Profound Insights I Learned From Buying Ethereum at $105 a Coin

Use my six years of common sense Crypto experience to help you prepare for what’s next.

I thought I’d discovered fire.

Let’s be honest: no one apart from the technology geeks saw this digital revolution on the horizon.

I downloaded Coinabse in 2017 and recklessly bought Crypto like an overdosed gambler in a rundown casino.

I didn’t have the foggiest idea what I was doing.

Everything was just narrative based.

I’d ask one of the lads in the office, “Hey, what do you reckon people are saying about this Litecoin?”. Yuck.

That was the basis of my investing prowess.

One day, a video pops up of Garyvee getting heckled by a Bitcoin crowd, and a member of the audience gets up and asks him, “Bitcoin or Ethereum Gary?”

Without hesitation, he snaps back and says, “Ethereum”.

So I bought Ethereum at $105, put about $1250 in, and completely forgot about it.

That was it.

That was the depth of my investing knowledge in Crypto.

I used a serial investor slash social media marketer as my safety signal to buy, and it was beyond reckless.

When we ended up locked in our homes because of a lab virus, the only things people could spend their Trump stimmy checks on were Jeff Bozzo’s Amazon app or Crypto.

As a result, money poured into Bitcoin and Ethereum.

ETH, the 2nd largest Crypto by market cap, went to Valhalla, and my Coinbase account was like one of Elon’s Rockets on its way to Mars.

I thought I was a genius.

I’ve made many mistakes over the last 6–7 years in Crypto, which you can learn from to set yourself up nicely for the next cycle.

You owe it to yourself.

Let’s dive in.

You need a framework!

Even chronic gamblers have a plan.

They look for data and patterns. It’s beyond pedestrian, not too.

It would be best if you had something to hang your hat on, some ration-nal that keeps you sane when the market capitulates faster than a broken elevator.

When I heard Raoul Pal speak about this framework of why prices go up and down and where we’re headed, it was another aha moment.

Crypto markets are driven by liquidity cycles that also match the business cycle.

When there’s more stimulus in the system, conditions are better for business and crypto prices.

For more stimulus to enter the system, it helps when there’s lower inflation and a lower interest rate environment.

It’s as simple as that.

Everyman and his dog are waiting for Jerome Powow and the Fed to pivot on interest rates because it’ll signal to the Crypto market that liquidity is returning.

Here’s what’ll help you more.

Here’s what having good data does

During my first rodeo in Crypto, I was vulnerable to someone else’s worldview and investing thesis.

It’s how bullsh*t spreads like wildfire.

I got lucky.

I didn’t know why

answered “Ethereum”; however reckless, I’m glad I took action.

The truth is, I would’ve had a lot more conviction if I had insightful data.

I sold some ETH very early during the next bull run because I had no water-tight reason to hang onto it. That was a Mistake.

Famous for the book “Crossing the Chasm”, Geoffrey Moore says it best, “Without big data, you’re blind and deaf and in the middle of a freeway”.

I pulled my head out of the volatility bunker and searched for data that detached me from the chaos.

Now I’m like a data crack addict looking for my next hit.

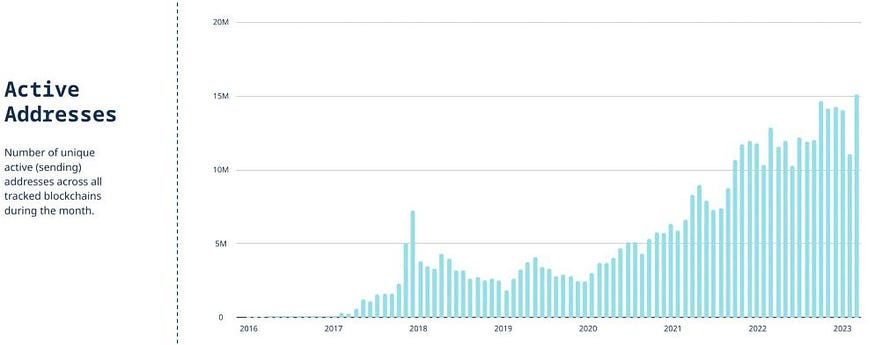

Even though Crypto might be up and down, active wallet addresses have doubled since 2021 and are increasing monthly.

I’ll share more data throughout this blog, but hang your coat on the below piece; adoption gives you a clearer picture than price.

People work in cycles; They come back

When everything capitulated in 2018, I thought the good times were over.

You had the ICO boom and bust, and everyone said Cryptocurrency was a scam.

The fear-mongering headlines failed to mention that this happens with all new technology.

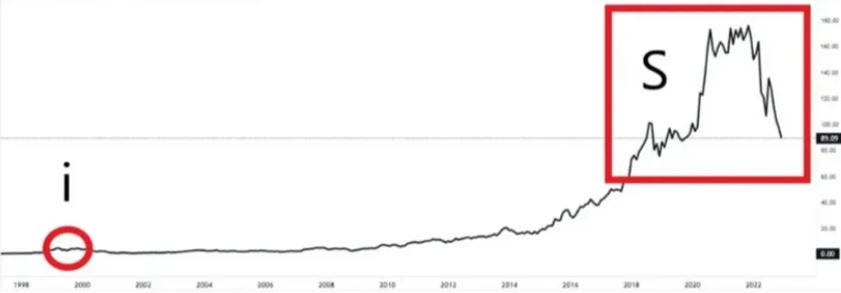

Famous early-stage investor in Hotmail Tim Draper, credited as the viral marketing pioneer, coined the phrase “the Draper I, S, Curve.”

