Consider Adding These 3 Cryptocurrencies to Your Portfolio in 2023

These technologies could be top-performing cryptocurrencies in the future. You’ll see why, even if you’re not an expert in Crypto.

Photo by Wes Hicks on Unsplash

Investing in cryptocurrency involves speculation about the potential demand for a particular network in the future.

It’s true of any investment. You’re taking a risk on its future potential.

When investing in cryptocurrency, it is essential to research and carefully evaluate your options thoroughly.

In this blog, I’ll highlight three cryptocurrency options for your portfolio.

I predict these three currencies to be leaders in the industry, with two already widely accepted and the third a subject of debate.

Remember, this is not investment advice, and you should always research before making investment decisions.

If you’re considering adding cryptocurrency to your portfolio, creating a small, diverse range of blue chip options is essential to mitigate risk.

One way to do this is by including a mix of technologies.

The three I recommend you research are the best in their category.

Ethereum — Proof Of Stake

Bitcoin — Proof Of Work

Solana — Proof of History

Ethereum is a proof-of-stake cryptocurrency that has become popular for its smart contract functionality.

Bitcoin is a well-known proof-of-work cryptocurrency with a strong track record and a high level of security.

Solana is a proof of history cryptocurrency that has gained market share in the non-fungible token (NFT) space, with network adoption effects similar to Ethereum.

I received criticism in a previous blog for considering Solana as a technology. Its recent price capitulation has made me double down on this thesis.

I’m sticking to my guns.

Solana’s zero fees, strong performance in the NFT market, and potential for future growth as it goes through its adoption and discovery phase present an exciting opportunity.

Similar to Ethereum at $80

Bitcoin

Let’s start with the least controversial of them all.

Bitcoin is a decentralised digital currency that uses cryptography for security. It was created in 2008 by an anonymous individual or group known as Satoshi Nakamoto.

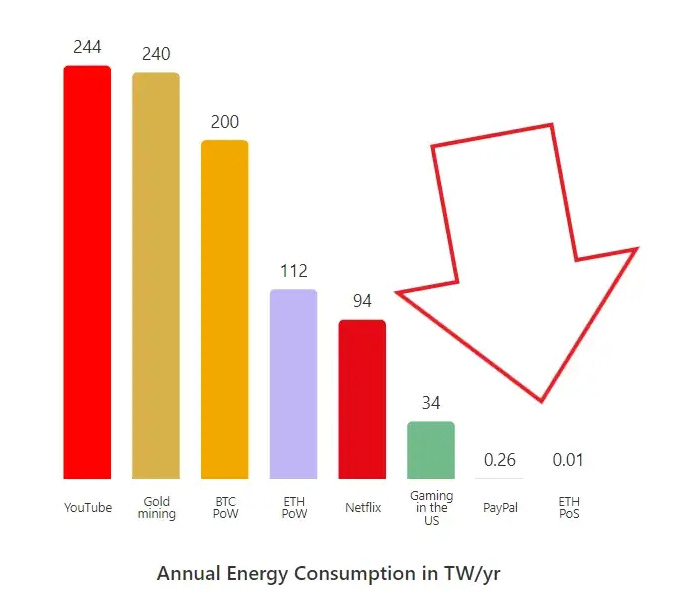

Despite being the most popular cryptocurrency by market capitalisation, Bitcoin has faced criticism for its high energy usage during mining.

The energy consumption of Bitcoin mining is estimated to be higher than the energy usage of the entire population of Argentina, which has a population of around 45 million.

