Major US Banker Issues Stark Stock Market Warning.

He’s seeing what people aren’t, and it’s a signal worth paying attention to.

The head honcho of JP Morgan, one of the planet’s most powerful banks, says, “It’s the most dangerous time the world has seen in decades”.

And, “If you dig deeper, you’ll see widespread complacency.”

Every time I scroll through Twitter (X), billionaire Banker Jamie Dimon is in the thick of it.

He’s usually caught in a fiery exchange with CNBC news anchors, grappling with the latest economic twists.

Actual comments circulate online: “How can someone with this much power in the financial services industry be so wildly misinformed?” Or, “He’s a combination of malicious, ret**ded, and stupid.”

That’s the internet for you. Everyone’s armed with an opinion, and they’re not afraid to use it.

Dimon, in his own words, says, “he doesn’t give a sh*t”.

The son of a stockbroker and no stranger to adversity, J.D. overcame throat cancer in 2014 and made a point to continue working while undergoing radiation and chemotherapy treatment, disclosed in an open letter.

“I have been advised that I will be able to continue to be actively involved in our business, and we will continue to run the company as normal.”

Jamie Dimon, a twin, adopted ‘Dimon’ instead of his birth name, ‘Papademetriou’, a change I can relate to, having an adopted surname myself. His Greek grandfather made this decision to better navigate the job market as a foreigner.

Now, the astute banker says he’s a little more on the cautious side regarding the economy because “It’s a mistake to think that everything is hunky dory. When the stock markets are up, it’s kinda like this drug we all feel”.

It’s a message that’s becoming hard to ignore, and he attributed it to several factors, but primarily Quantitative Easing (money printing), the full effects of which we’re still determining.

Jamie Dimon — Source

“We had so much fiscal, monetary stimulation. I’m a little more on the cautious side that we are facing a lot of things in ’24 or ’25. We mentioned Ukraine, the terrorist activity in Israel, the Red Sea, and quantitative tightening, which is still a question of whether we understand exactly how it works: I don’t think we know how Q.E. works. What the effect of negative-zero rates, and the politics and, you know, the Ukrainian war is affecting oil, gas, food, migration. So you have all these very powerful forces that will affect us.”

Data can’t hide anywhere.

I see more and more young people put “Investor” in their social media bio, just like when entrepreneurship was on a pedestal, and it was a flex to call yourself a Founder or CEO.

Today, Investing is a game with low barriers and open doors. One research study shows that 68% of Gen Z now invest in assets, up from 60% the year before.

It’s becoming like pop culture, something we do, and it’s meant more people are wisening up to macro events that impact their asset prices.

Liquidity and increased money in the system stimulate all assets, not just the stock market.

Despite media criticism, Jerome Powell significantly reduced inflation from 8.2% to 3.36% last year using his only tool: The highest interest rate in 23 years, 5.5%.

Entrepreneur Patrick Bet-David believes Fed Chair Powell shouldn’t give in to pressure to lower interest rates during elections, as it could significantly worsen the gap between the rich and the poor.

He thinks we’re facing ideal conditions for a ‘reverse market crash,’ a topic that’s not getting much attention.

Patrick Bet-David — Source

“A reverse market crash, you know what’s going to happen? What would happen if Jerome Powell decreased rates to 5%, 4%, or 3%? You think that house that’s $900,000, whose value has stayed the same even when they (banks) raised the rates to 8%, that $900,000 house will be $1.4 million. And if the DOW Jones suddenly goes to 48,000, you know what would happen? This whole concept of Rich getting rich or poor getting poor, it became Rich getting rich or poor getting poor on steroids.”

When liquidity changes, everything changes.

Once I realised asset prices rise optically with money printing, it gave me a framework to squeeze the juice from a trade.

This explains why the S&P500 has made a significant recovery: investors are pricing in the future inflow of money.

Lower interest rates, inflation coming down, the potential of governments giving out stimulus like candy to voters in an election year and the need to service the growing deficit.

