Crypto’s in Freefall — but These Overlooked Signals Could Trigger the Biggest Reversal Yet.

For many our hopes and dreams feel a little further away (but not as far as you might think).

The saying “A smooth sea never made a skilled sailor” has never felt more true than right now.

I’ve been through the ICO boom and bust, the Covid meltdown, the Luna and FTX collapses, and one of the most brutal NFT winters — and it’s safe to say, I’ve always come out better on the other side.

Today’s newsletter is made possible by the kind folks who support my writing with a paid membership. Upgrading helps keep the Carrot Lane machine running and pushes me up the Substack Crypto leaderboard.

Thank you.

Let’s cut straight to the chase.

Asset prices are getting crushed by the tariff headlines, and crypto — which has been the fastest horse in the race — is now the worst performer.

I’m not going to pretend to be a tariff expert, and to be honest, I don’t think most people actually know what the real outcome will be. But given how measured this administration has been — both in winning the election and how they’ve executed so far — it makes me think this whole thing is a charade for something else.

There’s a growing narrative online that this is all about creating just enough uncertainty to force a correction in asset prices. Why? To push the Fed into pivoting and cutting rates — which would allow them to refinance the national debt and reboot the economy, rather than dragging out this slow, painful sideways chop and ongoing cost-of-living crisis.

The money printer play is still up Trump’s sleeve. He can afford some pain now, knowing he’ll recover it all by rolling over the national debt… and then some.

“Oil prices are down, interest rates are down (the slow moving Fed should cut rates!), food prices are down, there is NO INFLATION, and the long time abused USA is bringing in Billions of Dollars a week from the abusing countries on Tariffs that are already in place. This is despite the fact that the biggest abuser of them all, China, whose markets are crashing, just raised its Tariffs by 34%, on top of its long term ridiculously high Tariffs (Plus!), not acknowledging my warning for abusing countries not to retaliate. They’ve made enough, for decades, taking advantage of the Good OL’ USA! Our past “leaders” are to blame for allowing this, and so much else, to happen to our Country. MAKE AMERICA GREAT AGAIN!”

You can argue about his approach, but fundamentally, it’s the right thing to do with the US middle class getting crushed and the growing deficit. The tariffs are already onshoring lost manufacturing.

The difficulty with little old Crypto investors and people heavily allocated to assets in the stock market is that they are creating uncertainty. It’s pretty unclear if these are short-, medium-, or long-term policies, so it’s difficult to know what will happen. However, the man to watch is Scott Bessent, a former hedge fund manager and US secretary of the Treasury.

In a recent post, Marco investing expert Raoul Pal summed up his thoughts on Bessent.

“People are yet to understand that we have a macro hedge fund manager running the Treasury, not an ex-Central Banker. He deeply understands liquidity impacts and how to drive financial conditions to drive liquidity and how that in turn drives the economy and markets. His entire strategy is to lower the three legs of Financial Conditions - dollar, rates and oil to goose the business cycle (ISM). Financial Conditions Index is screaming higher (conditions loosening) as is Global M2 and even more importantly Global Total Liquidity. The effects should kick-in in the next week or two and the recovery in asset prices and economic data should be sharp in the coming weeks and should be persistent. Can't stress how important this all is vs Tarrifs! "narratives"

He’s saying the U.S. Treasury is now run by someone who thinks more like a hedge fund manager than a traditional central banker.

Bessent understands how to loosen financial conditions.

Liquidity is already rising fast, and we should soon see a sharp recovery in asset prices and economic data. He believes this matters way more than the tariff headlines people are focused on.