If you understand this, you’ll be as calm as a Himalayan monk when markets are choppy.

You may even get in on the ground floor when everyone shouts “Ponzi”.

The I and S come from the shape it makes on a chart.

First, the technology takes off and makes what appears to be a huge spike.

Then, it drops off because it takes time for talented engineers who devote their lives to making it consumer-friendly.

When the masses start to use it, it takes off again, but this time to the heavens.

Here’s how it happened with Amazon: circled is the 1999/2000 dot com bubble. Remember, it’s when people said everything was overpriced.

Then it exploded.

Look for where the developers are

Once I had clarity on this one thing, it was like a light bulb moment.

It’s just friggin common sense.

Tim Draper says that every new industry gets hyped to the max, and then people say the technology doesn’t work and everything it promises is unfit for purpose.

But “while it sits there, great engineers work tirelessly for us to experience the new technology.”

He’s right.

When I saw this, I thought I had cracked the code.

You could’ve locked me up in Guantanamo Bay for a month, and I still wouldn’t have changed my mind on ETH.

Here’s the monthly developer data by Blockchain. It shows where talented engineers are devoting their time.

Ethereum is streets ahead with 1900 monthly active developers.

Logic would say some special sh*t will be built on here, creating more demand for ETH, the token.

History doesn’t repeat, but it does rhyme.

I wasn’t lying when I said data was my dopamine hit.

Your conviction will no longer feel like a house of cards as your data catalogue grows like it did for me.

Keep adding data to your armoury.

Past cycles are a good indicator of what to expect in the future; they don’t always play out, but at least you have a general gist of what’s to come.

Each new low beats the previous Crypto cycle’s high, dating back to 2012.

Then you chuck in continued demand, liquidity set to return when interest rates come down, and institutions applying for ETFs and the cement starts to set on all of this.

Here’s what’s coming: Don’t close yourself off to the next thing.

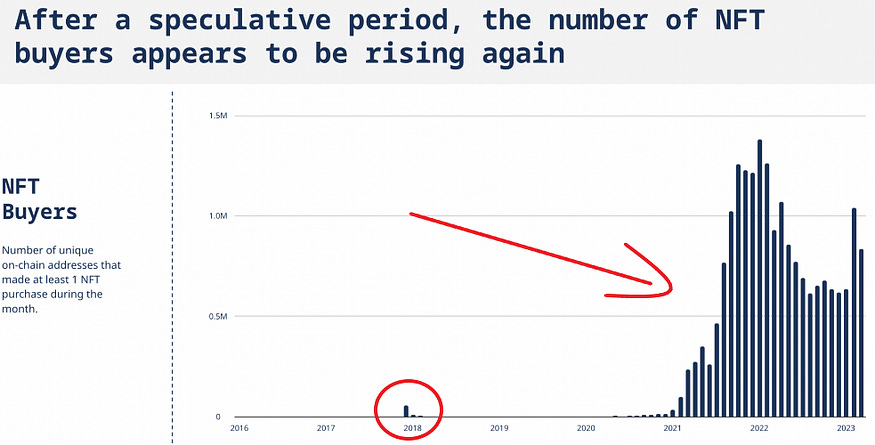

Remember that I, S, technology curve from earlier?

Well, it’s happening again.

This time, it’s happening with NFTs.

Non-fungible tokens can’t be copied or replicated, and their first significant use case is art on the Blockchain.

Ethereum is the most prominent marketplace for these digital assets that people buy frivolously.

Please pay attention to it.

Dig a bit deeper like I should’ve done with ETH in 2018.

In the last two years, NFT marketplaces paid creators $2 Billion in royalties. Mark Zuckerburger’s Meta only earmarked $1 Billion but has 3.7 billion more monthly users.

You can see signs of the I and S curve in the chart below.

NFTs will be the next evolution of Cryptocurrency because communities grow around them, and there’s an image people can “socially signal”.

You can show you’re part of a team the same way you wear your sports team shirt or how you support a brand like Rolex by wearing their watch.

People are taking this expressive signalling ‘on chain’ with NFTs.

Bitcoin and Ethereum maximalist and arguably the most respected voice in Cryptocurrency, PUNK 6529, says NFTs will “consumerise cryptocurrency”.

Punk 6529 —Source

“In an extreme example, people die for their national flag.

In less extreme examples, people go and tailgate after a football game.

In other less extreme examples, people will pay $10,000 for a watch when a $50 one will do the same thing.

I’m not here to tell you this is bad.

This is fundamental to human nature. This is how we are. Identity matters, community matters, emotion matters,

NFTS are the moment where we can take all of those feelings from an off-chain world on-chain.”

Final Thoughts

It’s simple.

But it took me six years to figure it out.

Develop a framework.

Use Data to navigate in the dark.

Realise we all work in cycles that come back.

Look for logical signals; for me, a major one is developers.

Be open-minded about what’s on the horizon.

NFTs are like assets built on top of currencies; they do more than “number go up”.

While everyone thinks they’re a fad, dig a little deeper.

I’d be lying if I said I don’t look back and wish I had poured more into Ethereum at $105, but the second best time to grow that bamboo tree is today, or however the saying goes.

Go for it.

Dig a little deeper.

Who knows, you might pat yourself on the back someday.

🙏👍🦾