Bitcoin Just Erased Four Years of Progress in One Day. Most Won’t Make It.

It would suit folks to lean into the pain.

Today's newsletter is free thanks to paying subscribers who support Carrot Lane for a tiny fee. You guys are the ones who keep this entire thing running. To show your supoprt please consider upgrading to paid:

The last 24 hours have been carnage, and while many can sit back and see the humorous side of crypto and the wider market crashing so spectacularly, I want to make it clear that people should look after their own well-being.

It can knock the wind out of you.

A product of these assets going up by astronomical amounts is that they can crash by the same amount. In any normal world, a 50% to 70% crash would mean your asset is dead and buried. These are not productivity models like stocks, where the price is an indication of the company’s performance. They are network adoption models, or put more simply, community tokens.

These sellers are people selling out of their communities, either through being liquidated, overleveraged, trading around the cycle, or a combination of all three.

I am seeing so much BS on the timeline, from folks in my comments section blaming the release of the Epstein files, as a rumour circulates that Jeffrey Epstein is the creator of Bitcoin, or that somehow the Bitcoin community had reached a psychological $100k level, and, almost out of celebration for reaching the summit, people were selling.

People are going to be people and find all sorts of creative, alluring reasons for why there’s sell pressure, or why they think the cycle is over for another four years, but the harsh reality is no one knows.

People looking at RSI charts of Bitcoin (relative strength index), which basically tracks a 14-day moving average, may be a great indicator of short-term price movement, but they serve absolutely no purpose beyond making crypto influencers look insightful.

Anything that overrides a macro investing framework is bullshit.

When you invest based on a political view, philosophy, short-term chart patterns, a narrative or mere guesswork, you will be in all sorts of bother.

Let’s dive in.

It’s much easier to pick a bottom than it is a top.

This is the part many people miss.

You can take this to the bank: you have far more chance of spotting the bottom of the market because of the consolidation phase it goes through before it recovers than you do of spotting the top.

That’s why you need to size in small enough during drawdowns so you can run the marathon and go the distance with the trade, while still adding to your position during the pain.

I know it feels counterintuitive, but if you have capital and high conviction, it lowers your cost basis of what you paid for the asset, which compounds on the back end when the market recovers.

“I’ve lived all of this. Every horrific, gut-wrenching moment all within a secular bull market. My first entry was at $200. The price is now $65,000. I even missed a 3.5x in the middle by timing the market (badly). The first key lesson (for me) in a secular rising asset is just to do nothing. HODL is a meme for a very good reason. It is much more powerful than the 4yr cycle meme.

My second lesson was to add aggressively in the sell offs. Even if I didn’t time them right, averaging into weakness to add to the overall position massively compounds returns over time, even more so than DCA’ing. I didn’t always have cash to buy meaningfully into a sell off but I’d always buy something as its good to train your psyche.

It always feels like you’ve missed your chance, it’s never coming back, it’s all going to blow up forever. It is not the case. BTFD (buy the f*cking dip) and let time in the market beat timing the markets, because it always does. Adding into big sell offs lowers your high water mark. It makes a BIG difference.”

Stop day trading, it doesn’t work.

Every Tom, Dick, and Sally thinks they’re Paul Tudor Jones when the price goes up and they suddenly start trading around the asset.

Some crypto influencers are scoffing on the timeline, feeling pretty smug, saying they sold in October before the liquidation event and conveniently sold a large percentage of their position in December because they thought the cycle was ending.

Let’s say for a second they’re right, that the cycle is over, which given the current market position looks accurate. Even if someone played that perfectly, which I can tell you almost no one did, I am yet to see receipts of it, they would still incur a tax event on the sale. In my jurisdiction here in the UK, that works out to about 26%. So you sell out, you now have to outtrade the shrinkage from your tax event, and then you have to time the bottom perfectly to trade back in.

The reality is that the psychology of the buyer on the way down is more driven by fear, so you do not put the same amount back in. Out of fear, it becomes much harder to add into pain.

It’s much easier just to hold what you have during the pain or slam the laptop shut.

Let’s say you sold the Bitcoin top at $126k. Now it’s $70k. You won’t put in the same amount at $70k. You think it’s going lower you’re waiting for it to go below $50k because you feel better about buying there, for no other reason apart from price anchoring.