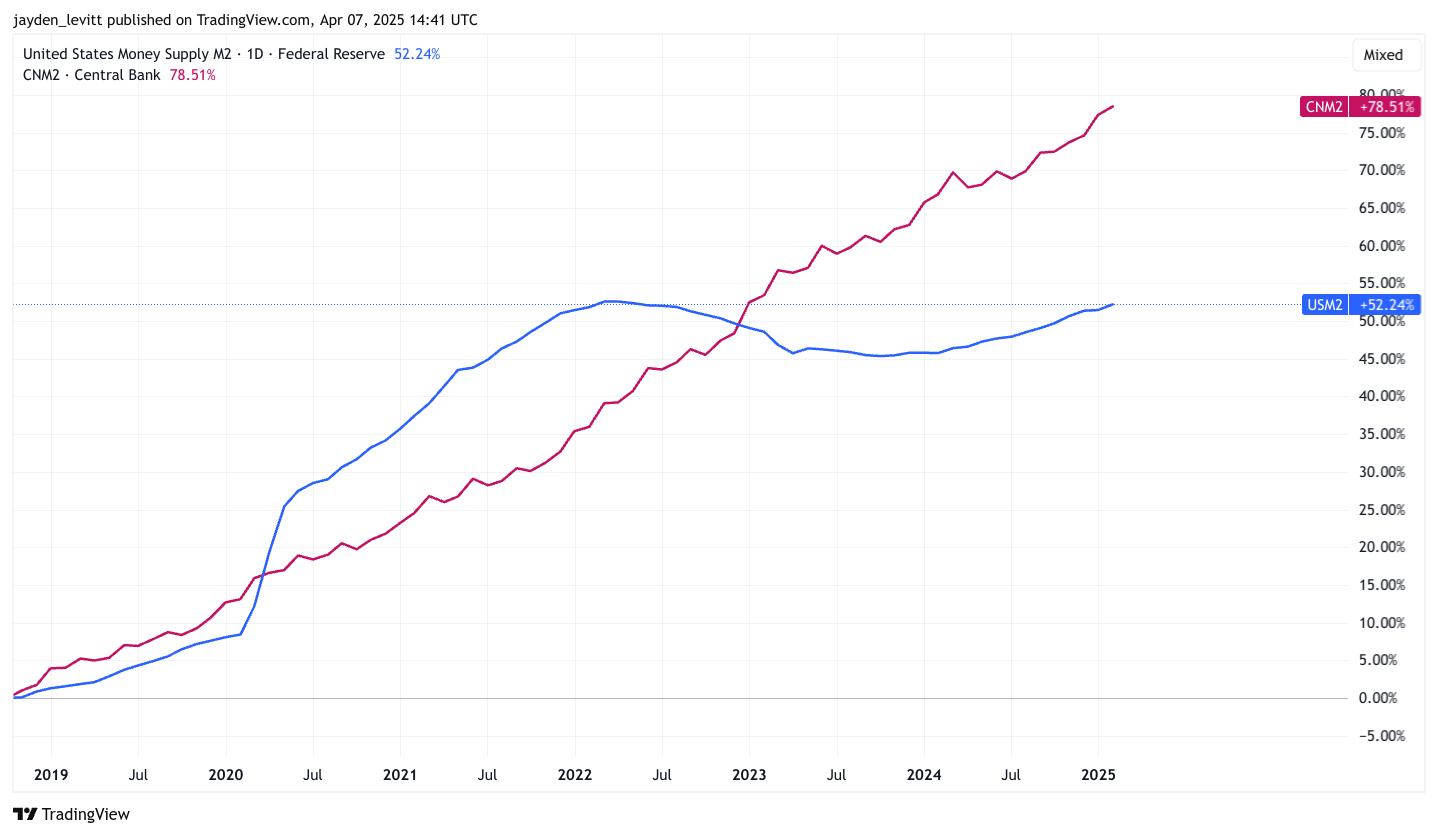

In red below, the Public Bank of China is printing money like it's going out of fashion. After a squeeze in conditions in December 2024, the Fed has now increased the M2 money supply, which is nearing all-time highs again in blue.

This is significant because Bitcoin is the most sensitive asset to money printing and is correlated by 94%.

We also know that BTC works as a sentiment signal to the entire Crypto space, so when that tide lifts, all crypto boats rise—this is why this all matters.

The liquidity provision for the entire system sends an obvious signal.

The dollar is the global liquidity tap — and right now, it’s signalling that financial conditions are easing.

The uncertainty around tariffs could be the perfect excuse for the Fed to step in and cut rates. When that happens, the whole picture flips — changing direction like a supertanker.

