How Two Working-Class Twins Beat the NFT Odds With a Strategy No One Saw Coming.

Jacob and Oliver Timperley started one of the UK's most iconic NFT projects and have leaned into a token launch few were expecting.

This newsletter is free thanks to the support of paying subscribers. Please consider supporting Carrot Lane by becoming a free or paid member. I hope you enjoy the blog.

Famous writer Michael Lewis once said:

“The pleasure of rooting for Goliath is that you can expect to win. The pleasure of rooting for David is that, while you don’t know what to expect, you stand at least a chance of being inspired.”

I always salute the mad bastard entrepreneurs who stare down the odds and still make shit work.

The best stories come from the ones who were supposed to lose, and didn’t. It’s why Hollywood made a fortune selling us underdog classics.

Make no mistake, in the NFT game, the odds are brutally stacked against both collectors and founders.

I was lucky enough to sit down with one of the Chimper’s founders, Jacob, the operator, alongside his artist brother, Oliver, who once summed up their partnership as: “I handle the canvas, and Jacob handles the chaos.”

Both men hail from Manchester, England, a gritty, working-class city known for its industrial roots and resilient spirit. While they’ve kept much of their personal life private, their story paints a picture of two self-made creators who turned childhood passions into a Web3 empire.

They pulled it off when every sign said they wouldn’t.

According to Castle Crypto, there are around 273,490 NFT projects traded across 47 marketplaces and multiple blockchains. But when you dig into Dune Analytics and DemandSage, 97.7% of those projects haven’t seen a single trade in the last 90 days.

That leaves just 2.3%—roughly 6,000 active NFT projects. And if I had to guess, most of them are barely keeping the lights on.

I’ve got my hat in the ring for about 40 NFT projects. Most were thoughtful investments, based on art, history, or the founder’s ability to execute. Others, mostly back in 2021, were so reckless I’d have had better luck swinging at a piñata after sinking a row of tequila shots.

For argument’s sake, if you held 10 projects and picked them completely at random, hoping all 10 landed in that 2.3% pool, your odds would be about 1 in 16 quadrillion.

To put that in perspective, you’ve got a better chance of being struck by lightning. Twice. On your birthday.

As cosmic-lottery as those odds sound, time changes everything.

These assets develop a Lindy Effect. The longer they survive, the safer they become. As Nassim Taleb, the former options trader known for his work on risk and probability, put it:

“For the perishable, every additional day in its life means it is closer to death. But for the nonperishable, every additional day may imply a longer life expectancy.”

These immutable assets survive and grow in demand by sustaining attention, which usually leads to buying flows.

It’s largely down to the founder’s ability to drive demand, but also to not chuck in the towel when things get tough. When you have a Twin brother bond, what people underestimate is how it de-risks your investment.

Studies show that family ties, especially between siblings who’ve worked together for years, build serious resilience.

Sibling teams reach full psychological safety 4 times faster than non-sibling teams, i.e., can I say ‘his idea is rubbish’ without my co-founder ghosting me for a month?

When the quarterly numbers look ugly, non-sibling teams might ask, “Is this worth my equity?” Brothers think, “Do I really want to explain this failure at Christmas dinner for the next 40 years?” The second question has a far higher grit coefficient.

Interestingly, when times are good, family units outperform.

A key note from a Harvard study:

“Over the decade from 2004 to 2014, the family-controlled businesses in our sample outperformed the MSCI World Index by 22% in total shareholder return. They also outperformed the S&P 500 by 17%.”

The hidden value in Chimpers that almost everyone overlooks.

As legendary Web3 thought leader Punk6529 puts it, the nature of a token attracts the type of holders who, in turn, shape the token’s nature.

It starts with the founders' DNA.

Over time, it creates a reinforcing snowball and network effect that’s almost impossible to break when people believe in something.

“The single most important test, is can I imagine myself saying (or the token hodlers saying): “I have no intention of selling this token, I plan to give it to my grandchildren when I die and I hope they don’t sell it either.”

I’ve lost count of how many times I’ve seen comments like “Finally got my forever chimp,” “Vaulted my forever chimp,” or “Chimpers are family forever.”

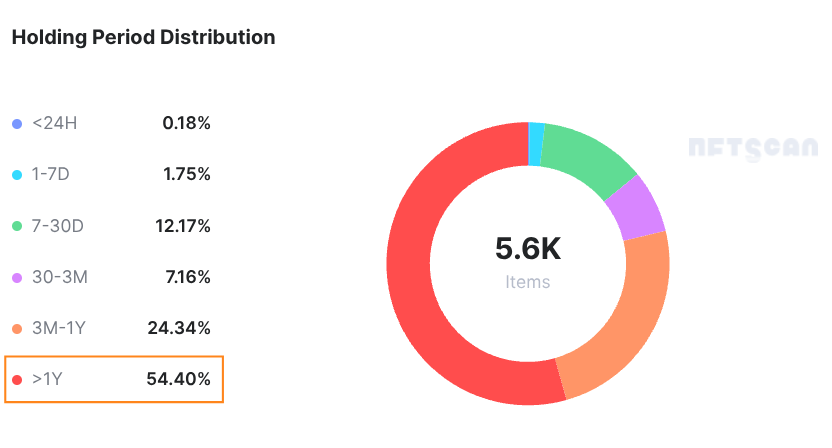

I know talk can be cheap, but over 50% of the core holders have held since mint day, which was billed as the “last hyped mint” of NFT summer.

