Bitcoin’s Final Macro Hurdle: Government Shutdown and Fed Chair Chaos

Once the dust settles these signals will be obvious in hindsight.

Today’s blog is free thanks to paying members who support Carrot Lane. A small subscription goes a long way. It helps grow the newsletter and fuels the content I put out here.

This cycle is starting to feel like being slapped by a wet fish.

The gold and silver maxis, who spent years sniggering at our “magical internet money”, are now feeling the irony like needles going into a voodoo doll.

Gold is down roughly 9% from its highs. Silver closer to 28%. That marks one of the largest drawdowns in the history of modern precious metal investing.

Nobody’s laughing now.

Someone said on the timeline recently that “this cycle has been exhausting”. Well, fucking woe is me. I get it. You priced in buying that sports car or promised your partner the holiday, and now it feels like the cans been kicked further down the road. The real poison here is expectation. Too many people are glued to the 2021 rear-view mirror, feeling like they’re owed a repeat of that gates-to-Valhalla period in time.

That expectation is creating anxiety.

The old four-year crypto cycle is dead and buried. The reason is simple. Debt. We’re now further into a global debt refinancing period because rates have been higher for longer, and this changes the entire structure of the cycle.

With rates higher, the US has not been able to roll over its debt, which usually has an optical rising effect on assets. Higher interest rates also crowd out spending, which squeezes risk assets.

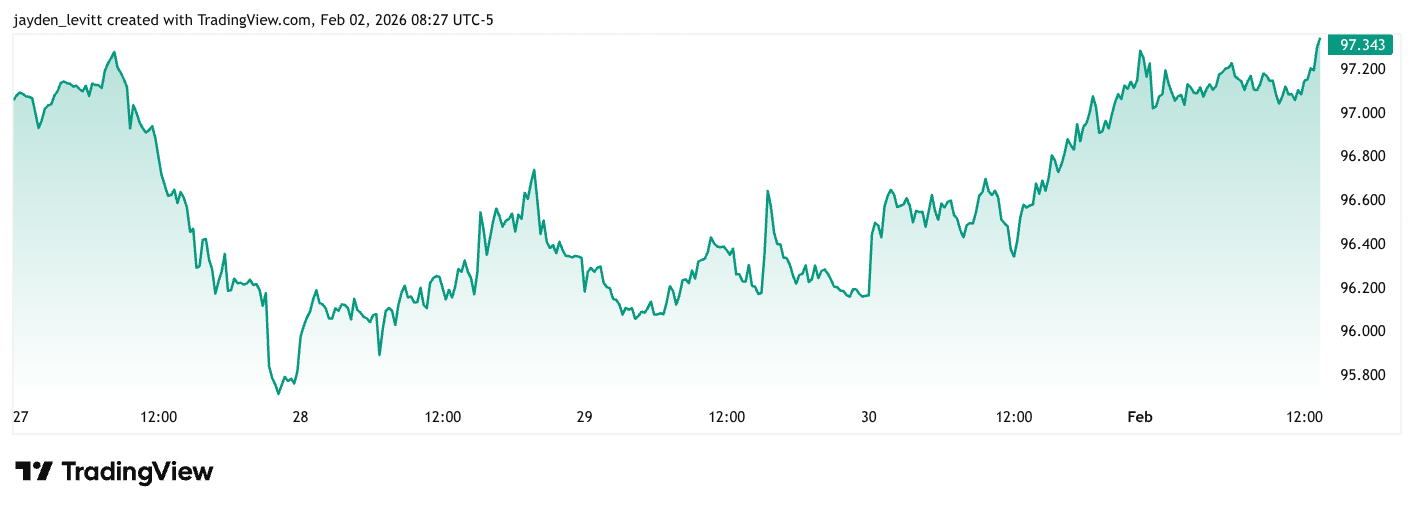

Kevin Warsh was announced as the future successor to Jerome Powell as Fed chair, someone who has been openly critical of Powell. Right after the announcement, it triggered a sharp sell-off in gold and silver. It also hit our beloved internet money because of the easier access to capital while traders waited for the week to reopen.

