I’m Not Selling My SUI Until This One Event Happens.

It's the weight holding down the coiled spring.

Today’s newsletter is available to both free and paid subscribers.

That’s only possible because of the paid subscribers who support Carrot Lane with a small membership. Your backing keeps this whole thing running and allows me to keep putting out the research and insights you read here. I appreciate you more than you know.

If you’ve been getting value from these posts, consider upgrading and joining the members who make it all possible.

In any normal world, if an asset drops 60%, it’s buried six feet under, pushing up daisies through the cracks in the headstone.

Crypto volatility is a rollercoaster on steroids, making your weird uncle look stable.

Unlike traditional productivity-based assets, those drawdowns can recover. In stocks, a crash usually reflects company performance. In crypto, it’s much more closely tied to financial conditions.

Most altcoins are highly correlated to Bitcoin. That means when Bitcoin drops, all alts usually underperform. But when Bitcoin recovers, the right altcoins with strength tend to outperform because they are smaller and less liquid.

It really is that simple.

I know a lot of my readers got into SUI because of the early price performance, the strong tech promises, or just from reading my research.

Nothing has changed. The technology is still the most profound of the new layer ones. The former Facebook team is still one of the most capable in the space. And among the top-performing chains, it still has one of the lowest token floats on the market, which, in an uptrend, creates supply friction and sharp price moves.

The only thing that has changed is Bitcoin’s price.

Bitcoin plummeted because traders played the four-year cycle narrative, a wave of liquidations hit in October, and then more selling followed in December.

What is interesting is that financial conditions are actually improving. Inflation is down, job growth is up, the dollar, which acts like a tax on the entire system, is down, and oil prices, which are passed through to goods and services, are at pre-pandemic lows.

While the backdrop of financial conditions looks like it’s improving, the memetics of people still playing the four-year cycle is clearly the stronger force right now. As Chris Burniske famously says, “human nature is very hard to change.”

