Crypto Prodigy Reveals: This Cycle Is Your Final Chance for Generational Wealth.

Significant gains are only possible in markets that are new and inefficient.

If you enjoy reading and want to explore my work in more depth, please support me by upgrading to a paid membership (and if you're already a member, I bloody love you!).

Paid subscribers get direct access to me for any questions or comments on my posts, and as a cherry on top, I’m offering a 40% discount on the annual subscription.

If the cost is a barrier, please feel free to drop me a message—I’m here to help!

People who say, “It’s now or never”, make me cringe.

I’ve seen Bitcoin, Ethereum, and Solana go through long periods of sideways price movement, followed by explosive gains, only to crash 70% and leave you stuck in that nightmare for three years.

I’ve been in crypto since 2017, and trust me, these things take way longer to unfold than people expect.

It’s a benefit and a feature of the space that Crypto always gives you a chance to play catch up.

When my portfolio soared like an Elon rocket in 2017 and 2021, we experienced 13 significant drawdowns during both bull markets. Each of those 26 moments was a prime entry point — recognising that is the key to overcoming FOMO.

But…

There’s no escaping the fact that as these blockchains mature over time, their upside becomes less significant as they’re adopted more widely.

Ivan Liljeqvist is a Cryptocurrency genius.

He’s a data scientist who began developing games and websites at nine, inspired by his mathematician mom.

Like me and many others in crypto, Ivan learned his toughest lesson the hard way: buying at the peak of a bull run, only to be crushed by the relentless pain of a three-year bear market.

He recalls:

“I went all-in right at the end of the 2013 cycle, and then everything collapsed, and we entered a bear market,”

Ouch.

I’ve been there myself.

Ivan picked himself up and learned from his mistakes. At just 28, he’s become an international speaker, blockchain educator, and global sensation with over 528k YouTube subscribers.

He’s now issued an alarming warning for people sitting on the sidelines.

Ivan On Tech — Source

“This is the last major cycle when we’re entering a new bull market.

We must realise this is probably our last chance to make insane gains. And when we’re speaking about insane gains, it’s gains that you can retire off — financial freedom for life.

It’s only possible in markets that are very new and inefficient and still not fully discovered, where you have a whole new industry that is becoming big, taking its place in the world, and you’re early.

That’s when these wonders of finance typically happen. It’s the last one because, after this bull market, we will have full financial integration with traditional finance.

After the next bull market, what’s going to happen is that banks are going to merge with Crypto fully.”

One major catalyst.

The stars may start to align.

Politics makes me want to throw up, but when there’s one pro-business candidate who could seriously boost our asset prices, it’s in our best interest to get that person elected.

I know I’m just an armchair quarterback here in the UK, but I still have a serious stake in the outcome of this election.

Ivan, from Sweeden, has some strong views:

