Peter Schiff Gave a Dire Warning About the Economy That’s Worth Paying Attention To.

As long as there’s no disaster, we’ll kick the can down the road.

Photo By Gage Skidmore On Wiki Media

Inflation is starting to make its presence felt.

When you’re going about your every day, and you catch yourself tallying up the cost of a milk carton, coffee beans and cream, you know the cost of living has your daily routine by the balls.

Suddenly some invisible force is infiltrating your everyday life.

Economists like Peter Schiff say the outcome of trying to build an economy on zero per cent interest rates since 2008 will have catastrophic effects. Way worse than anyone expects.

The final nail in the economic coffin was to lock us in our homes and send us free bat virus money with nowhere to spend it, and then to expect everything to be hunky-dory.

Well, it’s not.

Schiff, a well-known financial commentator, economic analyst, and doomsday poster boy, predicted the 2008 housing crisis long before most. He’s from the old school of ‘bad news gets views’. Heck, he’s been predicting Armageddon since 2011.

This time you didn’t need to have a sixth sense or follow any subprime breadcrumbs like in 2008. If they don’t raise the debt ceiling, America will run out of money, and Schiff is saying we’re getting it all wrong about how badly this could end up.

Peter Schiff — Source

“The question isn’t, ‘Are we going to have a recession?’ The question is, ‘Is it going to be a depression?’ If we get away with a recession, we’re getting off easy.

But there isn’t any way that the payback for over a decade of 0% interest rates and massive quantitative easing will be just a mere recession.

It will be a depression, and I believe it will be worse than what is known as the Great Depression, which we experienced during the 1930s.”

The Government Is Manipulating You With Data.

Peter Schiff says The Consumer Price Index (CPI), widely used to measure the cost of living and inflation, was designed for manipulation.

In the past, Governments used CPI to compare the prices of a fixed basket of goods from one period to another. However, nowadays, they adjust or “tinker” with the basket of goods to produce a lower number for inflation.

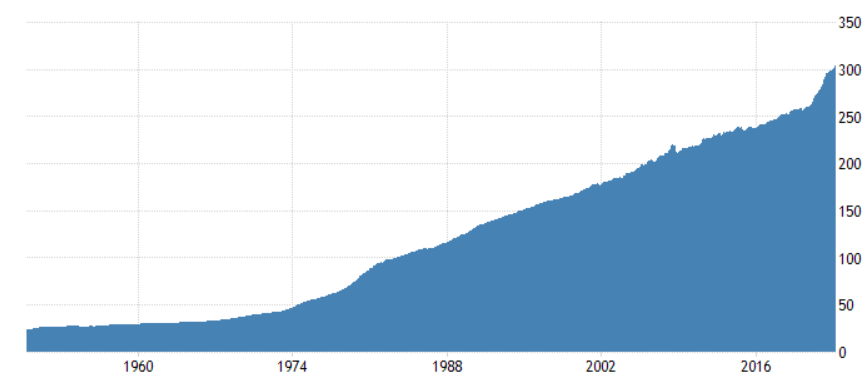

The government have tracked CPI in the U.S. since 1950. Over that period, the average CPI value has been 121.23 points.

In April 2023, the CPI reached its highest recorded point, at 303.36 points. In contrast to February 1950, the CPI was at its lowest recorded point, at 23.50 points.

Peter Shiff says CPI methodology is designed for dishonesty.

Governments don’t need to lie about inflation because the CPI calculation does it for them.

Even the Bureau of Labor Statistics has acknowledged its limitations.

“Substitutions” stand out like a sore thumb.

People often switch (substitute) to cheaper options when the prices of certain things shoot up. For example, they might choose store-brand products instead of fancier name brands and opt for less premium items when shopping.

CPI doesn’t take this expected behaviour into account.

Instead, it calculates its numbers assuming that people keep buying the same amount of those increasingly expensive items. It does not accurately reflect the true impact of price changes in people’s wallets.

