PNKSTR: The Hidden Market Signals Behind Crypto’s Most Overlooked Play.

It’s gathering pace fast — here’s what could happen next.

I sent this blog out to paying members 3 days ago.

Since then, the chart has gone vertical.

It shows just how important speed of information really is.

My Founding group got into this token back in early September when the market cap was around $12B (maybe less).

It’s still early based on the holder count, but now’s the time to be getting this information in real time by upgrading to the Founders group.

We’ve got an entire week of new strategies lined up, and all the communication will happen in there.

Upgrading is simple.

If you’re already a paid member, it’ll refund your current membership and move you straight into the Founding plan when you edit your subscription.

You’ll be added to the private chat. Additionally, you can join monthly group calls with an exceptional community.

I’m working my face off for you guys so we can all capitalise on this moment.

If there aren’t exploits in the contracts being launched, this has a real shot at being a generational play.

But let’s see…many unknowns.

PNKSTR—the ticker symbol for Punk Strategy—has just smashed through a $140 million market cap and only has 6,350 holders.

Meanwhile, anyone with coin exposure but little clue about NFTs is standing there scratching their heads, thinking: how the hell did that happen?

In hindsight, it’ll feel as obvious as getting smacked with a wet fish.

Some readers here will wish they got in, and those who did will wish they’d gone bigger. It’s the age-old crypto story. We’re talking about an asset that’s less than a month old, and listen when I say this overused cliche: We are very fucking early.

When you mix the most iconic NFT collection with a perpetual buy–sell–burn mechanism designed to arbitrage the price appreciation of the “Bitcoin of NFTs,” you end up with something that feels like a money glitch.

That’s precisely what Adam Lizek has built with PNKSTR.

The wild part? The higher the price runs, and the more volatile it gets, the more fees the protocol generates to buy up CryptoPunks.

It already holds 19 Punks and is on the verge of acquiring number 20, bringing it close to cracking the top 50 Punk wallets in existence.

Lost? Let’s back it up.

What is $PNKSTR?

PNKSTR is a decentralised protocol that uses trading fees from its native token to buy floor CryptoPunks, relist them at a premium, and burn PNKSTR with the proceeds.

Every trade of $PNKSTR carries a 10% tax—8% goes to the protocol, 2% to the team. Once enough fees accumulate, the protocol sweeps a Punk at floor price, instantly relists it at 1.2×, and when it sells, all ETH proceeds are used to buy back and burn $PNKSTR.

The endless adrenaline loop is sucking in crypto enthusiasts.

Price discovery.

Folks message me often to say “Jay, where do you think the price goes?” in a bid to rent some conviction.

Price-prediction dopamine-fueled buzzwords are the quickest way for an aspiring writer who has a financial newsletter to go to zero.

But I’ll share some thoughts anyway.

I’ll remind readers here that this makes up less than 10% of my allocation to Crypto because there are still an entire host of things that could go batshit wrong here.

But the possibilities are friggin incredible, they actually remind me of when I first got into Crypto and then NFTs, it all just felt like a cheat code until uncle Jerome pulled the aux cable out of the economy.

