Here Are All the Things I Believed About Bitcoin — That Ended Up Being Total BS.

Photo by Hans Eiskonen on Unsplash

When I first heard about Bitcoin, I was fascinated by the idea of a decentralised digital asset used as a store of value.

The idea of having a currency used to buy and sell goods and services without a central authority blew my mind.

You might have had the same experience too.

It’s a revolutionary concept starting to change our thoughts about money and finance.

As you delve deeper into Bitcoin, you realise that many misconceptions and misinformation are floating around.

You may have thought Bitcoin is anonymous, but it’s not.

Transactions are recorded on a public ledger called the blockchain, which means that anyone can see the history of a specific Bitcoin address. So, it’s possible to trace the ownership of a particular coin.

You might also think Bitcoin is untraceable, but that’s only partly true.

It can be more challenging to trace Bitcoin transactions than traditional financial transactions, but it’s possible.

Law enforcement agencies and government agencies have been able to trace Bitcoin transactions in cases of illegal activity.

You may have heard that only criminals use Bitcoin, but that’s not true either.

While it’s true that Bitcoin is sometimes used for illegal purposes, it’s also used for legitimate reasons, such as buying and selling legal goods and services and charitable donations.

Some believe Bitcoin is not a legitimate investment because a physical asset does not back it. However, experts argue that Bitcoin has value because it’s scarce and has a finite supply.

Plus, it can be a volatile but potentially profitable investment, with some people making significant returns on their investments.

You might think that Bitcoin is too complex to understand, but with some research and education, it’s possible to understand it better.

Bitcoin Is Bad for the Environment.

Bitcoin’s environmental impacts are the most contentious of all the issues.

Bitcoin’s energy consumption is negligible compared to most industries.

Data from the Bitcoin mining council shows 59.5% of energy for bitcoin mining comes from renewable energy, improved by 47.4% yearly.

Additionally, the Bitcoin halving that happens every four years halves the number of bitcoin miners receives.

Bitcoin miners are awarded 6.25 bitcoins for each block they successfully mine. The next halving will occur in 2024 when the block reward falls to 3.125.

Over time, the impact of each halving will diminish mining as the block reward approaches zero.

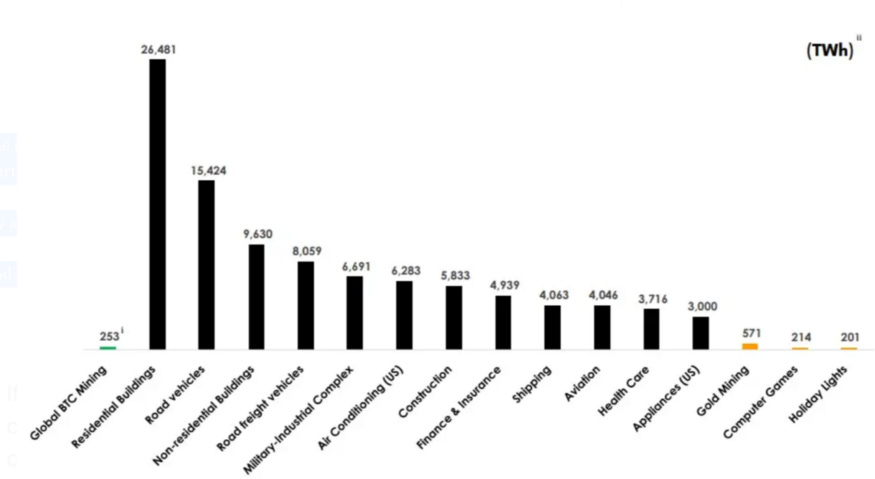

Here’s Bitcoins power usage compared to other industrial uses of energy.

Michael Saylor, a famous Bitcoin investor, responded to a negative report from the White House regarding Bitcoin’s energy usage.

Michael Saylor:

“Bitcoin mining is the most efficient, cleanest industrial use of electricity and is improving its energy efficiency at the fastest rate across any significant industry.

Combined with the halving of bitcoin mining rewards built into the protocol every four years.”

Bitcoin Is the Only True Blockchain.

Bitcoin maximalists believe there is only one valid blockchain.

It’s a tribal delusion.

You can’t be the ironic person who dismisses other networks when 75% of the world outside of Cryptocurrency denies Bitcoin is even a legitimate asset.

It doesn’t make sense.

There are several other cryptocurrencies with their blockchain and distributed ledger architectures.

Ethereum has emerged as the Defi and NFT king. Solana has picked up market share with their faster throughput and gas-less NFT transactions.

There can be a solid digital echo system of Blockchains.

It’s Too Late for Me To Invest in Bitcoin.

It’s never too late to invest in Bitcoin.

While it is true that the price of Bitcoin has seen tremendous growth in the past, it is still a relatively new and volatile market.

There’s still plenty of room for growth and potential returns on investment.

It’s important to remember that Bitcoin is not the only Cryptocurrency on the market.

There are hundreds of other cryptocurrencies, many of which have seen significant price appreciation in recent years.

So there are plenty of opportunities for investors to get in on the action, regardless of how late you may feel.

Keep in mind Cryptocurrency is not a get-rich-quick scheme.

As with any investment, it is essential to research and understands the risks before diving in.