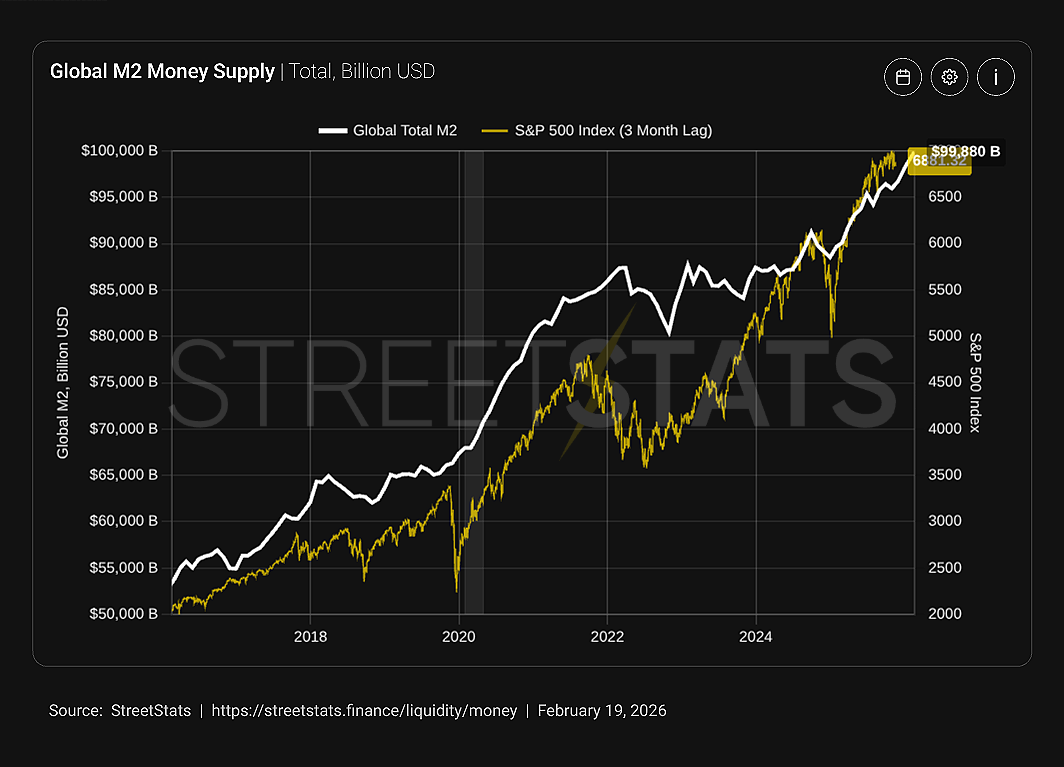

Global money supply is near all time highs. Just from first principles, thinking more money in the system means more capital that can flow into assets.

As you can see below, the global M2 money supply is just under $100 trillion, and the S&P 500 practically mirrors it (with a 3-month lag).

The S&P 500 has averaged about 10.56% a year.

While the global M2 money supply has grown roughly 8%. That 8% is basically your hurdle rate.

At first glance, the S&P looks like a solid bet, but once you factor in another 2.4% for inflation, your real return is close to break-even.

If your investments aren’t beating that benchmark, you’re treading water like Leo while the Titanic sinks, watching your purchasing power slowly slip away even though there’s clearly enough room on the floating door.

Everyone knows now that Crypto is the fastest horse in the race.

Raoul Pal often points out how closely liquidity conditions and asset performance are linked. He believes Scott Bessent, now the Secretary of the Treasury, built his career on understanding and using financial conditions to make investments.

As Raoul Pal put it recently

“It’s not about the politics. Unfortunately, they politicized technology right now. That will change over time and will morph into something different. But the Republicans driven by Scott Bessent will throw absolutely everything at it, which goes back to the beginning of our conversation. They will not allow the ISM to be below 50, because their voter base is middle America, and they have to see prosperity from the Trump administration. They have to appease the crypto overlords who paid them to win the election.

They have to appease the tech overlords who paid to win the election. Because the big game is, you can’t lose to China, and if you stop, pause, do anything, they will win. I think what we are going to see this year is something people aren’t quite prepared for.

It is going to feel like the pandemic in terms of the amount of stimulus coming.”

What most people buying SUI still haven’t realised

Unlike most blockchains that process one transaction at a time (sequential), SUI handles independent ones simultaneously.

It’s like a friggin low-cost, frictionless Flash Gordon of blockchains.

Think of it like a smart highway where transactions (cars) can drive in parallel across multiple lanes without waiting in line or causing traffic jams, enabling near-instant speeds, super-low fees, and massive scale for things like gaming, DeFi, NFTs, and the apps we use daily.

Its design improves speed and keeps costs low when the network is busy.

Web3 and Crypto expert Kyle Chasse said recently:

“SUI is quietly positioning where the next cycle of users actually lives. Fast finality, object-based architecture, and low fees make it easier to build apps that feel like normal consumer software, not crypto experiments. The chains that win the next phase won’t be the loudest. They’ll be the ones users notice because everything just works.”

SUI’s goal is to make blockchain infrastructure feel more like regular internet apps without you noticing it’s on blockchain rails.

Fast responses, low fees, a very easy user interface, and easy login features. System developers can also build on SUI without heavy friction.

One area the team is pushing into is decentralised storage through its Walrus protocol. The decentralised storage will reduce costs compared to traditional cloud providers. Large companies today spend billions annually on cloud infrastructure, so any credible lower-cost alternative naturally attracts attention.

Adeniyi Abiodun, who previously worked on Meta’s Libra project and is now a Sui co-founder, describes the vision like this:

“Our Vision for Sui is to build a global coordination layer for intelligent assets, going beyond traditional blockchains. We’re creating a decentralised web stack that supports everything from smart contracts to decentralised storage with Walrus, a global storage layer that is more distributed and cost-effective than AWS (cloud storage). This infrastructure will underpin a wide range of applications, offering unprecedented security and decentralisation.”

