Peter Schiff: Brace Yourself for a Crisis Worse Than 2008 As Our Banking System Collapses Like a House of Cards.

You can’t build an economy on zero per cent interest rates for as long as we did.

Photo By Gage Skidmore On Free Wiki Media

Peter Schiff first rose to fame when he said the United States was like the Titanic.

He was the hero in disguise in 2007, trying to help people deluded about the economy leave the sinking ship before the 2008 financial crisis and global credit crunch.

Despite his warnings, many in the financial industry and the media dismissed Schiff’s predictions and accused him of being alarmist. However, the housing market began to collapse, and the financial crisis unfolded.

It was a scintillating prediction, Schiff shouted from the rooftops of every media channel, making people sit up and take notice.

Now a well-known financial commentator and economic analyst, he unapologetically speaks his mind and expresses divisive views even if it triggers his followers.

Schiff is also not short of receiving criticism for his tendency to be overly pessimistic, making dire predictions about the economy’s future. Heck, he’s been on record for the last ten years predicting a depression.

You’ve heard the saying before, even a broken clock is right twice a day.

It feels different this time. Schiff’s explanation for what is happening is insightful and makes complete sense.

He says after ten years of interest rates at 0 per cent, there’s no prayer we’ll get away with a light recession.

You know what to do, buckle up, strap yourself in and let’s get into it because this gets good.

We’re Headed for a Depression — The Likes of Which We’ve Never Seen Before Since the 1930s.

Peter Schiff is a proponent of Austrian economics.

In simple terms, It’s a concept of examining how the economy works and letting people have freedom.

Austrian economists believe people should be free to make their own choices about how they use their resources and let the market do its thing to make the economy strong and successful.

They say when the Government gets involved too much, like with regulations and controlling the money supply, it can cause problems and slow down the economy, as we’ve seen.

Schiff is warning that the entire financial system, from banks to the housing and the automotive industry, is on the brink of collapse, and the low-interest rates set by the Fed have destabilised these industries.

According to Schiff, low-interest rates have artificially propped up these industries, built on a fragile foundation, and are now crumbling piece by piece.

Peter Schiff —Source

“The entire banking system is a house of cards, built on the foundation of the U.S. government, and now it is collapsing one card at a time.

Although the banks are at the forefront of the 2023 financial crisis, it is not limited to the banking system.

The Federal Reserve has also caused everything that is a function of interest rates to be all screwed up because rates were so low for so long.

This includes the automobile industry, where people bought cars with low-interest loans, propping up the whole automotive market.”

Schiff is worried about the financial situation that’s on the horizon. He thinks it’ll be worse than the 2008 financial crisis, possibly closer to the 1929 Great Depression.

The Federal Reserve’s actions have destabilised the banking system and the automotive and housing industries. And as loans start to come due and the market starts to wobble, Peter says the banks holding these loans will collapse.

Peter Schiff — Source

“As the loans come due and the market collapses, the banks are also involved as they hold the paper for these loans.

The same is true for the housing market, where everybody buys homes with a mortgage. The media is reluctant to call this a financial crisis, but banks keep failing, and that is exactly what it is.

It may not be another 2008.

It’s going to be worse.

The FED has caused the banking system, the automobile industry, and the housing market to be dysfunctional.”

186 Banks Risk Failure if Uninsured Depositors Decide To Withdraw Their Money.

Some clever researchers are taking a closer look at how recent changes in interest rates might impact U.S. banks.

They discovered the value of assets held by these banks is lower than what’s shown on their books. This one’s a no-brainer.

The researchers explain that the bank’s future depends on how many uninsured depositors will withdraw their money if the value of the bank’s assets continues to decrease.

Some banks might become insolvent if interest rates increase too much and have to sustain potential withdrawals. Banks with less money and more uninsured depositors are more at risk of this happening.

Uninsured depositors are anyone holding anything over $250,000.

