In Five Years, You’ll Wish You’d Backed This Crypto Bet Today.

Sometimes it just seems so obvious in hindsight.

It’s the everything token.

Otherwise known as NFTs.

For the first time, we’ve got a token that acts like a contract, has a layer of art on top, organises community, and solves scarcity — all in one.

If that sounds like a bunch of gobbledygook, that’s actually a good thing. It means you get to keep things simple. And there’s no better place to start than by ignoring the tech… and focusing on how people interact with it.

As the old truism goes, technology gets adopted when people stop talking about it.

Right now, we’re in one of those rare moments — where assets hold historical significance, carry cultural weight, or are being led by operators turning their projects into the next big IP. And honestly, it’s magical to see.

But you’ve got to know what to look for...

In crypto, everything is about attention. Attention drives buying flows. But that attention only really shows up when financial conditions improve and people start to feel more affluent. When that happens, they turn to expressive assets.

In the past, that meant cars, watches, physical art, fine wine, whisky — all the stuff that signals taste and our P&L to the world.

Now, that same expression lives on-chain through NFTs.

We spend most of our time online — not behind the wheel or strolling the high street — so it makes sense that we’re now signalling to more people digitally. And over time, these digital assets will keep gaining value.

But first… a quick pulse check.

Did we just witness the final crypto shakeout?

These are luxury goods. High-end trophy assets. And they tend to rise in price when financial conditions ease up.

Right now, Uncle Trump seems happy for us to take a bit of short-term pain.

I wrote a note earlier with a theory I’ve been sitting on about these tariffs. I don’t think it’s really about crushing other countries or making them “pay their fair share.”

I think it’s about forcing a slowdown — maybe even a mild recession — just enough to pressure the Fed into reversing its stance on interest rates. (Remember, Trump doesn’t control rates or refinancing.)

The current administration knows they’ve got the money printer in their back pocket.

So why not spook the market now, instead of dragging this painful sideways chop out for months?

The dollar is weakening — which is a good thing for countries sitting on dollar-denominated debt. It also means they can fire up their own money printers and start quantitative easing again, without tanking their currencies.

