It Doesn’t Feel Like It, But Crypto’s Setting Up for a Move No One Sees Coming.

"Like a beach ball held underwater, the pressure builds — then bursts."

Please consider upgrading your membership to unlock my most in-depth research on crypto and NFTs, including how to position yourself for the next significant rotation of capital.

All annual members get a 1-2-1 strategy call with me, and founding members get even more exclusive access and benefits.

When your hopes and dreams are tied up in something long enough, it’s easy to get disheartened.

If it’s not tariffs, it’s war in the Middle East.

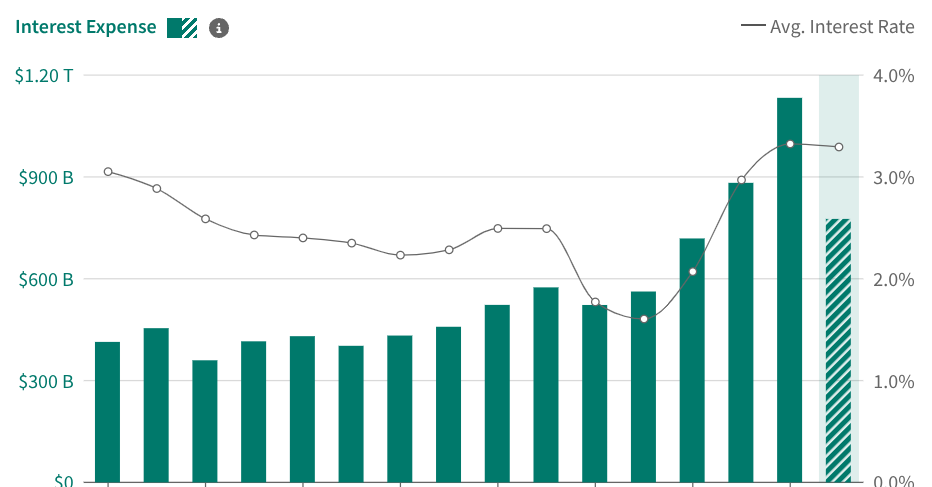

If it’s not that, it’s Uncle Jerome refusing to plug the aux cord back into the economy and cut rates. Which, to me, is bewildering, considering the US interest payments alone are projected to total approximately $950 billion, according to the Congressional Budget Office (CBO).

In past cycles, none of this would’ve mattered.

We were all just degenerate speculators, ignoring macro and keeping it simple.

Every new cycle pulls in a bigger and slightly wiser crowd. People who are quicker to ask, “Why the hell did my crypto bags just tank?”

The loudest answer right now? Global liquidity. It’s the main driver behind asset prices.

While most are glued to daily price swings, debating every dip and pump, it’s the growing money supply that’s quietly fuelling the log burner in the background.

And that means there are more tailwinds behind us than most people realise.

Top crypto researcher in the world Jamie Coutts said this recently:

"Every time we exit a contraction, it kicks off what I call a super bullish liquidity regime.

Global liquidity can’t stay flat or falling for long, the system’s too indebted. Eventually, the cost of debt gets too high, and there’s always an impulse to add liquidity.

Like a beach ball held underwater, the pressure builds then bursts.

That’s exactly what started in early April. Global liquidity broke out, and Bitcoin ripped 40%. Historically, when liquidity rises 1%, Bitcoin climbs around 7%. But in these breakout regimes, that multiplier jumps to 20–30x.

This isn’t theory, it’s happened before. And we’re seeing it again now.

Even with recent pullbacks, Bitcoin massively outperformed equities on a risk-adjusted basis. It’s not overheated, it’s doing exactly what it should.

Every new dollar added, even through a weakening dollar, makes financial conditions easier and injects more fuel into the system.

The breakout already started. Most people just haven’t noticed yet."

What Coutts is saying is that Liquidity cycles drive everything.

As the system is so indebted, there is only one direction liquidity can head, and that’s to friggin Valhalla. Bitcoin is the most sensitive asset to money printing and the index of the entire Crypto space.

Most people are still asleep at the wheel.

Sceptics remain.

One of the best hedge fund managers in the world, Ray Dalio, says we’re entering a danger zone, the end of a long-term borrowing cycle.

He was quoted as saying: “The greatest mistake investors make is thinking the past is a guide to the future.”

Dalio believes three major forces are on a collision course: uncontrollable debt, internal conflict in the US, and external conflict, as seen in recent developments in Iran, Ukraine, and Gaza.

It all leads to pressure on financial conditions and, ultimately, printing more money.

Dalio says the real issue is that interest payments on the debt are starting to crowd out spending, which slows economic growth. As the debt continues to rise, demand to buy that debt is falling. Investors are shifting to alternative assets, such as Bitcoin and gold. With fewer buyers, the US is forced to buy its own debt, adding it to the balance sheet and creating even more debt in the process.

We’re in a reinforced debt spiral, which is why the digital asset space is becoming a flight to safety. Dalio uses gold as his example, being a traditional finance guy, but we see the same scarcity thesis playing out in Bitcoin and other digital assets.