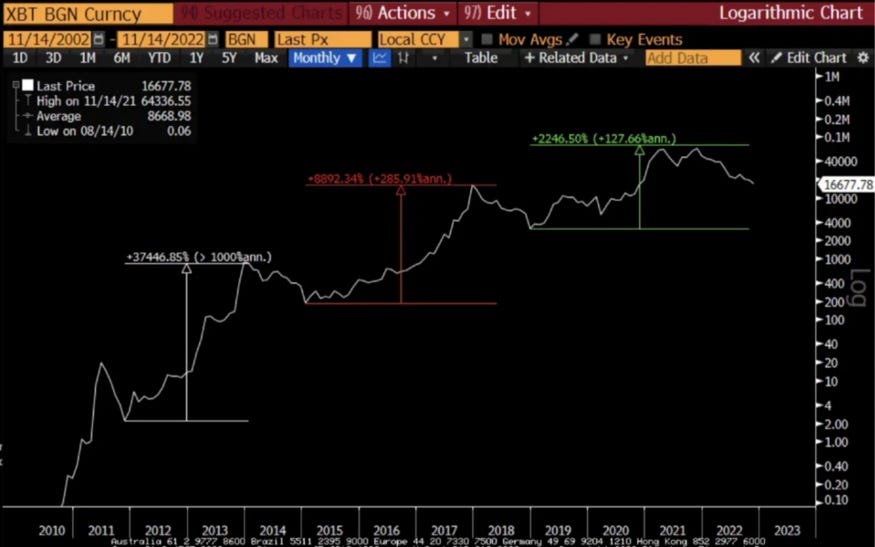

Despite these concerns, Bitcoin has gained widespread adoption and has been the top-performing asset over the last decade, outperforming the stock market.

Each new low in the Bitcoin cycle beats the previous high, consistently dating back to 2012.

According to a recent report from Goldman Sachs, there is a strong possibility that Bitcoin will continue to compete with Gold for market share as digital assets become more widely accepted.

The report cites Bitcoin’s $316 billion market capitalisation, compared to Gold’s $2.6 trillion investment value, giving Bitcoin a 12.5% share of the “store of value” market.

In its list of predictions, the global investment firm predicts that Bitcoin will likely become more significant than Gold by 2030 if it continues on its current trajectory.

Ethereum

Ethereum is a decentralised platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference.

Ethereum smart contracts are written in Solidity, a programming language designed specifically for the Ethereum platform.

Ethereum has often been referred to as “internet money” due to its potential to revolutionise our business and exchange value.

ETH has gained widespread recognition for its smart contract capability, which is being compared to the printing press by business moguls Kevin Rose and Gary Vee for its potential impact on society.

To address environmental concerns, Ethereum recently underwent a successful merge event, which made the blockchain 99.5% more energy efficient by transitioning to a proof-of-stake network.

As a result, Ethereum is now more energy efficient than popular streaming services such as YouTube and Netflix.

Solana

Solana is a high-performance blockchain platform that verifies up to 65,000 transactions per second at less than a penny each.

As of September 2022, it has processed over 100 billion transactions at an average cost of $0.00025.

Its proof-of-history mechanism allows it to record and verify every transaction that has ever occurred on the platform, making it a reliable and efficient way to exchange value.

Solana’s technology is significantly faster than other blockchain platforms, such as Bitcoin and Ethereum, which struggle to scale beyond 9–15 transactions per second.

Solana gets compared to Visa for its similar transaction speed.

At its peak, it can handle more than 65,000 transactions per second, designed to host scalable applications such as NFTs (non-fungible tokens) and decentralised finance tools.

It’s recently gained market share against Ethereum due to its lower processing fees.

The co-founder of Solana, Anatoly Yakovenko, is a tech industry veteran with experience in distributed systems and compression at Dropbox and holds two patents for high-performance operating system protocols.

Investors are attracted to Solana due to its smaller market capitalisation, which offers the potential for significant upside and network effects.

A significant number of developers are actively working on the Solana platform, with approximately 1000 monthly active developers building applications on the platform.

This is compared to the 4000 active developers on Ethereum and 500 on Bitcoin. These developers’ dedication and hard work are crucial factors driving the mainstream adoption of these technologies.

These figures give you an indication of where people are focusing their attention the most.

Final Thoughts

Investing in cryptocurrency involves speculation about future demand for a particular network.

It’s essential to thoroughly research and carefully evaluate your options before making any investment decisions.

The three recommended cryptocurrencies I believe your portfolio should include:

Ethereum a proof-of-stake cryptocurrency known for its smart contract functionality.

Bitcoin, a well-known proof-of-work cryptocurrency with a strong track record and high level of security

Solana a high-speed proof of history cryptocurrency that has gained market share in the non-fungible token space and has potential for future growth.

Each cryptocurrency has unique features and potential risks, and it is crucial to consider these before investing.

Please let me know in the comments what other cryptocurrencies I could have added to the list.