Cathie Woods Tesla Prediction Will Transform Your View of Elon Musk.

Some people are about to eat their words if her research holds up.

I’m on the road today—diving into the concept phase of a special piece for Sunday that explores the deep meaning behind the art layer of Crypto, why it’ll be culturally significant, and the astonishing financial opportunities it represents.

Below is an updated version of my original research from Cathie Woods Ark Invest. We all saw Elon’s Humanoid Robot and Robo Taxi launch recently, and I was astonished, especially when he said your Tesla could earn you money while you sleep.

If this post brings you any value please feel free to share or re-stack it—it really helps the Newsletter grow.

Elon Musk: "Your car will become a combination of Airbnb and Uber to some degree. There will be some cars that Tesla owns itself, but for the fleet owned by our customers, it will be like an Airbnb. You can add or subtract your car from the fleet whenever you want. You can do it for a few hours, a few days, or a few weeks, and it just makes money for you while you're gone."

I've been all in on the Cathie Wood hype train for a while now.

Judging by the comments on her posts, admitting that might make me public enemy number one, and I can smell the misogyny from here — it's as strong as a post-workout locker room.

I get it — 68-year-old Wood, once hailed as a "star stock picker," is a lightning rod for criticism.

She's a career-long investor and a magnet for online hate, largely because Ark Invest's stock performance has been dismal — with most investors down 65% since 2021.

Many might have weathered the wild price swings and risks of tech stocks if it weren't for her audacious, off-the-wall price predictions — and the "relentless self-promotion," as one commenter put it.

It's mostly men who pile on the criticism.

Wood chalks up any professional marginalisation to her contrarian investment views, not her gender:

“People say that I am attacked in the media because I’m a woman. I don’t think that is. I think it’s because we’re disrupting the financial world and unsettling people.”

Her thematic investing style is all about going big — she's ploughed $60 billion so far into emerging trends and is banking on a single winner to catapult her firm to the stratosphere.

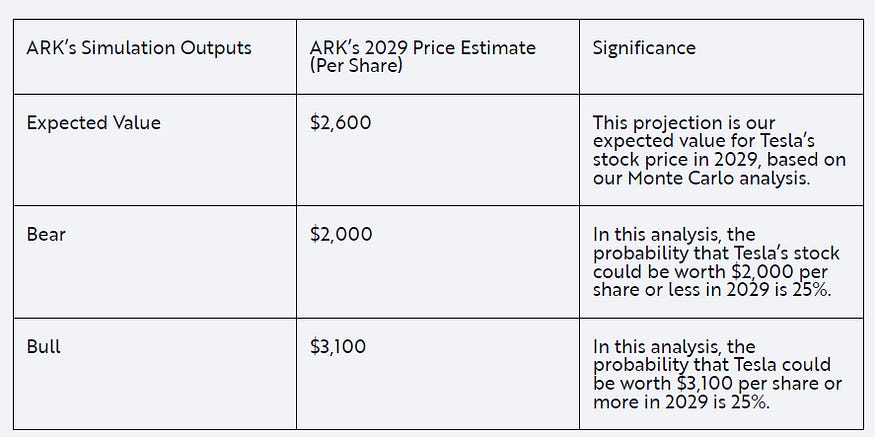

Recently, Wood predicted that Tesla's stock would skyrocket to $2,600 a share by 2029, up from its current $256 (a 10x jump).

“This is a five-year price target, as all of ours are, and what has to happen is an autonomous taxi platform: Tesla’s autonomous taxi platform. So, robo taxis are a SASS-like model. Instead of selling a car and the software package, this becomes a recurring revenue model — a slice of every mile driven on that autonomous taxi network with very high margins. Right now, auto gross margins are around 16%. Gross margins in the SASS world are more like 80%.”

Wood claims it's a winner-take-all market, and Tesla is leading the charge as the biggest AI project globally, thanks to its push for autonomous taxi networks.

“We believe that the entire opportunity will generate revenues of 8 to 10 trillion dollars by 2030. Half of these will go to platforms like Tesla.”

People are lousy drivers (data-backed).

