Everyone Is Making the Same Mistake with the PNKSTR Trade (But No One Wants to Admit It)

"It's like getting 15X leverage on ETH but without the risk of getting liquidated."

Today’s newsletter is free thanks to the paid subscribers who support my work for a small fee. It’s what keeps me doing this, and I appreciate you folks more than you know. Enjoy.

I remember Raoul Pal once saying in an interview:

“If you can’t say your investing thesis in one sentence, you probably don’t have one”

Mine’s simple.

PNKSTR is sustaining attention, which will lead to buying flows, while the NFTs in the protocol protect my downside risk.

When I first laid eyes on it, I’d never seen anything so damn perfect.

But explaining PNKSTR to someone new to NFTs is like trying to describe TikTok to folks still using a Nokia 3310.

It’s an automated protocol that operates independently, perpetually buying and selling the most iconic digital artwork in existence: CryptoPunks.

Once it buys a floor CryptoPunk using PNKSTR proceeds, it instantly relists it at a 1.2x premium. When that Punk sells, the proceeds are used to buy and burn PNKSTR tokens, generating more fees that feed back into the protocol to buy the next CryptoPunk.

The deflationary design has people hooked like it’s digital crack.

People finally see a way to get price exposure to an iconic piece of digital art without having to sell a kidney.

CryptoPunks lit the institutional fuse back in 2017, but the apple really started bouncing off people’s heads in 2021 when they realised these weren’t just JPEGs, they were apex art assets with provable provenance, bound by the same conditions as physical art.

It was like an aha lightning bolt to the brain for folks who really understood it.

As the first use case for NFTs is art, they naturally behave like trophy assets, the kind that historically go parabolic when people have a bit more cashola in their pockets for discretionary spending. Think “look-at-me” sports cars and luxury watches.

Even with Uncle Trump flicking crypto’s lights on and off with his tariff button, Punks have outpaced Bitcoin over the past year, which, considering the rest of the market’s been about as stable as a drunk on roller skates, is pretty damn good.

Punks is up 100% over the last 12 months. Additionally, the underlying currency used to purchase the asset, ETH, is up over 120% over the previous 6 months.

It’s resulted in most enthusiasts being priced out, with an entry sitting at $150,000, not exactly change you’d fish out of the glovebox.

Punks only have a small percentage of tokens that actually trade at the floor, yet that’s what everyone fixates on instead of asking, “Wait a sec, what are the majority of holders in this collection actually doing?”

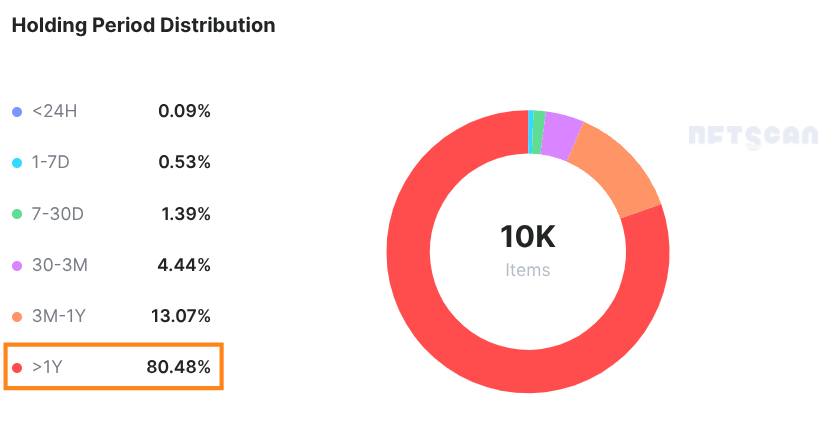

According to on-chain data, over 80% of Punks haven't moved in the past 3 years, and 75.2% of holders hold only one. Only 13.07% of folks hold this project for less than a year.

If these were Bitcoin stats, the Boomers, converted gold bugs, and maxis would be foaming at the mouth.

This clearly creates a supply squeeze, as most folks are reluctant to sell their one and only CryptoPunk because of the project's provenance and expressive nature.

As a PFP-based project with historical significance, people also use the asset as their digital identity, adding to the ‘infinite regret’ of never being able to sell.

NFTs are fucking impossible to sell once you’re attached.

They’re like a puppy that’s chewed up your sofa and wrecked your carpet with catastrophic shits, yet there’s no scenario you’re taking it to the shelter.

What ends up happening is the most sought-after assets climb to holy-cow-how-is-that-real prices, shutting out a huge number of participants, while, on the flip side, when financial conditions get squeezed, there’s seemingly no real floor, just those “text-your-therapist” capitulations.

PNKSTR is like the picks and shovels that play off this volatility.

The naysayers will say, “Yeah, but Jay, there’s fractional.” Guys, I’d rather lick a 9-volt battery than own that shit.

There’s nothing exciting about passively holding 0.01% of something you only pretend to flex as yours, while the blue-tick overlord on X who actually owns it frees up some liquidity.