In plain terms, SUI aims to become an infrastructure that enables digital assets and applications to run at scale on the chain.

Supply and performance dynamics.

I’ll be straight as an arrow. I, like plenty of others, got the timing of this cycle wrong.

The goal was never perfect timing, but getting close to probabilistic outcomes, because no one can predict short-term markets.

Right now, the backdrop is messy.

Political noise, especially around tariffs, can hit risk assets out of nowhere. At the same time, this is one of the most crypto-friendly policy environments we’ve seen, which could lock the U.S. in as a leader before the G20 catches up.

So it’s a bag of mixed signals.

As Raoul Pal says, governments want strong economies heading into elections. That usually means liquidity eventually rolls back in through refinancing debt. The delay has been due to rates staying higher for longer than expected, with Fed Chair Powell commenting:

“The economy has once again surprised us with its strength. We still have some tension between employment and inflation, but it’s less than it was. The outlook for economic activity has clearly improved since the last meeting.”

This is the weight holding down the coiled spring.

When rates fall to a level where the debt is rolled over, asset prices rise optically, maybe even to Valhalla.

I get why people struggle to see value. But nothing that actually matters has changed. My approach stays the same. Back the strongest tech, strongest teams, and assets with the most potential upside relative to size.

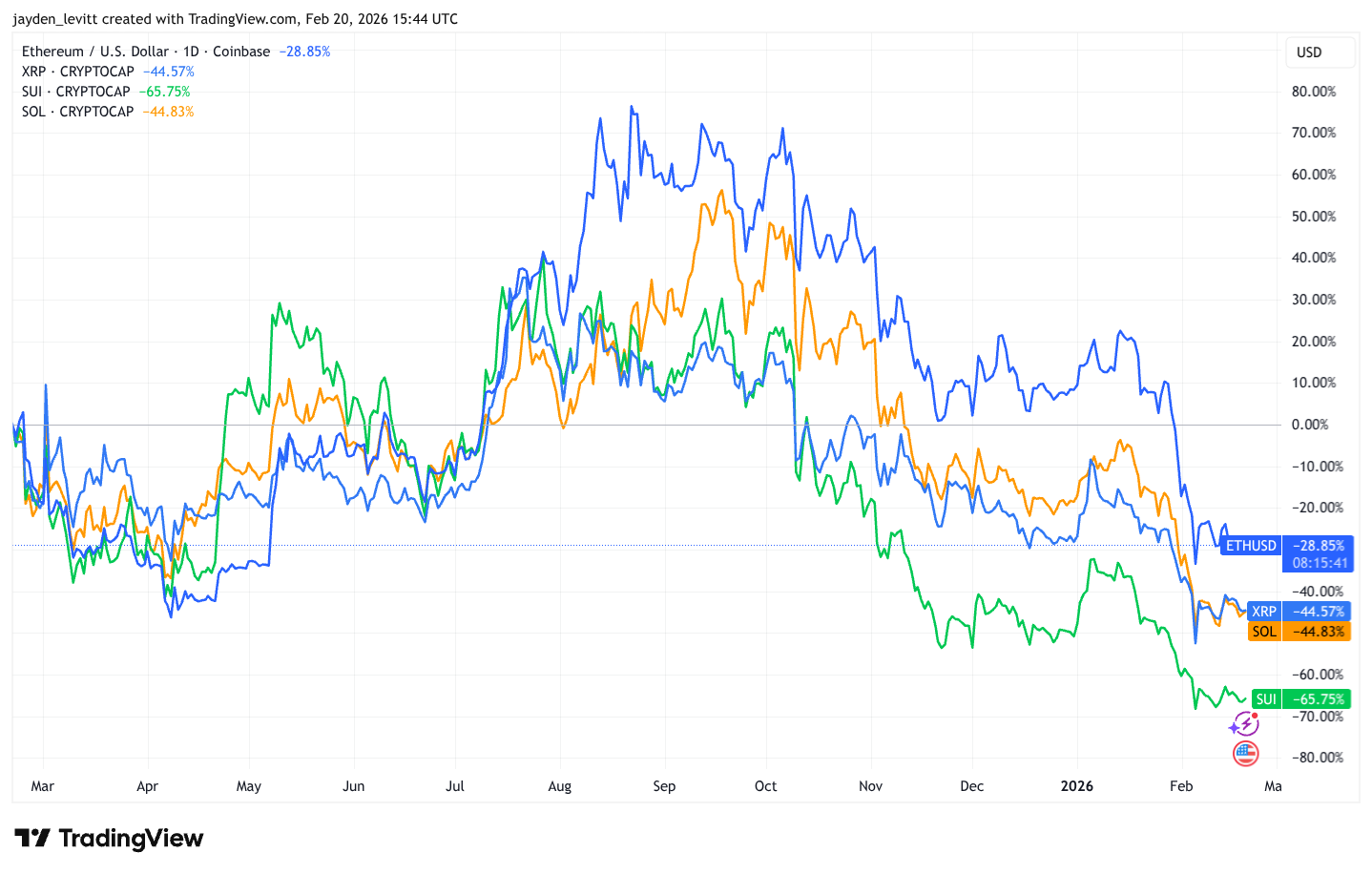

SUI has something most people gloss over. Its circulating supply is still relatively low. In crypto terms, that’s called a low float. Translation. A smaller percentage of their total token supply is actually trading right now than compared to more mature chains like XRP, ETH, or Solana.

When supply is tighter, prices tend to move more when demand shows up. That cuts both ways. You can get a sharper upside if adoption grows, but you also carry the risk of more volatile downside moves. And that risk increases as the unlocks add more supply.