Jacob credits the launch pad they had to Oliver’s YouTube channel and the support they received from around 100 early Bored Ape Yacht Club collectors as Oliver minted the project:

“It all sort of started with him. He’s an artist. Back when we graduated university, he was running a YouTube channel — creating art and animations, teaching pixel art, and collaborating with different gaming streamers. He had around 40,000 subscribers at the time.”

The seeds of community they cultivated have resulted in a cult like collector base.

54.40% of the supply hasn’t moved in over a year, and over a 24-hour period, only 0.18% (9 tokens) out of 5,555 are traded, making this a sticky collection.

The most obvious part of all this is the one thing nobody’s talking about.

It hit me like a fucking apple to the back of my noggin when I spoke with Drew Austin, a venture capitalist and Web3 expert.

It’s the supply.

There are only 5,555 of these Chimpers tokens compared to, say, other collections that have 20,000, or Veefriends Series Two, which has 55,000.

It’s an advantage folks overlook.

Drew told me he’s all in on CHMPSTR, their native token, which I’ll explain in a second. It’s because he likes the mix of a die-hard community and tight supply, which sets up a perfect storm.

“Meebits I like and I think Sergito has done a great job but it’s just too much supply. The fact that there’s 20,000 Meebits I think he’s at a disadvantage everday. It’s just so much inventory. I like collections that have good communities and lower supplies because the reality is there is way too much supply of these Crypto projects, they should be burning 60% of their projects, all of them. We built this for a time where there was way more demand.”

How a calculated community play could become Chimpers’ Trojan Horse

I knew the second I got a DM reply from Jacob at 2 am, this guy was deep in the fucking trenches and void of any ego.

I grew up on a council estate in the UK after immigrating from Johannesburg, and ingrained in me is a quiet admiration for boots on the ground, never too good to talk to someone, folks.

Recently, he and Oliver launched their own native token through TokenWorks.

Think of it like creating your own coin that seeks to arbitrage the price appreciation of the NFTs in the collection, but gives folks exposure to your ecosystem who may ordinarily be priced out of the NFTs.

They essentially get rented access to the NFT. It’s not exactly fractional ownership. The token is used to buy the NFT, which is then relisted at a 1.2x premium. The profits from those sales are used to buy back and burn the native token (in this case, CHMPSTR).

The deflationary mechanism is a real crowd pleaser in Crypto (obviously). But the protocol actually keeps value circulating within the ecosystem, benefiting both NFT holders and CHMPSTR token holders.

On the surface, the decision looked like a knee-jerk kamikaze move.

Founders like Spencer, formerly of Spencer Ventures, who has taken over the Moonbirds NFT collection, commented on NFT projects that were using the TokenWorks strategy as their native token:

“GVC I think it’s cool how fast they moved but I strongly disagree with this implementation, they should have at least deployed a fork, 1% of trading volume going towards buying and burning punkstr leaks 50% of the value capture exterior to their direct ecosystem. This seems like a miss especially if this is your official token. I also think official tokens should be in some way given to the community versus just sold to them and likely there’s more emergent value if they can be exchange listed which I don’t think that str tokens can be.”

The team at Chimpers soon followed Good Vibes Club (another major success story in the space) by adding CHMPSTR as their native token.

Funny enough, GVC are also brothers in business, and, from what I’m told, close friends with Jacob and Oliver.

After my two-hour conversation with Jacob and his explanation of why they chose this route, it dawned on me that Spencer’s actual predicament was that he now had competing tokens, both vying for attention, but shouting from the rooftop for his TGE would give him and early VCs a larger payday.

Spencer’s doing a great job with Moonbirds, and granted, he’s in a tough spot, so he’s earned a free pass from any shit-slinging from me.

It’s clear, if not totally fucking obvious, that TokenWorks’ fair launch model, where everyone buys on the open market, is far more equitable for all. It stops the usual chaos of people scooping NFTs just to claim the token, then dumping both right after.

Jacob explained the thinking behind adopting CHMPSTR as their native token.

“Joining the Tokenworks ecosystem wasn’t an easy decision, it required full commitment and understanding the implications. But Tokenworks is an independent entity with an existing token we could adopt. It’s risk-free, avoids legal headaches, and saves us the time and cost of setting up a token ourselves. With the Strategy ecosystem, there’s already an in-built structure. We can be creative, build layers on top, and experiment freely. Typically, with TGEs and tokens, there’s no real value connection between NFTs and tokens, they exist separately. Tokenworks changes that. The token’s volume and velocity feed back into the ecosystem through burns and buybacks, creating a sustainable loop.”

