Raoul Pal: If You Keep Adding Bitcoin This Panic Cycle, You’ll Surprise Yourself in 5 years

You’ll see why your returns could exceed your wildest expectations. Bitcoin prices never return to previous cycle lows.

Source — Raoul Pal — YouTube

Raoul Pal has a broad and deep understanding of financial markets.

He is often called the leading Business Cycle Economist and Economic Historian.

The Economic Historian part is down to his ability to break down complex ideas and uses clever historical references to describe what may happen in financial markets.

He’s eerily accurate (most of the time) and easily explains his points so that the person on the street can understand.

It’s also no secret that Raoul Pal is a Cryptocurrency maximalist.

Pal, who retired momentarily in his 30s and is a former Goldman Sachs employee, says this panic cycle in Cryptocurrency is unlike anything in his career.

While negative sentiment across Crypto is at all-time highs, he says that fundamentals and the story of blockchain technology haven’t changed.

Raoul Pal — Source

“We’ve got peak freak-out because the earthquake happened, and everybody’s hypersensitive.

I’ve never in my career seen sentiment like this, both in Crypto and the stock market.

Twitter is so bad.

I put up a relatively bullish chart, just marginally bullish, to say maybe the NASDAQ has priced in a significant recession.

I must have had 100 comments of anger. How dare I suggest that?

Pal believes nothing has changed in the narrative and says investors should take a long-term approach to Crypto investing, buying during panic dips and holding onto their assets for compounded gains in the future.

He also compares it to previous cycles, saying that adoption keeps increasing despite price decreases.

Raoul Pal — Source

“If you look at the past cycle, the 2017 peak to the low in 2019, we lost about 80% of the active wallet addresses.

When I look at it now, we’ve lost about 30% because the adoption keeps rising.”

Everything Will Fall Into Place When You Understand Crypto Cycles and Avoid Leverage.

Crypto markets are cyclical, and the price usually trends in line with the Bitcoin halving, which happens every four years. With sentiment usually being positive in the run-up to each halving.

Halving cuts the Bitcoin miners’ rewards in half and halves the rate at which new Bitcoin gets released into circulation.

Cycles usually follow a pattern of four stages.

Accumulation phase

2. Run-Up Phase (Bull Market)

3. Distribution Phase

4. Run-Down Phase (Bear Market)

Raoul Pal believes that two things dictate the market’s cycle.

Value of the technology

Global liquidity

When liquidity dries up, people have less money to invest in assets, which leads to boom and bust cycles.

Pal believes that the armchair quarterbacks who say Crypto is a Ponzi scheme after they react to price fluctuations will be buying Bitcoin and Ethereum during the next cycle.

Raoul Pal — Source

“Crypto is cyclical. Always has been. Its value is derived from a simple formula: Value of the underlying technology + Global Liquidity.

The global liquidity cycle leads to large boom and busts in the space.

Each time we have a boom, everyone not in the space yells “Bubble!” and true enough; eventually, prices collapse, and we get to the “It’s all a scam! It’s a Ponzi! It’s never coming back!” phase of the cycle.”