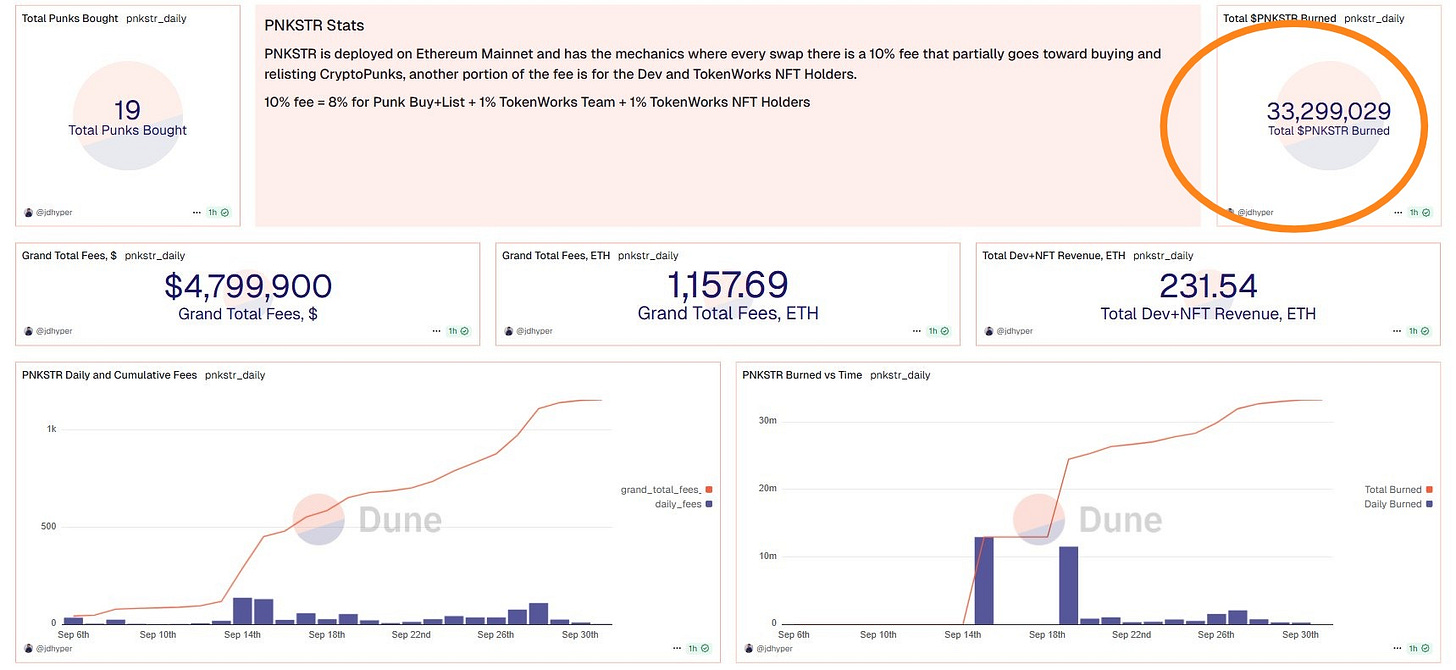

Josh Hyper, a data engineer who lives and breathes analytics, shared his breakdown of what he’s seeing in PNKSTR:

“PNKSTR casually breaking 100M Marketcap. It did so on a calm day for fees and buyback/burn. Closing in on $5M in lifetime fees and 3.3% total supply has been burned so far. Makes you wonder what’ll happen when TokenWorks strategies start launching again.”

Dune Analytics shows 33 million PNKSTR tokens have already been burned—that’s 3.3% of the entire 1 billion supply gone (circled below).

