Michael Saylor: Central Bank Digital Currencies Will Be a Government Marketing Event That Unintendedly Fuels Bitcoin Fever.

Politicians have shown they’re capable of interfering in your private affairs and will soon want to know how you spend $50

Free CC0 image — michael.com

Have you ever questioned why Michael Saylor, with all his peculiarities, manages to gather such a large following?

He’s the prodigal son of Bitcoin.

And his ability to share hidden truths using clever storytelling is exceptional.

A loyal band of internet followers hang off his dopamine fuelled buzzwords like crack addicts.

Saylor is also a considerable safety signal to the Bitcoin community because his company MicroStrategy is the largest corporate holder of Bitcoin globally, with 140,000 BTC worth over $12.6 billion.

Talk about eating your cooking.

Saylor can divide opinions, but this time he’s shared thoughts about governments and something wildly unspoken: How they use your money as a form of control.

It doesn’t matter where you’re from; governments are a widely embraced, easy target.

Bitcoin is a network you can’t control because of its decentralised nature. The government is scrambling to launch a Central Bank Digital Currency (CBDC) before Bitcoin and other Crypto obliterate the dollar.

Saylor is ringing the warning bell, suggesting this is another version of government control. And the recent smear campaign of Bitcoin in favour of CBDCs will only ignite the flame for further Bitcoin adoption.

Michael Saylor — Source

“Every time a politician wants to ban guns, there’s an explosion in demand to buy guns.

When we talk about CBDCs, it’s a marketing event that causes everyone to think about a world where they don’t own their own money.

And that leads them to wonder what kind of money they could acquire that they would genuinely own. The most censorship-resistant monetary network in the world is Bitcoin.

So, interest in CBDCs will drive more feverish interest in Bitcoin.

It’s actually driving more awareness, and Bitcoin is growing as people realise the need for a non-sovereign store of value resistant to nation-states’ control.

People want Bitcoin.”

The Assumption Is You’re a Criminal if You Carry Too Much Money.

Specific forms of money are subject to control and regulations, and Saylor uses examples of Gold and Cash.

If you carry large amounts of either through airports, the assumption would be that you’re a criminal.

Putting money in a bank also comes with control and scrutiny, with payments over $10,000 traced in line with anti-money laundering regulation, which historically wasn’t even a conversation but with the level of inflation and the value of $10K being worth substantially less in terms of buying power it brings it into question.

Michael Saylor — Source

“A ‘French Wing’ wants to control everybody, and they don’t trust anybody. And, at some point, they would probably like to see how you spend 50 bucks.

That’s the ‘control freaks’ in the political sphere. Politicians have shown themselves quite capable of interfering in your Private Affairs.

For the last three years, if they’ve shown anything, they’ve shown people can come up with any justification to tell you how many can sit at your dinner table on Thanksgiving.”

The Opinions of Americans Regarding CBDCs Are Pretty Revealing.

Observing the contrasting opinions between the government and the general public regarding CBDCs is fascinating.

A Central Bank Digital Currency (CBDC) is digital money created and regulated by a country’s central bank.

It’s a digital currency that works electronically, just like the money we use online or on our phones. But instead of being managed by private companies or banks, the CBDC is controlled directly by the government.

While governments see CBDCs as the future of money, many Americans have reservations.

The Federal Reserve sought public comments on its CBDC discussion paper and has received 2052 comment letters addressing CBDCs. The Fed published these comment letters on its website for public access.

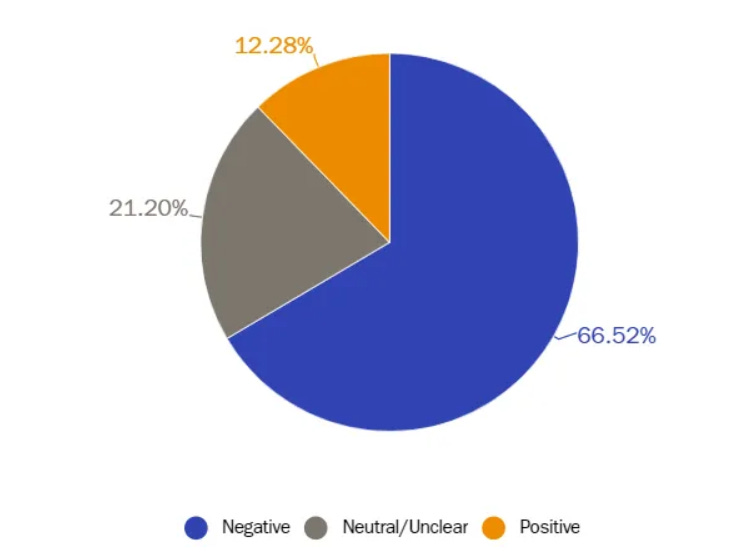

Nicholas Anthony from the Cato Institute painstakingly broke down the data from all commenters to gauge sentiment; the data is fascinating.

A significant majority of commenters still hold a negative view towards CBDCs. More than 66 per cent expressed concerns or outright opposition to implementing a CBDC in the United States.

The most common concerns revolve around financial privacy, financial oppression, and the potential risk of disrupting the banking system.

Final Thoughts.

Michael Saylor is right — money is the ultimate form of control.

There’s no correlation between people’s sentiment about CBDCs and the price of Bitcoin (yet). But amid the banking crisis, Bitcoin’s price spiked 21.2%.

The increasing lack of trust in centralised entities is evident and supports Saylor’s theory that it’s unintentionally contributing to fuelling the Bitcoin furnace.

Bitcoin was born out of the 2008 financial crisis when the US government introduced stricter and stricter rules around monitoring “Know Your Customer” (KYC) and anti-money laundering (AML) following the attacks on 9/11.

It was all to eliminate and trace money used for terr*r*st finance.

Your everyday, law-abiding person prefers to avoid being monitored by something centralised like governments who say they have our best interests at heart.

But we’re also hypocrites giving our information out all the time, whenever the narrative suits us.

Facebook have our information.

So do Google

Credit Card Companies

Streaming services

Health care providers

Online retailers.

The list is endless.

But this time, it’s our money they can control or, at the very least, are capable of interfering with.

Money = Freedom.

People aren’t going to take this one lying down.

I hope Micheal brushes up on the US Constitution and B of R in order to realize what it will take to achieve his goal and the purpose of BITCION.

Since declaring a national security thre*t on cryptocurrency it really doesn't matter what Saylor thinks unfortunately. The only thing he's correct about is why, CBDC: control of all Americans' money to 'manage' their way out of it's Debts apparently. That way they get a 3rd whack at the Central Bank running it all this time around.

Yep that'll do it. We The People just mess everything up being/wanting a free market, right!?!

Great piece, as usual.

Thanks Jayden!