Peter Schiff Saying Bitcoin Will Go to Zero Is Like the Japanese Soldier Who Never Realised WW2 Was Over.

It’s time to come down from the mountain now, Peter

Photo By Gage Skidmore Commons Image

Saying Bitcoin is going to Zero is yesterday’s news.

We’ve seen this movie before.

First, they ignore you.

Then they laugh at you.

Then they fight you.

Then you win.

Throughout history, we’ve seen recurring patterns where people deny or dismiss new technologies until they become widely accepted and integrated into our lives.

Here’s a quote from an article about the internet in 2000 during the dot com crash.

“The internet may be a passing fad as millions give up on it.”

We’re at the “Then they fight you” phase.

Bitcoin is challenging what we’ve become accustomed to, and the disruption triggers scepticism, fear, and a shit ton of resistance from Governments and Sovereign nations who are thinking, “How the heck do we control this monster”.

Peter Schiff is a financial commentator and radio personality who shoots from the hip regarding Bitcoin. He says nothing goes down in a straight line, but we’ll see Bitcoin’s death spiral down to zero soon.

In his eyes, the only thing that prevents total capitulation are the brainwashed idiots buying the dip.

Peter Schiff — Source

“I do expect the remaining air to deflate from this bubble. As inflation remains persistent, it becomes evident that Bitcoin is not a hedge or digital Gold.

It lacks any inherent properties of Gold; it’s merely a collectable digital token without actual value.”

There’s a provocative undertone to Schiff when he blatantly says Bitcoin has no value while the growing masses are starting to adopt it.

It’s bordering on delusion.

It’s akin to the stubbornness of Hiroo Onoda, the Japanese soldier who spent 29 years hiding in the Philippines fighting long after World War II.

Despite many attempts by people to convince Onoda that the war was over, he refused to surrender even when all of the signs were there. The first time he heard about the War ending was when it ended in 1945.

He saw a leaflet left behind by local islanders that Japan had surrendered.

The note read:

“The war ended on 15 August. Come down from the mountains!”

It’s where I’m at with Schiff.

Despite overwhelming evidence of increased Bitcoin adoption, you can only describe Peter Schiff’s stance as willfully ignorant.

Maybe even attention seeking.

His criticisms of Bitcoin are that it lacks any inherent worth. He compared it to the historical tulip bubble and dismissed it as a passionate religious-like belief held by its supporters.

Let’s dive in.

Bitcoin Is a Network of People That Don’t Surrender.

Network adoption is the hardest thing to create and the most challenging thing to break.

Take the Winklevoss twins, for example. They are one of the world’s largest Bitcoin holders, with a reported 70,000 BTC.

They’re also knowledgeable about the network effects of Social Networks and Cryptocurrency. They point out the most crucial fact that pulls Peter Schiff’s argument apart.

The people using the technology become the greatest proponents of the Network and systematically kill off other ideas in the same way we use social media networks.

Tyler Winklevoss — Source

“People had the same concerns about social media platforms as with Bitcoin.

It would help if you looked at Bitcoin almost at how you would value Facebook in its early inception.

Google took a run at social media, It was called Buzz, and it fell flat on its face.

Social Media platforms require network effects, so the users become the most prominent champions of the Network.

They don’t want to leave because nobody wants to upload their pictures ten times on ten different networks.”

It tells you why Facebook happily copy features from competitors.

Tyler says when people pick one Network, they consciously and subconsciously try and kill all the other ideas because they don’t want the psychological overheads.

The Data Show Potential for Hyperbolic Growth.

In a world of unknowns, people hang around waiting for price predictions like crack addicts on a street corner when the most obvious move is to look at the data around adoption and make your own decision.

Heck, it’s Blockchain. Everything is on an open ledger, so you can quickly see how much BTC is being bought and sold and how many new wallets hold BTC.

The most conclusive research data you’ll come across in the industry is from Ark Invest, which is Cathie Woods investment company. They have broken down the data, making the price prediction forecasts significant.

Ark Invest suggests $1 million per Bitcoin by 2030 is downplaying it.

There’s a caveat.

You’ll need to stomach the ups and downs of the market and hold your investments for the long term to see substantial gains, as with any investment.

According to the research, when people wait to trade Bitcoin for around six months, the chance of it ever being sold drops significantly.