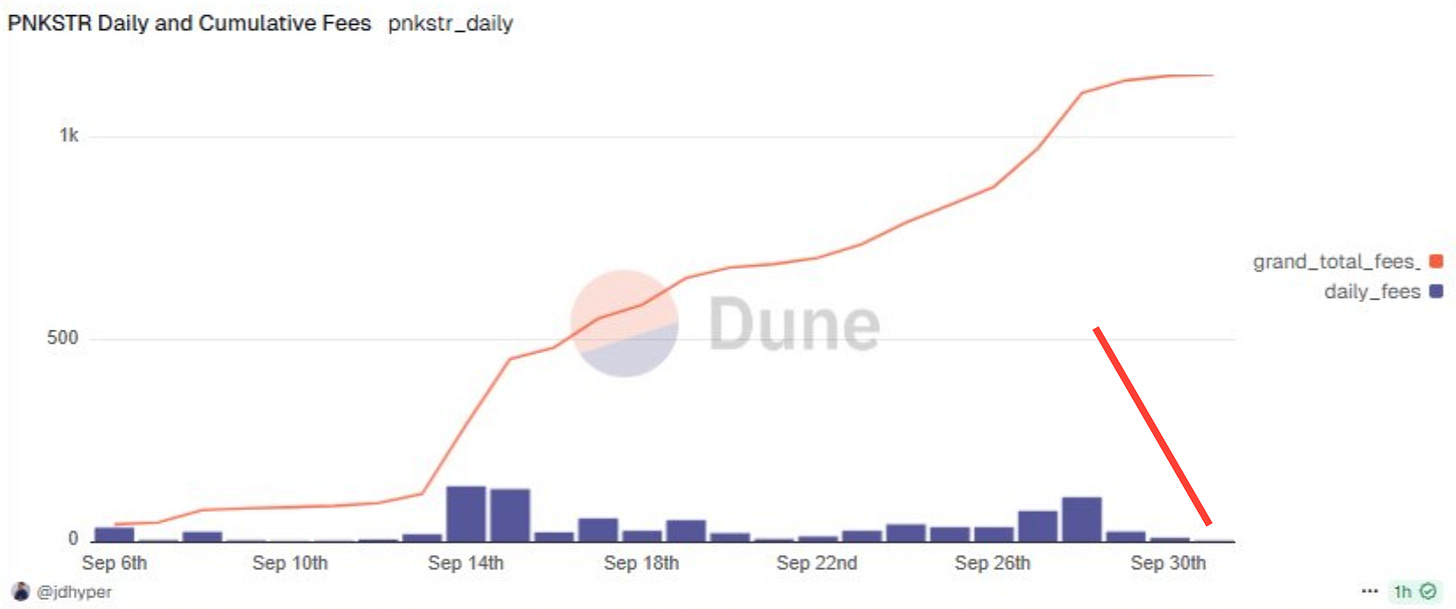

When you zoom in on the chart below, you can see the daily fees have slowed even as price discovery pushes higher, meaning more entrants are buying the PNKSTR token and driving the price up.

Fees from anticipated token launches will mean more lighter fluid.

The orange line below shows the total fees for the project, which have flattened out somewhat.

The red arrow highlights a drop in daily fees, resulting from a pause in the other NFT strategies while their contracts are being audited. These are expected to restart in the next few days and will eventually roll out across every NFT project.

Reminder: There are approximately 250,000 NFT projects available. Each team that deploys a strategy gets 1% of the total supply of their native token (10 million tokens), plus a 10% rake from fees, with 10% of that rake flowing straight back into PNKSTR.

In these early stages, it feels like everyone’s getting fed, and few get screwed.

So every NFT project will have access to this perpetual buying and selling protocol.

I keep scratching my head, thinking, why wouldn’t every project lean in? They’re basically getting free money. It’s open-source code, so people are going to fork it anyway (some already have, like Miladys).

The protocol is sweeping floor NFTs, most of which have been underwater for three years or more. It’s starting with blue-chip projects that still carry cultural weight, but as it spreads, it’ll be like a tow truck dragging clapped-out cars off the motorway.

So again—why wouldn’t founders jump on this?

In fact, here’s what Snowfro, the creator of Chromie Squiggles, had to say about it:

“Honored for Squiggles to be included in the next batch of projects. While I’ve generally shied away from the financialization side of things like tokenization, lending and fractionalization, I’ve always acknowledged the inevitability of it. Tokens are a maturing product, still in its infancy, but taking the learnings from Adam’s previous experiments and nearly a decade of tracking the implications of tokenization, this feels like the next phase.

It’s fitting for Adam to launch this for Squiggles. I see many parallels in his madness with my journey in web3—a true passion for the tech, the blockchain as a medium, and a rare holistic understanding of the ecosystem. Unlike many tokenization models, he often brings NFTs into the projects as well, and that’s noteworthy.

Unlike a lot of financialization of art, this project supports the creators. That’s massive. With my share, 1/3 will go to @SquiggleDAO, 1/3 to @artblocks_io, and 1/3 to @endaomentdotorg for institutions that have supported my work and the digital art space as a whole.

Be thoughtful and careful in your participation—as with anything in web3, there is a significant risk of things not working out as expected. And please be kind to one another.”

There hasn’t ever been a token like this that I can remember that has had this kind of impact in such a short space of time.

So it’s hard to compare anything to $PNKSTR.

The market cap is $140M, with a burn mechanism not afforded to almost every other token. The deflationary element of this is the Crypto crowd-pleasing ace up PNKSTR’s sleeve.