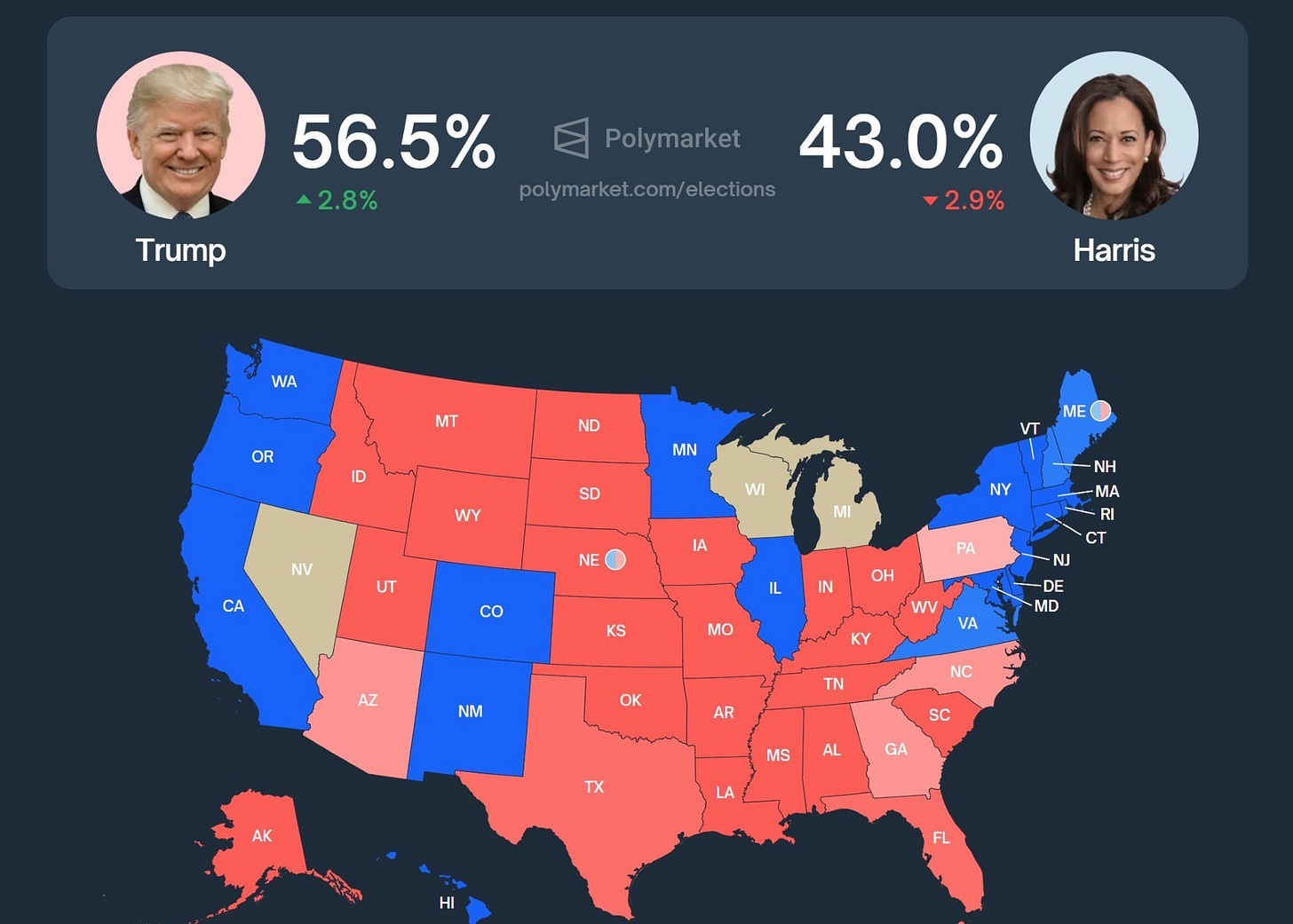

“As long as Trump is going up in the polls — Crypto and the stock market will normally follow. Kamala’s goes down because as soon as she does an interview her poll numbers take a hit. Trump then goes up because she can’t tie her words together.”

It’s not just about the policies each candidate offers—it’s the sentiment they bring to the crypto space.

When Trump says, “I want Bitcoin mined, minted, and made in the USA,” it fires folks up. As a pro-business candidate, Trump is very good for asset prices.

It would be extraordinary for the entire space if he gets elected and then delivers on his promise to maintain a strategic reserve of Bitcoin that the US government never sells.

It’s all ifs, buts, and maybes.

It’s worth noting that both candidates will need to refinance the national debt and print more money, which would benefit risk assets.

Unfortunately, Harris does not offer much support for the 55 million crypto holders in the U.S. — just an all-out assault from her elected SEC chair, Gary Gensler, whom Trump has vowed to fire from day one if he gets into office.

A well-known crypto investor and internet personality stirred up controversy when he backed Trump as an African American, saying he hates them both but doesn’t hate himself.