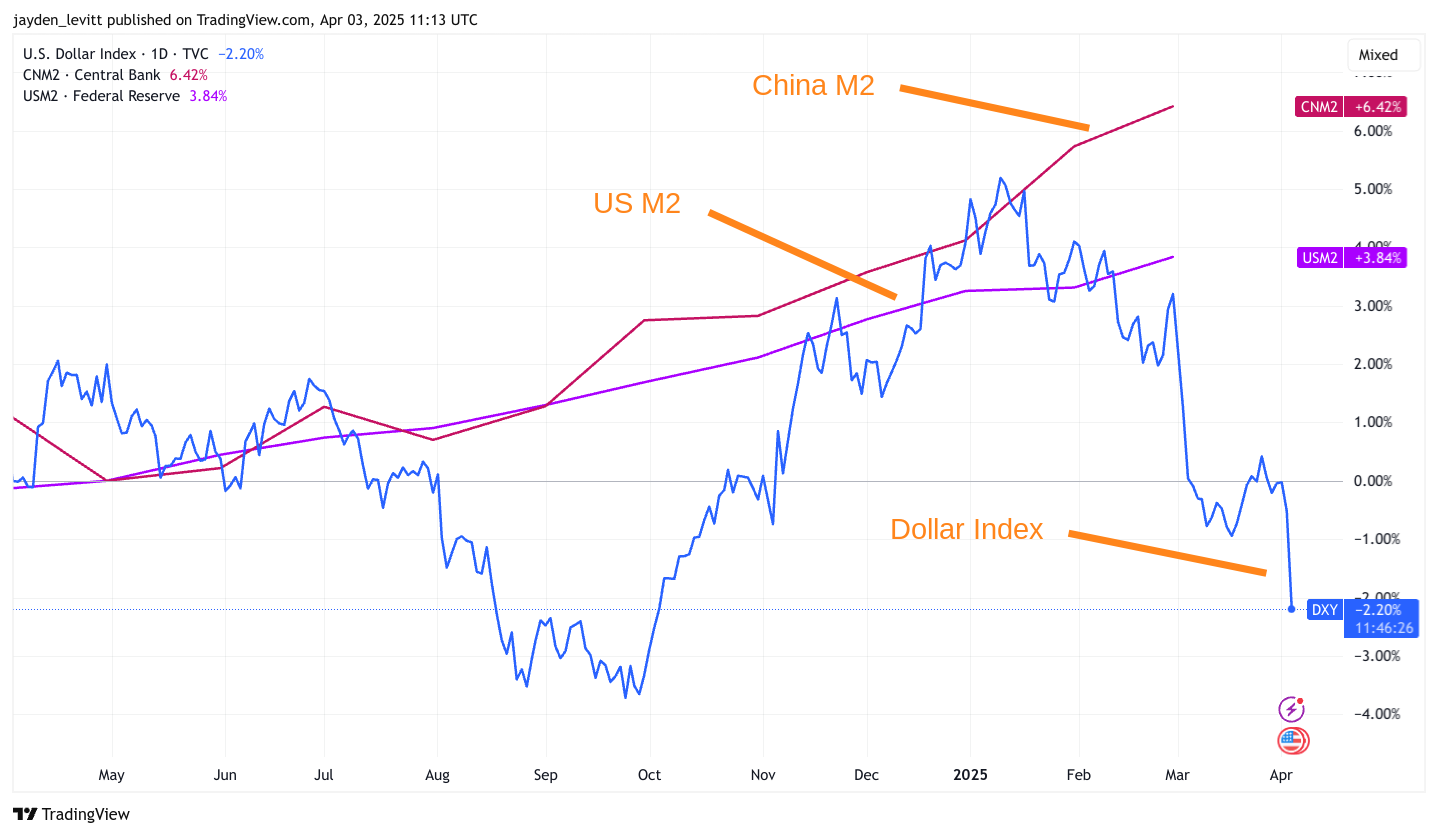

You can see it clearly below:

The dollar (blue line) is at its lowest point since September 2024

China M2 (red line) has printed 6.5% more money in the last 12 months — and will likely print more as the dollar keeps falling

The US (purple line) is about to hit all-time highs in national debt, with a 3.84% increase in money supply over the last year

Now… you might think none of this matters for NFTs. But it does.

In fact, it’s the only thing that really matters — because when financial conditions ease, these assets tend to explode in value.

What’s wild is they’ve already shown serious strength despite the recent squeeze.

We might look back at this moment and realise it was the perfect (if slightly painful) buying window.

Digital strength despite Tarrif pain.

This is an alien asset class.

Unlike crypto coins, NFTs don’t just sit in a wallet — they organise community and tap into raw human emotion.

We meet people through them. We get attached to the art. We follow the events, the meetups, the updates. And honestly? For me, it’s been the single biggest cure for loneliness.

Writing can be soul-crushing — it’s not exactly a team sport. But this tech has connected me with hundreds of people online. It’s like a meme coin community... on steroids.

