Janet Yellen Is Sounding the Alarm To Raise the Debt Ceiling So Other Countries Don’t Think America Are a Bunch of Deadbeats.

No solution will prevent America from incurring substantial economic and financial damage.

Free Commons Image Wiki Media

We’re all screwed.

Janet Yellen knows it, and it’s scary.

The look of resignation and defeated expression on her face every time she’s on the news sends chills down my spine.

Here’s a woman known for her composed demeanour who usually instils confidence with her deep understanding of macroeconomic policy, saying there’s nothing we can do to avoid catastrophe.

America spent money like a drunk sailor.

Now, the 78th United States treasury secretary responsible for managing the country’s finances says we’re all on thin ice because the U.S. is about to run out of cash and default on debt obligations.

The debt limit is like a self-imposed money cap. It sets the maximum amount the government can borrow to pay for things it has promised to deliver.

These include Social Security and Medicare benefits, military personnel salaries, national debt interest, tax refunds, and other payments they make.

Janet Yellen — Source

“All I can say is that there is no satisfactory solution for the United States.

There’s no other solution good for the economy and financial markets other than Congress acting to raise the debt ceiling.

But there’s not a single thing that can be done that will save the United States from considerable economic and financial damage.

We are working full-time with Congress to raise the debt ceiling. That’s where our focus is.

We know that the only reasonable outcome is one in which Congress acts as it has many times, almost 80 times since 1960, to raise the debt ceiling.”

Here’s How Much America Is Losing Each Year.

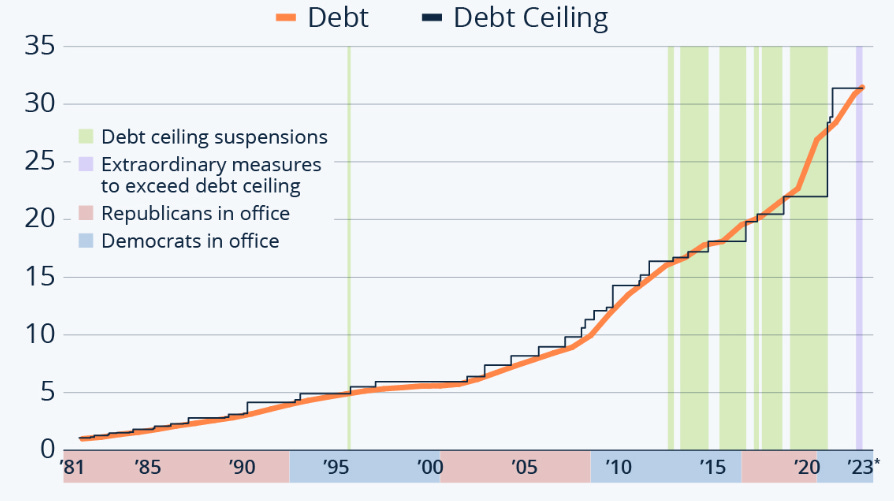

1917 Congress introduced the debt limit to cap the U.S. government’s borrowing.

Fast forward to January 2023, and the national debt hit a staggering $31.4 trillion.

Since 1960, Congress has taken action on the debt limit 78 times, either by permanently raising it, temporarily extending it, or redefining its parameters.

Out of these instances, 49 occurred under Republican presidents, while the remaining 29 took place under Democratic presidents. Regardless of which party holds the executive office, it’s been a recurring topic.

Since 2001, the government has consistently spent way more than it earns, with an average yearly deficit of nearly $1 trillion.

They borrow yearly to cover debt obligations, keeping things afloat. Yet, this only postpones the inevitable task of addressing the mounting debt, essentially kicking the can down the road.

The Economy Could Be in Freefall.

Skipping payments would have cascadingimpacts.

The stock market would decline, nuking the economy even more than it has been. The combination of collapsing home values, rising interest rates, and global financial instability is a recipe for an economic death spiral.

If we factor in the recent banking crisis, we face the catastrophic scenario Yellen addresses.

She says many banks, particularly regional ones, face earnings pressure. They pay higher rates for deposits, their investments yield lower interest, and their stock prices are under pressure.

Most banks, including those facing stock price pressure, have solid liquidity and would be able to manage to pay off insured depositors (anyone holding up to $250,000) even in the event of a mass withdrawal.

America has yet to default on its debt obligations for over 200 years, and Yellen says she’s not about to start now.

Janet Yellen — Source

“We need to see that we have a Congress committed to paying the bills we’ve incurred due to our legislation, that we’re not a deadbeat country.

And if Congress fails to do that, it impairs our credit rating, and we’ll default on our obligations, whether treasuries or payments to Social Security recipients.

America hasn’t done that since 1789, and we shouldn’t start now.”

Final Thoughts

The U.S. once suffered a “mini-default” in 1979, partly thanks to glitchy word-processing equipment.

The Treasury was transitioning from paper-based securities to automation while its check issuance department was relocating.

It caused a perfect storm of chaos which delayed sending around 4,000 Treasury checks worth approximately $122 million to individual investors for interest payments and maturing securities.

The colossal “mistake” gave the appearance of a default, leading to increased borrowing costs for the federal government by approximately $12 billion.

The national debt was $845 billion at the time.

In a financial review article, researchers (Terry Zivney and Richard Marcus) blamed the delay on “an unprecedented volume of participation by small investors and on the failure of Congress to act in a timely fashion on the debt ceiling legislation.”

It’s one small historical reference which is an insight into how right Janet Yellen is in sounding the alarm.

Raising the ceiling is the only solution.

And Promptly.

Or America could be deadbeat.