Jerome Powell Just Increased Interest Rates in the Middle of a Banking Crisis and Put the Final Nail in the American Economy.

By anyone’s definition, we’re heading for a nasty recession.

Photo By Federal Reserve Free Commons Image

Jerome Powell is the Federal Reserve (Fed) chairman.

He’s mild-mannered and thoughtful in his responses on the economy.

And he’s usually very composed when dealing with the media.

Still, the Fed is in a dysfunctional relationship between the two political parties, and they’re expected to manage the country’s economy independently with pressure from both sides.

Now Powell’s Federal Reserve is walking on a tightrope with no straightforward choices to make regarding the economy. It’s either soaring Inflation or the risk of a full-blown Banking Crisis, and either scenario could twist the knife in the economy.

In his role, Jerome Powell is responsible for guiding the Federal Reserve’s monetary policy decisions, which include setting interest rates and overseeing the nation’s financial system. By doing so, he’s supposed to help maintain economic stability.

Powell yesterday announced a small but significant adjustment to the interest rates and increased it from 5% to 5.25%.

He’s now raised interest rates ten times for a total of 525 basis points, which is 5.25% since last year, seven times in 2022, and 3 times in 2023 to tackle Inflation.

During a Federal Reserve Board of Governors meeting, Powell reported that banks were facing unrealised losses and pointed out that Silicon Valley Bank was in particular trouble. Three weeks later, he told Congress he would raise interest rates aggressively regardless. Twenty-four hours later, SVB failed, revealing Jerome’s list of priorities.

The interest rate increases are working, just not at the pace everyone is hoping for. And Jerome Powell says the Fed has set out its stall and left the door open for further increases in June with a target inflation rate of 2%.

Meanwhile, banks are becoming concerned and reducing the amount of money they lend. This combination can be challenging for an economy that relies heavily on debt.

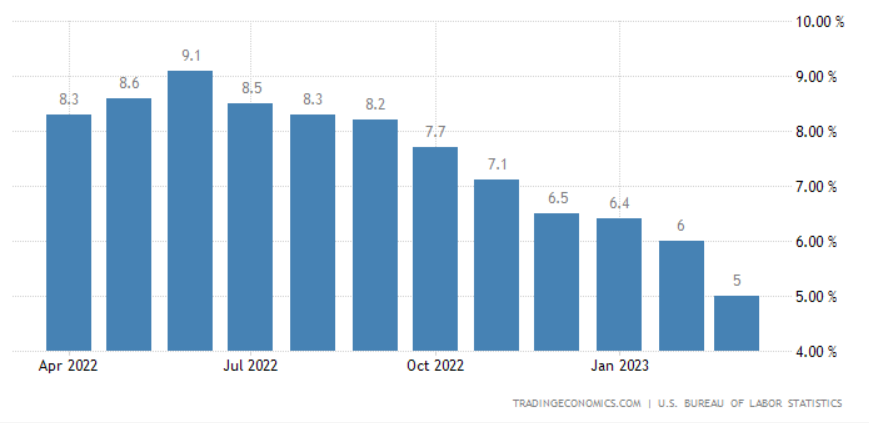

You can see inflation trending down since June 2022 in the below chart.

Some Expert Say Powell Is Sending Us All to a Certain Disaster.

With banking failures that will most likely dwarf anything we saw in 2008 and unprecedented inflation levels, which could continue to increase if left unattended, our cost of living will continue to skyrocket.

Powell is taking a solid stance on increasing interest rates to reduce the money supply bringing Inflation down.

The Federal Reserve is removing money from the economy through Quantitative Tightening, but simultaneously, banks are reducing the money they lend.

When the amount of money available decreases, companies and businesses that rely on borrowing are at risk of being wiped out.

A money supply contraction is what it says on the tin.

It’s a decrease in the total amount of money circulating in an economy. And it’s only ever occurred a handful of times in modern banking history.

The Great Depression (1929–1939) — The Federal Reserve’s monetary policy during the Great Depression exemplifies a money supply contraction that led to economic hardships. The Federal Reserve failed to respond to the banking crisis by providing the necessary liquidity and instead allowed the money supply to contract, causing a severe economic downturn.

