PNKSTR Crashed 70%: Why Everyone’s Watching the Wrong Signals.

Every asset needs to be battle tested.

Haven’t upgraded to a paid or Founding plan yet?

You’re missing daily trade ideas, live calls, NFT giveaways, and our best insights, all inside a community that’s winning together.

Join us.

Morning folks,

Plenty of people are shitting their pants over what can only be described as a horrendous drawdown.

I get it.

You screenshotted the highs instead of taking profits, and now you’re staring at the chart thinking this thing’s going to zero.

For the record, I haven’t taken any profits yet.

What most people are missing is that PNKSTR always gives you a reason to keep watching, coupled with the protocol being permissionless. It’s here forever.

I’m amazed at how shortsighted people can get, particularly in the trenches of day trading.

When there’s a sell-off, my first thought is, “Did it scoop up another Punk?”

And if I look at my own attention flows, and what the collective is saying on the timelines, that’s exactly what people are checking too.

When the coin pumps, I’m immediately asking which NFT sale just lit the fuse.

That constant cycle, buying, selling, burning, is keeping me hooked like a dopamine-fuelled crack addict. I’m enjoying every second of it with play cash, while maintaining confidence in PNKSTR because it’s tied to one of the most iconic assets in the space.

Don’t overthink this shit.

Two days ago, one holder clipped their entire stack of PNKSTR—worth $2.9 million. The market cap instantly shed around $150 million.

It was fucking bizarre.

They dumped in a way that cost them nearly 50% in fees, which ultimately resulted in the protocol buying two more CryptoPunks.

So yeah, people freak out at every stomach-churning swing, but if you’ve held NFTs through this bear market, these are rookie numbers.

Like an old buddy used to say to me: “Jay, there’s no hiding place for data.”

So let’s look at the signals that actually matter.

While the price has been tanking, the holder count has been climbing, and it just broke above 10k for PNKSTR. Even more interesting is the concentration compared to other tokens.

There isn’t a high concentration of whales in PNKSTR.

Even in the top 100 holders, the percentage is lower than in most notable coins. Granted, PNKSTR is more productive as an asset than a meme, but it’s the closest comparison.

A quick glance at Etherscan shows that Uniswap, the liquidity provider, is the single largest holder, with just over 6% held in two addresses. The data also accounts for 3.9% held by the burn address, and what you see is a low concentration.

It’s precisely the kind of setup that could lead to healthier distribution over time.

I think everyone’s staring at the wrong signals.

The only true north here isn’t the strategy coins. It’s the underlying assets backing the coin, which is the NFT.

In my private Founder’s group, we ran a test on Gobstr. It fell flat on its face. Could it come back? Sure. But the reality is that the NFT project backing it was underperforming. And if the underlying NFT is weak, the coin drops faster than a broken elevator.

Yesterday, out of the blue, they decided to launch PainStr by XCopy, but we managed to line ourselves up nicely.

That launch was billed as stronger, and for good reason. Painstr was pegged to the most iconic digital artist alive. The Max Pain and Frens collection was already deflationary, having undergone multiple burn events with another on the way, and boasting a 63% holder ratio, which is substantial.

That data matters.

When most people only hold one NFT, they’re reluctant to sell. Nobody wants to be out of the trade. That friction creates astronomical buying pressure until an eventual shakeout.

Just this morning, one of our members dropped a note:

“Looking at my PAINSTR—I got 1.6M tokens at 0.000151, about 4–5 minutes into the auction. That’s $235 for a total cost of $3,640. It’s now valued around $5,000.”

Prices will swing, no doubt.

But the key takeaway is that it always comes back to the underlying performance of the NFT.

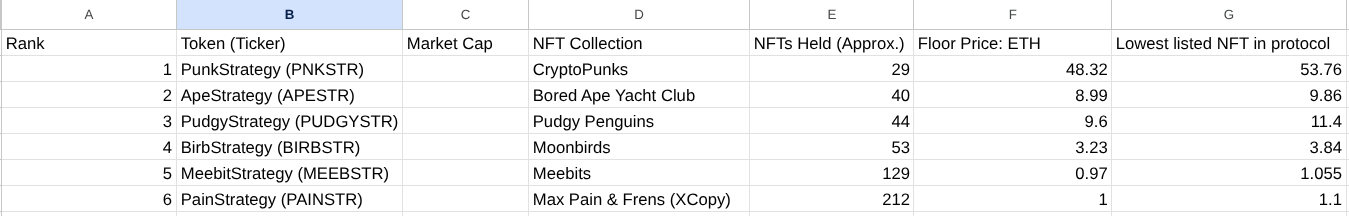

Look at the chart below.

It displays the top-performing strategy tokens, which also happen to be the more successful NFT projects, along with the number of NFTs they hold, and, most importantly, the last two columns. That’s where you see the NFT floor price catching up with the protocols’ relisted NFT.

That’s the signal that sets off the flywheel.

Right now, Xcopy and Meebits are on the edge of generating the sales that will light the cascade effect. Sales then create fees and fuel burns for PNKSTR.