And don’t forget: A bad economy is good for crypto.

Because Uncle Jerome and the central bankers won’t let the system fail. They’ll always reach for the same bandaid — printing more money.

Jamie Coutts is the standout Crypto researcher in the space. I like the way he searches for information to disprove his own thesis.

This is in total opposition to many other folks who try to protect their ideas with rose-tinted glasses and act like they’re the holy grail—instead, he takes the inverse position.

Coutts says he’s built a system to remove personal bias and help spot where the market’s heading. Those signals started turning positive in February and picked up speed in March — pointing to a favourable environment for Bitcoin and Crypto over the next few months.

"I build these frameworks because I'm trying to eliminate a lot of the subjective bias that creeps in when you're investing — to try and reduce errors.

My models (liqduidity indicators) are also saying that financial conditions, starting in February and accelerating into mid-March, all started to pick up — and gave me the signal that Bitcoin should do very well over the foreseeable future: 3 months, 6 months.

I couldn't predict what the Trump administration was going to do with tariffs — especially that formula they've applied. I think that caught everyone by surprise, even those who expected Trump to maybe surprise on the upside.

And even with that, you now get so much more pressure on the Federal Reserve to act. And we know that typically, asset prices respond quickly. So it does seem like this is a growth shock — one that will be met with a requisite amount of stimulus.

And that is typically very, very bullish for risk assets."

The lead indicator.

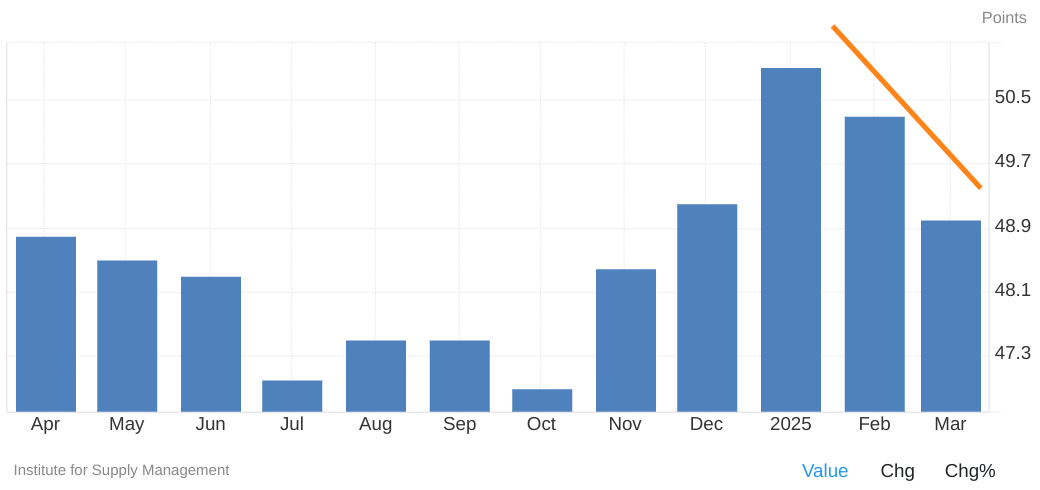

The ISM — which is basically the global financial conditions index in disguise — just posted a sharp drop.

March came in at 49, down from 50.3 in February and below the forecast of 49.5.

That puts us back in contraction after just showing signs of recovery for the first time in 2 years.

Chris Williamson, chief business economist at S&P Global, has over 20 years of experience analysing economic data — especially around PMIs. He said:

“There’s much to suggest that this improvement could be short lived. Production and purchasing were often buoyed by companies and their customers building inventory to beat price hikes and supply issues caused by tariffs,”

New orders, backlogs, and employment all dropped faster than last month. Production also took a hit, falling to 48.3 from 50.7.

At the same time, price pressures spiked—now at their highest level since June 2022, mostly due to tariffs.

Inventories bounced back a bit, and supplier deliveries are still slowing — just not as sharply as before.

Remember, a score of 50 trending upward is a bull market territory, and 50 trending downward signals a bear market.