Let’s compare PNKSTR to coins that rely on mindshare and have a look at their market caps. Which I think we can infer some direction of where this is headed:

DOGE – $80B (2021)

SHIB – $40B (2021)

PEPE – $7B (2023)

WIF – $4B (2024)

FLOKI – $3.5B (2024)

BONK – $4B (2024)

BRETT – $1.1B (2024)

FARTCOIN – $1.24B (2024)

PNUT – $1B (2024)

SPX – $1.4B (2025)

Barring any exploits, I think PNKSTR has the potential to rip well past a billion dollars. That's a 7x from here. Does it get there? I think so.

None of the big meme coins relying solely on attention had a burn mechanism, yet they still garnered insane buying flows.

DOGE had Musk as its poster boy, which alone sent it to Valhalla for a while, and now it’s permanently cemented in the mainstream. However, don’t forget: DOGE’s supply continues to inflate by approximately 5 billion tokens per year.

Then there’s PNUT. A pet squirrel goes viral on Instagram, is turned into a meme, and is then controversially euthanised by the state, which lit up the internet like a dumpster fire and sent PNUT the tribute token into orbit.

The coin managed to smash over a billion in market cap, proof we’re all more than happy to buy dumb shit.

The difference now? This time, there’s actual utility baked in. However, I know as well as anyone that utility alone doesn’t necessarily draw eyeballs.

One of my readers kinda nailed it:

“Only difference is those meme coins are pushed by crypto influencers and this is not being done yet. Sadly tokenomics or utility does not drive price in crypto, it’s the HYPE.”

Valid questions from the community that deserve a closer look.

When I look back to when I first invested in PNKSTR, the market cap was around $12 million.

We started talking about it in my Founders group, where we share trade ideas.

From the messages I get, some people are kicking themselves for not putting more in or not getting in at all. It’s easy to sit there drowning in the should’ve, could’ve, would’ves, but the trick is not to dwell. Look forward, size into your position with what you can actually afford.

It brings me to the number one question filling my inbox: Is it still early? My response—loud and clear—is yes.

Two key factors are playing out in real time.

The first is the attention the coin is getting, which is driving buying flows. I catch myself checking the website daily, particularly during sell-offs, because I know it’s generating fees.

It’s clear that the same dynamic will play out with the other strategies once they’re released. I’ll get to those in a second.

Another reader messaged me this:

“Hey man, been following the PNKSTR thing. Aren’t you scared of the punks just not selling? There are so few sales recently, and it probably doesn’t look great for someone thinking of investing when the token they’d buy is just a floor token priced up.”

It’s a valid question.

That’s until you actually realise that CryptoPunks are grossly underpriced at the moment. Right now, PNKSTR has 19 Punks listed in the mid-50 Ethereum range. If we get a tailwind of better financial conditions, these will get swept no problemo.

Look at the price history. Punks hit 150 ETH four years ago, when Ethereum was at its last all-time high (my chart below only goes back far enough to show 113 ETH).

In the last cycle, we had 23 million NFT collectors.

That number is expected to 10x, based on a basic log trend of the entire crypto market cap moving from $1 trillion at the start of this cycle to somewhere between $10 and $15 trillion.

What the data leaves out is the psychology of NFT collectors, who white knuckle cling to their assets like trophies, making selling nearly impossible.

Or as Crypto expert Gmoney humorously put it:

“The bull case for $pnkstr is nft people don’t know how to hit the sell button. Dont overthink it.”

Opher, a member of my Founding group, asked me:

“Jay, what about the other strategies?”

