Bitcoin Presents a Once-in-a-Lifetime Investment Opportunity Even Though We’re Heading for Unavoidable Economic Catastrophe

It would help if you were fearless in the face of volatility and doomsday thinking.

Photo by Daniel Páscoa on Unsplash

We all spent money like reckless gamblers at the roulette table.

That sweet pandemic cash felt good.

Now it feels like the sky is falling.

And no solution will prevent America and possibly the world from incurring substantial economic and financial damage.

We’re screwed.

According to United States Treasury Secretary Janet Yellen, the U.S. is skating on thin ice and will likely run out of cash by June. They’ll either default on their debt obligations which has never happened in 200 years or have to raise the debt ceiling (which they do every year).

It won’t take a genius to determine which one they’ll go for. But raising the debt ceiling and kicking the can further down the road is like jumping out of the frying pan and into the fire.

There’s not a single thing that’ll save the United States from considerable financial pain. We’re in too deep.

In 1917, the U.S. Congress implemented the debt limit to restrict the amount the U.S. government could borrow. Today the national debt soared to an astonishing $31.4 trillion.

Republican and Democrat governments have consistently spent more than they earn, with an average yearly deficit of nearly $1 trillion.

They borrow yearly to cover debt obligations, keeping things afloat. Yet, this only postpones the inevitable task of addressing the mounting debt and slowly turns the dollar into junk.

Jerome Powell is responsible for guiding the Federal Reserve’s monetary policy decisions, which include setting interest rates to help maintain economic stability. He’s raised interest rates ten times for a total of 525 basis points, which is 5.25% since last year, seven times in 2022, and 3 times in 2023 to tackle Inflation.

While combating rampant Inflation with interest rate increases, there is a fear that quantitative tightening could trigger a chain reaction of banking failures, like a button popping off a shirt.

The growing worry about the banking system has sparked a remarkable change in people’s feelings towards Bitcoin.

Bitcoin has come out of this sh*t storm smelling like a rose.

Let’s get into it.

Here’s What’ll Happen if You Show Patience and Some Blind Faith.

Fairy tale stories of quick riches don’t exist.

Like the ones, you hear on the news. Where someone took a chance and invested in something early and suddenly found themselves swimming in an unimaginable amount of money.

Those days are over.

But Bitcoin is an opportunity for investors to achieve significant returns still. Heck, a forecast from Ark Invest suggests $1 million by 2030 is downplaying it.

There’s a caveat.

You’ll need to stomach the ups and downs of the market and hold your investments for the long term to see substantial gains, as with any investment.

According to the research from Ark Invest, when people wait to trade Bitcoin for around six months, the chance of it ever being sold drops significantly.

In other words, more time holding Bitcoin equates to a lesser likelihood of people ever letting go of it.

As of the end of 2022, data shows that people who have owned Bitcoin for more than six months make up 71% of all the Bitcoin available to buy and sell.

That 71% of Bitcoin hasn’t moved in 6 months.

Bitcoin’s value has been unpredictable, making it difficult to see its long-term benefits. However, despite five significant drops in the value of more than 75% since it started in 2009, Bitcoin has still given positive average returns over three, four, and five years against other traditional asset classes.

In a world of unknowns, people hang around waiting for price predictions like crack addicts on a street corner.

While no one can predict the future, here are some possible outcomes based on the same research from Ark Invest by making, as they say, “reasonable assumptions” and factoring in several categories and trends.

Disclaimer; this makes sense.

Institutions are committing to Bitcoin during a bear market.

Bitcoin’s hash rate hit an all-time high In 2022

Forecasts on digital wallet usage

Exchanges have increased transparency in response to the collapse of trust in centralised crypto entities.

Data shows Bitcoin holders are more long-term focused than ever in history.

Bitcoin’s capitulation has hit levels associated with price troughs in the past — so subsequent price increases may repeat, but previous performance doesn’t guarantee future results.

Bitcoin’s fundamentals are stronger today than in past drawdowns.

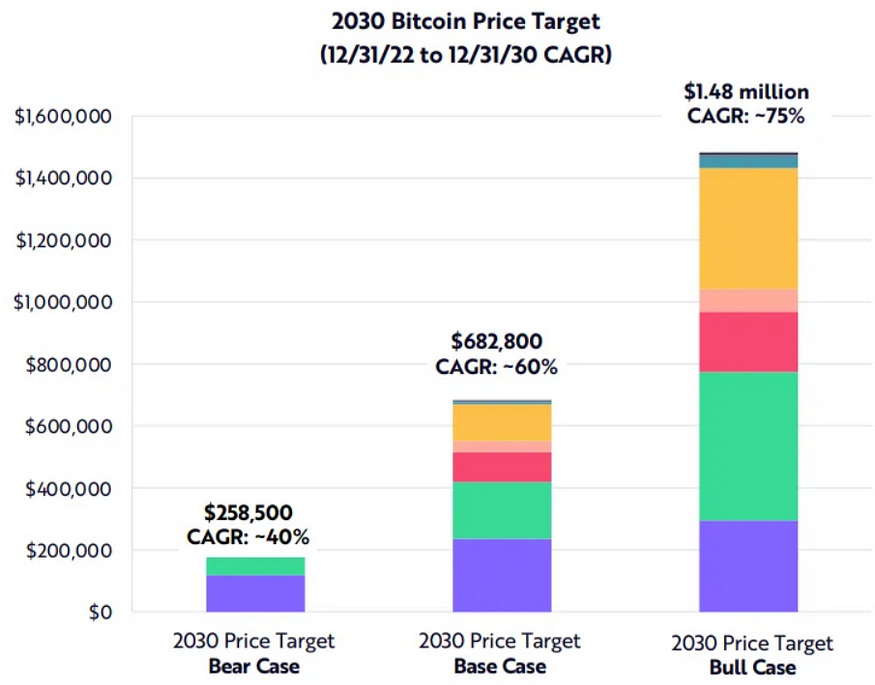

As a result of their forward-looking indicators and the current trend of compound annual growth rate, ARK says the price of one Bitcoin will exceed $1 million by 2030.

It’s a plausible scenario, not some far-fetched pie-in-the-sky stuff a 20-year-old YoutTuber created in his mom’s basement.

Here are Ark Invests Forecasts.

Bear Case — $258,500 by 2030

Base Case — $682,800 by 2030

Bull Case — $1.48 million by 2030

Final Thoughts

Only a few factors bring Bitcoin’s thesis to a grinding halt.

Governments will likely tax the eyeballs out of it.

Sovereign nations could ban Bitcoin.

Centralised exchanges could be prohibited from trading it or have imposed purchase and sell limits.

When you squeeze down on the Bitcoin balloon, the air will head elsewhere, and Bitcoin’s value will continue to increase as it has done and based on continued demand.

It’s an emerging asset class that’s outperforming everything.

Each new low in Bitcoin beats the previous high dating back to 2012, as detailed in this logarithmic chart.

Provided you’re playing with money you can afford to lose and in it for the long term, you should be fearless during this recent turmoil and doomsday thinking.

It’s a once-in-a-lifetime shot.

Can't wait!! But will USD be worth anything at that point?

Love your content as always! This is the information i needed to learn and be ready for the market, thanks Jayden for making your briliant mind avalaible to us 👌