To quote the ISM directly:

“Demand and production retreated, and companies kept cutting staff as they faced confusion around future demand. Prices jumped due to tariffs, which led to delays in new orders, slower supplier deliveries, and growing inventories.”

A pulse check.

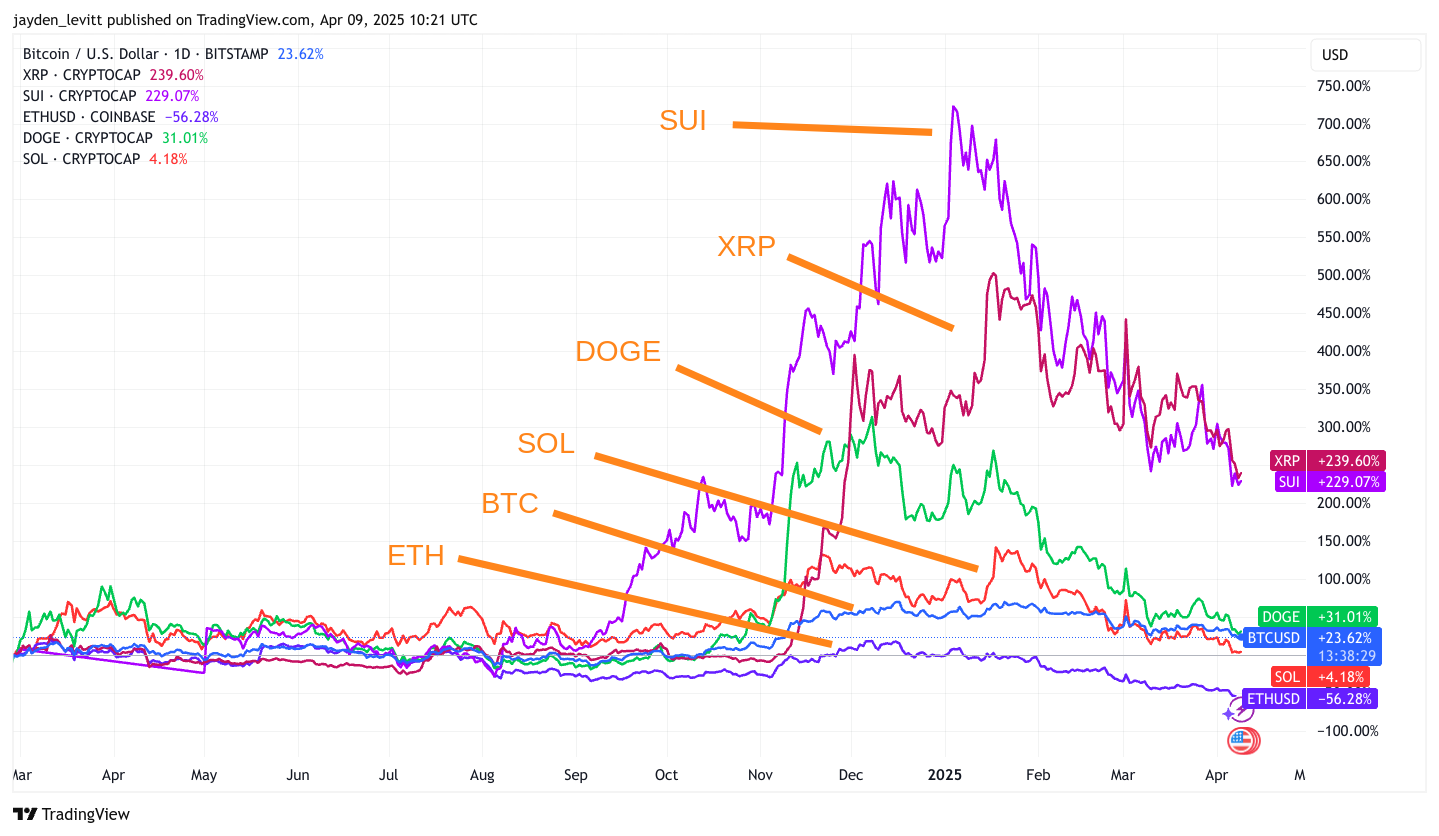

Crypto prices are getting slaughtered right now.