Warsh is known as an inflation “hawk”. In central banking terms, a hawk prioritises fighting inflation, while a dove prioritises growth and jobs. Which, if you think about it, kinda goes against the current adminsttraitons stance on the economy.

Not everyone is convinced. Some see Warsh as someone whose political stance shifts with the wind depending on who’s in power. Paul Krugman, a professor, former NYT columnist, and someone Trump once called a “deranged bum”, said:

“As I noted, many news reports have characterized Warsh as a monetary hawk, but I argued that he’s more of a political weathervane: He’s for tight money when Democrats are in power, but all for running the printing presses hot when a Republican is in the White House.”

Neil Dutta of Renaissance Macro, another Warsh sceptic, used AI to map every single one of Kevin Warsh’s speeches and public comments over the years and score them for hawkishness versus dovishness. Lol.

When you see it on a chart, there really is no hiding place for data and the potential political bias.

I couldn’t care less about anyone’s political views. I’m in risk assets. I want prices to go up. Warsh was aggressively hawkish in the years after the 2008 financial crisis, then abruptly flipped dovish after Donald Trump won in 2024, which ties into Krugman's “weathervane” comment.

Call it self-interest, even downright greed, but I’m pretty happy we’ve got a guy to make the money printer go brrrr.

For context, here’s one of Warsh’s speeches from mid-2025 that’s now going viral on the timeline.

It signals his bullishness on Bitcoin, alongside his views on reducing the Fed’s balance sheet and his stance on inflation.

“The elephant in the room is that we know it when we go to the grocery store. But we also own financial assets. Maybe we own some Bitcoin. 52% of our fellow Americans own no financial assets. They don’t have equity in their house. They don’t have an account at Schwab. They don’t have an account at Coinbase. They are living off their W2 income. And this surge in prices have destroyed them. It’s the most regressive tax any government could ever come up with. Imagine if we had a central bank that had been deadly focused on that. I think we wouldn’t have taken a divided country, made it more divided. When we have a big balance sheet, we’re asking for the inflation that came, and as a final point, my own judgement is the story that I hear from many of my peers. Well, the inflation, well, that’s not really the central bank’s fault. That’s because of Putin and the pandemic. Nonsense.”

During Warsh’s previous time at the Fed, even in the aftermath of the 2008 financial crisis, he was more concerned about inflation than about employment.

On the surface, that makes him an odd choice given Trump’s long-running frustration with Jerome Powell over rates.

Trump hasn’t exactly been subtle. He’s called Powell “crooked”, a “clown”, “incompetent”, “too late”, with “some real mental problems” and added, “I’d love to fire his ass”.

The message has been unambiguous. Rates need to come down.

The current administration is acutely aware that rolling over debt lifts asset prices. In fact, former fund manager and founder of Key Square Capital Management, and now Secretary of the Treasury and Trump’s right-hand man, Scott Bessent, once pointed out that administrations on both sides, Democrat and Republican, have used this as a kind of political ace up their sleeve to make the economy look good and win votes

The midterms are this year. Trump's administration will have a strong incentive to roll the debt.

Check this excerpt from Bessant’s letter to investors in January 2024:

“As Trump’s lead persists, the Biden administration, led by Treasury Secretary Janet Yellen, would be expected to continue to follow, and perhaps accelerate policies, to keep the economy buoyant, provide ample liquidity, contain interest rates and avoid any more blowups like Silicon Valley Bank. All are extremely equity market positive.”

More recently, Warsh has softened his tone, echoing Trump’s criticism of the Fed and leaning toward lower rates.

Whether that moderation sticks or his hawkish instincts resurface remains to be seen. But the market reaction suggests that the sell-off in precious metals indicates investors are pricing in lower inflation expectations and greater financial stability.

The dollar is in recovery mode, which supports that.

Macro experts say this is the final hurdle.

