Bitcoin Is About To Reach the Banana Zone.

We are so close to parabolic prices moves.

I hope you’re enjoying a great Sunday wherever you are! Today’s newsletter is made possible by paying subscribers supporting Carrot Lane. Consider upgrading to a paid plan for access to me and a growing community, and help us become the fastest-growing newsletter on the block—plus, annual plans are now 40% off!

This has to be the most snooze-worthy bull market of all time.

Someone dubbed it the "sideways summer," and it's spot on. But it's during those moments of maximum boredom, when everyone is caught off guard, that things really start to take off.

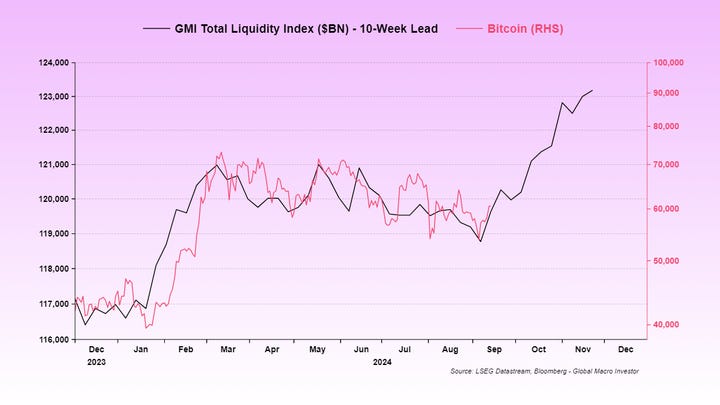

People are tuning in to experts like Michael Howell, who point out that Bitcoin and risk-on assets are highly sensitive to global liquidity, which has now hit a record high of $93 trillion.

Julien Bittel, probably the best business cycle analyst out there, says:

“At this stage in the business cycle, with financial conditions easing – and fast – we're right in the middle of a classic setup where commodities are primed to move higher again soon, just as everyone else has turned mega bearish.

As always, when financial conditions loosen, demand comes roaring back, and the market tends to catch everyone offside."

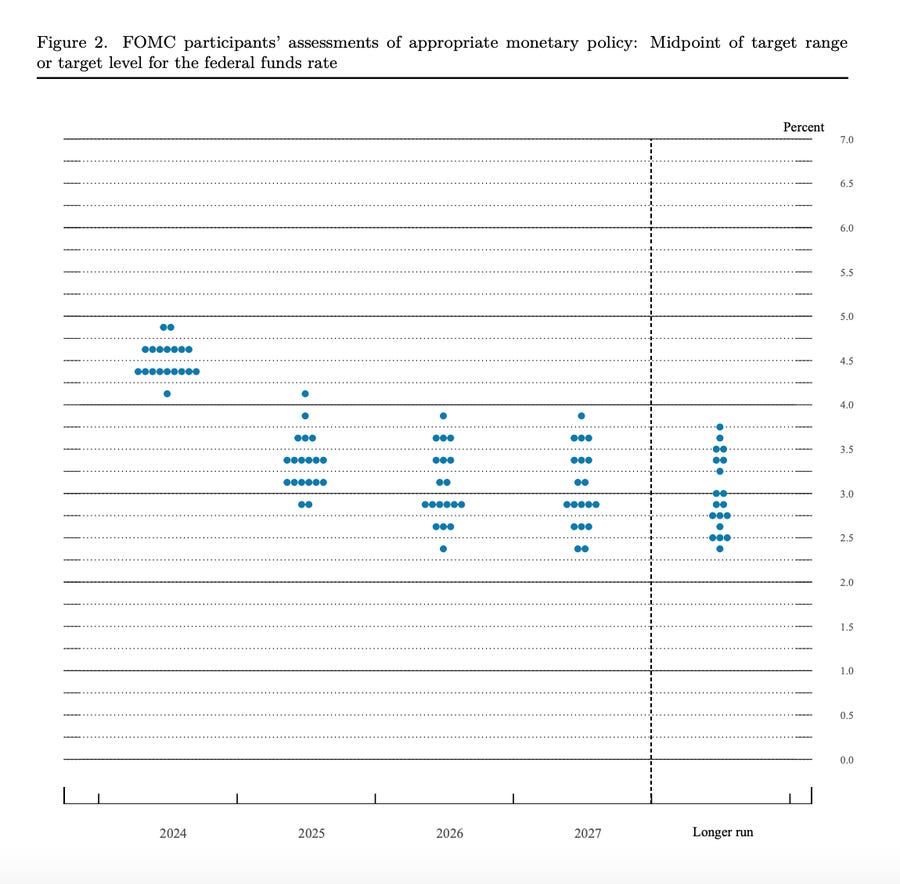

China just rolled out a massive stimulus, and the Fed is cutting interest rates by 50 basis points. According to their dot plot voting system, they're also forecasting another 50 basis point reduction before the end of 2025.

