NFTs Just Surged by $2 Billion: Here’s Why Sitting Out Could Cost You Big.

Join the dots and lean into the friction.

Now’s the time to start scratching your NFT itch.

Price action is beginning to bubble over, and you don’t want to be knee deep in a sea of opportunity, not knowing how to buy your first NFT or, better still, what to buy and how to maximise your capital.

I’m aiming to help as many people as possible gain access to these assets.

The best way to do this is actually to walk you through the steps from beginning to end. But there is only one of me, which means I have to reserve that time for folks who support Carrot Lane for a small fee.

It’s beyond tiny compared to what people will be investing in these assets.

Upgrading is easy—it also gets you access to all of my researched content and helps Carrot Lane grow more than you know.

Author note: Today's piece is based on a video presentation I did with my Founding members. You can watch our full monthly catch-up here using the password below for access.

Video passcode: ec^78Qv*

Well-known digital asset investor Dan Tapiero once said:

“Early-stage assets have the highest upside, but no one touches them until house money is in play. That’s when risk appetite expands.”

This is exactly what is happening with NFTs.

People's risk appetite needs to improve, and the precursor to this is usually improved financial conditions. When people have more money in their pockets for discretionary spending, they move money further down the risk curve.

I was on a call recently where the person said that in multiple crypto groups they’re part of, NFTs aren’t the hot topic. In fact, the directive was to emphatically avoid the space altogether. That, my friends, is a colossal mistake.

The data says it all: as Bitcoin increases, that house money rotates into altcoins, and then people search for expressive assets to signal their wealth.

If you lend me an ear for a few minutes, I’ll show why this is the most significant opportunity in all of Crypto.

Unless you’ve been in aeroplane mode or cryogenically frozen this month, you’ll have noticed NFT trading activity has skyrocketed.

It’s just another cog in the same well-oiled machine: Bitcoin broke all-time highs, which pushed Ethereum higher, and that momentum is now spilling into NFTs.

What’s driving it? The dollar’s plummeting, while M2 money supply is being launched upward like the other end of a seesaw being leveraged by a sumo wrestler.

We go life-changingly higher from here.

Bitcoin, being highly sensitive to liquidity, responded first, and now the ripple effect is reaching the rest of the market.

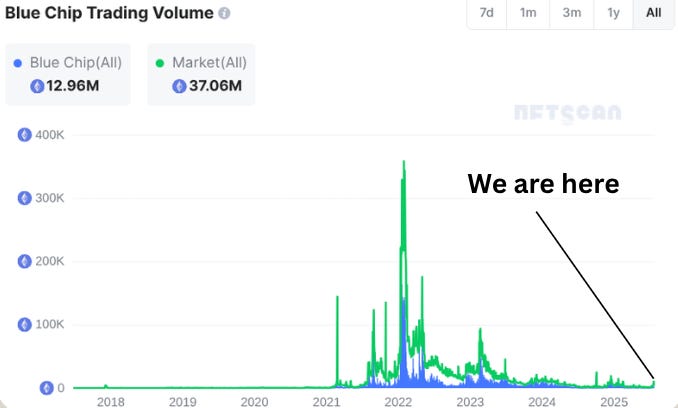

Blue-chip trading volume in NFTs has been skyrocketing.

We can all agree that $260 million in volume (above) appears to be a substantial amount of capital being invested in just the top 20 NFT projects.

I’ve had a few folks—some of the early ones who got into NFTs from 2021/22—message me asking if I think now’s a good time to sell.

Usually, I’d give my classic fence-sitting answer. Somewhere in the grey.

But this time? It’s an emphatic no.

The chart below is zoomed out, and when you look at it in the context of the last bull market, it’s clear: we’ve still got a monumental ceiling above us.

Especially when considering that the previous all-time highs included around 23 million NFT holders, this cycle could bring in 10 times that number, meaning we’re not just aiming to hit the old highs—we’re likely to blow past them.

That $260 million skyscraper?

On this chart, you can’t even see where we are right now, and there’s bull posting all over the timeline.

As I say, send my JPEGs higher.

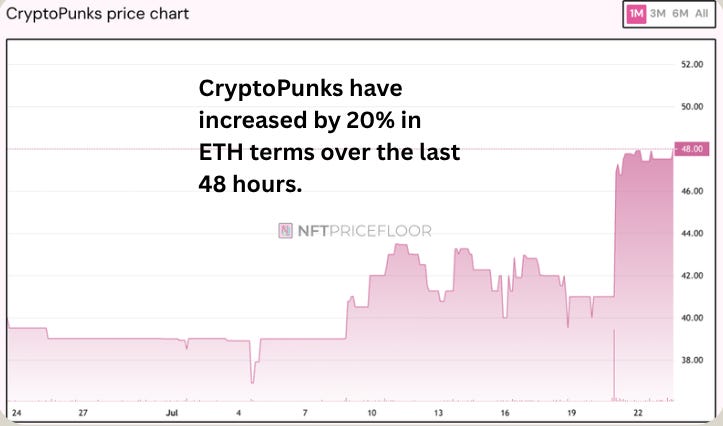

Many here will know I’ve said before that CryptoPunks act like the index for NFTs, just like Bitcoin does for altcoins.