Important to note that unlocks don’t mean selling will occur. It just means the token can now be traded, transferred or sold.

Here’s the most recent data:

SUI

Circulating supply: ~3.85 billion tokens

Max supply: 10 billion (capped)

Percentage circulating: ~38-39%

Over 60% remains locked/vested, releasing gradually at a rate of 0.40% to 1.1% over the coming years via scheduled unlocks.

XRP

Circulating supply: ~61 billion tokens

Max supply: 100 billion (capped, with monthly escrow releases)

Percentage circulating: ~61%

More than 15x SUI’s circulating supply, which makes XRP more liquid and less sensitive to small buying/selling pressure.

ETH (Ethereum)

Circulating supply: ~120.69 million tokens

No hard cap, but 37 million ETH (30%) is staked

Percentage circulating: ~70%

The raw circulating supply is small in absolute terms, but Ethereum behaves like a mature, high-liquidity asset due to broad distribution, institutional holdings, and massive on-chain activity.

SOL (Solana)

Circulating supply: ~568 million tokens

Total supply: ~620 million (no hard cap; inflationary but rate declining to low levels)

Percentage circulating: ~91-92%

High float relative to newer chains like Sui—nearly fully circulating, though staking removes a significant portion from the immediate liquid supply.

SUI stands out with only 38% of its float unlocked, which gives it tighter supply dynamics in the short to medium term than mature, heavily circulated assets like XRP or SOL, and even ETH, given the significant supply tied up in staking.

If the best assets rise in line with Bitcoin, as the ones mentioned above do, the outperformance you get from picking the smaller, less liquid assets can go vertical. But that only works if Bitcoin's price increases.

And for Bitcoin to run up, financial conditions need to ease, rates need to fall, and debt needs room to roll.

You can see ETH, XRP, SOL, and SUI mirror each other on the chart below, but aggressive moves, up or down, are exaggerated, largely based on their size.

Macro experts say this is the final hurdle.

