Gary Gensler Just Turned America Into an Uninhabited Technology Wasteland (Crypto)

America could soon be the place where Crypto goes to die.

Source — Wikimedia, Commons Image

Do you ever feel weak regulators spread fear when you’d rather see them apply opportunity?

They seemingly have the touch of a giant sledgehammer regarding any new technology.

Gary Gensler is renowned for his deep knowledge of financial markets, particularly blockchain technology and cryptocurrencies.

He knows his shit.

Given investing in cryptocurrencies is becoming like Pop Culture, policymakers like Gensler, who directly impact people’s investments through decision-making, are getting their moment in the spotlight.

He intensified his criticism of the crypto industry, taking legal action against Coinbase and Binance for alleged securities violations and raising concerns about the future of token trading.

His actual thoughts on Cryptocurrency are revealing. Don’t be fooled. It isn’t just about protecting unsuspecting crypto investors. Following an interview with CNBC, he spilt the beans, which tanked the market quicker than an elevator in free fall.

Four of the top 10 most valuable coins experienced significant declines of at least 15%. If you’ve been in Crypto for a while, you’d think those are rookie numbers.

The lawsuits and Gensler’s interview triggered sell-offs, where he expressed his belief that “we don’t need any more digital currency.”

Gary Gensler — Source

“We already have digital currency. It’s called the U.S. dollar. It’s called the Euro. It’s called the Yen. They’re all digital right now.

Let me say this to the investing public.

These trading platforms, they call themselves exchanges, are co-mingling a number of functions which we don’t see in traditional finance.

The New York Stock Exchange, for example, doesn’t operate a hedge fund or engage in market-making.

In the case of Binance, we alleged that they have a sister organisation flooding the platform with transactions known as wash trading, and there’s a lack of controls on the platform.

It’s really a web of deception and conflict, with a controlling person, Mr CZ, trying to evade U.S. law.”

You Only Need To Peer Into the Past To See Crypto’s Future.

When we look at the future of cryptocurrencies, many have drawn comparisons to the rise of the internet in the late 1990s.

Both cryptocurrencies and the internet serve as platforms for connectivity; they have different core functions. While the internet facilitates the exchange of information digitally, cryptocurrencies serve as a digital exchange of value.

One striking similarity between Crypto and the internet is their decentralised nature. With minimal regulations, they offer unparalleled freedom.

This freedom can sometimes open the door to bad actors or people operating in the grey, but it still changes the landscape.

Take the peer-to-peer file-sharing platform Napster. It allowed users to share and download music files for free, primarily in MP3 format.

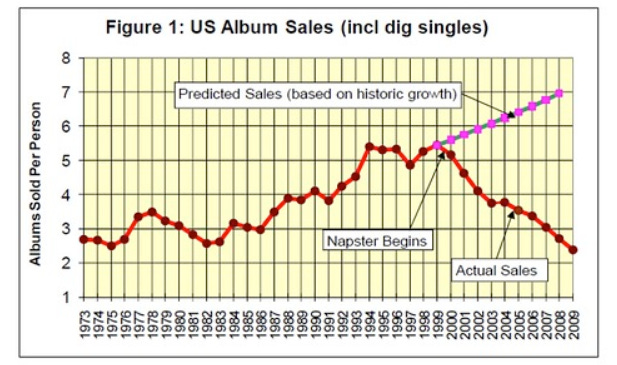

While it initially led to revenue declines in album sales due to unauthorised file sharing, it also significantly accelerated the transition to digital distribution, ultimately contributing to the growth of the streaming market.

While I’m not saying Crypto is illegal, it does show, good or bad, that the landscape will change every time a revolutionary technology comes along. In that transitory period, there will be regulations and people saying it’s a scam or a fad. But time and time again, technology pulls through and becomes the norm.

The rise of Napster and other file-sharing platforms profoundly impacted the music industry’s financial landscape. The Recording Industry Association of America (RIAA) reported a significant decline in global recorded music revenues from $14.6 billion in 1999 to $11.4 billion in 2002. The proliferation of free file-sharing led to decreased CD sales and the industry’s overall profitability.

Below you can see a considerable decline in album sales. Regulators later shut Napster down, but the underlying technology was here to stay.

Napster played a crucial role in transforming the music industry’s distribution model and demonstrated the potential of digital music and the demand for online access to music files.

Following Napster’s demise, legitimate digital music services like iTunes, Spotify, and Amazon Music emerged, offering legal alternatives for accessing and purchasing music. It paved the way for the digital music revolution forcing the industry to adapt to the digital age.

The same is happening with Cryptocurrency, but this time, it’s not retail outlets that must bend to consumer expectations. It’s governments and financial lawmakers.

They’re going out of their way to ensure no light touch.

America Will Look Like a Technology Wasteland in 40 Years.

Tim Draper, a billionaire and early investor in Hotmail and Skype, didn’t hold back when sharing his thoughts on Gary Gensler.

Draper typically invests in start-ups with high growth potential but carries significant risk. So he’s very much bullish on the cryptocurrency revolution.

He anticipates the tech industry’s future and invests in innovative start-ups before they make it big. His success rate is beyond belief, with early investments in Tesla, SpaceX, SolarCity, Ring, Twitter, and Twitch.

Draper is now saying that people like Gensler should embrace new technologies and not spread fear because we’ll end up turning America into a place where innovation goes to die.

Tim Draper — Source

“The SEC has been spreading fear, and all innovators are leaving the country. This regulation by enforcement makes no sense.

Crypto needs to be regulated in a new way by a new group. What is America going to look like in 40 years? It’s going to be a total wasteland.

There’s going to be no technology. Crypto is coming. A.I. is coming. What is this spreading fear about these new technologies? They’re great for us.

We’ve got smartphones, we’ve got Tesla cars, we’ve got all these amazing new technologies. All these things happened because the regulators had a light touch.

Now, it’s like we don’t even know the rules, but somehow he (Gensler) can enforce whatever he wants anytime he wants. That is just going to drive all of the innovation out of the country, and it makes no sense at all. He is damaging our country if he’s going to do this sort of thing.

Coinbase, all they wanted to do was abide by the law. They kept writing the SEC, asking what they could do, but now they are claiming violations.

It’s time to reign in the regulators and develop good regulations we can all abide by. If there’s a new technology, you need new regulations”.

Final Thoughts.

There’s an air of inevitability to Cryptocurrencies, so financial planners and lawmakers like Gary Gensler are keen to have as large a head start as possible.

The crypto community are calling it “Operation Choke Point 2.0”.

Operation Choke Point aimed to pressure banks and payment processors to cut off services to high-risk businesses operating in sectors prone to “fraudulent activities”.

This approach raised concerns within the crypto community as legitimate businesses and individuals involved got caught up in the regulatory crackdown.

Popular exchanges Coinbase and Binance are both on Gensler’s radar.

Depending on how hard Gensler squeezes, all this innovation will move to other areas of the globe, like air in a balloon.

America could soon be an uninhabited technology wasteland.

So true. New technology needs to be embraced by regulators who understand it. The dollar may be "digital", but it is centralized, controlled by a government more interested in controlling the populace than actually protecting anyone. The fact is that they can try to regulate cryptocurrency as much as they like, but they cannot stop the internet from running.