Cathie Wood's Ark Invest dropped a bombshell report on Tesla and its upcoming Robo Taxi launch.

I often wonder why anyone would choose self-driving tech or if regulators will even approve it as road-worthy, especially within Wood's two-year deadline.

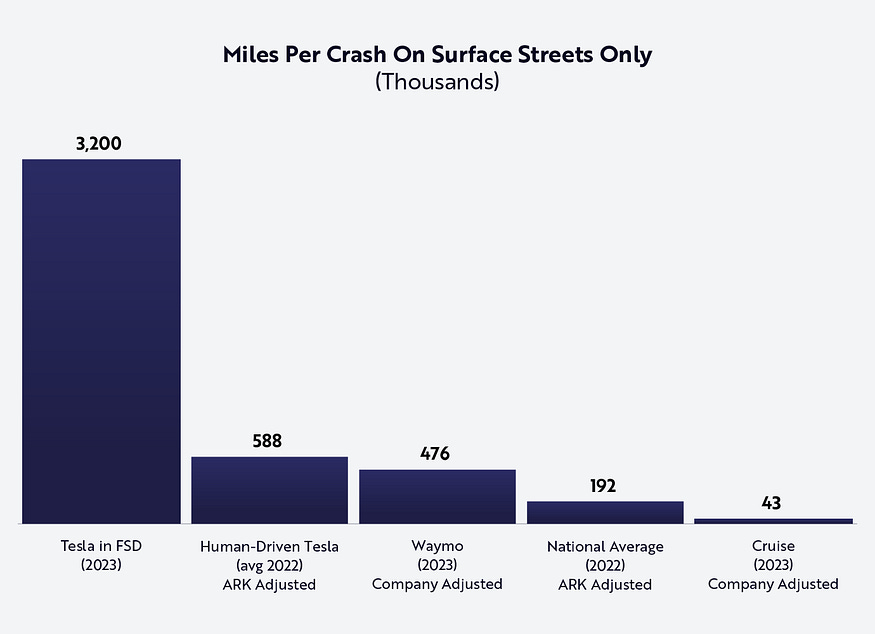

Yet, according to Ark's research, the full self-driving mode is five times safer than a human-driven Tesla and 16 times safer than other cars on the road.

“The average car on the road in the US has an accident every 200,000 miles. The average car with old FSD (Full-Self-Driving), think six months ago, has an accident every 3.2 million miles. Volvo built its brand business on safety. I think we’re trying to tell the story that Tesla should be using this.

Elon has been sending messages to his employee base, his supplier base, to the extent he has not verticalised, and to ultimate consumers that we’re getting very close to the days of a robo taxi driving us from point A to point B safely, quickly, and inexpensively.”

It's not unrealistic — unless Elon gets the boot.

Her bear case for Tesla over five years is $2,000.

At the high end, she's eyeing a price of $3,100, which would catapult Tesla's market cap to a staggering $9.7 trillion — right up there with one of Elon's rockets.

It's currently $728 billion.

“Tesla’s accelerated software updates enhance performance and safety. As a result, Tesla should be able to demonstrate superior, statistically significant safety metrics and receive regulatory approval for its robotaxi network.”

Cathie Wood uses a "Monte Carlo" method, evaluating 45 variables they deem plausible over the next five years. But here's the catch:

“An unexpected event, such as Elon Musk’s sudden departure from the company, or a natural disaster or pandemic, could throw these outcomes off considerably.”

One notable time Musk nearly exited the company was when shareholders refused his $46 billion performance-based pay package.

Later, in a tweet, he implied he would leave and build AI and Robotics outside of Tesla if this were the case.

“I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned. Unless that is the case, I would prefer to build products outside of Tesla. You don’t seem to understand that Tesla is not one startup, but a dozen. Simply look at the delta between what Tesla does and GM. As for stock ownership itself being enough motivation, Fidelity and other own similar stakes to me. Why don’t they show up for work?”

On their hands and knees, Investors did a complete 180.

Ark Invest thinks it's a blessing in disguise. Their research relies on exclusive data — historical prices, profits, interest rates, and market trends — that's not typically public.

If the research checks out, this could be a major win.