As Web3 savant and pseudonymous Punk6529 puts it, owning fractional assets actually loses value because it often trades at a discount to the net asset value:

“In any case, every properly fractionalized NFT / NFT collection with a redemption mechanism (Fractional, Whale, etc) has always traded at a discount to NAV because it is boring - just hanging around owning a 1% of a punk in the hope that later you will sell it for more, is very boring IMHO. I bought some fractionalized $APE back in 2021 and almost died on the spot from boredom. One the other hand (referring to PNKSTR), “we will collectively own a lot of punks forever”, I dunno, that seems more fun and interesting and you can “do things” with them.”

The downside of going to zero is zero (NFA).

I know it sounds like I need a wellness check for saying the downside to zero is protected, but it’s true.

Unlike, say, a meme coin, which can literally go to zero, you have some net asset value protecting your downside with the CryptoPunks in the protocol.

It’s intended as a rental of the assets, not fractional ownership, since the protocol isn’t designed for the Punks to stay there permanently.

Or as Investment Banker ZYC explained:

$Pnkstr is a highly reflexive token, I look at it as the ETH with 15X leverage but without the risk of getting liquidated. Downside to 0 is protected with the PUNK treasury while the upside is enlarged with hundreds of potential STRs burning the token. Highly asymmetrical bet.”

So basically, PNKSTR’s a leverage bet on the NFT that’s already a leverage bet on ETH. It’s like stacking fireworks on dynamite while pegged to the most solid asset in the space.

In the chaos of it all, I’ve often had a few “holy fuck this might actually be massive” moments while simultaneously wincing at the stomach-churning drawdowns.

Unlike coins, very wild swings, up or down, drive the gamification of it all and pull more eyes back to the NFTStrategy site.

As founder, Adam Lizek says:

“It’s like renting a car. These punks aren’t going to be in the protocol forever, but it’s like you’re renting them and it’s appreciating. That’s the bet. It’s like everything is good news. If the price is up, that’s great. If the price is down, the percentage to buy the next punk is up. So it’s always tons of dopamine.”

Signals everyone ignores

The elephant in the room no one’s talking about is market volume.

We’re not even in the same postcode to storming the gates of Valhalla.

So far, 5.07% of the total 1 billion PNKSTR supply has been burned, totalling 50.7 million tokens.

The treasury holds 33 CryptoPunks with a cost basis of 1,575 ETH and a current relisting valuation of 1,888 ETH.

At today’s ETH price ($3,900), the expected proceeds of $7.37M (1,888 ETH × $3,900) would buy and burn approximately 113 million $PNKSTR (at $0.065 per token), representing a further 11.3% reduction in total supply.

This brings the potential combined burn to 16.4% once complete, and that’s not including the potential of additional NFT strategy flywheels activating.

The real focus isn’t “oh no, the price of PNKSTR has capitulated.” It’s whether the CryptoPunks floor can catch up to the relisted Punks in the protocol. It’s beyond obvious that it can.

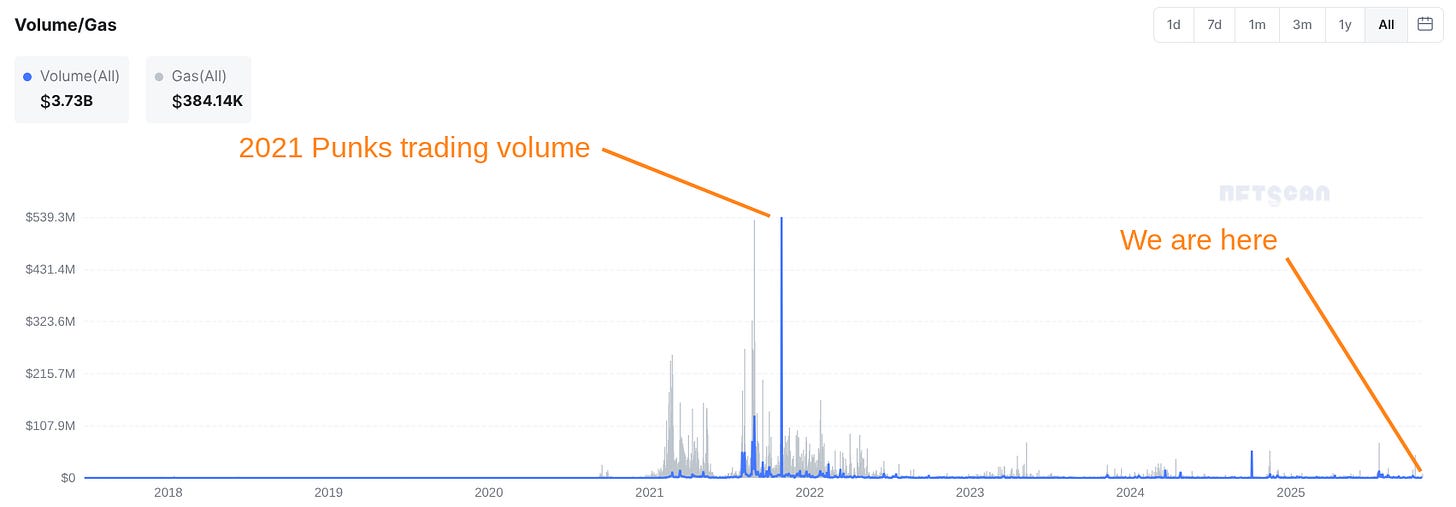

Look back at the last cycle (below).

