I Spent 53 Hours Over 12 Months Studying a Macroeconomic Wizard: Here Are His Most Thoughtful Crypto Insights That Impact Your Investments.

If you plug into Raoul Pal’s unique observations, you’ll see what’s on the horizon to help navigate the next cycle.

Happy Sunday, all!

I'm doubling down on two weekly newsletters to respect your inbox's valuable real estate. We all know the pain of email overload, and I've been closely monitoring open rates. Sundays and Wednesdays seem to be best.

Over the past year, I've delved into the world of macroeconomic expert Raoul Pal quite a bit. Why? Because he speaks my language.

Enjoy.

You and I are about to swallow a “limitless pill” of technology.

According to Raoul Pal, folks don’t even realise what’s about to happen because they don’t understand “exponentiality.”

It’s when something grows faster as time goes on.

Think of it like doubling your money daily.

Day one, you have $1, then the second day you have $2, then $4, $8, $16 and so on. It’s like a snowball rolling down a hill, and it’s what Pal says is happening with Crypto.

People get high off his price prediction dopamine-fueled buzz words like crack addicts. Brian Fantana would say, “60% of the time, he’s right every time”.

When Pal gets it wrong, people lose their minds as if the prodigal son of Crypto has betrayed them.

For the last 12 months, I’ve been in a Raoul Pal YouTube K-hole, clocking up 53 hours and writing 15 blogs of his cliche and jargon-free assessment of Crypto markets.

Heck, I’m starting to write how he talks.

His views are worth paying attention to, and while he’s no Nostradamus, he takes complex ideas relating to Crypto investing and makes them duck soup to grasp.

I’ve packed each nugget of information together shoulder to shoulder like passengers on a busy subway train.

Let’s dive in.

Raoul Pal: “You can be a blind chimp and still get rich from Crypto”.

Firstly, Pal is a man of the people.

When you’re the people’s poet, you must appeal to the normies, the everyday person who still thinks Crypto is a scam.

His comment about people overcomplicating the space and that you could do this blindfolded and still be successful sent his content to the moon like one of Elon’s rockets.

People started to scratch their heads and say maybe Crypto isn’t complicated if Uncle Raoul said, “You can choose between a basket of basic bets and still become rich.”

He says to take the pressure off yourself, “Make some basic bets, you know, like Bitcoin and Ethereum, maybe a few others, and over time, you have a basket of stuff. You might even look into other assets like Solana.”

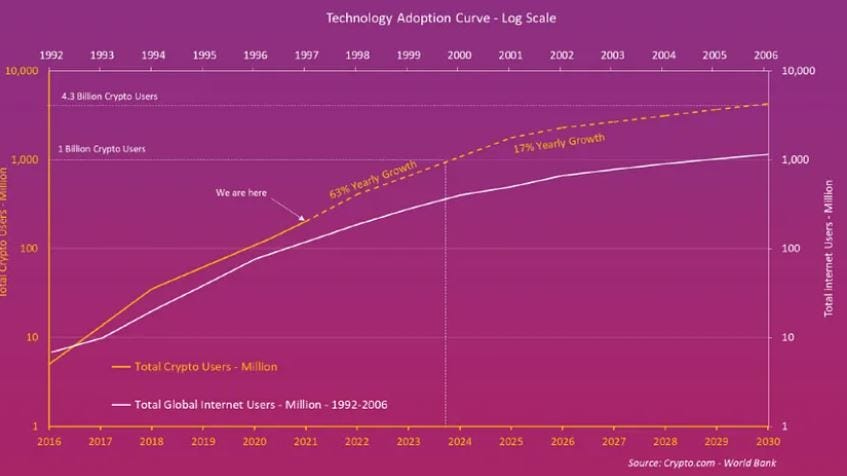

There’s no pressure because adoption will be exponential.

If you only ever look at one single metric, he says, “your true north should be searching for adoption.”

“At this rate, we’ll reach a billion people by 2024 and four billion people exposed to Crypto by 2027–28. A blind chimp could choose a crypto and get rich.”

Adoption in Crypto is growing at 113% per year compared to the internet growth of 63%

AI, converging with Crypto, will send prices to Valhalla.