Some aren't exactly sold.

While Wood's enthusiasm is as intense as a rocket launch, commenters are slamming the whole idea of AI-powered vehicles — and Tesla as an investment.

I lean towards people wanting cheaper, safer, and more convenient transport, which saves us time, and the data proves it.

Strap in — these actual reactions from readers are lively.

That's called gambling, not investing. Wood is criticised because of her track record, which is fair criticism, not misogyny.

Elon Musk is the master of premature truths. The autonomous driving model, a necessary precondition for robotaxis, was supposed to arrive in 2016 — just a year away. Yet, here we are in 2024.

I call BS. The legacy auto makers are catching up and have better, more affordable EVs. Tesla will suffer. Hopefully Musk's ego takes a hit. He is insufferable.

Yeah — no. AI and fully autonomous self driving will never work as long as a) there are human drivers still on the road, b) anything is allowed on or near the road at the same time as the AI.

I just think the joy in driving has been removed for a lot of people. I've thought for a while now that the biggest tech companies of our time really don't like their users very much.

Investors are piling into a record number of Tesla short positions.

It's a trading method that bets against the stock performance.

Elon Musk, infamous for his humorous rants, is now declaring Tesla "the most shorted stock in stock market history."

Around 3.5% of Tesla's shares — 97 million worth a staggering $22.4 billion — are now being shorted.

Tesla announced that it delivered 443,956 cars in the second quarter, beating Wall Street's guess of 439,000. This news caused short sellers to lose $3.5 billion.

Danny Moses, the infamous short seller and "Big Short" investor, says Tesla's stock will plummet to around $50 a share and thinks Cathie Wood is off in La-La Land.

He got personal, claiming Elon Musk's ventures with SpaceX and Neuralink will drag down Tesla's financial performance.

He's so sure about his prediction that he's opened up a short position himself.

“For someone who cares so much about the human race, he’s firing a lot of humans at this moment, and everything is kind of falling apart in their core business. He’s pointing everybody to robo-taxis and A.I. and autonomy. At the same time, Reuters is reporting that the DOJ (The Department of Justice) is investigating this for wire fraud because he’s been selling a product that doesn’t exist.”

Moses notes that while everyone's fixated on Tesla, another autonomous vehicle company has slipped under the radar.

He highlights Wayve, backed by Nvidia, Microsoft, and Bill Gates, as flying under the radar.

I caught him slipping up and admitting he's an investor in Wayve himself.

That pretty much wrecks his credibility.

Final Thoughts.

What I love about the internet is the raw, unfiltered immediacy of people's replies.

Elon Musk responded to Cathie Wood's price prediction with:

“Extremely challenging, but achievable”

Wood first bet on Tesla in 2014, and while it drew scathing criticism, it catapulted her into the spotlight.

As fresh data and research roll in, it's crystal clear: AI and tech investments, like Tesla, are set to outperform the entire market.

Tesla is tearing ahead in the Full Self-Driving race and dominating AI, riding the wave of a massive macro trend — the writing's all over the wall.

One notable analyst summed it up perfectly.

“There are no other competitors in the world who can ramp up the amount of manufacturing capacity to produce these vehicles at a low enough price who really have any sort of competitive threat to Tesla, and it means that the market share opportunity for Tesla to capture is massive. They are far, far, far ahead.”

The autonomous vehicle industry is set to hit $10 trillion by 2029, and according to Ark's base case, Tesla is poised to dominate 50% of the market.

Cathie Woods' price predictions might not change how you view Elon Musk.

But it's a signal worth paying attention to.

Cathy Woods has misread tech start ups for the past 6 years. Her gamble on Tesla shows she's backed the wrong business. In a little of 3 months, Tesla stock has fallen over 48% in value.

It's in free fall.

Leon Husk has set his company on fire by showing the world his true nature and people aren't having it. Tesla sales globally are plummeting. Members of the Tesla board have dumped their stock, running like rats abandoning the sinking ship and that includes Musk's own brother.

So yeah.. keep schilling for failure, mate 👍

She thinks there’s something that will make me no longer think he’s a cringe, amoral, pedo?