“The credit system is like the circulatory system in that it brings buying power throughout the economy. By creating credit, you have great buying power and that creates debt.

If that debt produces income, then that’s a healthy system. If it doesn’t, it produces interest rates and debt service that build up and crowd out spending.

We can see that happening to the government. Interest rates are now $1 trillion.

The government spends $7 trillion a year and takes in $5 trillion — resulting in a $2 trillion deficit. It works the same as it does for individuals or companies, except the government can print money.

Over the next 10 years, debt and debt service will increase dramatically. We’re seeing a crowding out, like a plaque build up but in the financial system, and the amount of debt is now about $230,000 per person.

One man’s debts are another man’s assets. When more debt is being sold and there isn’t enough demand, you have a supply and demand problem.

Central banks and foreign investors are buying less US treasuries and shifting to gold.

That’s the dynamic and it’s not political.”

The story we tell about asset prices is wrong.

A weak economy, rising conflict, uncertainty, and a shaky bond market are surprisingly good for asset prices because they force central banks to step in and stop the system from collapsing.

The money printer comes to the rescue, but at a cost. It quietly debases the currency, reducing your spending power year after year. Roughly 9% vanishes annually.

The latest flashpoint, the conflict in the Middle East, sent crypto assets into a near-free fall.

Andreas Steno, fund manager and CEO of Steno Research (and one of the sharper macro minds in the space), dug into what usually happens during major conflicts. He examined every modern US war and its impact on the S&P 500 — the index that tracks the 500 largest US companies.

The result?

It went up. Parabolically. Every single time.

Everyone thinks US involvement in Middle East conflicts is a negative. But look at the immediate market reactions to Desert Storm and the 2003 Iraq invasion—parabolic. Sometimes, the “deal sealed” by the US is exactly what markets crave. Challenge the variant perception.

The “variant perception” refers to the contrarian view, the idea that what seems like a negative (war, uncertainty) could be a positive trigger for markets, especially when it brings clarity, stability, or US dominance into the equation.

Crypto will bleed the most, then lead the rebound.

There’s one signal that cuts through the noise: liquidity.

Right now, it’s saying everything you need to know.

Friends in my day-to-day life read this blog and ask the same question:

Is it still a good time to buy? Are you still all in on SUI and NFTs?

My answer’s simple: nothing’s changed.

Yes, a few bombs dropped in Iran, which might affect oil prices (they produce around 3% of the world’s supply), but in the grand scheme, that’s noise.

Somehow, the crypto market interprets that as tightening. But if you zoom out, the actual picture shows strong tailwinds. If history is any guide, we’re on the edge of a breakout.

Global liquidity is now well above all-time highs, and both China and the US are rolling over massive short-term debt, which only pushes that figure higher.

Below is a chart of the M2 money supply, which has a 12-week lag behind Bitcoin and mirrors its movement with a 93% correlation.

I’m not saying it’ll continue to follow M2 perfectly or shoot up tomorrow. It gives you an idea directionally that it’s not going down over the next few months. Famous last words. I know.

The current context is that it’s not all doom and gloom — not even close.

Final Thoughts.

It doesn’t feel like it, but crypto’s setting up for a move no one sees coming.

It’s because there is this pressure of liquidity building up, which lifts all assets, and while crypto is down, it’s like a beach ball held under water.

Stop the panicking.

A buddy and founding member summed up all of our thoughts in a comment in our private chat this week:

“I’m versed in the crypto drawdowns, but even I’ve doubts about doubling down.”

If you want the crazy upside, you have to deal with the stomach-churning downside. It’s a benefit and a feature of the space. Many individuals with less experience will be shaken out of their positions by rage selling or trading into something less volatile, and it always ends in disaster.

If possible, add into the pain. And if you can’t, do anything.

As the saying goes, time in the market beats timing the market.

As Jamie Coutts quite rightly says, money printing must happen. Every time we exit a contraction, it triggers a highly bullish liquidity period.

So good is bad, and bad is good.

Ray Dalio perfectly explains the impact of using debt to pay off old debt, because as interest payments increase, which will be close to $1 trillion by the end of the year, less of the money is used for productive purposes, and more goes to servicing debt. That’s why we’ve seen the flight to gold and scarce assets like Bitcoin.

History doesn’t always repeat, but it sure as heck rhymes. And as Andreas Steno perfectly points out, previous conflicts have always resulted in the opposite effect to what people think will happen. Markets tend to rally once there is a sense that the issue is resolved and confidence returns, typically through U.S. dominance.

I think we may be very close to something significant.

It’s just a game of how long we can all hold our collective breaths for.

If today’s newsletter helped you in any way, consider sharing it with a friend or family member, it’s how Carrot Lane grows. And if you’d like to upgrade you’ll not only benefit from addtioanl access but help keep this content going. It genuinely means a lot.

Funny....Julien Bittel recently said on an MIT video that, "Patience is the ultimate Alpha."

I think he's right.

Great article, Jayden. And if I may add, patience really is a virtue when it comes to the crypto market. That said, let that beach ball burst already ;-))) lol.