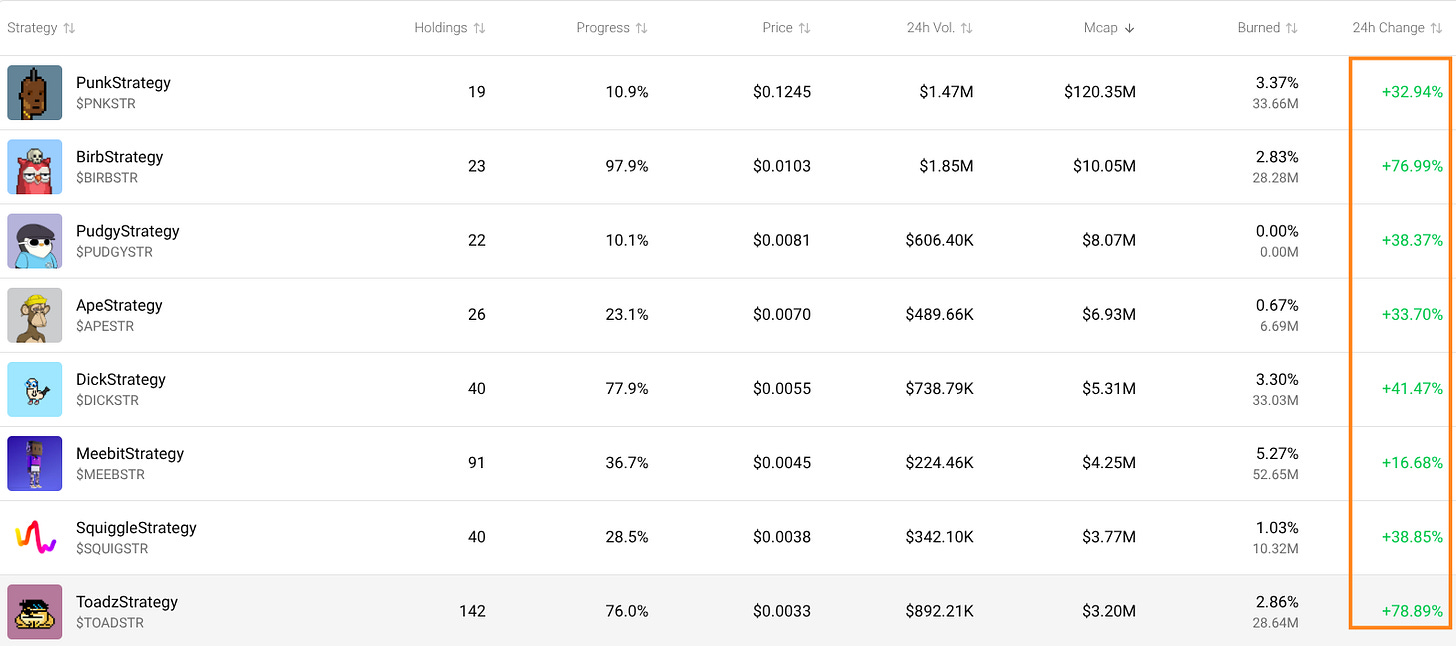

They also look like a great opportunity.

It comes down to how much time and capital you have.

The proof’s in the pudding—these tokens have all ripped because their market caps are tiny. But the communities aren’t bottomless pits of liquidity. So maybe you only throw a small % at them, or you take profits and rotate back into PNKSTR.

Remember, you’ve got to beat the 10% trading fee and account for a tax event. In the end, you’re taking on more risk for only marginal outperformance, and the math (for me) doesn’t add up.

There’s also an overlap to consider because every other strategy token’s fees are already burning PNKSTR. So it just makes sense to own the mother token.

(Author’s note: That’s just me. Do your thing, poke around and back what you like.)

There are still unknowns about how communities will react to these strategy tokens.

Some NFT founders are even hinting at releasing their own coins, which could lead to conflicts of interest and oversupply dilution. And while these smaller 2021-era projects may be iconic, they don’t carry the same financial weight as CryptoPunks.

Remember, buying a strategy token essentially means becoming an arbitrageur of the NFT price performance.

Smaller projects might pump early, but could plateau quickly—just look at their actual NFT price performance. Most of these strategy tokens only have about 1,000 holders, as you’ll see below.

That’s insanely low.

It either means we’re incredibly early, or liquidity in those tokens dries up fast. Probably both.

On the livestream the other night, I called PNKSTR a layer-one-esque token—capturing value across the whole network—while the other tokens feel like L2 beta plays that probably won’t carry the same financial weight long term. With an NFT bull run brewing, my bet is to stay focused on PNKSTR instead of scattering into the rest.

So we’ll see.

I’d rather be concentrated than stretched thin.