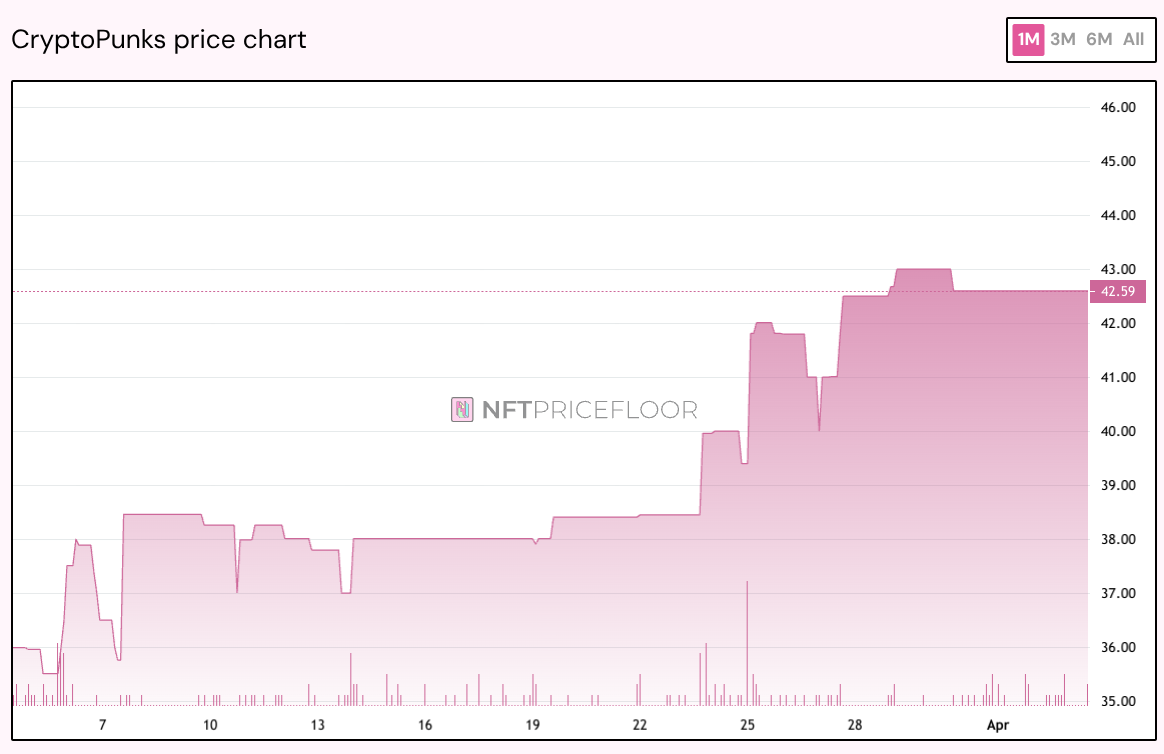

I keep sharing this chart because sentiment keeps quietly climbing.

CryptoPunks acts as a signal for the entire NFT space, and seeing it hold a 35 ETH floor for three months and spike to nearly 43 ETH in the middle of global turmoil really tells you something.

These assets are becoming a flight to safety for people in coins — a store of value.

And art has been upstream of everything for centuries.

What’s weird is once people hold these assets, they rarely sell. You don’t hear, “I’ve got a grail NFT — let me rotate that into the S&P 500.” It just doesn’t happen.

Early NFTs are falling into stronger and stronger hands. And because supply is fixed and no new early assets can ever be created, they’ll just keep climbing, possibly to absurd levels.

People compare them to traditional art, but NFTs are built differently: They sit on global financial rails, with no gatekeepers and very little friction.

So if you thought NFTs were going to be big — think again.

They’ll be much bigger.

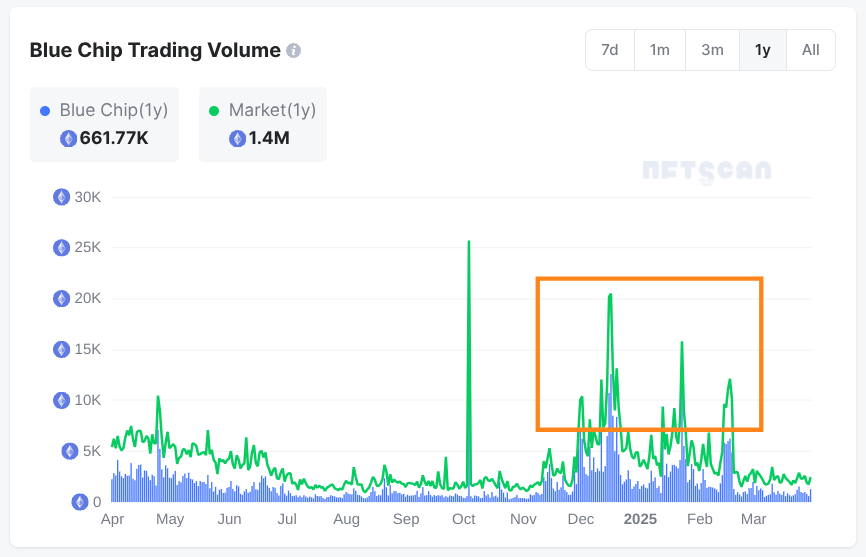

Out of the top 20 so-called “blue chip” collections — and yeah, I get it, what counts as blue chip is subjective — they make up a combined market cap of 1.5 million ETH, which is 26.09% of the entire NFT market.

You can think of these collections like the strong altcoins of crypto.

When capital starts flowing into them again, and I say this next bit with a pinch of salt, the so-called “smart money” usually gets active. And right now, that activity is bubbling just beneath the surface.

Mostly in the 2021 collections.

We already know financial conditions are set to improve — tariffs are probably 90% priced in.

When people start to feel a bit richer, and asset prices start climbing thanks to money printing… capital will rotate further down the risk curve — into the final frontier: NFTs.

There’s nowhere else for the money to go because people aren’t rotating out of the ecosystem, so they get locked in this bottleneck. Folks then find it hard to sell.

Their communities mean too much.

Their grail pieces mean too much.

Their online identity means too much.

Every other financial investment starts to feel subpar, especially when compared to picking the right NFT project.