For example, the researchers looked at Silicon Valley Bank (SVB), a failed bank. They found that SVB were better capitalised than more than 10% of the other banks in the U.S.

The researchers calculated the same risks for all the banks in the U.S. If only half of the uninsured depositors take out their money, nearly 190 banks with assets worth $300 billion could be in trouble.

If this happens, their remaining assets’ value won’t be enough to honour the withdrawals. Yuck.

Here’s a trip down memory lane.

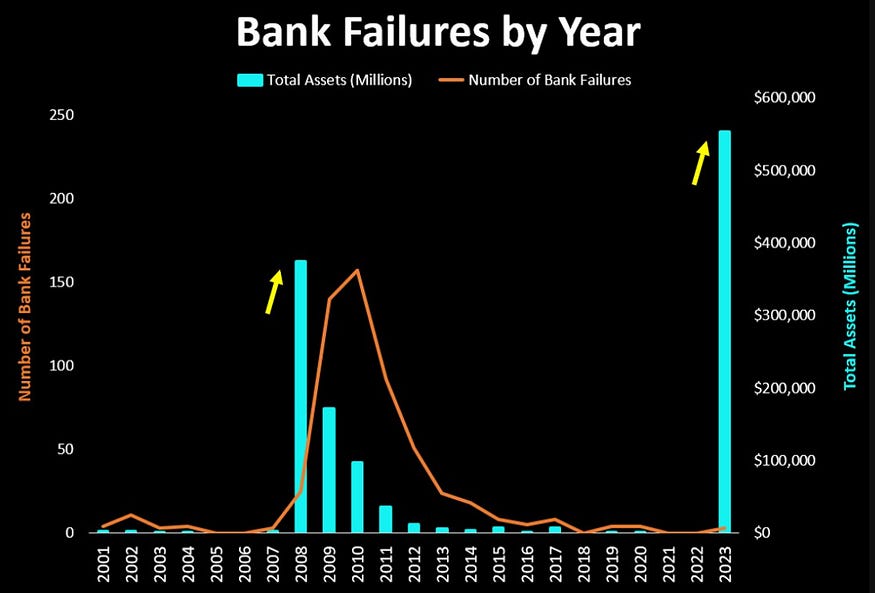

In 2008, the Global Financial Crisis led to the closure of over 150 banks. Fast forward to today, just four bank failures equal the amount of assets financial institutions held during the 2008–2009 banking crisis.

The figures below are represented in Billions dwarfing 2008, and you could say we’re not even in the eye of the storm yet.

We Spent Too Much Money When Times Were Good.

Schiff says if interest rates reflected the actual cost of borrowing, the Government would not have been able to engage in such lavish spending.

He believes the Government’s current size and spending habits would not have been possible if interest rates were higher and the interest on the debt was unaffordable.

Peter Schiff — Source

“The Federal Reserve has dramatically impacted the Government’s spending and ability to run enormous deficits.

The current national debt stands at 31.7 trillion dollars and is above the ceiling of 31.5 trillion.

Despite efforts to keep the deficit down, the Government was able to sustain such a large debt because of the low-interest rates set by the Federal Reserve.

If interest rates had reflected the market’s price of money, the Government would not have been able to get away with such spending.

The Government couldn’t have grown to its current size and spent as much money as it has if the interest rates were not so low, as the Government wouldn’t have been able to afford to pay the interest on the debt.”

Final Thoughts

As of January 2023, the national debt and the debt ceiling were $31.5 trillion.

So every year since 2001, the U.S. government has spent an average of $1 trillion more than it takes in from taxes and other sources of revenue.

To cover this gap, they borrow more money.

Peter Schiff says the Debt Ceiling will need to increase, but the borrowing rate will be substantially higher because the Fed is trying to tackle rising inflation (Current rate 5.25%), giving us all the short end of the stick twice.

We’ve also borrowed too much against overpriced houses and cars and taken personal loans out.

The cost of borrowing will increase across all these industries, which will be unaffordable for many.

The writing is on the wall.