Here’s the data:

PunkStrategy (PNKSTR) – CryptoPunks | 6,340 holders | $140M

PudgyStrategy (PUDGYSTR) – Pudgy Penguins | 1,553 holders | $11.2M

DickStrategy (DICKSTR) – CryptoDickbutts | 776 holders | $7.1M

ApeStrategy (APESTR) – Bored Ape Yacht Club | 1,320 holders | $8.4 M

MeebitStrategy (MEEBSTR) – Meebits | 860 holders | $4.6M

SquiggleStrategy (SQUIGSTR) – Chromie Squiggles | 993 holders | $4.9 M

BirbStrategy (BIRBSTR) – Moonbirds | 1,454 holders | $12.80 M

As a counterpoint, about DickStr is that it has meme power like jet fuel.

Who wouldn’t laugh at making money off a dick token called Dick Strategy lol. And BirbStr has huge potential too. The NFT floor was just 0.3 ETH a few months ago, before Spencer bought the project, and now it’s at 3.7 ETH, with Ethereum up over 100%.

Kevin Rose, the original MB creator, was a Silicon Valley heavyweight who brought in his VC buddies. That move sent Moonbirds to 40 ETH during the bull run. So the ceiling here is massive.

These dynamics can play out fast. Bored Ape holder and NFT influencer Warren nailed it in one comment:

“In the last 24h all the strategies (without Punk Strategy) had $3.5M in trading volume. 1% of that = $35K was used to buy & burn $PNKSTR. That creates about 0.9% daily (!!!) price pressure. Now 10x that → $35M volume = $350K daily buy+burn → ~9% daily pressure → ~14× in a single month. Price then: 1.62 USD”

The question of value.

One of the most significant aha moments in my crypto journey, not just NFTs, was realising that while these aren’t productive assets, their value comes from the square root of the user base.

Unlike traditional models, like stocks that rely on productivity, the game here is different. Typically, you’d look at assets, turnover, and profit. But in this space, that’s like forcing a square peg into a round hole.

Which brings me to something my buddy Henry, who’s a pro spread bettor and a maths genius, said:

“My only issue is that the market cap is already $100 million, but the NFTs inside the protocol are worth $4 million. So it looks overvalued.”

And that’s exactly the point.

The protocol isn’t built as an ownership mechanism. It’s designed to arbitrage the price appreciation of an iconic project that’s likely heading higher, and one that most people are priced out of.

So you’re basically renting access to Punks while still being part of the ecosystem. The rising market cap is actually bullish, as every new user strengthens the network, akin to Metcalfe’s Law.

That’s why I tell people: watch the holder count. You want that number climbing.

Think about Facebook being worthless without users, or Bitcoin’s social consensus growing stronger with every new participant.

The value isn’t in the assets—it’s in the users.

Final Thoughts.

For many of my readers, this is the first time they’ve experienced a hockey stick god-candle since I shared Solana at $12 or made the very early call on SUI at $0.70.

What I’ll say, folks, is please don’t lose your mind.

Like SnowFro rightly says: “Be thoughtful and careful in your participation—as with anything in web3, there is a significant risk of things not working out as expected.”

I added one last bit into PNKSTR yesterday. My personal thoughts are that this project just has it. There doesn’t seem to be a point of failure, because price declines stimulate fees, which buy NFTs.

The question really becomes: Do you believe in NFTs? I could bet my life on CryptoPunks, because the proof is already in the pudding. The floor price for one is $200,000.

Barring any exploits or further contract issues, I think this project cooks.

I’ve mentioned before: the real test comes when Punks hit 100 ETH and then relist at 120 ETH. The gap in the premium would be huge—but over multiple cycles, it balances out. And the irony is that if people dump PNKSTR, it generates more fees, sweeps more Punks at the lower floor, and kicks the flywheel back into gear.

That’s what makes this so fascinating.

Some people think this protocol alone could light the spark for the next NFT bull run. Every NFT project dreams of a perpetual buyer, and PNKSTR might just be it—a deflationary liquidity laser beam.

I think there are also major opportunities in the satellite projects, but some of their communities aren’t that liquid. It takes education—like understanding the Moonbirds VC origin story.

Another factor is that you must outpace the 10% trading fee. While that fee feeds the goose that lays the golden eggs, it doesn’t exactly make for active trading.

The beauty of this project, and the joy it’s giving us, is that it lets your core assets bubble away in the background.

To me, that’s the punchline to all of this.

If today’s blog gave you value, pass it on to a friend or family member—word of mouth is how Carrot Lane grows.