In other words, more time holding Bitcoin equates to a lesser likelihood of people ever letting go of it.

It makes you wonder where Peter Schiff gets his “Bitcoin to zero” thesis when the reality is entirely the opposite.

As of the end of 2022, data shows that people who have owned Bitcoin for more than six months make up 71% of all the Bitcoin available to buy and sell.

Despite five significant drops in the value of more than 75% since it started in 2009, Bitcoin has still given positive average returns over three, four, and five years against other traditional asset classes.

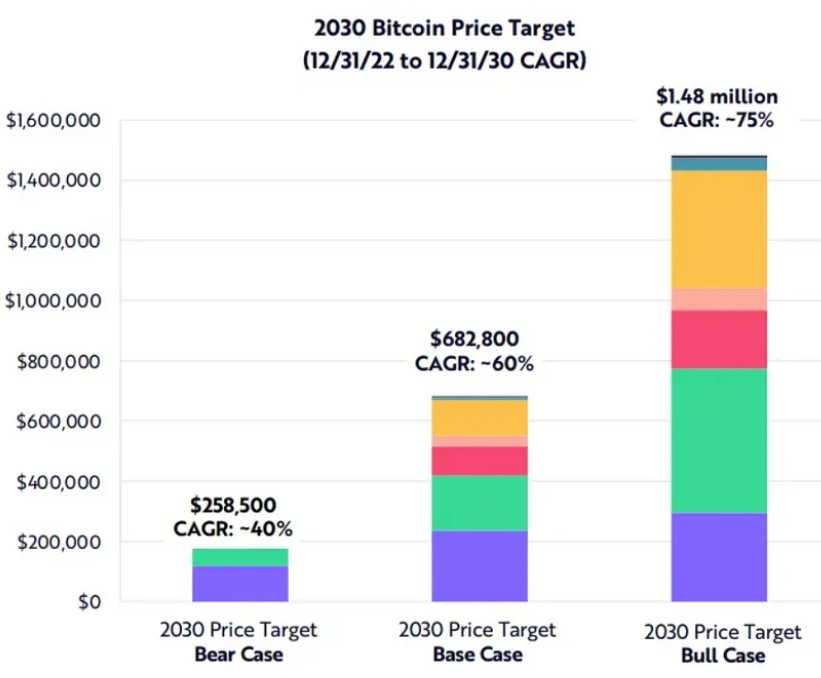

You can’t predict the future, but historical data and current trends can guide you, so here are some possible outcomes based on the same research from Ark Invest by making, as they say, “reasonable assumptions” and factoring in several categories and trends.

Disclaimer; Ask yourself which makes more sense; this conclusive breakdown of metrics or Schiff’s take on Bitcoin being a hyped-up religion.

Institutions and retail investors are committing to Bitcoin during a bear market.

Bitcoin’s hash rate hit an all-time high In 2022

Forecasts on digital wallet usage trending upward

Data shows Bitcoin holders are more long-term focused than ever in history.

Bitcoin’s capitulation has hit levels associated with price troughs in the past — so subsequent price increases may repeat, but previous performance doesn’t guarantee future results.

Bitcoin’s fundamentals are stronger today than in past drawdowns.

As a result of their forward-looking indicators and the current compound annual growth rate trend, ARK says the price of one Bitcoin could exceed $1 million by 2030, and it’s not outlandish.

While, in my opinion, the figures are high given that these things take longer to play out than people anticipate, it’s a more plausible scenario than saying, “Bitcoin is going to zero”.

Here are Ark Invests Forecasts.

Bear Case — $258,500 by 2030

Base Case — $682,800 by 2030

Bull Case — $1.48 million by 2030

Final Thoughts

The current fear-mongering climate of a down-only mentality brings these doomsayers out of the woodwork.

It gives people like Peter Schiff more air time, speaking against the tide of popular opinion.

As an investor, you know you can have a diversified portfolio and invest simultaneously in multiple things. So when Schiff does party politics over where to put your money, it’s obvious he’s trying to seek attention by speaking against a growing and popular sentiment.

Sometimes he might leave you thinking he’s right when you factor in price fluctuations.

The situation couldn’t be more dire for the economy.

Bank failures.

Record inflation

Highest interest rates in decades

You should take the emotion out of all this and be guided by the only data that matters.

Adoption.