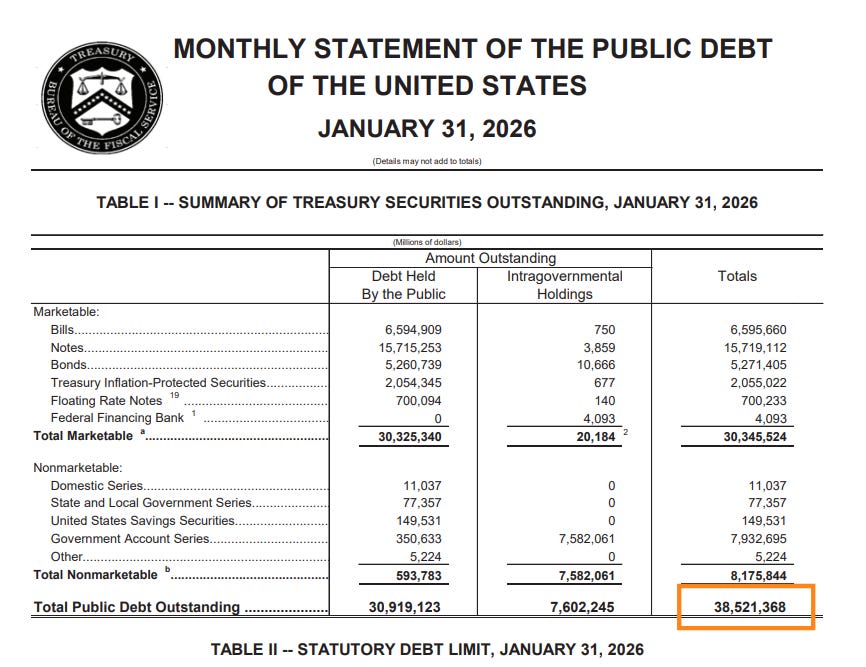

24.9% of the $38.5 trillion national Debt Matures in 2026.

This is what Crypto folks are hanging their hat on, and why I won’t be selling my SUI until this debt rollover is factored into the price of Crypto.

With rates higher, the US has not been able to roll over its debt, which usually has an optical rising effect on assets. Higher interest rates also crowd out spending, which squeezes risk assets.

It’s simple. If people have more money, they’ll invest more in risk assets like Crypto.

