If Bitcoin’s Bottom Is In, The Data Points to a Move No One Is Prepared For.

Don't blow it by sitting in fear.

If today’s blog brings you any value, please consider becoming a paid subscriber. To those who already are, I appreciate you more than you know. I hope you enjoy the blog.

The Bitcoin four-year cycle is categorically dead.

People hanging their hat on some imaginary gift we received from Satoshi, who hardwired a perfect four-year halving event into the code, will now be sitting with their thoughts and the realisation that they got it horribly wrong.

Timing is hard.

In fact, it’s impossible, which is why the old adage that time in the market beats timing the market is something you can’t take to the bank.

Everyone had the same idea of playing the cycle, and if everyone has the same idea, it usually isn’t a good one.

What hasn’t changed is the dominant force in financial markets. Liquidity and business conditions drive asset prices. To think otherwise is ludicrous.

Right now, we’ve got record stock-market highs, the lowest inflation since the pandemic, oil at five-year lows, and interest rates coming down. The dollar, the liquidity provision for the entire system, is also falling, which signals far more positive tailwinds ahead.

But recently, it’s as if the timeline is in disarray, like it’s the end of Crypto, people are battening down the hatches, and I’m sorry to say, but it’s bullshit.

In 2022, we had Silicon Valley Bank collapse, literal queues of people trying to withdraw their money, the Luna collapse, the FTX debacle, and the Three Arrows Capital collapse, and Bitcoin tanked to $16k.

People are now making the same mistake they did back then: not leaning in more when there’s friction, because that’s where the actual opportunity lies in all of this: Adding on the way down, which is majorly counterintuitive. But it’s the answer.

If you are in altcoins like I am and in NFTs, realise they are just correlated with Bitcoin. I am bullish on SUI as my bet for this cycle and continue to be, but in a drawdown, it’ll bleed the most, and in an upswing, it’ll increase the most (and it has), so the price you pay for crazy upside is volatility.

In any normal world, if something crashed by 50% or more, it’s dead and buried, but this is no normal world. These are network adoption models, and while people are in the network and have been battle-tested in the drawdowns, the network over time becomes infinitely stronger.

