Billionaire Investor Who Outperformed the Market During the Dot-Com Bubble Says What’s Coming Is Worse Than a Recession.

Humans always look for better outcomes than historically typical

This content is free because of readers who fund it.

If you enjoyed today’s letter please consider supporting me with a paid subscription equivalent to the price of a coffee.

It plays a pivotal role in sustaining my full-time writing career and producing better content—I genuinely appreciate your support.

Wisdom and experience never lose its edge.

Some macroeconomic experts are optimistic about the market’s outlook, while others are getting high as a kite on doomsday recession porn.

While I can’t predict the future, it’s clearly a topic on everyone’s mind as the stock market teeters on the edge of being nuked. So, I’ve combed through hours of content, searching for a balanced view.

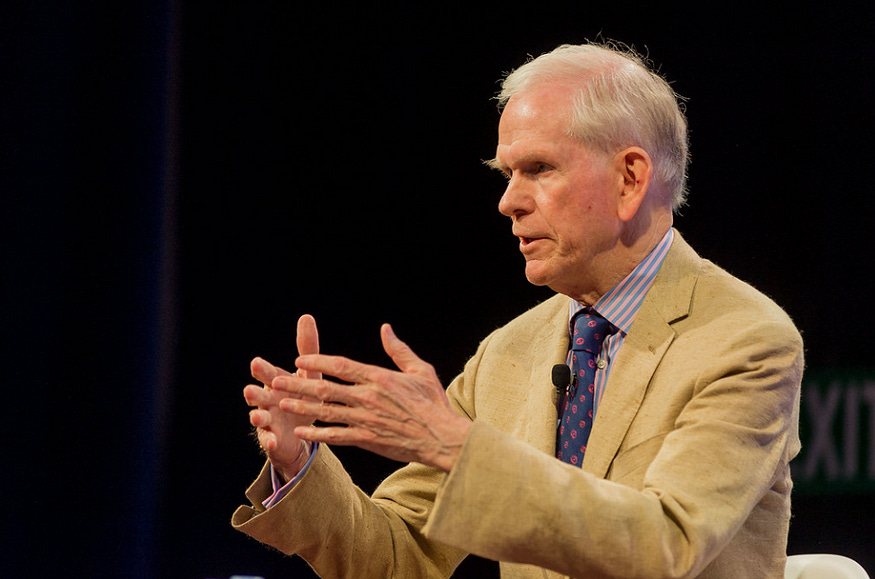

Renowned British investor Jeremy Grantham, famous for studying market bubbles, believes there’s a 70% chance we’re heading for a recession that could result in a further 50% correction of the S&P 500.

The 84-year-old seasoned pro says — “I think of myself as a realist trying to see the world as it is and not the way I’d like it to be. And sometimes, I succeed, and sometimes I fail in that”.

Critics characterise Grantham as a “Perma-bear” (permanently bearish), a label he playfully dismisses by saying he feels like shooting people when they use it. Instead, he prefers “bubble historian.”

In 1999, Grantham’s clients fired him during the dot-com boom and bust as he began pulling money out of growth stocks when the market “kept going up and up and up”.

Jeremy Grantham — Source

“We fought the bubble all the way but were horrifically too early. That was a brutal two years. The market moved significantly from its all-time high in early ’98. It went straight up until March of 2000, and our clients disapproved of us being early and, to a very considerable degree, fired us.

People pulled money out, and then when the market finally did have its collapse, the so-called dot-com bubble burst.

Question — So people called up and said, ‘We’re sorry, can we give you our money now?’ Answer — No solitary person who fired us returned for the same product they fired us for”.

Grantham said, “We (GMO Global Equity Fund) didn’t lose money in 2000. We didn’t lose money in 2001, and we did not, by the skin of our teeth, lose money in 2002. So by the time the S&P was down 50%, we had three up years. So that made the firm and drew in the assets”.

Not everyone agrees about the state of the market.

The most frequently discussed topic I encounter daily is whether we’re on the brink of a recession or whether we’ll narrowly escape it.

The market bubble guru believes it would be unique if we didn’t have an extended problem with the economy — “This tech bubble bursting is far from over — what happens after the bubbles break, there’s always a recession pretty quickly, and people never get it. People never forecast it”.

The Federal Reserve, clearly reading from a different hymn sheet and in charge of monetary policy in the US, dropped their forecast for a recession altogether because the economy, as they say, is “resilient”.

Jerome Powell — Source

“So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession.”

