Discover the Massive Potential of Bitcoin: Multi-Millionaire Investor Tim Draper Urges You to Think Big and Take Action

From a Billionaire investor, you’ll see why we haven’t scratched the surface yet.

Source — YouTube — Tim Draper

Tim Draper is a lifelong Venture Capitalist with a rich history and a strong bloodline of VCs in his family.

He’s a 3rd generation Venture Capitalist, so having an eye for investing has been hardwired into his DNA.

Draper is a strong proponent of Bitcoin and hit media headlines when he bid successfully at an auction for 30,000 Bitcoins worth $19 Million.

It hit media headlines because the Bitcoin he purchased had previously been seized from the Silk Road Marketplace by the US Marshals service and auctioned to the public.

Silk Road was an online black market that operated from 2011 until 2013. Drug dealers used it to distribute massive quantities of illicit goods and launder funds passing through it.

Draper has a catalogue of successful investments in household names.

You might recognise a few.

Skype

Tesla

SpaceX

SolarCity

Ring

Twitter

Twitch

DocuSign

Coinbase

Robinhood

Hotmail

Draper, an early investor in Hotmail, which most of us use, famously credits him as the inventor of “viral marketing.”

The acclaim was from an idea he gave the founders of Hotmail to automatically attach an advertising message to the bottom of each outgoing Hotmail email.

Most People Don’t Realise How Big Bitcoin Can Become

Draper believes that Bitcoin has the potential to impact the biggest industries in the world and will likely transform countries that are making Bitcoin a legal tender.

He says that El Salvador will change from one of the poorest countries in the world to one of the richest.

Tim Draper

“Only one or two countries worldwide have started to do that. They will go from the poorest to probably some of the wealthiest countries in the world over the next 40 years.

El Salvador and the Central African Republic are going to benefit big.”

Draper thinks that two other significant areas could boost Bitcoin adoption.

He says women are an untapped demographic for Bitcoin, and more retailers will likely use blockchain protocols for payments and transfers instead of traditional finance methods.

Tim Draper:

“This is an interesting statistic. Women control 80% of retail spending. And, until recently, about one in 16 Bitcoin wallets was owned by a woman. Now it’s more like one and eight.

“At retail, when the retailer can easily accept Bitcoin, which they can now with OpenNode, they’re going to realise that they can bring another 2% right to their bottom line. And they’re going to encourage their customers to buy with Bitcoin.”

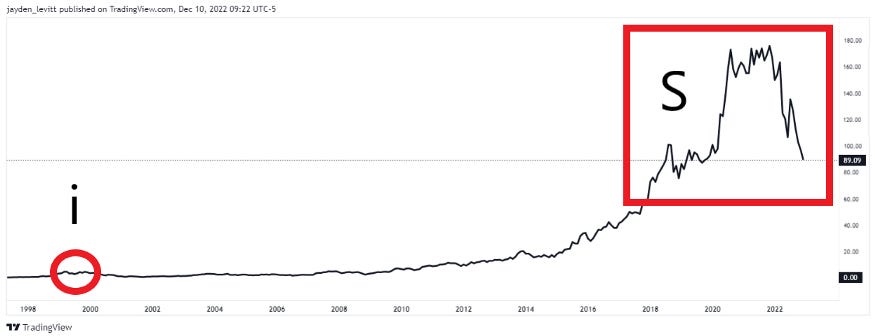

The ‘I’ and ‘S’ Curve With New Technology Shows You How Early We Are.

People need to understand the cycles to get excited about new technology.

Draper says emerging technologies have a false start at the beginning, and there’s hype because people see what the technology could achieve, but the work still needs to be done.

He says while people are sitting fixated on the price, brilliant engineers are working on the technology in down markets.

He calls it the ‘i’ and ‘s’ curve.

The ‘i’ is the first speculative pump in price, but as the technology develops, it skyrockets, creating an S shape.

He uses Amazon as a strong example of a technology that has shown these characteristics.

Circled below is Amazon’s first bull run, where its market cap was around $100 million. Today they are worth around $1 Trillion and have reached highs of over $2 Trillion.

The ‘i’ is no small below. You can’t see its shape on this chart.

Tim Draper:

“I’ll give you an example.

Almost every technology goes through the i,s, curve.”

The same thing is happening with Bitcoin.

Every industry comes up and gets hyped to the max, and then that is the dot on the ‘i’, then it drops down, and people say the technology doesn’t work, all these things the technology promised it can’t do.

So for years, the price sits there languishing.

But while it sits there, all these great engineers are working hard to develop great ways for us to experience the new technology.

The price then starts slowly creeping up like an s, then it explodes for years and then flattens out until new technologies come along and go through their same i.s. Curve.”

Draper says that the S is always much higher than the ‘i’.

He says the top of the ‘i’ had Amazon valued at maybe $100 million, and now, it’s worth a Trillion Dollars.

He says that’s 500–1000 times higher than the ‘i’, so people don’t even realise how big something like Bitcoin can become.

Bitcoin and Blockchain Have the Potential To Impact Governments.

Draper says that Bitcoin will impact some of the largest industries in the world and believes that, at some point, we won’t want a government-backed currency.

And we won’t want our collapses in the economy determined by some political candidate who happened to win and then spends funds in a way that devalues our money.

Tim Draper:

“You’re going to see enormous changes in real estate, and insurance will significantly change.

Governments will be impacted the most because 80% of the government is insurance.

Healthcare, Work compensation, Welfare, Unemployment, Pension, Social security etc.

All of that with a Bitcoin economy could be virtual, and governments globally could compete to provide better service for you.

Final Thoughts

Tim Draper’s track record speaks for itself.

His I and S curve is a strong argument for technologies that take off and indicate where Bitcoin might go.

Retailers and different demographics adopting Bitcoin will encourage its growth.

You may have heard stories of investors who went into Bitcoin early and made ungodly amounts of cash.

On the flip side, some people were early and bought Bitcoin at $12 and sold at $250, thinking they were geniuses.

There’s no point in thinking in ifs, buts and maybes.

You can’t look back or turn back time. Only realise that there is a significant opportunity ahead of us.