The big trade is on!

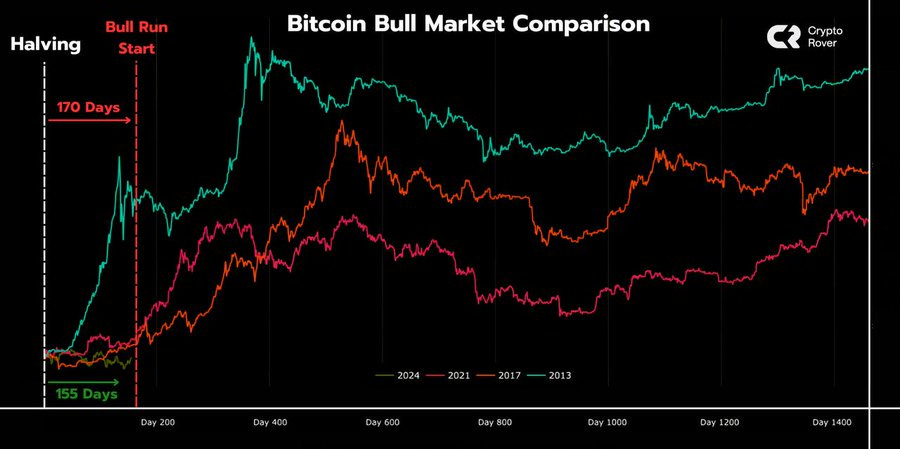

In every previous cycle, we've seen a Bitcoin bull market around 170 days after the halving, which brings us to October 5th.

Global liquidity is lifting all boats.

Once I understood that 98% of asset price rises are due to money printing, investing in volatile assets became incredibly easy.

Financial conditions are improving, and the money supply is increasing, so asset prices are rising optically. Bitcoin is incredibly sensitive to the global money supply.

Here is a chart of the Global money supply (with a 10-week lead) against a chart of BTC, which practically mirrors it.

So we're very close, and the chart doesn't include the recent Chinese stimulus bill set to inject $1.4 trillion into their economy which is the most since 2016.

Bitcoin ETF inflows are reaching daily highs.

I talk about these ETFs like you know what they are, but if you're unfamiliar with them, ETF stands for Exchange-Traded Fund.

It's just a fancy term for a stock that represents underlying assets.

So far, the ETF has scooped up $76 billion worth of Bitcoin and has a recent run rate of $2.5 billion in daily inflows. Those numbers are mind-blowing, and we aren't even in banana zone — bull market territory yet.

The significance of the ETF is the investor protection and the fact that folks can get some exposure to an asset without the self-custody issues or worrying about a succession plan if they pass on.

The inflows into these ETFs will keep increasing.

Someone asked me the other day when they should sell their Bitcoin, and my honest answer is: never. Selling risks missing out on the whole trade. Of course, smaller altcoins are a different story due to unlocks and downside volatility, which allows you time to catch up.

Take a look at the Gold ETF: gold rose for six years straight before it finally corrected. Keep in mind that as prices kept climbing, those miners were digging up more gold.

Bitcoin shares the same traits as gold: it has a fixed supply and is much easier to buy worldwide.

GOLD ETF Performance on a chart.

The Bitcoin Multiplier effect.

This part of Bitcoin is wild.

MVRV is a ratio that compares Market Value (MV), or market cap, to Realised Value (RV). Market Value is simple—it's the total value of all coins at current prices. Realised value looks at what each coin was worth when it changed hands, giving us an idea of the network's overall cost basis.

Right now, the four-year average is 0.24, meaning it takes $0.24 of new investment to bump Bitcoin's market cap by one dollar. In other words, the market cap increases by about $4 for every $1 of net capital inflow—a 4x multiplier.

A big reason for this is the shrinking supply of Bitcoin since many investors are holding on for the long haul.