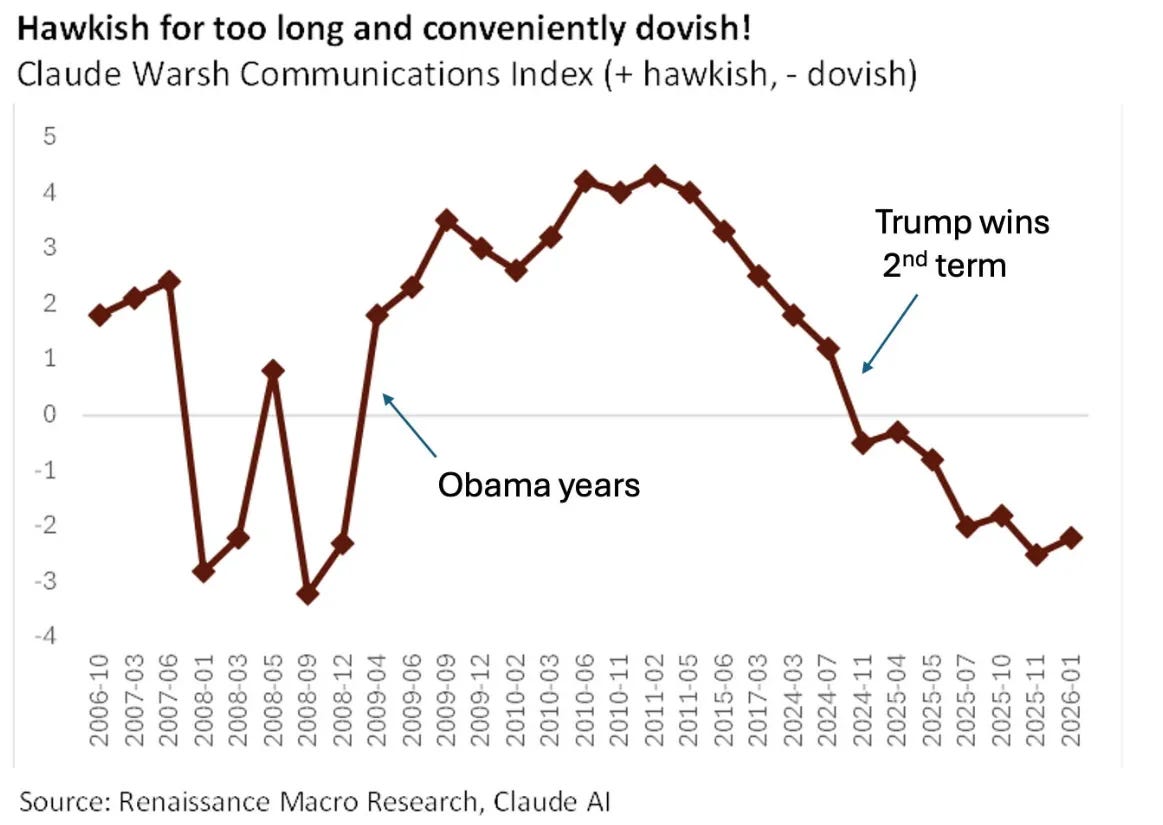

Kevin Warsh was announced as the future successor to Jerome Powell as Fed chair, someone who has been openly critical of Powell. Right after the announcement, it triggered a sharp sell-off in gold and silver. It also hit our beloved internet money because of the easier access to capital while traders waited for the market to reopen.

Warsh is known as an inflation “hawk”. In central banking terms, a hawk prioritises fighting inflation, while a dove prioritises growth and jobs. Which, if you think about it, kinda goes against the current adminsttraitons stance on the economy.

Not everyone is convinced.

Some see Warsh as someone whose political stance shifts with the wind depending on who’s in power. Paul Krugman, a professor, former NYT columnist, and someone Trump once called a “deranged bum”, said:

“As I noted, many news reports have characterized Warsh as a monetary hawk, but I argued that he’s more of a political weathervane: He’s for tight money when Democrats are in power, but all for running the printing presses hot when a Republican is in the White House.”

Neil Dutta, another sceptic and investing expert, used AI to map every single one of Kevin Warsh’s speeches and public comments.

He went all the way back to 2006 and scored each of them on a hawkish-to-dovish scale.

On a chart, there is nowhere for it to hide. You see the data, the political lean, and a pretty loud signal that Warsh would likely cut rates quickly once he steps into the Fed Chair seat.

Warsh will likely get out of Trump’s way and drop rates faster than a broken elevator.

When that happens, there’ll be a metric ton of cash freed up.

A huge chunk of U.S. debt matures between now and December 2026, with the midterms in November, so a lot needs to happen before then.

This list shows all maturity dates in one place. Since thousands of individual Treasury securities mature daily, weekly, and monthly, they all hit at different times. What the Treasury does instead is publish a full breakdown of the Public Debt in its Monthly Statement.

Inside that report, there’s a section called “Detail of Marketable Treasury Securities Outstanding,” which lists every security, its maturity date, and the amount.