Not for the reason you think, either.

Although inflation has been rampant, AI will commoditise goods and services, benefiting Crypto prices because things are about to get cheap.

According to Pal, Cryptocurrency responds to liquidity in the market. AI adoption will reduce output costs, crashing consumer costs.

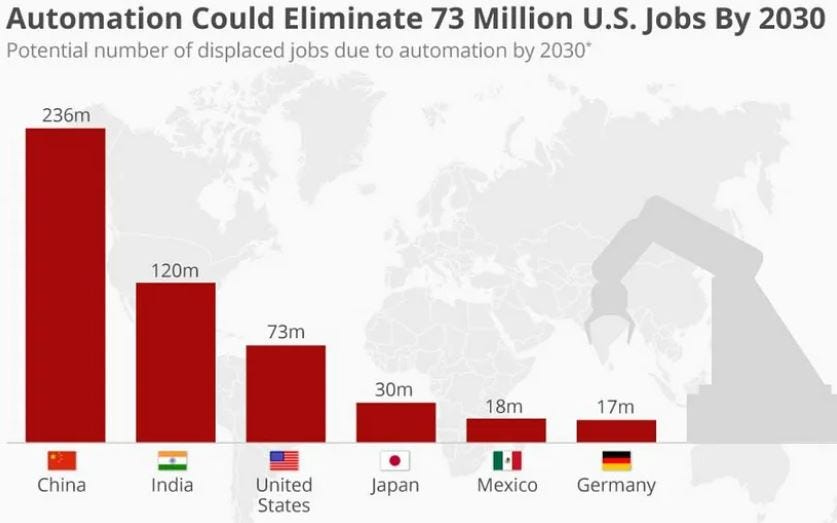

There’ll be fewer and fewer jobs a human can’t do better than a robot, and the output of goods and services with all the automation will be sky-high and bring colossal abundance!

Pal says, “It’ll be the biggest disinflation shock the world will ever face.”

When you dig into the data, he’s probably right: automation from AI is about to replace 20 million manufacturing jobs by 2030 in America.

25% of US jobs are vulnerable to automation anyway.

You could see 73 million roles displaced in the next five years, according to data from Zippia.

It’s unclear what new roles AI will generate, but the air in the balloon will move somewhere else, and people will have to figure it out or someone at the Fed better send me my stimmy check while the robots slave away.

When liquidity changes, everything changes.

Even though Bitcoin is down from its 2021 high of $68k, over 70% of holders, according to Glassnode, are in profit, and 56% of all Bitcoin hasn’t moved in 2 years.

People aren’t selling.

You don’t need to be Raoul Pal, a macroeconomic wizard, to understand how the supply and demand mechanics play out; more demand and less supply means a space shuttle trip to the moon for Crypto.

I’ve not even mentioned what will happen when sky-high interest rates stop bleeding us dry, and the Bitcoin halving event removes more supply from the market.

It’s a trade that’s as obvious as slapping yourself in the face with a shoe.

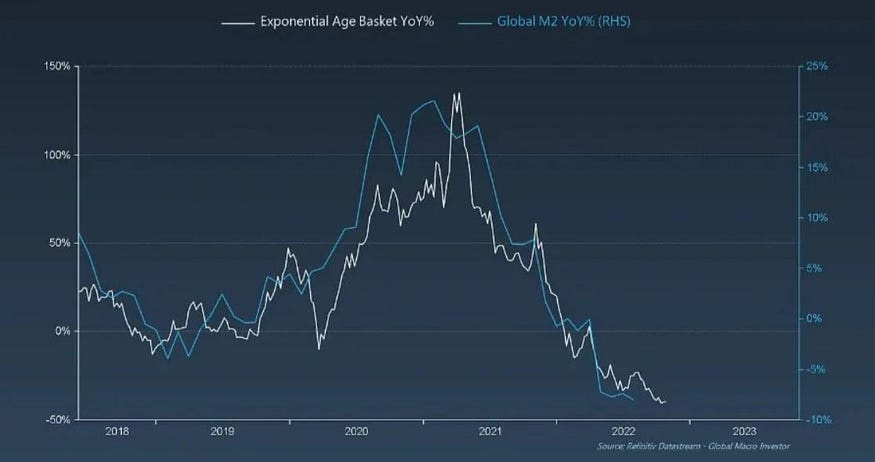

Pal says, “When liquidity changes, everything changes.”