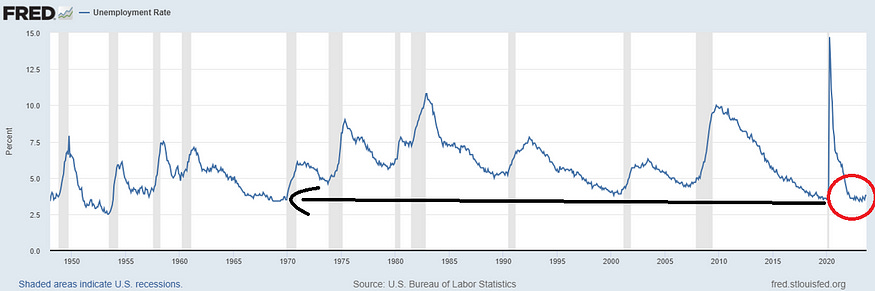

The Fed has taken inflation from 8.2% to 3.7% in the last year, and unemployment is as low as ever since the 1970s at 3.8%, below their target of 5%.

Hedge fund manager and popular television personality Jim Cramer summed it up best when he said — “If I speak in no gibberish, this economy is so hard to kill.”

Grantham disagrees entirely and said the Fed is happy to take the credit when asset prices are increasing but never puts its hand up to take responsibility on the downside.

He says it’s simple — “Low interest rates push up asset prices, and higher rates push them down. And we’re now in an era that will average higher rates than we had for the last ten years.”

Jeremy Grantham — Source

“I think the Fed’s record on these things is wonderful. It’s almost guaranteed to be wrong. They have never called a recession, and particularly not the ones following the great bubbles. They prided themselves on stimulating the bubbles — they took credit for the beneficial effect of higher asset prices on the economy. They have never claimed credit for the deflationary effect of asset prices breaking, and they always do.”

One hidden indicator that fools people during every market bubble.

It’s a real head-scratcher watching the stock market rally in the wake of a banking crisis, a war in Europe, sky-high interest rates and inflation rates that have your disposable income at gunpoint.

At times, it feels like reading a map in a foreign language.

According to Grantham’s data, it’s pretty standard that you see a rally concentrated amongst blue-chip stocks ahead of an inevitable crash. One vital indicator of a market top is when there’s a “divergence in performance”, i.e. When the performance of certain stocks is headed in opposite directions.

He says there are many historical references to show during market bubbles, “blue chips initially outperform”, which convinces people everything is hunky dory.

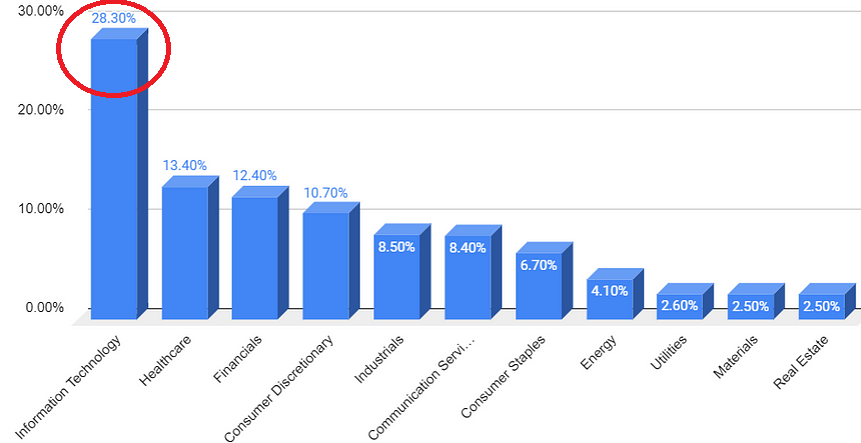

Eight of the top 10 performing stocks are tech giants, promising a future of AI, which makes up for 28.30% of the market gains, which is heavily concentrated.

Jeremy Grantham says, which I agree with, that this is an obvious indicator that once the AI speculation softens, there’ll be significant downward pressure on stock market prices.

Divergence — i.e. the separation of performance between “Junior” performing stocks and blue chips, is an obvious sign of a top signal, according to Grantham.

Today, we have an AI bubble with companies like Apple, Microsoft and Amazon making up 15% of the gains of the entire market.

The bubble historian says the same happened in “1929, 1972 and 2000 — the beautiful Great Tech bubble.

After consuming more than 20 hours of his content, I can tell with certainty my fellow Brit revels in market bubbles — you can see in his facial expressions that it’s a true delight. Lol.

But he says this AI bubble is confusing people like it usually does.

Jeremy Grantham—Source

“You get this divergence where, at the beginning of the bubble, the speculative leaders take a hit, sometimes a significant one, while the big blue chips keep climbing.

People wonder, ‘What are you talking about? It doesn’t look like a bear market — the S&P is up 20%. The S&P was up a lot more than 20% in 1929. But the low-priced index, the speculative stocks, were down 35% to 40% the day before the 1929 crash. The low-priced index had even been up 85% in 1928.

Nothing resembled that divergence, where the high-beta stocks plummeted, and blue chips skyrocketed, until now.”

According to Grantham’s investment firm GMO, high-risk stocks often take a nosedive quickly during economic downturns.