Approximate monthly maturity amounts (in trillions) and % of total public debt (~$38.5T) are estimated as follows:

February 2026: $1.5 – 2.0T (heavy bill rollovers + major quarterly notes/bonds on Feb 15)

→ 4 – 5% of total debtMarch 2026: $1.0 – 1.5T (mostly short-term bills)

→ 3 – 4%April 2026: $0.5 – 0.8T (lighter month, mainly bills)

→ 1 – 2%May 2026: $1.2 – 1.5T (quarterly refunding: notes/bonds on May 15)

→ 3 – 4%June 2026: $0.6 – 0.9T (bills + some notes)

→ 1.5 – 2.5%July 2026: $0.6 – 0.8T (mostly bills)

→ 1.5 – 2%August 2026: $1.0 – 1.3T (quarterly refunding + bonds/notes on Aug 15)

→ 2.5 – 3.5%September 2026: $0.4 – 0.7T (lighter, bills dominant)

→ 1 – 2%October 2026: $0.5 – 0.8T (bills + minor notes)

→ 1 – 2%November 2026: $1.0 – 1.3T (quarterly refunding on Nov 15)

→ 2.5 – 3.5%December 2026: $0.5 – 0.8T (end-of-year bills + notes)

→ 1 – 2%

The latest version as of Jan 31, 2026, is here, and most maturities are between now and December 2026.

Final Thoughts.

Legendary investor Stanley Druckenmiller once said:

“Earnings don’t move the overall market; it’s the Federal Reserve Board...focus on the central banks, and focus on the movement of liquidity...most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

It has already flowed into Gold, Silver, and Tech stocks, but liquidity never sits still.

It has to go somewhere. And in a world that’s getting more digitised by the day, the place with the most explosive upside gravity is crypto.

That’s why we’re here.

Michael Howell, the liquidity maestro, summed up exactly how I see this period in the economy.

“People need to understand that liquidity is the key thing going forward. Liquidity is likely, from a global perspective, to be the main driver of asset markets in the future. One of the reasons I say that is what we’re seeing in the U.S. right now. The Federal Reserve is bailing out the banks. What the Federal Reserve is going to have to do in the next ten years is bail out the government. The U.S. happens to be the cleanest shirt in the global laundry. Other countries are far worse. Ultimately there’s a huge amount of liquidity coming. If you believe QE is dead, forget it. It’s not. It’s coming back, and it’s coming back big time. Investors have got to start adjusting their asset allocation methodologies to take this into account.”

That’s what everyone sitting in risk assets is really waiting for.

That one fast, powerful event where financial conditions loosen over a few months and suddenly prices catapult. The numbers stack up: 2026 is the year.

If Kevin Warsh steps in as Fed Chair around May, that gives roughly six months before the midterms. That window could be extremely strong for asset prices, as we’ll likely start seeing clear signals on interest rates. Warsh has already said, “We can lower interest rates a lot, and in so doing get 30-year fixed-rate mortgages so they're affordable, so we can get the housing market to get going again.”

So there is a lot to play for this year.

SUI still stands out to me for its technology, team, and the fact it’s one of the newest and smallest layer ones. It gets hit harder in downturns, but that same dynamic is why it can outperform in an uptrend. And that uptrend is coming. It’s just taking longer than people expected. Including yours truly.

I usually avoid politics, but the reality is the backdrop right now is tied to it, whether we like it or not.

The next phase, once this SUI trade plays out, will be deciding when to sell. Right now, we’re not there yet.

We also have the CLARITY Act discussion, where the President’s Council of Advisors for Digital Assets at the White House, Patrick Witt, said:

“There are trillions of dollars in institutional capital on the sidelines waiting to get into this (crypto) space.”

This is the last stretch now, folks.

Hang on tight.

We’re nearly there.

If you found value in this, consider upgrading your membership. It directly supports the newsletter and allows me to keep producing the research and insights you’re getting here.

I’ve also added extra benefits for members, including 1-to-1 calls and access to the private group, so you’re not just reading the analysis, you’re part of the circle that discusses it in real time.

This article is for informational purposes only and should not be considered financial, tax, or legal advice. You should consult a financial professional before making any significant financial decisions.

As I stated already in 2024. SUI is the Apple of the Blockchain Ecosystem . Just take this to the bank for the coming years.