The ebb and flow is evident when you compare Bitcoin’s price to the M2 money supply. So BTC vs. all the money in circulation. It’s simple; when there’s more money in circulation, the Bitcoin price goes up.

When you put the Bitcoin and M2 money charts over one another, they mirror each other.

Not everything has to be about Bitcoin.

Let’s be honest: Bitcoin is the granddaddy, but hearing other people’s views on why something else is worth consideration is refreshing.

It also makes me laugh when vast parts of the world deny Bitcoin, and Bitcoiners are firing shots at altcoins.

Everything is getting tokenised, so put those stones down, buddy.

Pal is bullish on Bitcoin and all the BlackRock ETF news. He’s more bullish that those funds will come down into smaller-cap cryptocurrencies, exponentially impacting potential returns.

He compares it to how the bond market hots up, and people rotate those funds into other investments like stocks and commodities.

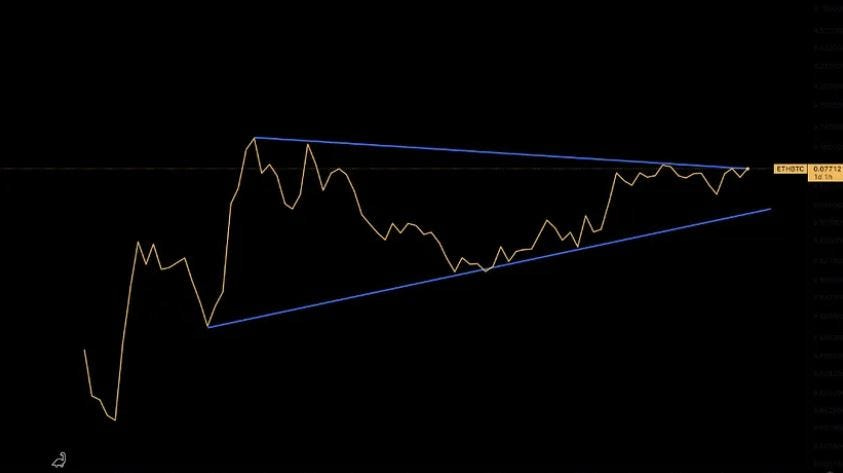

Pal was asked in an interview, “You can only back one horse, either Bitcoin or Ethereum and your holding period is two years; which one are you backing?”

Raoul Pal: “Ethereum. The monthly chart on a log scale of the Bitcoin and Ethereum cross reveals a big wedge pattern, and we’re at the turning point where we should see ETH starting to outperform BTC over the next couple of months massively.

Pal’s eluding that if ETH’s price is, say, $2000 and the price of BTC is $40,000 (hypothetical figures), the ratio would be 0.05 because 2000 divided by 40000, comprende?

So, 1 Ethereum would be the equivalent of 0.05 BTC.

Pal says when comparing the two assets, there is a crucial resistance level of 0.077 BTC, which is $2,115, and the ratio currently sits at 0.0639 BTC, which looks to be close to a “breakout”.

The ratio between the two is getting closer and closer, creating a wedge pattern, “a classic sign of a breakout”.

Final Thoughts

Raoul Pal struts his stuff like an economic investing gladiator.

But at the end of the day, he’s human.

He sometimes misses the mark.

You’ll sleep better at night if you use his research as another spoke in your tyre instead of a Toyota Camry driving you the length of Route 66.

Take note of Pal’s suggestions. Add them to your armoury. But make sure it’s you making the final decision.

Investing in Crypto is easier than you think; a chimp can do it.

AI, converging with Crypto, will significantly impact prices.

When liquidity enters the system, everything changes.

Other assets could outperform Bitcoin.

Let me know if there’s anything you disagree with.

Or what other things you’ve picked up on?

I’ll see you in the comments.

🙏👍

Is the Fed printing press preventing the government shutdown a source of liquidity to pump crypto?