Note from Jayden Levitt.

It's now or never for Crypto and NFTs.

Unless you’ve been living under a rock, you’ll have noticed the shift in sentiment on the timeline—crypto and NFTs are starting to pop up everywhere again.

It’s mainly because financial conditions are improving and interest rates are coming down around the world.

But more importantly, the dollar is weakening, which allows countries with dollar-denominated debt to turn up the money printers again.

Right now, the dollar’s at its lowest level since it rained free pandemic stimmy checks.

Bitcoin—the asset most sensitive to money printing—has already hit all-time highs, and we’re still nowhere near financial conditions being red-hot for risk assets.

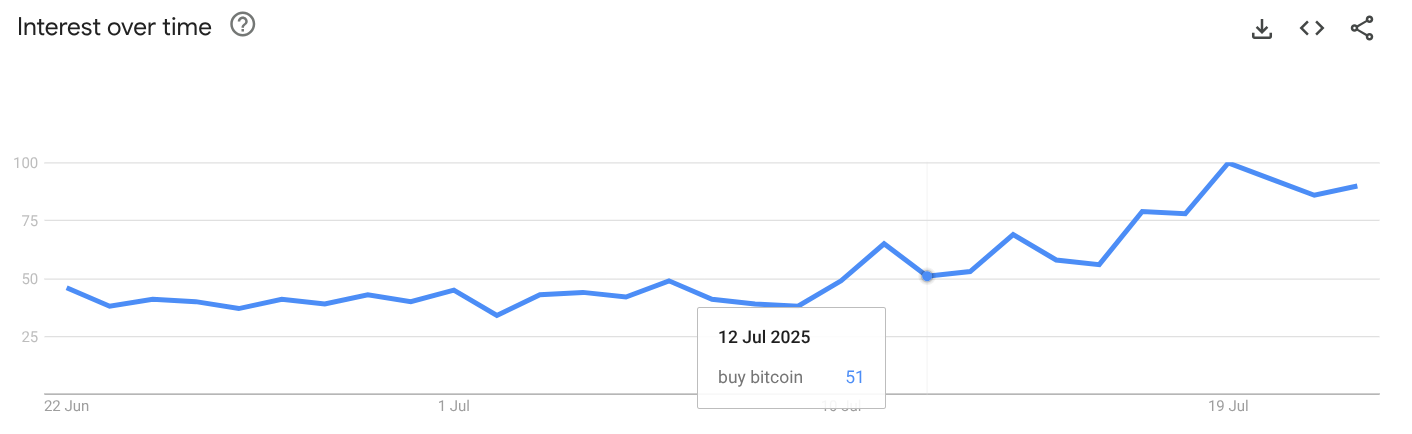

When BTC, the granddaddy of them all, hits new highs, it sparks media coverage, bull posting all over the timeline, and a spike in search interest.

The attention feeds the cycle because more eyeballs lead to increased buying flows.

We all know by now that Bitcoin is essentially the index for the entire cryptocurrency space.

When it moves, the top-performing assets usually follow.

That’s why I’m in SUI for this cycle.

But—and I want to be clear on this—NFTs are the end game.

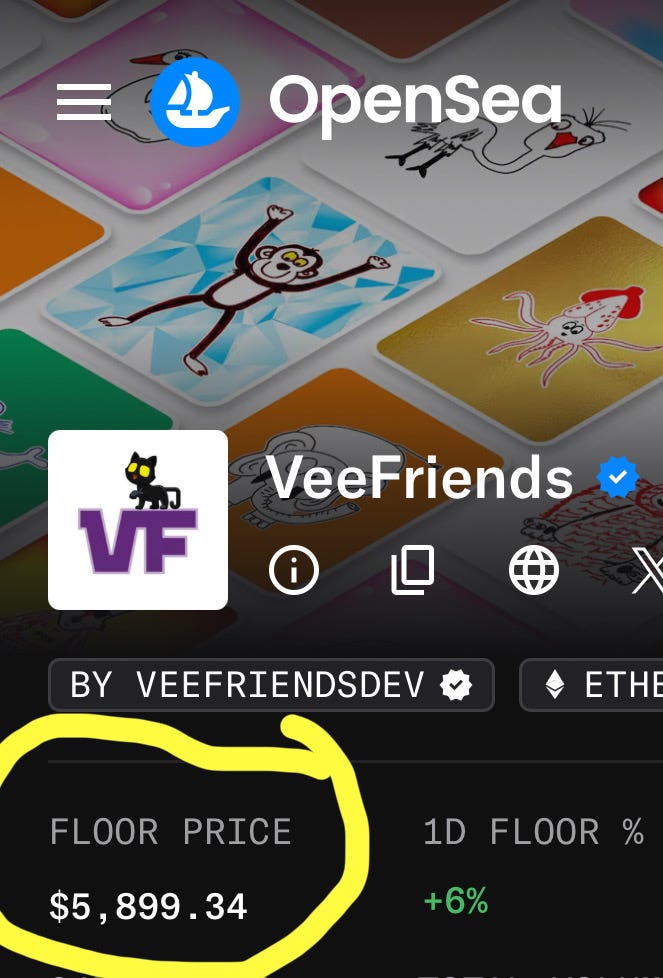

I shared Veefriends, an IP NFT project, earlier this year when the floor price was $1,200.

It’s now just under $6,000.

That’s nearly a 5x move—and most people still don’t really understand what an NFT is.

NFTs are the most significant opportunity in Crypto, full stop. No question.

The reason these assets move so aggressively is because of a hidden multiplier effect.

You’ve got both NFT supply and demand kicking off and Ethereum moving up at the same time.

That’s why you get these moves that almost seem unbelievable.

The example I always use is simple:

Say you buy an NFT for 1 Ethereum. If it catches demand, that NFT can go to 10 ETH (for the right project).

However, we know Ethereum could hit $10,000 this cycle (which it may), and suddenly your $4,000 turns into $100,000.

And it all starts with Bitcoin.

As people's risk appetite improves, their house money rotates into ETH. Those sitting in ETH then look for expressive assets—such as NFTs—to signal success.

NFTs’ first use case is art, and art has always been a precursor to wealth.

So here’s what I’m really trying to say…

Don’t screw this up by being underprepared for this bull run.

The opportunity is enormous—if you just lean into your curiosity.

I get messages daily from people saying things like:

“I don’t know how to set up my wallet.”

“Where do I buy?”

“How do I buy?”

“What do I buy?”

And a whole list of other questions.

There are opportunities right now to peg yourself to these assets early.

I’m on a mission to help as many of you as possible get in early and make this work—but there’s only one of me.

That’s why I have to reserve my 1-to-1 time for people who support Carrot Lane with a minimal annual fee.

Currently, the annual membership is 40% off the monthly option, and I’m including a complimentary 1-to-1 call as part of it.

You’ll also get access to an entire 12 months of research, which you’re going to need, not just for knowing what to buy, but knowing when to sell.

So what are you waiting for?

Upgrade to the Annual plan (or Founding for more premium features) and let’s get the ball rolling.

Honestly, I’d love nothing more than for you to message me one day saying:

“Yeah, you made a huge difference in my journey.”

If you’ve got any questions about the membership, just drop me a DM here—I’m happy to chat.

Are ETFs suitable proxies to enter the crypto world ( ie. IBIT, ETH,MSTY)?

'