Charlie Mungers Startling Stock Market Prediction for the Next Decade (Before He Died)

The influx of more investors and advanced technology has transformed the investment landscape — though not everyone sees it that way.

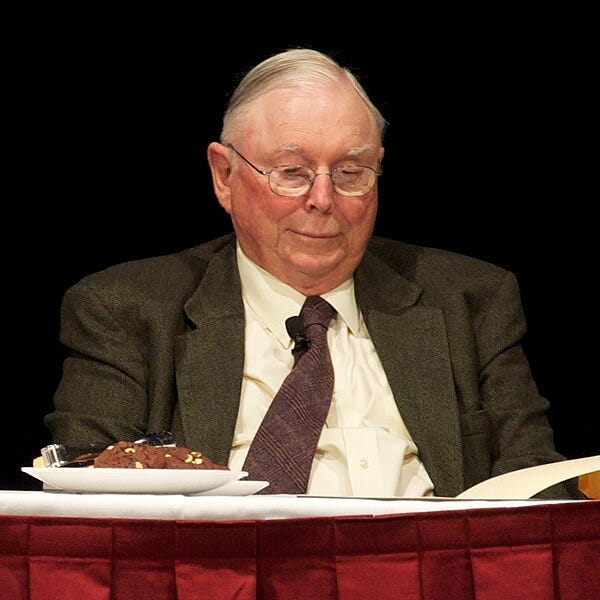

Charlie Munger once said, "If I can be optimistic about life when I'm nearly dead, surely the rest of you can handle a little inflation."

He embodies what happens when immense wealth and age collide — a person unfiltered, speaking their mind.

While alive, Munger seemed like a measured, softly-spoken intellect with doses of clever humour, but he was more resilient than a two-dollar steak.

Before amassing wealth and fame as one of the most significant investors ever to walk the planet, the billionaire faced some of the harshest adversity life can throw at a person.

At 29, he divorced when it was socially unacceptable, leaving him broke. A year later, Teddy, Charlie's 8-year-old son, was diagnosed with incurable leukaemia.

In the early days, Rick Guerin, Charlie and Warren Buffet's lesser-known business partner, said, "When Teddy was in bed and slowly dying, Charlie would hold him for a while, then go out walking the streets of Pasadena crying."

Munger recalls that he and his ex-wife would sit in the leukaemia ward with the other parents, watching their children waste away. It was devasting.

Munger reflected on this time in his life — “I lost my first son to Leukemia, a miserable slow death. At the end, he kinda knew it was coming, and I’d been lying to him all along. It was just pure agony.”

When Charlie lost his left eye to cancer at 52, the voracious reader and wisdom-absorbing magnet nonchalantly said with an undertone of humour, "It's time for me to learn braille."

Munger, who was worth $2.3 billion compared to Warren Buffett's $107 billion, worried that his successful value investing strategy, which once propelled his wealth, is becoming more complex.

Charlie Munger — Source

“There is so much money now in the hands of so many smart people all trying to outsmart one another and out-promote one another at getting more money out of other people.”

He said it's why you'll most likely get fewer returns if you are a value investor.

Let's dive in.

Where's the value in value investing?

I first encountered this concept through one of the many Warren Buffett videos, in which he strongly endorses reading Benjamin Graham's The Intelligent Investor.

The book's premise in one sentence is "Buy cheap and sell dear."

Value investing does what it says on the tin and became a strategy Munger and Buffet made famous by finding undervalued stocks.

It involves buying something for less than its actual worth based on the belief that the market will eventually recognise its value.

Here's a brief excerpt from the book explaining the strategy.

Benjamin Graham — Source

“You must thoroughly analyse a company and the soundness of its underlying businesses before you buy its stock — you must deliberately protect yourself against serious losses — you must aspire to “adequate,” not extraordinary, performance.”

Munger was still determining if this strategy would hold much weight in the future because of the increasingly intense investing competition.

Being an "investor" has almost become pop culture. It's far more popular today than ever because anyone can do it with a few taps on a keyboard or a phone pad.

Wealth managers have increased over the past few decades as more professionals and individuals seek to profit from the stock market's inefficiencies.

According to Statista, assets under management in the wealth management market will reach US$ 83.19 trillion by 2027 — financial advisory will dominate with a projected market volume of US$ 80.87 trillion. (Current — US$57.03tn)

It's dog-eat-dog when intelligent people compete against each other.

Munger's view was that a broader range of people are accessing trading and investing technologies online.

As a result, the overall pool of investment opportunities has shrunk.

According to the expert investor, identifying and analysing stocks is more accessible. Undervalued stocks with significant price discrepancies are becoming less common because faster information has led to more efficient markets, making mispriced stocks harder to find.