The macro reality nobody wants to admit

Currently, the timeline’s like a car crash you can’t look away from.

When things get shaky, I always turn to a bit of crypto therapy from the macro investing heavyweight himself, Raoul Pal.

And yes, I know he’s wrong a lot.

But his mental framework around these assets is undeniably accurate.

He believes they move with financial conditions and sit right at the edge of the risk curve. Business conditions need to improve first for these NFTs, which are trophy assets, to get liquidity.

When folks have room to stack cheddar and start getting pay increases, we’ll all start buying Jpegs again.

“I got invited to a private event at Beeple’s studio. At the event, I was explaining why NFTs are macro because there were a bunch of artists there feeling pretty shitty about themselves since their NFT prices were down. So I showed them the data, how NFT prices compared to things like fine wines, Rolex watches, the business cycle — and they were like, ‘Oh, it’s not me being a moron. It’s actually just part of a cycle.’ It takes for the Ethereum economy to reach new all time highs for NFTs to increase (capital rotation). People firstly need to have excess money to put into these trophy assets.”

A repeat of the free bat virus would be nice.

Unfortunately, we still have a way to go to get to the gates of Valhalla.

The sharpest indicator of financial conditions, and one that leads asset prices, is the ISM. Think of it like a business conditions or financial conditions index that the big boy macro investors keep to themselves.

It stands for the Institute for Supply Management survey.

It’s a monthly sentiment survey sent to around 400 supply chain management companies across the US. Each month, they send a short survey to senior purchasing managers at U.S. manufacturing companies, and roughly 300 respond.

The topline figure has a scoring system that covers:

New Orders – Measures demand for manufactured goods (most heavily weighted).

Production – Tracks current output levels.

Employment – Gauges hiring or layoffs in manufacturing.

Supplier Deliveries – Measures how quickly or slowly suppliers deliver materials (a slower pace often signals higher demand).

Inventories – Tracks changes in manufacturers’ stock levels.

It’s considered one of the most reliable indicators of the U.S. manufacturing economy.

The ISM index tends to oscillate between bear and bull territory, a bit like a heart rate monitor, but rarely trades sideways. Except for a few anomalies, like Trump playing fuck around and find out with his tariff button.

A score below 50 and trending downward signals weakening conditions, often leading to a bear market. A score above 50, trending upward, points toward economic expansion and a potential bull market.

Right now, the index sits at 48.7, suggesting business conditions are still set to improve. As productivity picks up, this typically boosts corporate profits, which in turn enhances employment figures and financial conditions, meaning more money in people’s pockets for discretionary spending.

So the answer here is much simpler than “NFTs are dead” or some obscure critique of the founder.

They’re a product of people having extra money, like back when we were throwing $500 on ETH gas fees like it was confetti.

If projects like Chimpers continue to deliver real value through strong community dynamics and tight supply, they could be well-positioned to light the touch paper.

Add in their not-so-insignificant following of three million across social media, and it might only take a small spark to reignite massive attention around the project.

Final Thoughts.

In a recent post I read on X, someone said: “I’d rather be wrong than bearish.”

How true.

Because at least then, you’re backing two creators who are slugging it out with a community-first mindset, running a profitable business independent of royalties, managing tight supply dynamics, and doing it all as brothers who’ve navigated a market that’s been anything but fair.

Two former 21-year-olds, when they launched 3 years ago, who nobody took seriously, are now building a community-led behemoth.

In the UK, company accounts are public information, and it’s clear they’ve been incredibly frugal with everything retained in the business. It’s a signal to me, at least, that this is a forever project.

Jacob said as much:

“For us, this is everything. There’s nothing else we’d rather be doing than growing and building Chimpers. We’ve had to be intentional and smart, which sometimes means moving a little slower, but it pays off in the long run.

We’re doers and creatives who came into this without a whole lot of experience. We joined the space in 2021, both 21 years old and family, and there’s something about that bond that really sparks something special.”

They’ve kept showing up like a metronome.

As Punk6529 once said, can you imagine token holders saying, “I have no intention of selling this token”?

I’ve seen the cascade of comments with my own eyes.

The fact that 50%+ of assets haven’t moved throughout the most brutal bear market tells you everything you need to know.

But the macro reality no one wants to admit is that people don’t have spare cash right now. They soon will, with business conditions improving (blog for another day).

Studies show that these family partnerships are more likely not only to survive the tough times but also to outperform when the tide turns.

When it happens, expect to be inspired because these two working-class twins have a real shot at beating the NFT odds.

And no one saw it coming.

If today's newsletter provided you with any value, it would mean the world if you could share it or show your support by upgrading to a paid subscription.

Brilliant Article. Love the way you wove real world business ecosystem cues into web3 metas. Bullish on the brothers Jacob and Oliver. Oliver's a fantastic creator and Jacob is a people's person. Couldn't have a better duo as Founders.