So the next big question: will the CryptoPunks floor at 48.32 ETH catch up with the 53.76 ETH protocol? My answer: a resounding yes. Especially when you consider the floor last cycle went to 150 ETH

Remember, people aren’t just buying Punks as assets. They’re collecting them as digital identities. And they’ll pay a premium for one they truly resonate with, even if it’s above floor.

With improving financial conditions and a certain rate cut this month, I see the Punk floor smashing through 50 ETH and eating into protocol NFTs.

Don’t overthink this. It’s a massive opportunity.

Most people will mid-curve it, trying to outsmart the short-term noise or act as if they have some special vision that the average person doesn’t. Lol.

I don’t want to fuel a ton of speculation, but Xcopy posted the below yesterday, and what he’s hinting at with “endorsement” is the burn of the Max Pain supply as shown below.

Max Pain started at around 7,394 NFTs and is now 4,849, with 2,545 burned.

What we’re looking at is a perpetual cycle of buying, selling, and burning in a collection where nobody wants to sell—and the artist himself is buying pieces and sending them to a burn address independently.

I was telling Carrot Lane Founding members to buy this NFT over a year ago. Now we’ve finally reached the apex.

As for Painstr exposure—I’m 2x up. I’m fully aware that they can swing in real time, but these satellite tokens aren’t my core positions—they’re a bit of fun.

PNKSTR is the one I’m still bullish on.

Final Thought.

This is a buy if you believe in CryptoPunks, the NFT PNKSTR is pegged to.

I’m only using a small amount of my allocation for this because, yes, something could go wrong, although it’s not immediately clear what.

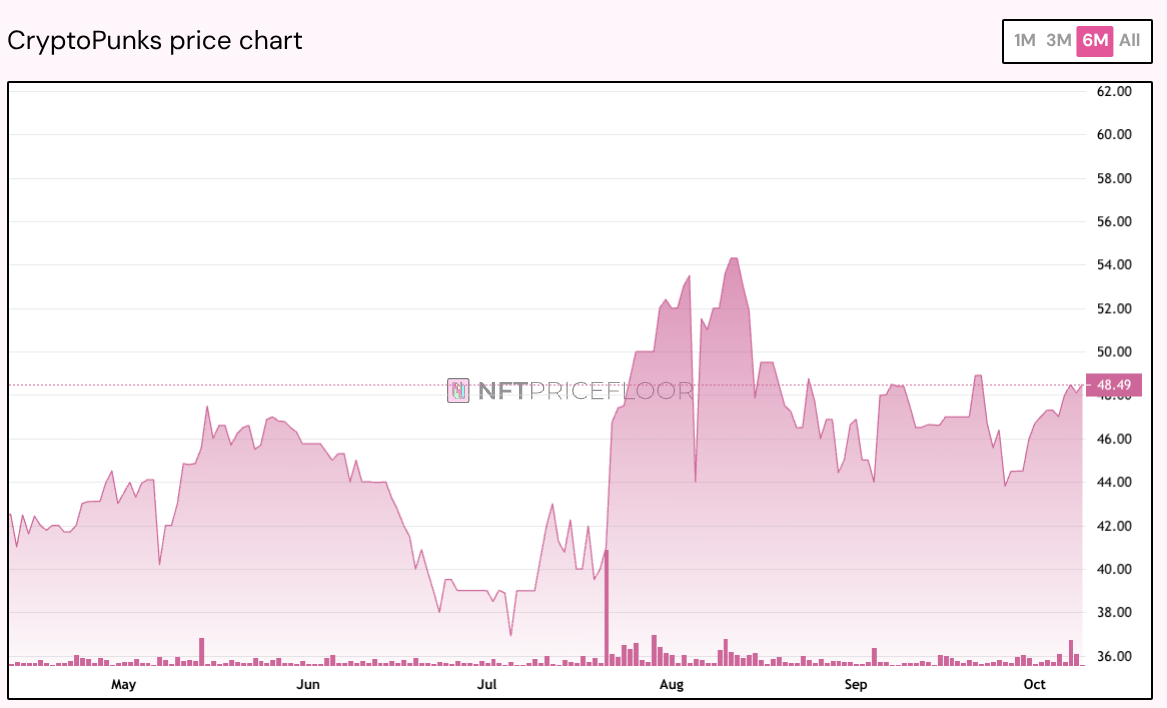

Here’s the price performance of CryptoPunks over the last six months, during some of the most brutal tariff drama that spooked the markets.

Pretty darn solid.

It’s the most stable asset you could be in outside of Bitcoin.

PNKSTR, which seeks to arbitrage the price appreciation of this iconic art, also has a low concentration of holders.

NFT floor prices across major iconic collections are also low, and as financial conditions improve, Bitcoin becomes more sensitive to these improving conditions.

We’ll see rotation into ETH, and further down the risk curve into NFTs, as all boats rise in a tide.

NFT buying kicks the flywheel into gear—and once the flywheel spins, we’re strapped to a rocket heading straight for Mars.

Big PNKSTR sell-offs aren’t as damaging as people think. They actually help with distribution and generate fees.

So the number one signal?

Time until the next protocol NFT sale. Everything else is just noise. And all of it is underpinned by one thing: attention.

"I like the strategy." 😏

Let's go, baby!