The tidal wave of capital flowing into Ethereum is now spilling over into NFTs, as people begin rotating into more expressive assets.

CryptoPunks jumped 20% in just 48 hours, which is wild, especially given how high the entry price already is.

You may be sitting there thinking, “Well, that’s great and all, Jay”,—seeing a project you don’t hold assets in go from $80,000 to $180,000 in no time at all.

I know. I don’t own any CryptoPunks either.

But the point here isn’t about Punks increasing by 20%, it’s about the confidence that move creates and the overspill into other assets like financial lava—slowly creeping into every NFT crack it can find.

These assets will often rise by a much higher percentage than Punks.

There’s also a hidden multiplier effect that most people miss. Punks, and any major project for that matter, are leveraged bets on Ethereum.

So it’s not just the NFTs’ buy-and-sell demand driving prices up—it’s also the fact that ETH, the underlying asset, can increase and has increased nearly 100% in the last 3 months.

And we’re still nowhere near full bull market territory.

The sentiment signal couldn’t be any clearer.

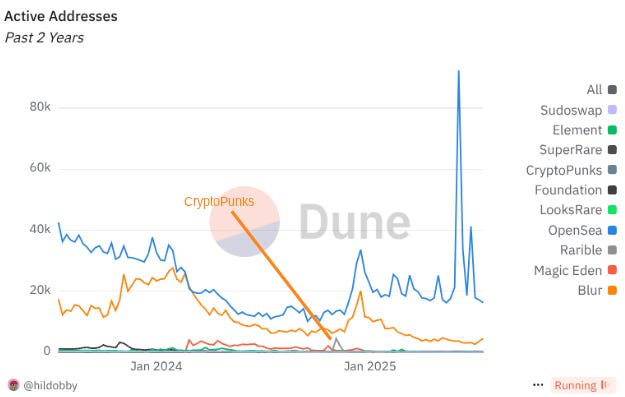

Every marketplace is now recording its highest numbers since 2021.

It’s also worth noting that CryptoPunks are sold on their own independent platform, so what you’re seeing across the rest of the market is a reaction to Punk price action and the rising price of Ethereum.

But don’t be deluded, this isn’t a “rising tide lifts all boats” moment.

This is a race to the top for the best and most desirable assets in the space.

And I can tell you right now—they’ll never be this affordable again. Ever.

OpenSea is currently leading the way in trading volume, and if you look at the chart below, you’ll see that slight bump in CryptoPunks activity and the ripple effect it created across the entire market straight after.

Closing Thoughts.

The big trade is now on.

Over the last three years, NFTs have been crushed like being run over by a supertanker.

They’ve survived the ultimate battle test of pretty horrid financial conditions.

These assets will change people’s lives. I know that’s a gutsy call—but it’s true.

That said, 99% of NFTs will be lousy investments.

Most people chase value in all the wrong places, usually because they’re in an echo chamber of folks around them saying something is good. So it must be true. Wrong.

There are plenty of unqualified and straight-up awful actors in this space, which is why I always tell people: bet on operators you know and understand, but by far the better risk-adjusted option is to bet on history.

History just needs time to do the heavy lifting.

But good people, whether they’re all-star entrepreneurs who can generate massive demand or culturally significant artists, usually have reputations they don’t want to tarnish. That’s my yardstick. Are they going to throw away, say, a 20-year reputation over an NFT project? It’s unlikely.

The opportunity at our feet is significantly larger than my readers here may think, thanks to the network effect in these communities, as well as the hidden multiplier effect of both ETH increasing and NFT buy-and-sell pressure.

ETH is running hot, and people are now seeking expressive assets.

When both assets climb, it’ll feel like you were the first caveman to discover fire because, honestly, it’s fucking magical.

When you zoom out from this bull run and realise we’re only at a tenth of the total people who’ll eventually enter the space, it makes you wonder just how high this could all go.

The beauty of owning coins is that the volatility, especially the downside, gives you a second chance. You can catch up if you miss the first move. But NFTs don’t work like that. They’re more like scarce physical assets—once they’re gone, they’re gone.

You’ve got an open window.

Don’t end up like the fly banging your head against the glass.

Final note from author:

I’m personally helping my readers (that’s you) buy their first NFT—or if you’ve already made a purchase, I’ll guide you towards building the best risk-adjusted portfolio of assets.

No guesswork.

I’ve got you covered.

But there’s only one of me, so I’m reserving these 1-2-1 calls for anyone who signs up for our annual plan (which is already discounted by 40%).

That also gets you a full year of access to my research, including the insights you’ll need when it comes time to sell.

If you’re serious about getting in the game, now’s the time.