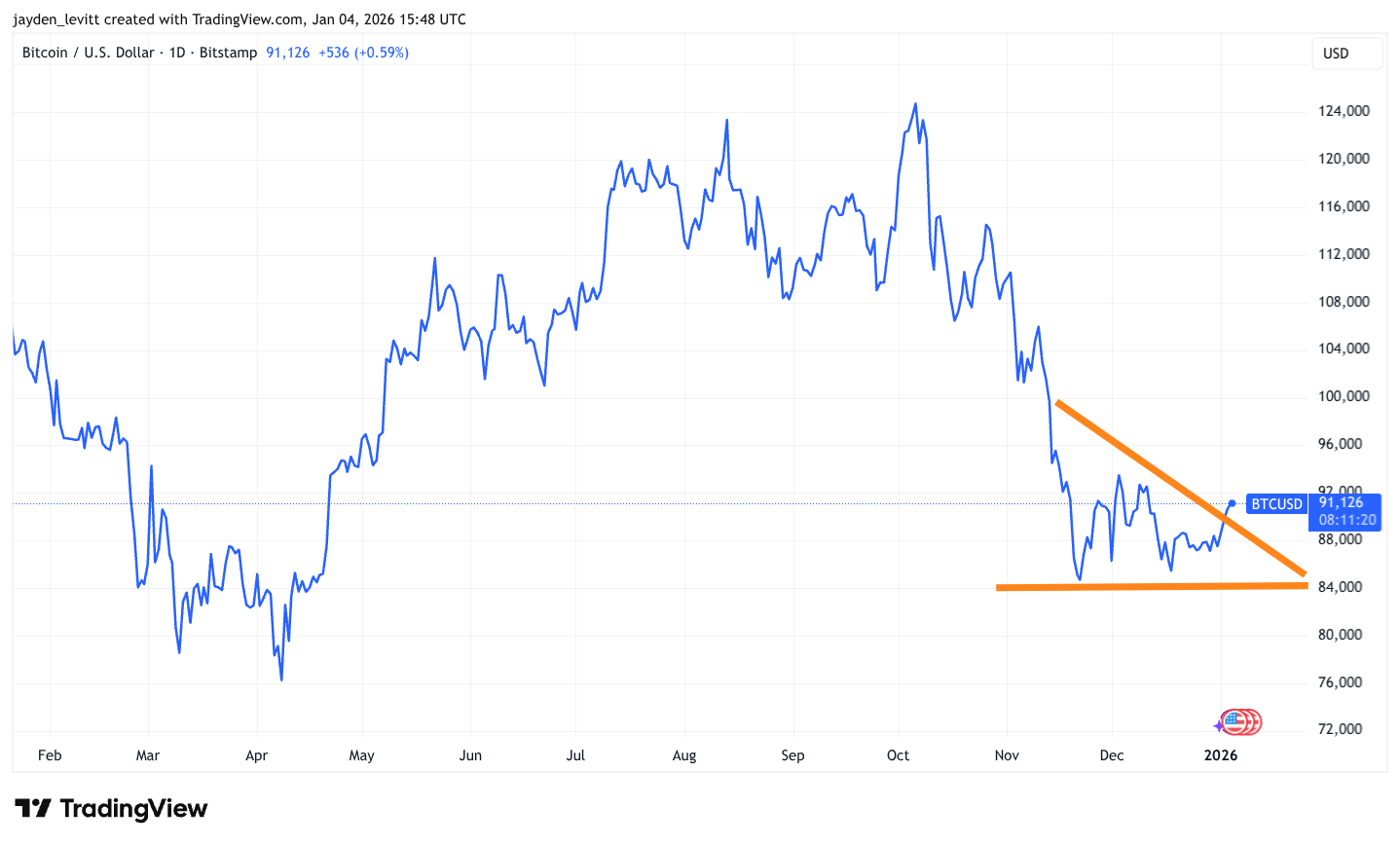

But first, let’s have a look at the Bitcoin chart below.

What we saw was either tax-related selling or people selling out, still playing the old four-year cycle framework. The reasons are irrelevant. Over the last six weeks, we have had a strong consolidation period and a slight recovery, creating a short-term wedge pattern.

Bitcoin is now breaking out, which is giving the entire market an optical boost.

Technical analysis can be hit-and-miss. However, the wedge pattern suggests a very high likelihood of a breakout to the upside (64% likelihood).

Does it drop lower first? Perhaps, but my guess is we have probably bottomed, especially heading into Q1, where folks start to reallocate.

Remember, no one actually knows, but as famous macro investor Raoul Pal says, “charts always tell a story of a structural shift in the market,” and that is what we are seeing.

This one framework I speak about that everyone ignores.

The one signal most people ignore because it feels like added complexity is actually the wizard’s position on all of this.

You want to know what is happening with business conditions.

Business conditions reflect productivity, which has a knock-on effect on stock market prices, which in turn leads to new or declining employment, and to people having more or less money in their pockets for discretionary spending.

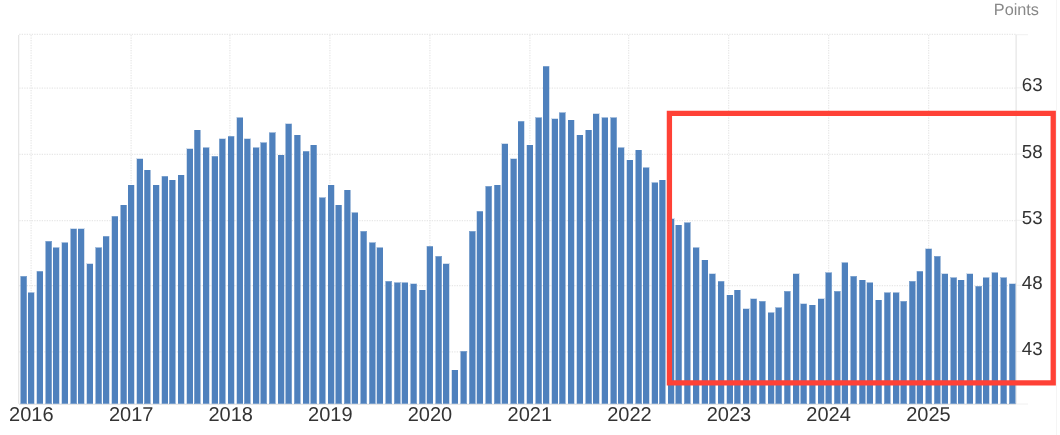

The one signal is the ISM.

