One Money-Making Investing Idea That’ll Rewire Your Brain and Help You Profit From Chaos (From the Greatest Money Manager of All-Time)

You’ll realise how simple but profound it is when you notice the opportunities around you.

Photo by Hunters Race on Unsplash

Do you ever feel like people who talk about investing and money go out of their way to make it as complicated as possible?

A sure sign that someone is talking smack is their inability to keep things simple.

Heck, understanding all this should be like shooting fish in a barrel.

A practical and common sense approach is how Peter Lynch has trained his eye for hidden gems. He’s an expert who simplifies complex concepts.

These aren’t classified secrets.

Or something that requires you to be an investing maestro.

It’s simple. Grab promising opportunities people miss in everyday life. You can find valuable insights by observing your surroundings and paying attention to personal experiences.

Over the last decade, we’ve used products as consumers with astronomical adoption. You only needed to scratch your curiosity itch and take some action.

I’ve been using an Apple iPhone for more than ten years now. When the product launched, I knew I was never getting any other phone. It couldn’t have been more evident that most people thought the same (excluding those who prefer Android).

If I had the presence of mind to stop drooling over my phone for 2 minutes and invest $1,000 in Apple Inc 10 years ago today, the investment would be worth: $12,977.00

The annual rate of return: 29.15%

Total profit: $11,977.00

It includes the recent nuking of the stock market, where the Fed increased interest rates to over 5%.

Spotting opportunities like this has been hardwired in Lynch’s DNA since he was a kid digging up earthworms. He’d sell them to local fishermen struggling to find quality bait. It’s an early lesson in seizing opportunities.

Lynch says investing and spotting opportunities to make money is so easy everyone can do because we all possess the skills. For example, you shouldn’t be intimidated by investing in the stock market.

It would help if you had patience.

Avoid panic when things become volatile.

And ensure sure you’re equipped with research to make informed decisions and justify yourself holding when the price goes down.

Today Lynch is regarded as the most significant money manager ever.

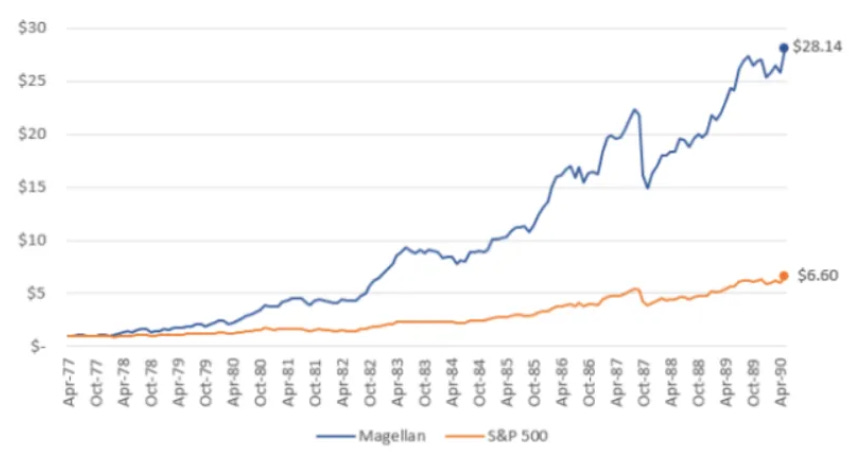

From 1977 to 1990, he generated an average return of 29.2% yearly for those who invested in his fund. It’s impressive, considering it was more than double what the S&P 500 stock market index returned during the same period.

He says all of these principles are as relevant today as ever.

“Invest in what you know”.

If you’re knowledgeable in a particular area, it’s easier to identify good undervalued opportunities. If you’re not, your second best option is your distinct advantage at identifying excellent investment opportunities in everyday life.

Sometimes you may love a product, but it doesn’t even cross your mind to invest in the company’s stock.

You likely use companies like Amazon and Facebook regularly. Both have given significant returns over the last decade.

Lynch encourages you to look for investment opportunities in things you already know and use. Heck, even your favourite coffee shop.

He invested in Dunkin’ Donuts after being impressed by their coffee as a customer rather than reading about the company in The Wall Street Journal.

He noticed specific locations were always busy with customers and assumed this growth would continue based on his experience there. After studying the company’s financial status, he decided to invest in Dunkin’ Donuts, which turned out to be one of the best-performing stocks he ever bought.

Lynch believes that you, as an individual investor, can also make intelligent investing choices by noticing opportunities like Dunkin’ Donuts or paying attention to business trends in your career or hobbies.

Make it simple by investing in things you know and use and avoiding industries you have zero experience as a consumer.

A firefighter making money from a Tampon company is obscure and bizarre, but it shows you what can happen if you notice opportunities around you.

Peter Lynch — Source

“A fireman from New England noticed a factory in his town seemed to be hiring and expanding constantly. This person didn’t have a great computer. He wasn’t a professional investor. He was just an observant neighbour.

He put $2,000 per year into Tambrands, now known as Tampax. By 1972, the fireman was a millionaire just from using his local edge.

Investing is a personal thing. You have to do it yourself.

You don’t do it with a committee.

You have to have the emotional strength to stand the volatility of the market and stocks in general.

The critical Organ here is not the brain; it’s the stomach. Do you have the stomach for this?

Do you have the patience for it?”

Here’s How You Profit From Economic Chaos.

Firstly you accept it.

Embrace that we’ll always have things happening in the world and economy that lead to market declines, but it doesn’t mean those companies aren’t good.

We’re currently in the midst of a recession

A banking crisis.

Record inflation

And a rocky stock market

But Lynch says the terrible news events and downturns in the market are your opportunities to buy them at a low price.

Peter Lynch — Source

“Actual bad economic news, rising interest rates, wars, elections. Any of these can push the market down. If you are one of those people pouring over graphs, economic statistics or astrology charts, trying to figure out what the stock market will do next, you are wasting your time.

You have to understand the market goes down.

For the last 95 years, we have had 50 declines of over 10%. Of those 50 declines, 15 have been 25% or more. About once every two years, the market falls 10%, and about once every six years, it loses 25%.

These are big drops.

You have to understand that is the nature of the market.

In 1990, Saddam Hussein went into Kuwait. The banking system was in trouble. We had a recession. You had all his background noise.

Lots of good companies that had nothing to do with wars and nothing to do with banking all went down in 1990.

The market fell from 3000 and lost over 20%.

It allowed you to buy terrific companies at excellent prices. Behind every stock is a company. The stock will do fantastic if the company does amazing over a long period. If the company does lousy, the stock will do lousy.

That’s all you are betting on.”

Final Thoughts.

I like Peter Lynch’s practical wisdom when it comes to investing.

Stick to what you know.

Look for opportunities around you. Don’t get cute.

We’re going through a massive wealth transfer and technology evolution.

AI is taking off.

Cryptocurrencies are starting to be normalised.

And technology adoption is increasing faster than at any time in history.

You have information at your fingertips and financial tools that allow access to invest in seconds.

To Lynch’s point, you’ll realise how simple but profound it is when you notice the opportunities around you.

Apply practical common sense and stomach volatility.

First, you have to take action.

Simple, but good advice for investing