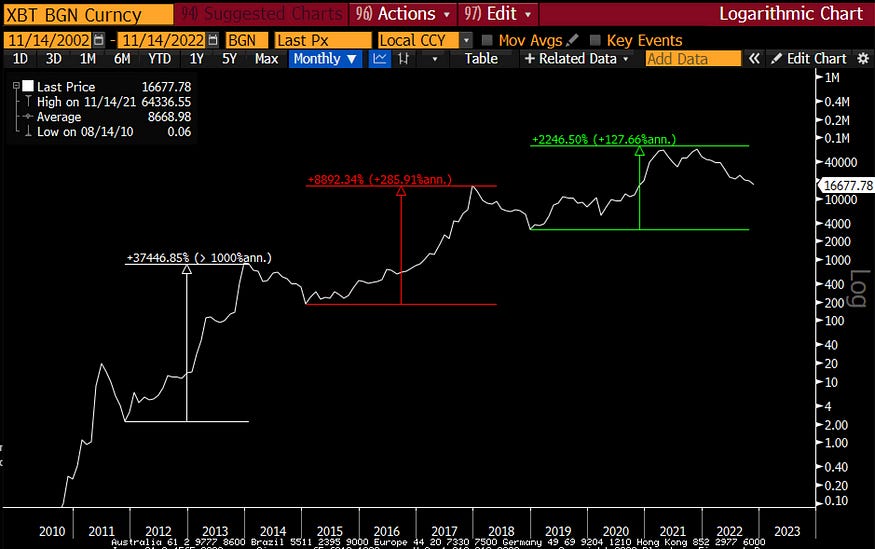

Raoul Pal says this isn’t true and that if you look at the charts, you’ll see the prices never return to previous market lows.

He outlines several events that had happened in the past when every single time, the market recovered and went over previous all-time highs.

2011 prices fell 92% because of the Mt Gox hack.

2013 prices fell 85%. People yelled ponzi scam.

2018 prices fell 83% because of the ICO crash.

Current — FTX lost their $32 billion net worth overnight, slumping the entire cryptocurrency market.

Pal says people tend to leave the space and return during the next bull run. But he sees data of fewer people leaving the space and blames the main culprit on people using leverage, other than lack of liquidity.

He’s adamant that using leverage in Cryptocurrency is a lousy strategy. Because you only need to be wrong once to be wiped out.

He also points out that the corrections in Cryptocurrency are just too frequent and significant to be able to manage risk.

Raoul Pal — Source

“This brings me on to leverage.

It’s almost impossible to manage open-ended leveraged balance sheets when the collateral falls 80% or your cashflows fall 50% over the cycle.

Also, retail investors shouldn’t use naked leverage as large price swings are frequent, and you lose your capital fast.

The global money supply drives the boom/bust phase. When money is tight, people go bust.

Also, there is less money for speculation. This is when the tide goes out, and you can see who is swimming naked.”

The Only Metric You Should Look for Is Adoption.

Raoul Pal says the Ponzi Scam comments from people outside the industry are nonsense and getting tiresome.

In a recent tweet, he explains his point using the Bitcoin chart, saying that Bitcoin’s growing by 125% yearly.

Raoul Pal — Source

“Scam! Ponzi” is getting tiresome.

It’s nonsense and hides the fact that the network growth in Bitcoin (taken from using the low to low) is up 125% year on year, which is astonishing growth.”

Below, the Bitcoin chart measures each new low, beating the previous high dating back to 2012.

Unlike other assets, Pal says each low leads to substantial price increases because Bitcoin is still going through this discovery and adoption phase.

He says the liquidity always comes back, and the network keeps growing.

Raoul Pal — Source

“Liquidity will soon turn.

You don’t need a super cycle of liquidity like 2020, just a positive cycle for Crypto to perform as the network grows.

Here we are again.

Somewhere near the bottom, the lows of despair are pervasive as everyone loses their minds, just as they did at the bottom phase of each previous cycle, but the network keeps growing over time.”

Pal says it’s a game of survival and that you should try and go against the grain of market sentiment by adding to your position because, as he says, you may surprise yourself beyond your wildest dreams by the end of the decade.

Raoul Pal — Source

“It’s a game of survival.

Have a long-term time horizon. Add to your position on the despair lows.

You’ll never get the exact low.

Don’t use leverage. Store your sh*t on a cold wallet. Stay in the game.

Filter out all the noise. The “Scam! Ponzi!” crowd will be buyers in the next cycle.

Repeat.”

Final Thoughts.

Pal has been wrong on a few occasions with his predictions. And he’ll most likely be wrong many times in the future.

The overall message he’s putting across is one I agree with entirely.

He suggests not using leverage because the space is still volatile, and being wiped out puts you back too far.

In addition, because of the swings in the market over time, you usually always get an excellent entry point.

Stay patient, buy when others are fearful and don’t use leverage.