The Volcker Shock (1979–1982) — To curb Inflation, the Federal Reserve, under the leadership of Chairman Paul Volcker, raised interest rates significantly, which led to a money supply contraction. The resulting recession was severe, with high unemployment and a sharp decrease in economic activity.

The Global Financial Crisis (2008–2009) — The global financial crisis, triggered by the housing market’s collapse, led to a contraction in the money supply as banks became more cautious in their lending practices. This, in turn, led to decreased economic activity, high unemployment, and a sharp contraction in global trade.

Each time what followed was either a catastrophic recession or a depression.

The only thing different from those occurrences is the labour market, with unemployment rates above 10% then (The current rate is 3.8%).

The last time a contraction went negative like it has now was during the 1929 Great Depression.

Jerome Powell — The Banking System Is Sound and Resilient.

During a press conference yesterday, Powell was stiff as a board, almost robotically reading figures off a sheet.

He claimed he didn’t anticipate us heading into a recession or that he’d hope for a soft landing if we were.

Following the Silicon Valley Banking collapse, they implemented a more robust process, “learning from past events”. What these takeaways were is anybody’s guess.

He then doubled down on leaving the door open for more rate hikes. When new information comes in, the Fed will take a data-dependent approach to determine if more rate raising is required.

Powell says the U.S. economy slowed down last year and grew modestly in the first quarter. The labour market remains very tight, but there are signs of a better balance between supply and demand.

He says the Fed is making its decisions based on what’s best for the American people, including creating jobs and keeping prices steady. They get that high Inflation can be rough on people, and they’re committed to fixing it.

Jerome Powell — Source

“Recent developments in the banking sector have shown improvement, and the U.S. banking system is sound and resilient.

We are committed to monitoring conditions and learning from past events to prevent them from happening again.

Our review of the Federal Reserve’s supervision of Silicon Valley Bank showed the need to make the banking system stronger and more resilient.

We focus on promoting maximum employment and stable prices for Americans and bringing Inflation down to our 2% goal.

Price stability is crucial for the economy to work for everyone and achieve a sustained period of strong labour market conditions.”

Peter Schiff — The Entire Banking System Is a House of Cards.

Popular financial commentator and economist Peter Schiff is openly very critical of the Fed and now says the banking system isn’t nearly as sound as the Federal Reserve Chairman Jerome Powell would have us believe.

Schiff recently chatted about it on a podcast, and he mentioned it’s more than just the banking world in a bit of a mess.

He feels the Fed has fumbled the ball regarding interest rates by keeping them at zero for a long time. And we’re now seeing the early days of the 2023 financial crisis, even if the mainstream media don’t want to call it that.

Peter Schiff — Source

“Banks keep failing.

Aren’t banks financial institutions? But no, they don’t want to do it because they don’t want to evoke the memory of 2008.

They don’t want anyone to think we’re experiencing another 2008.

In a way, they’re right because it’s not another 2008. It’s going to be way worse than 2008.

But it is a financial crisis.”

Final Thoughts.

Jerome Powell has the most unforgiving job in America.

No Federal Reserve chairperson has received as much criticism or public ridicule during my lifetime.

I think he’s doing an excellent job for what it’s worth.

The way the Federal Reserve leader looks at the situation (as previously quoted) is he needs to protect the 76 per cent of U.S. adults who make less than $50,000 and are living paycheck to paycheck and the 65.9 per cent of those making $50,000 to $100,000 and 47.1 per cent making more than $100,000 (all living paycheck to paycheck).

It’s hard to comprehend that most people in America are up to their eyes balls in debt and wouldn’t be able to come up with $1,000 in savings.

If the inflation rate is 5–6%, Powell feels the need to do something to protect these people.

He doesn’t want to let the stock market suffer, but he also doesn’t want to tell the 76% who live paycheck to paycheck that they have to deal with prices rising faster than their incomes.

It creates a dilemma for him if he focuses too much on Inflation, financial markets could struggle, but if he appeases financial markets, he risks letting Inflation go.

In his press conferences and speeches, Powell has made it clear that he’s viewing this situation from the viewpoint of those relying solely on their regular incomes for their livelihood.

And not from the perspective of investors and stockholders.

By any definition, we’re heading for a recession.

How severe is anyone’s guess?