With more cash flowing into Bitcoin ETFs and supply tightening, we could see Bitcoin's price shoot up to a conservative $250,000 (I'll detail why in second).

The chart below displays the grey skyscrapers representing the cost basis, while the black line above shows the impact on Bitcoin's market cap. The red and blue lines simply indicate the moving averages.

Bitcoin Price Prediction.

People get a rush from price predictions, and it's no wonder—one minute, everything seems headed to zero, and the next, prices are blasting off to the moon.

Currently, 78% of Bitcoin owners haven't sold in two years, a staggering number that creates a lot of supply friction.

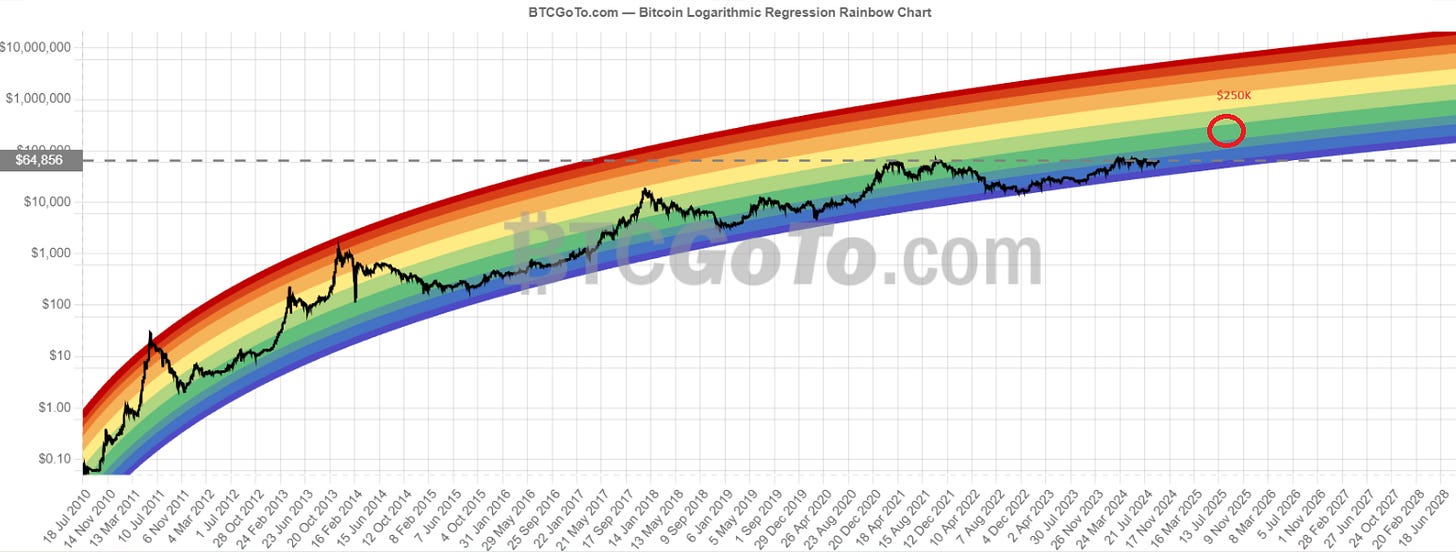

You hear the classic financial advice that past performance doesn't guarantee future results, but Bitcoin follows a solid log trend.

Using a log scale for past price movements helps us see how Bitcoin has responded to different market conditions, making it easier to predict its future behaviour in similar situations.

I view this chart more as a touchstone—it's not perfect, but it gives us a sense of where we might be headed—the next leg up is around $250k.

Final Thoughts.

Regular readers will know that I prefer moving further down the risk profile into smaller caps like Ethereum, Solana, and SUI, so I currently have a negligible amount of money in Bitcoin.

Here's the deal: it's a safe haven asset, and it's all about knowing your risk profile.

For most folks, using Bitcoin as a savings vehicle in dollars or sterling each month is one of the smartest passive investing moves you can make.

Supply friction, combined with the obvious rising demand, will lead to massive upside over the long term.

At some point, I might rotate back into BTC as my long term bet.

I came across the perfect reply to Michael Saylor on this topic that really nails the concept of risk profile.

I love BTC and 1,000% believe in it and it's future, but my job is optimal capital allocation at this point in my life and that means aggressive risk taking which is what I do for a living . I'm not a rich as you...

Find what’s right for you.

Catch you later!