Everyone in crypto drinks from the Raoul Pal Kool-Aid.

He hates being called a guru, but when the shit hits the fan, people usually turn to him for answers. His thesis on these assets has always been clear. They’re driven by liquidity. Even if they’ve somewhat decoupled recently.

People search for alluring explanations. Whales selling. The cycle being over. When the answer is usually far more obvious, like that wet fish slapping us earlier.

It’s the refinancing of the debt.

The U.S. can’t do that while rates are this high. And he believes that once Warsh takes over, we’re likely to see rate cuts. Maybe not immediately.

"Raoul Pal: The big narrative is that BTC and crypto are broken. The cycle is over. It's all fucked and we cant have nice things. It has dislocated from other assets, its CZ's fault, its Blackrock, its whatever. It is an alluring narrative trap for sure... especially when we see prices puking each and every fucking day...”

Pal says Warsh’s job will be to cut interest rates, stop over-managing the economy, and let it run hot.

Back in the late 1990s, renowned economist Alan Greenspan, who served as Fed chair, allowed strong growth even when things looked a bit overheated, because productivity gains from new technology kept inflation under control.

Pal says Warsh will likely run the same playbook. AI is expected to boost productivity, which should help keep prices in check even if growth accelerates.

Raoul Pal: “Warsh’s job and his mandate is to run the Greenspan era playbook. Trump has said this, as has Bessent. It means cut rates and let the economy run hot and assume that the AI productivity rise will subdue Core CPI. Just like the 1995 to 2000 era.

He is no fan of the balance sheet but the system hit reserve constraints so likelihood is he wont change its current course. He cant or he blows up the lending markets.

Warsh will cut rates and do nothing else. He will get out of the way of Trump and Bessent who will run liquidity via the banks.”

Final Thoughts.

According to Polymarket, the government shutdown is expected to last around five days. That’s much shorter than the first debacle, which dragged on for 43 days and saw crypto assets get absolutely nuked.

I say this often. It’s moments like these when people don’t make money. They panic sell strong assets because of short-term price reactions. It fucking sucks, but that’s the price you pay for extreme upside in volatile assets.

In any other world, 50%+ drawdowns mean your assets are dead. Not this one.

Any time you override a macro investing framework with emotion-driven buying or selling, you come unstuck. Stick to strong, proven assets that have been battle-tested, and your future self will thank you for sitting through this period.

This may well be the final hurdle for Bitcoin and crypto more broadly. We’re creeping closer to rates coming down to levels where debt can actually be rolled.

You now have Trump, Bessent, and, somewhat precariously, Warsh aligned to goose the economy by letting it finally run hot once rates come down. When that happens, people will refinance debt at lower rates, businesses will free up capital for spending, employment should improve, and most importantly, people will have more money in their pockets for discretionary spending. That money always finds its way into risk assets.

So the takeaway is simple. There’s a lot of potential ahead of us in the not-so-distant future. Warsh, while not officially sworn in yet, is expected to assume office shortly after Powell steps down on May 15th.

Midterms are in November 2026. Trump has a vested interest in getting the economy firing on all cylinders, even amid tariff chaos and immigration friction that’s already causing tension within his own party.

Hang in there. We’re close.

Once the dust settles, these signals will be obvious in hindsight.

If you got value from this newsletter, consider upgrading to a paid subscription. If you’re already a paid subscriber, sharing this with a friend or family member who’d benefit helps more than you think.

This article is for informational purposes only and should not be considered financial, tax, or legal advice. You should consult a financial professional before making any significant financial decisions.

You make good points and your commentary is sound … But… you Do Not Need the swearing and bad language interspersed throughout. It cheapens your messaging and makes you unworthy of public comment. You are not in the pub bragging with your friends. You are , as a commentator, supposed to show intelligent and respectful points of view. Your bad language adds nothing of value to your audience except cheap bravo.

My comment is- shape up or quit putting yourself forward as worthy of attention as a “professional.”

Don Maxwell