There is a higher likelihood of less left-tail risk and a quicker recovery, simply because the backdrop of oil, interest rates, and financial conditions is much better. So price is likely to go up sooner.

You end up buying back in at $80k to $100k, chasing the train back out of the station, putting less money back in, and having less exposure to the apex asset.

And you probably bring yourself to about breakeven after your tax event, or even underwater.

It doesn’t work.

Nothing beats the good old-fashioned buy-and-hold.

Always use a macro investing framework before anything else.

Every time I have come unstuck, it’s been when I’ve moved away from using a macro investing framework and got caught up in a narrative, or an echo chamber.

The reality is simple. If the economy is better, that is better for crypto. Full stop. There are no other arguments.

If people have more money in their pockets, businesses are doing better, interest rates are lower, oil prices come down like they are, mortgage rates are lower, people get pay rises, it incentivises people to spend more.

So the question then becomes, what can we use to measure the health of the economy?

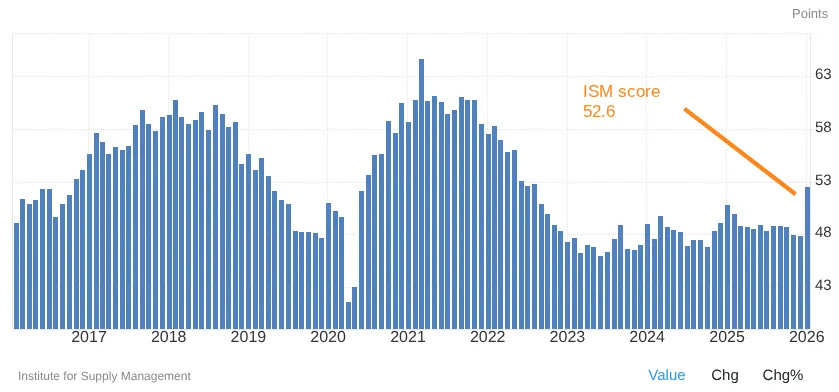

The lead signal is the ISM as per AronGroup:

“If you want to feel the pulse of the US economy before anyone else, you need to look at the ISM PMI index. This monthly indicator surveys purchasing managers with a simple question: are conditions improving or worsening. The responses provide an early signal of whether economic growth is on the horizon or if a slowdown or recession is looming.”

Each month, the ISM PMI surveys purchasing managers and asks whether conditions have improved, worsened, or stayed the same compared with the previous month.

Those responses are then turned into a number between 0 and 100.

A reading above 50 indicates expansion compared with the previous month.

A reading below 50 signals contraction or a slowdown.

Because the ISM PMI uses equal weights across key components such as new orders, production, employment, supplier deliveries, and inventories, it often signals where the economy is heading before lagging official data like GDP.

If the ISM PMI stays below 50 for several months, it points to weak growth momentum. Sustained readings above 50 signal expanding economic activity.

Here’s what the most recent ISM reading is telling us. We are in expansion mode despite market capitulation. ⬇️

Final Thoughts.

Author note: As I write this, the crypto market is starting to recover.

Make no bones about it, this is the reason many people do not make money in crypto: volatility.

They apply the old productivity framework, in which stock prices are associated with a company’s financial performance, versus network adoption models, in which price declines are more a product of financial conditions.

They are not the same thing.

It’s a square peg in a round hole, and it’s screwing many people up. Don’t get me wrong, it sucks when the price goes down because what it’s telling you is that your hopes and dreams have just gotten further away.

But you must realise this is not easy. If it were, everyone would be doing it and succeeding.

The only thing you can do to be successful is avoid trading core assets. Have a bag of assets that minimise regret. In other words, a core of majors like the top six cryptos and high-end NFT art.

But use the economy as your gauge. When economic conditions improve, more cash and attention will naturally flow into these assets.

Anything in the middle is just noise and a mid-curve.

It’s why most people won’t make it.

If you’re looking to make it through this cycle while minimising errors, please consider joining my Founding members group for the member benefits that come with the access. We will win together.

This article is for informational purposes only and should not be considered financial, tax, or legal advice. You should consult a financial professional before making any significant financial decisions.

As someone who’s always had a long time horizon, these dips make no difference to me.

but is now a good time to buy