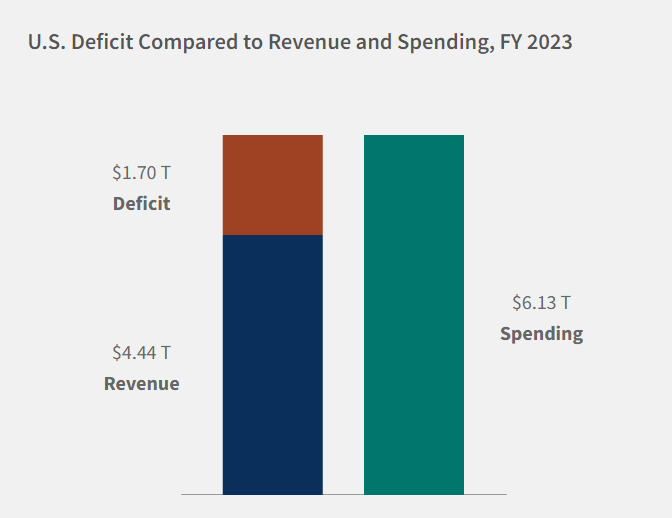

The government spent $6.13 trillion last fiscal year, while its total revenue stood at $4.44 trillion. It left a substantial deficit of $1.70 trillion, marking a $320 billion increase compared to the prior year.

The U.S. debt to GDP is 122.4%, which means they borrow more money than they produce in productivity.

Despite what Dimon says, I see very little chance of asset prices dropping because of the constant demand for stimulus to service the debt — which is propping up the economy like some beach ball held underwater. It can’t sink.

In the short term, we’re unlikely to see further catastrophic failure because there are too many reasons for liquidity to return to the system.

The reinforcing debt cycle has almost made America and other larger economies worldwide “too large to fail”, as Stewart McKinney famously said.

Something more sinister happens — while asset prices increase with money printing, your currency is turned into toilet paper.

Macroeconomic expert Raoul Pal points out that an increase in the money supply, known as M2, corresponds with a rise in the stock market.

Raoul Pal — Source

“Earnings are coming back, but inflation is falling, and unemployment is rising, which leaves the Central Bank injecting liquidity in an election year where the government will stimulate, creating a powerful boost for the markets”.

The average annual change in M2 (money in circulation) was 6.87%, while that of the S&P 500 was 9.11%. When you discount the 3.4% for inflation, your stock investment is at breakeven.

So your hurdle rate just to prevent yourself from treading water like you’re stranded at sea is just shy of 10%.

R.Pal says, “When you debase the currency via QE, prices rise instantly. The Fed balance sheet rises quickly in a financial crisis — the collateral prices begin to rise…and thus equities and bonds are rising commensurately.”

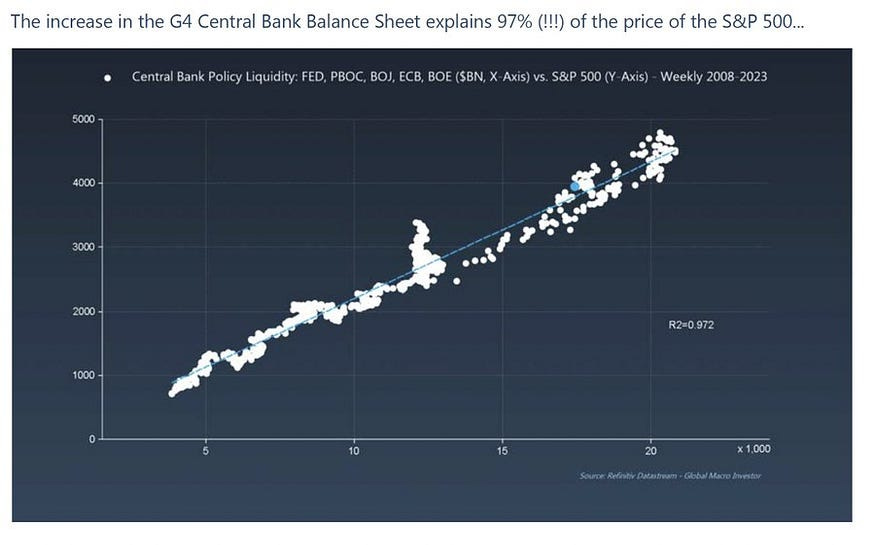

He says that 97% of all price movements in the S&P are due to increasing G4 central bank balance sheets, which is why stock prices will keep rallying.

Central banks are set to increase their balance sheet, which means currency debasement but increased asset prices.

Final Thoughts.

I agree with Dimon that approaching the stock market with caution is essential, but I can’t entirely agree with his time frame.

Markets have already bottomed, and more liquidity is set to enter the system. If there are issues, I see them happening toward the end of the 2026 business cycle.

In the meantime, governments must increase their balance sheets to service debt, and interest rates will also need to be at more manageable levels.

Since new money tends to be inflationary and stimulative, those owning financial and physical assets benefit most.

The lowest earners and those at the bottom of the societal ladder will suffer the most from the rising cost of living.

Ray Dalio, one of the most outstanding hedge fund managers ever, says, “You can’t keep spending money and expect inflation to come down because when you restimulate, asset prices go back up again”.

It’s a message worth paying attention to.