It’s Probably “Wise” Remortgaging Your House To Buy Bitcoin (Michael Saylor)

“If you can borrow money for long durations for next to nothing and have a use of proceeds that you’re confident in, then it’s a good idea.”

Photo Commons Image — Michael.com

It’s advice that would have your bank manager falling off their chair.

The idea of leveraging your home as collateral to invest in a decentralised digital asset would challenge every conservative view and poke at every dirty insecurity you have of borrowing money.

It’s wild even to consider.

Most humans walking the planet would need help understanding the outlandish concept. Michael Saylor is not one of them.

He’s the prodigal son of Bitcoin, and he explains complicated financial ideas in a relatable way that hooks your curiosity with a dopamine hit.

There’s no question around Bitcoin he’s incapable of articulating a response on.

His company MicroStrategy borrowed 205 Million dollars against their assets at a 1.8% blended interest rate to plough into Bitcoin. Saylor has so much ‘skin in the game’ (140,000 BTC) you’d be worried if he couldn’t take you on a Bitcoin journey with precision.

Michael Saylor thinks if you’re rich and live in America, you’re unlikely to be looking for the solution to the plummeting dollar because you’re too comfortable.

With money printers working overtime, the only way to protect the middle-class American against value destruction is by investing in “Apex Assets”.

An Apex Asset represents an investment you’d expect to outperform other assets or exhibits exceptional qualities. It’s usually a highly sought-after asset with a track record of delivering significant returns or possessing unique characteristics that make it stand out from other investments.

Saylor says there are only two he can think of. Your house that you live in and Bitcoin.

He says the money supply is expanding by 15% annually, and you can borrow from anywhere between 3–6 per cent. Any potential returns north of that is an arbitrage and a wise idea to deploy that capital into something you believe.

It would help if you reversed the equation, like is selling Bitcoin to pay off your house a good trade-off?

Michael Saylor — Source

“It seems wise to me to hold tangible assets and let them appreciate in value as the money printer goes brrr, and not pay off your mortgage.

If you believe in Bitcoin, then yeah, if you have a million dollars of Bitcoin and you sell it to pay off your mortgage, what you did is you gave up an asset that was going up 280% a year, and let’s just say it’s going up 20% a year, let’s be very conservative, let’s say it’s going at 10%.

You’re selling the asset going up 10% a year to loan a million dollars to the bank, and the bank is paying you 2.5% interest on it, and the Federal Reserve will increase the money supply by 20%.

So, paying off your mortgage doesn’t make sense if you have one. You should be long debt.”

Data Suggests Very Few Have the Stomach for Saylors Strategy.

They’re also using the wrong type of borrowing.

A study by KIS Finance revealed that two out of three cryptocurrency investors borrowed money to purchase rather than using income and savings.

It’s left people facing considerable losses in the current market whilst still burdened with the cost of repaying their original borrowing and, depending on the loan terms, potential added interest payments as the rate hikes attempt to bring down inflation.

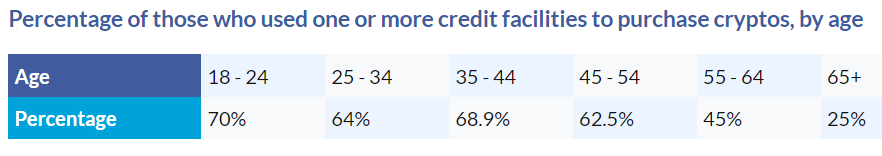

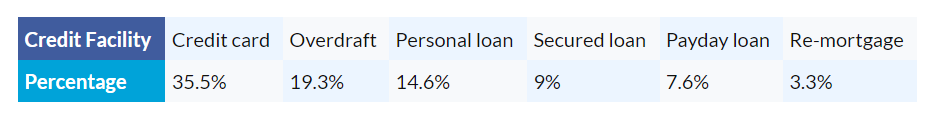

The data KIS Finance produced also breaks down the percentage of crypto investors who used one or more credit facilities to fund purchases by age. It also breaks down what kinds of credit facilities people have used to purchase cryptocurrencies.

Over a third of investors (35.5%) used a credit card, and the second most common credit facility used was overdrafts, with just under a fifth (19.3%) of investors using this method to fund their purchases.

Interestingly, Saylor’s strategy of mortgage debt is the least deployed, and its likelihood is that young people need help getting on the property ladder.

Holly Andrews, Managing Director at KIS Finance, commented on the research data from their findings — Source

“If you are thinking of investing in cryptocurrencies, you should only invest an amount of money that you can afford to lose, and it should be funded through income and/or savings rather than a credit facility.

Borrowing money to invest in cryptos can become a very vicious cycle that’s difficult to break. Once you start losing money, investing more to make money back can be very tempting, especially if you don’t have other means of repaying the funds.

Great care should be taken when investing money anywhere, especially when it’s something as volatile as cryptocurrencies.

Buying cryptocurrencies should also not be your only investment or savings as there is very little stability — spread your investments out and treat cryptocurrencies as a smaller, fun investment.”

Michael Saylor: You Should Use the Most Subsidised Debt in the World.

Saylors general view on debt is that you want to avoid short-term market margin debt.

For example, don’t buy crypto assets or Bitcoin on a ten-to-one margin because you might get forced to liquidate (margin call) in an afternoon and lose everything.

Never use a credit card.

He says that the most subsidised debt in the world is mortgage debt because the U.S. government buys $40 billion worth of mortgage-backed securities monthly, keeping mortgage rates artificially low.

Michael Saylor — Source

“If you’re paying off your mortgage debt, you’re basically holding cash.

You’re selling a million dollars of stock to buy a million in cash, which the Federal Reserve is debasing and devaluing at 20% a year, 30% a year.

The only way to get ahead of that is to flip it, borrow a million dollars at 2% a year, and then buy something which will hold its value.

I believe Bitcoin is the apex property. But if you disagree with me, study for 100 hours. If you still don’t agree with me, study a thousand hours. If you don’t have time to study for a hundred or a thousand hours, forget about Bitcoin.

The next apex property is a piece of real estate you will use for the rest of your life, right?

And then the next apex property is a trophy asset that you think a wealthy person will want to buy off you in a decade.

Ask yourself: What can I buy that someone with money and education will want to buy from me in a decade?

If I had to bet on Facebook, Apple, or Google versus a value stock, I would bet on Facebook, Apple, and Google because they can ship a product to a billion people over the weekend for a nickel.

I wouldn’t buy a chain of 20th-century restaurants because they won’t get 20 times more efficient.

I think that’s kind of common sense.”

Final Thoughts.

Michael Saylor is a seriously bright wartime general regarding Entrepreneurship and investing.

He’s weathered multiple recessions and used leverage throughout his career with an advisory board of financial experts.

He’s even got caught in the crossfire of some tax evasion controversy multiple times in his career. So even the experts get burnt playing with fire.

Saylor breaks down the math of borrowing against assets to buy Bitcoin, and everything stacks up.

Except for one thing.

It isn’t a maths equation; it’s about managing your emotions.

Our parent’s and grandparents’ financial security often came from a mindset of saving, working hard, and investing in so-called tangible and established assets like houses.

Putting your home at risk to invest in a volatile and relatively new digital asset like Bitcoin messes people up.

You’ll also always be tempted to add more money with a gold rush-esque mentality, like being at the Roulette wheel in a casino.

It’s not worth your mental health.

And it’s not a strategy I recommend.