Ansem: Source

“People are angry at me in DMs for supporting Trump. I don’t support anyone. I think you are all genuinely and legitimately brain damaged from US politics. So many of you need a LOT of help. But the probabilities of Kamala Harris continuing to nefariously attack the cryptocurrency industry are significantly higher than Donald Trump. This is unambiguous, not debatable, and I frankly think your other moral police arguments are ridiculous. I hate them both, but I do not hate myself. And as an active crypto participant, I support my own personal self interests. If she showed indication that she wouldn’t continue these policies then I would stop caring.”

Financial conditions are changing.

Global liquidity just hit a new all-time high — of $95 trillion.

We know that the M2 money supply is very sensitive to the price of Bitcoin increasing—when people make money in Bitcoin, they rotate out into smaller, less liquid altcoins.

We know that the only real comparison for Bitcoin, in terms of how people treat it, is gold.

So far, the ETF has scooped up $76 billion worth of Bitcoin and has a recent run rate of $2.5 billion in daily inflows.

When the Gold ETF was launched, Gold never corrected for 6 years.

If this same scenario plays out for Bitcoin, this bull market could have a continuous grind-up and an end to the booms and busts of the 4-year cycle.

Or, at the very least, significantly less aggressive drawdowns.

Julien Bittel, probably the best business cycle analyst out there, says:

“At this stage in the business cycle, with financial conditions easing — and fast — we’re right in the middle of a classic setup where commodities are primed to move higher again soon, just as everyone else has turned mega bearish.

As always, when financial conditions loosen, demand comes roaring back, and the market tends to catch everyone offside.”

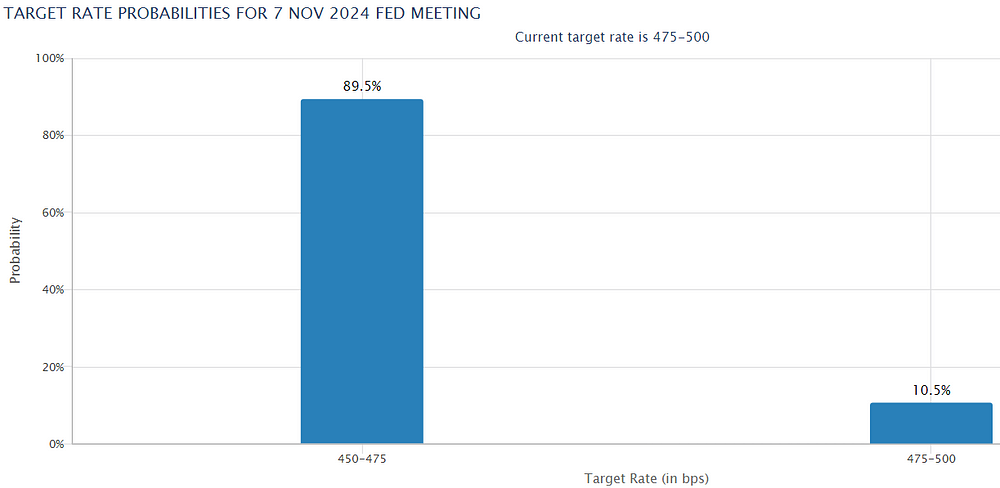

China dropped a massive stimulus package, and the Fed slashed interest rates by 50 basis points.

Interest rate traders predict another 25 basis points cut at the next Fed meeting just two days after the election.

It’s going to be a wild ride.

This bull run could take us above $12 trillion.

Ivan believes:

“It’s like having a hidden treasure right in front of us.”

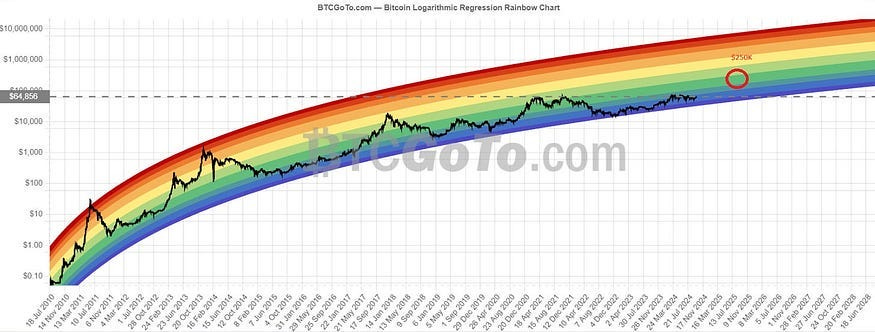

The crypto market cap has grown by a factor of 10 in the last two cycles, and the trend seems set to continue.