Charlie Munger — Source

“It’s essential to recognise that the market dynamics have shifted, with many intelligent individuals competing against each other, aiming to outsmart and extract money from one another.

It’s a far cry from the environment in which we initially started. As an investor, I have observed the diminishing frequency of attractive opportunities over time, and it is essential to adjust our expectations accordingly.”

Not everyone agrees.

Charlie Munger and Warren Buffett's famous Value Investing strategy has struggled over the last decade compared to growth investing (companies expected to grow faster than the market — think tech stocks)

One research study suggested that the poor performance of value stocks is due to the economy's slow growth. It's hard for companies to increase earnings during sluggish and uncertain times.

Hence, "Investors prefer investing their money into faster-growing companies like Facebook, Apple, Amazon, Netflix, and Google (FAANG stocks) because they are more confident in their ability to make profits."

In the same study, they use the Fama—French Three-Factor Model, created by World-renowned economists and finance researchers Eugene Fama and Kenneth French.

The model compares two groups of stocks each month: those with low book-to-market ratios (the value of assets minus liabilities compared to its market value) and those with high book-to-market ratios.

The model was designed to help investors determine which category, whether value (low book-to-market) or growth (high book-to-market), performed better for that month.

It's clear value stocks have underperformed for close to eight years.

The Oracle of Omaha says — "People never change".

Since society put entrepreneurship and investing on a pedestal, I've been captivated by Munger and Buffett's advice and their famous friendship.

I particularly love how they often had healthy disagreements mixed in with good humour, which, if I'm honest, injected a little excitement into a topic that can be a snooze-fest for the general public.

Buffett said in an interview, "We've never had an argument in the entire time we've known each other, which is almost 60 years. We knew we were sort of made for each other."

Buffett also says what gives you opportunities is "other people doing dumb things".

Regardless of intelligence or access to information, the stock market is still a place where humans make choices, which means calls will always be irrational, resulting in opportunities.

Warren Buffett — Source

“Investing has disappeared from this huge capitalistic market to something anybody can play in.

In the years we’ve been running Berkshire, there’s been a significant increase in the number of people doing dumb things because they can get money from other people so much easier than when we started.

You could start 15 dumb companies in the last ten years and become wealthy, whether the business succeeded or not.

You couldn’t get the money to do some of the dumb things that we wanted to do, fortunately.”

Final Thoughts.

Investing in markets requires people to make decisions, so it makes sense that we'll never overcome irrational choices.

It will always result in opportunities.

As Buffett eloquently said, "Regarding money, we'll always do dumb things".

Using the value-based investment strategy is as clear as day. However, it's not commonly practised, possibly due to a lack of patience or where people source their information.

With Millennials and Gen Z coming into their peak earning power and investing being less "capitalistic," and something we all do now, I believe it'll open up a cascade of inefficiency.

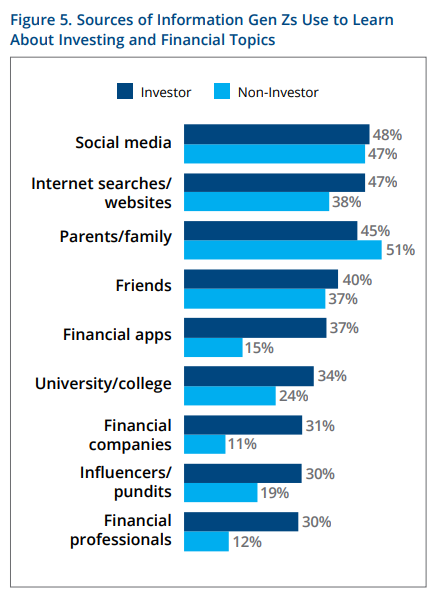

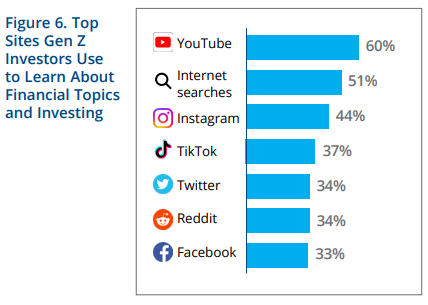

A research study delved into where Gen Z investors were sourcing their financial information.

It revealed that YouTube is the primary hub, with 60% of non-professional investors relying on it. Other sources include Instagram, TikTok, Twitter, Reddit, and Facebook.

Perhaps more worryingly, 51% of all Gen Z non-investors sourced their financial knowledge through a friend or family member.

If that doesn't signal inefficiency, I don't know what does.

Just 34 days before his 100th birthday, Charlie Munger passed away at the age of 99.

In a heartfelt statement, Warren Buffett said, "Without Charlie's inspiration, wisdom, and involvement, Berkshire Hathaway simply wouldn't be what it is today."