Any other framework people are using is noise. Two-hundred-day or six-hundred-day moving averages, or any political narrative, are all noise.

The ISM is a sentiment survey sent to 4,000 supply chain professionals who answer questions about the health of their businesses, which is laser sharp at gauging the economy's health.

You want to look at the direction the ISM is headed because it oscillates like a heart-rate monitor, either up into a bull market or down into a bear market. So you look at it directionally.

A score of 60 signals overheating. Low to mid-50s is a healthy economy. Below 50 and heading downward signals bear-market territory.

As you can see from the chart below, with a score of 48.2 and trending sideways for the last two years, it’s clear business conditions are due to rise again, especially with interest rates easing and the rolling over of US debt still to come.

Keep an eye on the liquidity provisions in the system.

As I mentioned earlier in this article, these assets are really just a product of financial conditions.

In fact, their prices probably tell you more about where we are in the economy than most other signals ever will.

And the two liquidity drivers I speak about most often are oil, which is essentially a tax on the entire system, and the dollar, because so many countries carry dollar-denominated debt since it’s the world’s reserve currency.

When you track those two, you start to see the real story behind the moves in crypto.

This isn’t just a game for the US.

Every country in the G20 and 95 per cent of central banks worldwide are reducing rates, and the liquidity provisions across the entire system are signalling positively.

You might still be wondering what this has to do with Bitcoin or other assets further down the risk curve, and it’s because Bitcoin is the most sensitive asset to financial conditions.

It almost acts like a financial conditions index on its own, minus the four-year cycle folks selling, because ordinarily people would sell around this time of year.

After the recent turmoil in Venezuela involving the literal kidnapping of the president and the obvious elephant in the room of the country sitting on a huge amount of oil, combined with Trump’s recent comments about the US likely selling its oil, prices have dropped even further, which is bullish for Bitcoin.

Final Thoughts.

The most significant mistake I made in some earlier cycles was stepping away from a macro-investing framework.

I almost unknowingly got sucked into narratives that triggered my emotions and led me to make poor decisions.

It’s the trap everyone falls into when you’re stuck in an echo chamber of thinking everything is good.

Even if I were wrong and we had a bear market, it would last no longer than six months. The desire to day trade, sell the top, and buy back in never plays out the way people imagine, because buying into pain is far harder in practice, which is why so few actually do it.

Even if you timed the top of the market and sold everything, you would never put the same amount back in, so on the back end, and in the fastest-growing (investable) asset class of all time, you have less exposure because you’re tryna trade like Paul Tudor Jones.

The consolidation period sideways around Bitcoin over the last six weeks, followed by a wedge pattern and a breakout, confirms a structural shift to the upside.

If you add in the likely backdrop of improving financial conditions, like interest rates coming down, the dollar dropping, oil prices dropping, and the ISM set to head higher, probabilistically, it shows that we have all of the fun ahead of us.

As I say repeatedly on my Substack Notes, stop trying to be the trader of the century. Get the idea out of your mind. The best in the world can’t do it. Keeping this simple, not overextending yourself, and adding during the drawdowns or simply doing nothing is the best way to squeeze the juice out of this trade.

I repeat, doing nothing is the real power move.

Understandably, many here round-tripped last cycle and want to take profits, but I implore you to think about what you want those profits for, and before you sell, make sure the funds have a purpose.

Buy the frivolous asset, pay off the debt, go on the holiday, do the thing, buy the art, whatever it is, but don’t sell thinking you’ll buy back in, because you’ll have to outtrade your tax event as a hurdle rate.

It’s also far too anxiety-inducing.

A big part of doing all this is enjoying the process.

Here’s what actually happens when people sell with no purpose for the funds and the market runs hot. Folks rotate into subpar, more speculative bets that mostly go to zero, and before you know it, you’ve traded out of your core winning bet.

Those core bets should always be among the top assets in price performance.

All the data above points to a move for Bitcoin and Crypto that most people are not prepared for.

It is a move much higher and for much longer, and staying positioned for it is the edge.

If this article provided you value, please consider upgrading your membership to paid or a higher tier to show your support for Carrot Lane.

This article is for informational purposes only and should not be considered financial, tax, or legal advice. You should consult a financial professional before making any significant financial decisions.

If it gives the State of Texas a 2x, it could happen faster than most people think, and wake up new retail who love big green candles to chase. Don't mess with Texas and their BTC!

My crypto guru using “tryna”? 😆