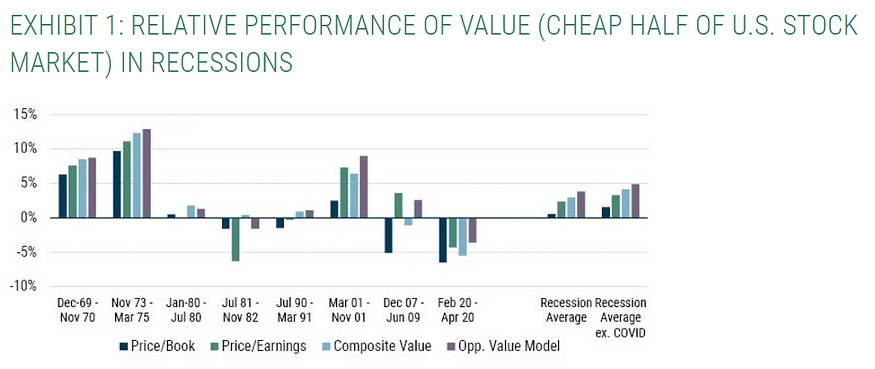

Looking at the past 55 years, it turns out value stocks have usually fared better during recessions, while growth stocks tend to hit a rough patch.

Growth stocks are associated with companies set for higher revenue expectations and earnings growth, often in innovative industries, while value stocks involve established companies seen as undervalued, often with stable business models.

Performance of value stocks during each of the major recessions. The only exception was during 2020 when there were imposed global lockdowns.

“It’s a head fake.”

In their quarterly communication, GMO said this cycle would be notably different and could be worse than an ordinary recession.

“The sharp increase in interest rates, the likely persistence of inflation, and a corporate tax change in the US that seems to have gotten less notice than we believe it deserves. Those factors make us believe that a recession, when it occurs, will be harder to cushion and that highly levered corporations will fare worse in a recession than investors might assume from past cycles”.

If those things weren’t enough to tackle, AI has come to spoil the party because, as Grantham puts it, “We were deflating quite nicely from the kind of tech classic bubble in 2021 when a series of things got in the way to mess it up, the main one being artificial intelligence”.

Jeremy Grantham — Source

“I wish it hadn’t arrived just now because the end of these great bubbles is hard enough without the elements of new bubbles to scramble the thinking”.

And that’s what has happened here.

A dozen giant American stocks have had a hell of a run on the back of AI, which has undoubtedly created the impression that it’s game over (for a recession).

The problem is prices are still incredibly high, and basically, the economy is beginning to unravel, and it’s a head fake, but it’s a hell of a head fake.”

Final Thoughts

Once the hype around AI dies down, we could see a significant cascade effect on the rest of the market.

Grantham says, “Humans always look for better outcomes than historically typical.”

While he denies being a doomsday fearmonger, he does say, “Just persuade yourself that the world is typically wrong, the world is typically too optimistic, too willing to go with the group.”

If you’re terrified, you should be because that’s the nature of a significant bear market.

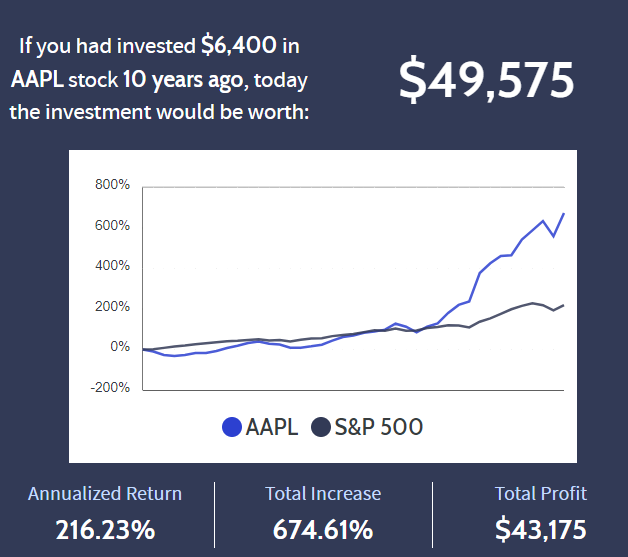

Using $6,400, which is, on average, the value of two month’s salary in the USA, if you invested a decade ago into Apple stock when people were saying the stock was high, you’d have had returned profits of $43,175.

Amazon, another tech giant's market cap, rose from around $100 million in its first bull run during the dot-com bubble in 2000 to over $1.3 trillion today. That’s an increase of 1.3 million per cent (1,300,000%).

It took ten years and two recessions for those who remained invested in Jeff Bozzo's company (since the bubble’s peak) to see significant gains, but their patience was handsomely rewarded.

The point of difference is not your ability to be Nostradamus but to thoughtfully pick stocks you believe in long-term.

The future’s a mystery. People like Grantham who dedicate their lives to a singular skill set are often right.

But does it actually matter if you’re in it for the long run?