According to Schiff, CPI prices are “far worse”, and inflation might even be “double”.

Peter Schiff — Source

“We’re going to have both high-interest rates and high inflation. Because interest rates prices are the price you pay when you borrow money, and the price is going up just like the price of everything else.

Interest expense is a significant part of every business. You have labour costs, raw material costs, rent, and interest.

As interest increases, it’s another cost you must pass on to your customers through higher prices.

It’s a self-perpetuating spiral.”

This Has To End in Disaster.

Americans are about to see a significant drop in their standard of living as higher prices make many things more unaffordable, and borrowing becomes unsustainable.

Peter Schiff says, ultimately, the disaster we are heading for is a collapse of the entire economy.

What we need to attack inflation is lower government spending. The government must cut spending, but that’s not happening because they do the opposite. They’ve been increasing expenditures, “throwing gasoline on an inflation fire.”

Peter Schiff — Source

“Americans continue to enjoy a higher standard of living than we would typically be awarded based on our collective productivity because of the dollar’s role as the reserve currency.

Our trading partners are willing to accept the dollars we print for the goods they produce and hold onto those dollars by buying our treasury debt, mortgage-backed securities, and other debt instruments.

It allows us to buy stuff at lower prices and borrow money at lower interest rates.

If the world stops wanting to accept our dollars due to a loss of confidence in the dollar’s future purchasing power and exchange rate, everything we want to buy becomes much more expensive.”

Something Worse Than the Great Depression Is Coming.

You’re pretending to yourself if you think a disaster isn’t coming. We’ll have a crisis if we don’t raise the debt ceiling. And we’ll have a situation when we do.

Schiff says we’ve continued to raise that debt ceiling rather than dealing with the real problem.

Comparing current events to the Great Depression, even the people who don’t lose their jobs will suffer. They’ll lose the value of their paychecks and savings because everything they need to buy will be a lot more expensive.

It’ll compound the burden for the unemployed because not only will they be without jobs, but their savings will be destroyed.

Peter Schiff — Source

“I think it is a depression, but unlike the Depression of the 1930s, where people at least got the benefit of falling prices that provided some relief.

During the Depression, if you lost your job, at least the cost of living went down. And if you didn’t lose your job, you were better off because your paycheck went further, as consumer prices fell during the 1930s.

It’s going to be a sovereign debt and currency crisis. So much worse than the financial crisis we had in 2008. Because this time, it’s not just going to be subprime mortgages that are the problem; it’s going to be U.S. Treasury debt that’s the problem.

Nobody will want to own our sovereign debt because of high inflation.”

Final Thoughts

Peter Schiff first rose to fame when he said the United States was like the Titanic. Ready to sink.

He was the hero in disguise in 2007, trying to help people deluded about the economy leave the sinking ship before the 2008 financial crisis and global credit crunch.

The housing market began to collapse, the financial crisis began to unfold, and people bullish on the economy at the time were forced to eat their words.

Almost two decades later, he could be right again.

Things feel different, and there’s an air of inevitability about the economy’s decline.

It’s spiralling out of control.

But it’s time we tackle it head-on.

Instead of kicking the can further down the road.

The train is approaching for a collision and many do not see it coming.

I am not sure why nobody speaks about this, but much of the problem of our economy and system of government is that money runs the electorate through huge Lobbying efforts and spiraling campaign contributions. Thomas Jefferson said that if Lobbying was allowed it would be the end of Democracy. This has slowly occurred since the Original Constitution was signed. It did not allow Lobbying and had fixed term limits which have also been changed. How is it that we have Congressmen and women who have been in for multiple terms and when they finally retire often become Lobbyists, only fueling the demise of democracy. We need a change with Leaders who are willing to tackle the problem of a fiat currency, spiraling Debt, and perpetual funding of a war machine while the electorate is ignored.

Honestly I don’t know how the US has avoided collapse this long.