Ivan’s thesis is that this will be the most important and biggest bull market you’ll ever face because there will be so much integration with the traditional finance space, leading to exponential buy pressure.

We already see Google, Paypal, Amazon, IBM, Master Card, and Goldman Sachs integrated with Crypto.

As technology becomes more widely adopted, speculation and volatility decrease, so it’s crucial to seize the opportunity while crypto is still relatively new.

He says, "Time is running out because, eventually, all industries become more established, and the opportunity subsides.”

Ivan On Tech — Source

“My prediction for this is that we will be above 10 trillion dollars for the entire market cap, and if you compare it to today, we have a 1.2 trillion overall market cap right now for all Crypto.

After all, this is done, we will be at a factor of 10x to the upside, so 12 trillion to 15 trillion. These numbers are not that crazy. You look at Gold and other assets in relationship to those assets.

It makes sense if Bitcoin, ETH, and the top 10 coins together go to something like 10–15 trillion.

Crypto would still not even be a massive asset class, it’ll be a respectable asset class, but it’s not a massive asset class at 10–15 trillion. So these are the kinds of numbers we’re speaking about.”

Final Thoughts

I’m not one to rush into things, but I wouldn’t want to sit on the sidelines without exposure to the top three assets: Bitcoin, Ethereum, and Solana.

According to the standard log chart for Bitcoin, the next leg up is projected to hit around $250k as a base case.

Given last time's stunted cycle and this lengthy sideways consolidation, we’ve built a stronger support level, increasing the chances of a prolonged cycle.

Regular readers know I have a higher risk appetite because I research daily.

I’m confident with my 70% exposure to Solana and 25% in SUI, the rising star of this cycle.

Later, I can rotate back into my hard money asset, Bitcoin. For now, I focus on optimising asset allocation and maximising my current exposure to crypto.

Ivan is right.

These events do not happen often. It’s an alien asset class outperforming everything else, including technology stocks.

While I never encourage anyone to rush in, it is worth noting that, like all opportunities, this will eventually disappear.

When the cat is out of the bag, the opportunity won't be as significant when that happens.

It’s a message worth paying attention to.

I liked the reminder about 13 dips in bull markets, feels comforting. 🙂

Nice and knowledgeable article all in all.

The only thing I‘d criticize is the obvious trump support. I‘m from Europe and I don‘t see any proofs based on his past promises & behaviour that he’d fulfill his promises. I take them as fishing for votes; a hyperbolic angst in promising this and that in every direction because he knows that he‘ll lose. I could go on an on… so better stop. Only one more thing: Kamala is waaaay better for crypto because she pioneers and communicates a rational and stable view of geopolitics which enables a clean environment for macroeconomy and risk assets. Trump only creates chos and uncertainty.

I am similarly irritated by Politics, and your poll numbers are way off, if this means something anyway. The fact of the matter is that Trump has never made good on any promise except killing Roe vs. Wade which about 2/3 of people think should be still in place. This is not the governments business. I follow crypto closely, and when I hear Trump talk about crypto, I can only laugh. He is only doing this to get votes and likely could not even explain how Bitcoin or Ethereum works. The last election cycle he was vehemently opposed to cryptocurrencies. He is mostly trying to make himself richer and keep himself out of jail. Harris has said little about cryptocurrency and it would likely be more level headed. I think Gary Gensler will be out soon either way. New policies will favor crypto entering mainstream finance. We need well thought out regulation of the industry but the SEC should not be in charge, and trying to enforce by suing without creating well articulated guidelines is clearly insane.