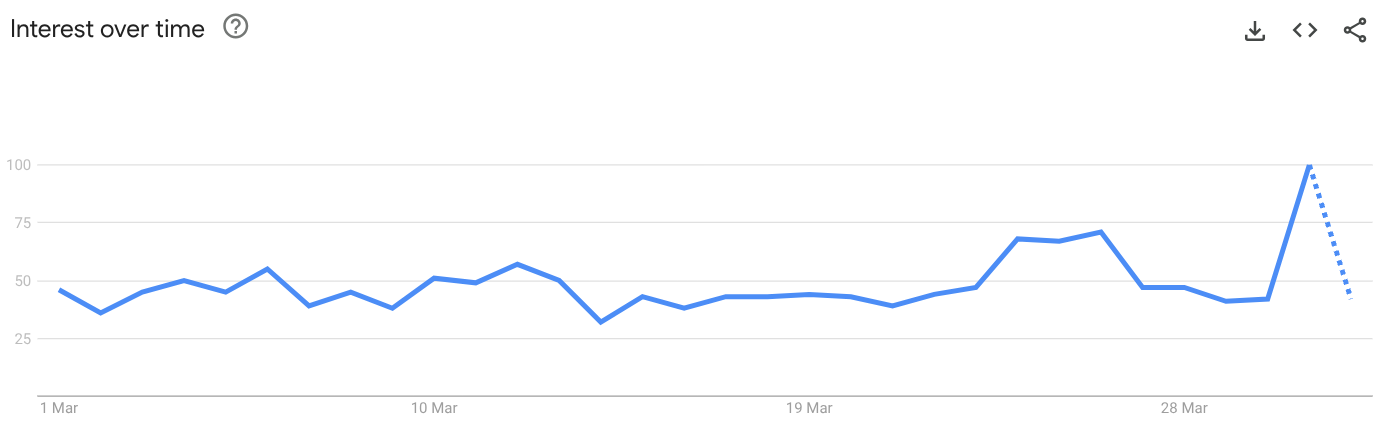

Thanks to this AI takeover, there will come a time when Google Search feels like the Yellow Pages, but for now, it’s still a strong signal of where consumer interest is heading.

In the last 30 days, the search volume for “NFT” has doubled.

Trust me — that’s not nothing.

So yeah — we’re seeing signs of a recovery.

But make no mistake: we’re still at the dawn of the dawn of the dawn of all this. Which means… we’re early.

I still get messages like:

“Jay, is it too late to get into this? Have I missed the trade?”

And the answer? Flat out — no. In fact, it’s the opposite.

This chart tracks the top 500 NFT assets across multiple blockchains like an NFT index — and the market cap is still down 97.46%.

You probably would've switched off if I’d hit you with that number at the start. But that’s precisely where the opportunity is.

We know this NFT tech is one of the most significant breakthroughs in all of crypto. And now that it’s showing real signs of life, it’s gaining that Lindy effect — the longer it sticks around, the more likely it is to survive long-term.

Final Thoughts.

A lot of readers here will look back, wishing they leaned harder into NFTs.

Total NFT volume has now hit around $70 billion, with over 20.6 million buyers and 13.4 million sellers.

Yet despite that, 97% of holders are still down on their investments.

That doesn’t mean NFTs aren’t going to win — it just means most will be bad bets. That’s why you’ve got to be laser-focused on what you put your money into… if you’re playing to profit.

If you’re buying to support emerging artists or simply because you love the piece — that’s a beautiful reason, too. Power to you.

But if we zoom out…

Crypto has likely bottomed.

Tariffs feel priced in.

The dollar index is down — signalling looser financial conditions.

M2 money supply is creeping up — another sign of easing.

In the middle of all that? NFTs are showing real strength.

CryptoPunks — the lead sentiment signal — is climbing.

Blue-chip collections are buzzing with activity.

Search volume is rising.

It’s setting the stage for the kind of slow-building attention wave that often snowballs into extreme buying flows.

But here’s your reminder: this stuff always takes longer than you think. No one knows what will happen. So, keep a long-term lens. Because, yes, we’re still early.

This might be the opportunity you wish you backed from the start.

If this blog brought you any value I would really appreciate you hitting the share button—it’s how Carrot Lane grows. Thank you.

Jayden, thank you for a great and insightful read, as usual! So then, for a first-time NFT buyer, are you still recommending CryptoPunks as a solid NFT investment - particularly if we are buying for profit (long-term hold) vs. supporting emerging artists?

Can you share any other noteworthy (investable) NFT collections to buy? i.e. you’ve mentioned Curio Cards as well, in some of your past newsletters and live video calls.

Also, you had said about a month ago you were putting together a live Zoom call (with other speakers), on How to Buy an NFT - did that already happen and somehow I missed the memo and Zoom session? Thank you again!!!

Fantastic as usual!