Millionaire Chief Economist: You Must Accept Being Poorer and Take Responsibility Instead of Playing “Pass the Parcel” With Inflation (Huw Pill)

Someone should pay for the inflation crisis, and that someone is you.

Do you ever feel like people with monstrous wealth are out of tune with the world?

They’re harmonically impaired.

When You’re Rich, it’s like you immediately become tone-deaf to the reality of the working and underclass, and if you’re poor, hating the wealthy is like pop culture.

I grew up on a council estate (low-income housing projects) where having nice things meant they either got stolen or vandalised. Every shred of progress it looked like you were making received personal vilification.

Having and aspiring to very little was the way things were.

Huw Pill, a renowned economist, is positioned far from a council estate on the British socioeconomic ladder.

Pill worked for institutions like the International Monetary Fund (IMF) and Goldman Sachs. He was the Chief European Economist, analysing and providing insights into the European economy, including macroeconomic trends and market conditions.

He’s a multimillionaire living in his parent’s London flat worth 1.5 million pounds and earns seven times the average salary in the UK. He says you need to take responsibility and live on less because everyone is playing a game of pass-the-parcel.

Individuals and businesses are passing on the rising inflation costs to others, attempting to preserve their spending power.

Oh, and you also need to stop asking for a pay rise.

His comments received backlash from the unforgiving internet in what seemed like a casual interview on an American podcast, which he likely assumed would never gain much attention (another pedestrian assumption).

It’s sparked a wildfire across the internet, sending Twitter into a frenzy.

Huw Pill — Source

You don’t need to be much of an economist to realise if what you’re buying has increased relative to what you’re selling, you’ll be worse off.

In the UK, people need to accept that they’re worse off and stop trying to maintain their spending power by bidding up prices, whether through asking for higher wages, passing energy costs onto customers, etc.

We’re facing a reluctance to accept that we’re all worse off, and we all have to take our share of the burden.

People are passing that cost on to one of our compatriots and saying we’ll be alright; they’ll have to take our share too.

That pass-the-parcel game that’s going on here is just generating more inflation. It’s a part of inflation that’s continuing to persist.

Currently, the relatively low unemployment and corporate pricing power leave too much bargaining power to pass these costs on in the value chain both in the US and the UK because they are all running too strong.

So that’s why interest rates have gone up to try, and cool demand, and that process of passing the parcel declines along with inflation to 2%.”

Consumer Prices Are Increasing, and Inflation Is Getting Nuked.

Passing the cost on to customers or shifting it onto others is commonly known as “cost-push inflation.”

It’s when businesses and individuals face increased costs for inputs such as raw materials, labour, or energy and raise prices to maintain their profit margins or personal income.

It’s normal, and you can’t do much about it because everyone raises their prices.

If a company’s production costs rise, its management might try to pass the additional costs onto customers by raising the prices of products. If the company doesn’t raise prices while production costs increase, the company’s profits decrease. It’s obvious.

Cost-push Inflation directly impacts the Consumer Price Index (CPI), which measures the average prices of goods and services consumers buy.

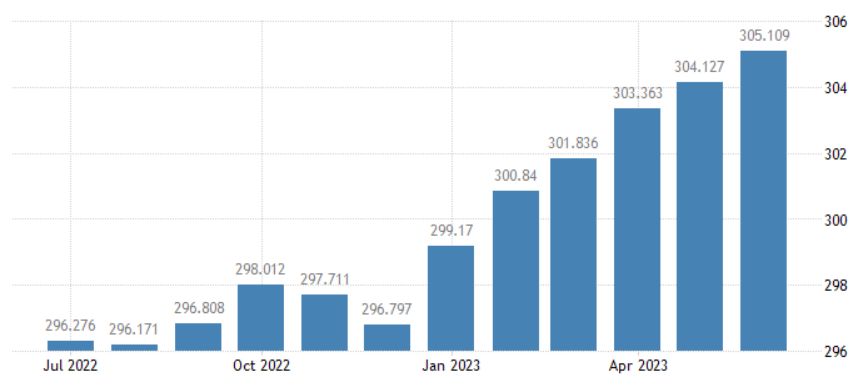

The Consumer Price Index in the United States increased by 3.0 per cent year-on-year to 305.109 points in June 2023, easing from the 4.0 per cent growth recorded in the previous month. Market expectations had predicted a larger 3.1 per cent increase in the CPI to reach 305.219 points.

We’re peaking, with CPI predicted to come down now.

People Are Majorly Overreacting to How Long Inflation Will Stick Around.

Marco investor Raoul Pal understands the economy like the back of his hand. He analyses data and draws insights from historical references to explain his perspective.

He says people are getting inflation wrong and overreacting because what we’re going through is normal. Countless times throughout history, inflation has increased, and people’s immediate thoughts are that it’ll stay for the long term or come back.

To ordinary people, tightening monetary conditions means the cost of your mortgage has increased, and any borrowed money has become much more expensive. Your wages haven’t kept up with the cost of basic services like food. So, you’re feeling poorer, and you can’t consume as much.

Pal believes as consumption drops, so will inflation, which could eventually go negative and lead to a deflationary period. He says by any measure, we’re headed for a recession. The closest example to what we’re experiencing today is World War 2.

Raoul Pal — Source

“Most people’s read on inflation is probably wrong. Right now, I’m going to take you through a history lesson. World War II was a fascinating period because, like COVID, the entire world was basically stuck at home or on battlefields. Everyone came back, and there was no supply of commodities and goods.

Global supply chains were broken, and everybody returned and started consuming again. And guess what? Inflation went up to 13% or higher.

And that period was fascinating because interest rates went up, and the first thing that happened was the economy went back into recession, and inflation went negative.

It was a massive tightening of monetary conditions. You raised the cost of goods on people and needed to increase their salaries. People couldn’t get the goods they wanted, exactly like now. And everything collapsed. So we went back into recession and, eventually, some better times.”

Final Thoughts

When sweet pandemic cash was raining on us, I don’t recall anyone from the Bank of England sounding the warning bell or coming out against the stimulus.

There’s no free lunch in this world.

Despite Huw Pill’s spontaneous comments and possible regret for appearing on that podcast, the essence of his message remains fundamentally correct.

People need to accept it.

At some point, we need to lower our standard of living, live on less, consume less, borrow less and save more.

I know it’s easier said than done.

When milk and bread triple in price, it’s clear this cost of living crisis has your daily routine by the gonads, and it’s because both the US and the UK built economies on 0% interest rates for a decade, locked us in our homes and then sent us more money we couldn’t spend.

Pill suggests that the BOE and the Fed should have addressed the interest rates sooner because we now have no prevention measures to stabilise the economy apart from the defibrillator shock of record interest rate hikes.

While there are still significant challenges to tackle, bringing interest rates back to reasonable levels is important.

Money isn’t free.

Someone always has to pay the price.

It looks like that “someone” is us.