the world and will likely transform countries that are making Bitcoin a legal tender.

He says that El Salvador, whose president is currently using their country’s reserves to buy one Bitcoin a day, will change from one of the poorest countries in the world to one of the richest.

Tim Draper — Source

“Only one or two countries worldwide have started to do that.

They will go from the poorest to probably some of the wealthiest countries in the world over the next 40 years.

El Salvador and the Central African Republic are going to benefit big.”

Draper thinks that two other significant areas could boost Bitcoin adoption. Women are an untapped demographic for Bitcoin, and more retailers will likely use blockchain protocols for payments and transfers instead of traditional finance methods.

Tim Draper — Source

“This is an interesting statistic.

Women control 80% of retail spending. And, until recently, about one in 16 Bitcoin wallets was owned by a woman.

Now it’s more like one and eight.

At retail, when the retailer can easily accept Bitcoin, which they can now with OpenNode, they’re going to realise that they can bring another 2% right to their bottom line.

And they’re going to encourage their customers to buy with Bitcoin.”

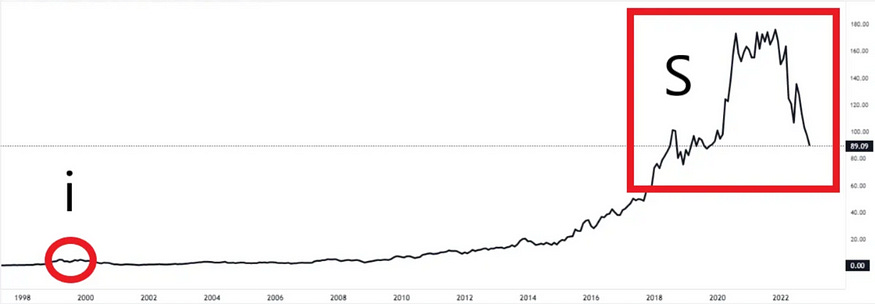

The ‘I’ and ‘S’ Curve With New Technology Shows You How Early We Are.

According to Tim Draper, understanding cycles is crucial to getting excited about new technology.

Emerging technologies often start with hype, but much still needs development.

While people focus on the price, engineers are working on developing the technology, particularly during Bear markets. Draper refers to this as the ‘i’ and ‘s’ curves. The ‘i’ represents the first speculative price increase, while the ‘s’ is the skyrocketing growth as the technology develops.

Amazon is a prime example of this phenomenon, with its market cap rising from around $100 million during its first bull run to over $1 trillion today.

The ‘i’ is no tiny blip despite being invisible on the Amazon price chart below. It’s circled in red, highlighting the famous dot com bubble Amazon survived.

According to Draper, the S curve always peaks higher than the initial ‘i’ stage. He uses Amazon as an example, which reached a market value of around $100 million during its first speculative pump.

Amazon has reached a valuation of over a trillion dollars, 500–1000 times higher than the ‘i’ stage. Draper believes this illustrates how people underestimate the potential of something like Bitcoin to reach enormous heights.

Tim Draper — Source

“I’ll give you an example.

Almost every technology goes through the “I”- “S” curve.”

The same thing is happening with Bitcoin.

Every industry comes up and gets hyped to the max, and then that is the dot on the ‘i’, then it drops down, and people say the technology doesn’t work, all these things the technology promised it couldn’t do.

So for years, the price sits there languishing.

But while it sits there, all these great engineers are working hard to develop great ways for us to experience the new technology.

The price then starts slowly creeping up like an S, then it explodes for years and then flattens out until new technologies come along and go through their same i.s. Curve.”

Final Thoughts

Tim Draper’s record speaks for itself when putting your money where your mouth is.

He has an eye and a proven track record of accurately predicting and investing in new technologies. He famously invested in all these companies in their infancy — Skype, Tesla, SpaceX, SolarCity, Ring, Twitter, Twitch, DocuSign, Coinbase, Robinhood, and Hotmail.

His strategy works.

For him, by understanding the I and S curve, it’s become easier to see the potential in new technologies that might have a false start at the beginning.

You’re getting a head start. It’s like the second mouse getting the cheese.

Draper’s example of Amazon is a powerful reminder of how far a technology can go if given the time to develop.

As investors, we should take note and avoid fixation on short-term price movements. Instead, focus on the long-term potential of emerging technologies like Bitcoin.

And recognise that the ‘S’ curve can take us to places we may have never imagined.