We all know altcoins come with way more upside — but they’re also brutally sensitive to drawdowns. When they correct, it can look like everything’s going to zero.

It’s not.

What we’re seeing is just a tightening — or even the threat of tightening — in financial conditions. And a bit further down, I’ll explain why this kind of setup can flip fast… from despair to Valhalla.

But let’s stay grounded for a sec.

Looking at the 12-month chart, SUI and XRP have been the top performers. You already know where I stand — SUI has a market cap of $6 billion, while XRP is sitting at $106 billion.

So, simple maths: for your investment to double in SUI, it must hit $12B. For XRP to do the same, it must climb to $212B. Way more buy pressure is required.

Since these assets all move with liquidity and money printing, I’d rather back the one that gives me the most significant percentage return (potential) on the same macro tailwind. Sure, it also means bigger drawdowns — but that’s the trade-off.

The volatility is the feature that gives you the upside.

People really underestimate how quickly this market can turn if the Fed steps in.

Below is a chart of Bitcoin. I bought the literal top in December 2017 — peak euphoria — and watched my investment crash all the way down.

Most don’t realise how fast asset prices can bounce back once the Fed starts cutting rates. I can’t see them letting the pain drag on much longer.

Look at the red line on the chart — that’s when the Fed stepped in and fired up the money printer. Within weeks, asset prices started recovering. By 2021, my Ethereum position had done 35x—I then rolled it into NFTs, which 40x.

This is why bad economic headlines often lead to good outcomes. Central bankers always step in before the system breaks.

The whole “too big to fail” thing? It’s real — because 85 million baby boomers have their pensions tied up in the market.

Why would you let the system fail when you can print more money?

Final Thoughts.

The anomaly in all of this is a trade deal with China.

Chinese ministry spokesperson Lin Jan said:

“The actions of the US side have not demonstrated any genuine willingness for serious dialogue. If the US truly wished to engage in talks, it should adopt an attitude of mutual respect. If it persists in disregarding the common interests of both countries and the international community and escalating trade and tariff conflict China will always fight to the end”

This doesn’t feel like an immediate solution, but who knows?

At the start of this piece, I said crypto was getting crushed — and it still is. However, the signal most people ignore is the one that matters: liquidity.

While the headlines scream tariffs and panic, the quiet shift beneath the surface is that financial conditions are easing.

The dollar is softening.

M2 is rising.

The ISM corrected slightly lower, so one to keep an eye on.

The Treasury is being steered by someone who knows how to work the system, like a hedge fund manager.

This setup has played out before. I’ve lived it. I bought the top in 2017, sat through the wreckage, and watched my assets rise to unimaginable heights when the Fed stepped back in.

It’s never comfortable when everything looks like it’s going to zero.

But these are the moments to either move into pain or, equally well, do nothing.

If this piece is valuable to you, please feel free to share it—it’s how Carrot Lane grows.

Sound reasoning Jay. All risk assets are a roller coaster ride when tipping points arrive and the fed is always late to the game. Success will come to those who stay calm and hang on for the ride of their lives.

We’re in a print and die end game with a date of??? Chaos- the why doesn’t matter- what the result is does. As you say and have said often- liquidity drives it all. Whatever their plan is, it’s sure (?) to launch relief, euphoria, skepticism, buying and, perhaps, a mania as inflation drives the psyche.

Weak $, low rates has been, and will be the “fix”, but the real wild card is the rise of the BRICS and the Global South, especially their moves away from $’s. Interesting development with this cycle.

Learning crypto and nft from you, and your experiences, reminds me of previous risk asset flows, ebbs and rockets as the average person wakes up and starts to take action.

As you mentioned, Bessent is hedge fund connected, floor to ceiling. His cronies are already positioned, as well as, the banksters for the coming ride.

Hopefully your followers will heed your guidance and stay 💪. If they’re out it will be costly to get back in.

Just my opinion. Ride the wave 🌊 that’s coming 🤩

Excellent piece Jay. Much needed at this time with all the carnage!