Punks hit an eye-watering floor of 125 ETH. With the NFT space set to grow from 23 million holders last cycle to at least 200 million+, and with barely any CryptoPunk holders willing to sell, that built-in supply friction is a recipe for serious upside we get to participate in with PNKSTR.

Look at the difference in Punks’ trading volume. Folks bull posting on the timeline when it goes up 20% but looks a complete bees dick on a chart in comparison to 2021.

The real genius is how Adam timed the launch.

He dropped the protocol right as the market was coming out of recovery mode, with a potential CryptoPunks run that could stretch into late 2026 or even 2027, given the delay in the business cycle.

Here’s where it gets wild.

While the downside is capped somewhat, the upside could be beyond astronomical. Like, no ceiling—tell your boss to watch his mouth, high.

It’s because every other NFT project is now launching a strategy token, bringing in a fresh wave of participants.

Remember, these tokens are network adoption models, and their value lies in the square root of users, as with Facebook, where the app is useless without the users, but each new user adds utility to the others.

I recently sat down with Jacob, the Co-Founder of Chimpers, a UK-based NFT project that’s built a massive social media following of over 3 million, making it the most-followed Web3 business.

They’ve adopted Chimpstr as their native token rather than running a token generation event.

Jacob’s explanation was fascinating, and it left me wondering why every project wouldn’t just copy pasta his approach.

Jacob Chimpers, Co-founder:

“Launching a token has been a precarious thing. It’s something we’ve observed over the past few years. TGEs tend to go one way or the other — either they’re executed successfully, or they become doomsday events for a project. The playbook’s been repeated: there’s rarely real community alignment. Everyone looks to the TGE as a payday for the team, investors, and community, but once it’s over, the token drops, and the community’s left wondering what’s next.

Joining the Tokenworks ecosystem wasn’t an easy decision — it required full commitment and understanding the implications. But Tokenworks is an independent entity with an existing token we could adopt. It’s risk-free, avoids legal headaches, and saves us the time and cost of setting up a token ourselves.

With the Strategy ecosystem, there’s already an in-built structure. We can be creative, build layers on top, and experiment freely. Typically, with TGEs and tokens, there’s no real value connection between NFTs and tokens — they exist separately. Tokenworks changes that. The token’s volume and velocity feed back into the ecosystem through burns and buybacks, creating a sustainable loop.

We’ve always aimed to protect the community and avoided destructive metas. Tokenworks offers a long-term way to build value without extracting it. When we launched the token with Chimpsster, everyone could purchase at the same time and level — no insiders, fully organic and grassroots.

Tokenworks gives you safety levers and guardrails so you can feel confident your community won’t be harmed by the event. For us, it was an exciting launch.”

Final Thoughts.

What people are missing is that this is becoming the new meta, the convergence of coins and NFTs.

If this becomes the standard path for every NFT project, and the momentum keeps building, is there really any reason PNKSTR won’t succeed?

I know things don’t always play out as planned in crypto, but I can’t see a scenario where PNKSTR doesn’t, and I’ve yet to hear a convincing argument to the contrary.

Crypto and Web3 venture capitalist Drew Austin said recently:

“If NIKE is CryptoPunks, Foot Locker is $PNKSTR.

Its a reseller...Right now.

What it will and can become...Is the infrastructure powering the entire supply chain and financialization of sneakers, if you will.”

Keep it simple. People aren’t selling Punks.

They’re the apex assets. Everyone with money wants one, but hardly anyone can actually get one. PNKSTR gives you a way in, a smart, lower-entry point into an iconic project that’s way more fun than passively owning 0.01% of a Punk and pretending it’s yours.

This isn’t financial advice, but it does feel like something you can size into properly.

The downside’s protected by the assets in the protocol, which is more than you can say for most speculative plays.

Add to that the new strategies launching and the top founders adopting it as their native token, and you’ve got a massive signal of confidence.

When I chatted with Jacob from Chimpers, it just clicked: why wouldn’t every project do this?

It’s a cleaner, fairer launch mechanism that brings in new people without wrecking current holders, and it keeps the value inside the ecosystem instead of bleeding it out like a TGE.

We just need financial conditions to play ball.

In the meantime, volatility, the supposed “flaw,” is actually the feature. It adds fees, and it sustains attention. Normally, when crypto dips, everyone ghosts. I know this firsthand: my open rates nosedive, and people unsubscribe (bastards).

Punks aren’t being sold in volume.

They’re the crown jewels of NFTs. When financial conditions improve, they’ll climb, and when they do, PNKSTR will too.

People are waiting for complete information before taking action.

It’s the mistake everyone is making, but no one wants to admit it.

If today’s newsletter gave you value, consider sharing it with a friend — or showing your support by upgrading to a paid membership. It genuinely helps me keep doing this full-time.

Agreed that PNKSTR feels a lot closer to picks and shovels.