Raoul Pal Talks About Crypto Often, Every Time He Does, It's Life-Changing.

His investing insight redefined my crypto journey.

I enjoyed writing this piece on one of the best macro investors in the space. His quintessentially British style always grabs my attention.

A big thank you to all my new subscribers. Today’s newsletter is made possible with the support of my paying subscribers.

Paid subscribers have direct access to me for questions or comments on my posts, and as a little bonus, I’m offering a 40% discount on the annual subscription.

If cost is a concern, feel free to drop me a message. I’m here to help!

Raoul Pal reminds me of that guy at the bar everyone gravitates to.

His cliche-free crypto investing advice rewired my thinking.

The former Goldman Sachs bond trader breaks down complex and, let's be honest, sometimes boring finance topics and turns them into edge-of-your-seat viewing — all while he gets trollied sipping wine live on YouTube.

Pal once said:

“What happens during this time in the cycle, which is Crypto summer, is people lose their f*cking minds because everything goes bananas.”

He means that when prices shoot up exponentially, people tend to trade in and out of assets, chasing the next pump instead of staying concentrated.

If you've never witnessed a god candle where your crypto skyrockets on the chart, you might believe that trading out of your position isn't something you'll do. But trust me, it's easier than you think. I've got my wallet of shame to prove it.

When the dust settles, and you pull out the abacus to tally things up during that endless bear market downtime, you realise you didn't make a dime.

So, why the hell not?

The lesson from all this, dating back to when I first bought Bitcoin in 2017, is that you must have a mental framework or a set of rules.

It's easy to get caught in an echo chamber of people saying, "This time, it's a super cycle", or convincing you that Cardano and XRP are the holy grail.

I've found that staying concentrated on your highest conviction bets — where you've thoroughly tested the thesis — works better than chasing every narrative.

Just stick to your guns and hold that position. As Pal says below, some folks can move further down the risk curve and nail it, but they're few and far between.

“Central banks have taken the left tail out by saying we can’t let collateral fall too far, so we will debase currency. Holy hell, if that’s the case, then we have the simplest, easiest risk-taking opportunity of all time. Hyper-concentration, I think, is the way.

There are people who can do the tail part — and get it right — but the probability is lower, and then you break the first rule, which is don’t mess it up.

If you get taken out in the cycle and lose your capital while this cycle shifts from $2.5 trillion to $100 trillion, that’s bad.”

Be a mercenary with your own money.

Being a mercenary with your money means not falling in love with a philosophy like:

"Bitcoin is the only true digital asset."

"Ethereum is ultra-sound money."

"Solana is an Ethereum killer."

“SUI is a Solana killer.”

It's all total nonsense — riddles people create online to justify what they've thrown their money at.

Given the current adoption rate, the space will go from $2 trillion this cycle to $100 trillion by 2030.

Your only job is to capture as much of that trend as possible while remaining open-minded to new networks and not marrying your bags.

Raoul Pal has been singing Solana's praises from the rooftops and crushed the SOL trade with an average purchase price of $30.

Now, he's stepping back and questioning the next big trade.

“I’m a mercenary when it comes to my own money.

I have for a while been thinking is that this (SUI) might be one of the chosen ones and the reason being is that the team is world-class.

They built a scalable blockchain suitable for 3 billion people, they have the latency of the chain down to 600 milliseconds.

They are just capturing mindshare, now don’t forget this is a low float high fdv. You’re gonna love them in a bull market and hate them again in a bear market because they’re super BETA.

They seem to be executing well, and people are looking for the next big trade. It feels like it’s got everything right.

I don’t see anything else that is going to dominate.”

Keep your eyes on this one crucial metric.

Peg yourself to a time horizon.

It helps you size your position and acts like a GPS to the finish line.

If you don't have one, which most folks haven't clearly defined, It's like hitting the road without a destination.

Setting my time horizon became the backbone of my investing strategy, allowing me to work backwards from that endpoint and determine how much capital I could allocate.

In the past, I would impulsively chase pumps and add to my position out of FOMO.

This cycle, I've set it and tried to forget it. I plan to cash in one-third of my holdings by December, right after the November 5th election, and let the rest ride into 2025.

That's my framework based on data from previous cycles and current global liquidity.

If we go on a golden run, I might take another 30% off the table sometime deep into 2025.

Author’s note: I’ll be sharing updates with my paid subscribers first on how to exit and when to re-enter your position. Upgrading to a paid subscription is definitely worth it — it also helps our newsletter grow and allow me to keep improving the content.

My time horizon keeps me in control and prevents me from panicking over short-term market fluctuations, allowing me to enjoy life outside of staring at a chart.

Here was Raoul Pal's take on 'time horizon' when BTC was at $25k.

“One of the key aspects of markets and investing is the time horizon. It’s the timeframe within which you expect your trade to play out.

For instance, if you believe Bitcoin is headed for $100k, the real question is: by when? The path it takes is often very volatile, so if it’s a long-term trend, you might allocate less money because you need to account for swings, capturing the 60% to 70% downturns to benefit from the upside.

I believe BTC might reach $100k in the next year, but we could see a 50% drawdown. However, if it’s going to 4x, that gives an 8-to-1 risk-reward ratio.

But since it could go down, I size my position accordingly, factoring in how long I expect my trade to take.

Generally, you shouldn’t mess with your time horizon. Once you establish it and size your trades around it, you need to let it play out — otherwise, you’ll end up trading short-term moves instead of focusing on the long-term trend you’re aiming for.”

Buy the sell-off.

I'm diving head-first into my 3rd cycle.

One thing that never changes in Crypto is that it always allows you to play catch up.

During the bull market of 2021, when prices shot to Mars — like one of Elon's rockets, we saw 13 aggressive corrections that would have given you some fantastic entry points.

In the early days of my crypto journey, I had a childlike mindset — caught up in wishful thinking: "If only I had sold at the peak, stashed the cash, and bought back in at the bottom."

This kind of thinking usually kicks in after a brutal 75% correction. It's pure fantasy, a fairy tale that leads nowhere.

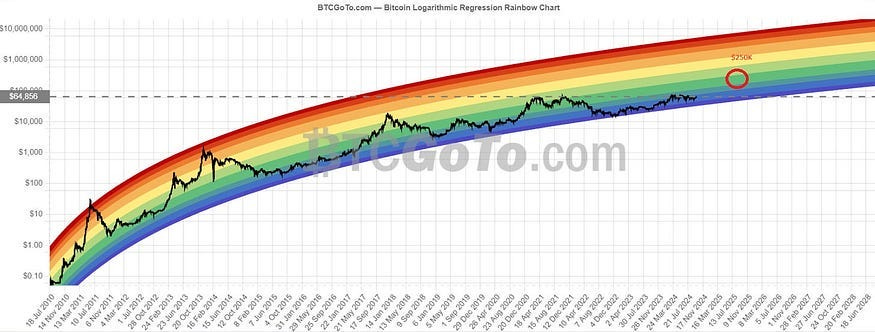

Crypto is on a macro upward trend.

Despite the highs and lows, each peak is higher than the last. It might look like a bubble on a standard chart, but when you zoom out to see the trend, those fluctuations are just minor blips in the grand scheme of this colossal movement.

The Bitcoin log trend indicates that each upward leg is approximately a factor of 10. As a base case, the next leg up will be around $250K for one BTC.

Pal says to focus on compounding.

“If you think about them right, the drawdowns are a feature and a benefit. Had I just added my typical investment each time we had one of these massive drawdowns in the previous two cycles, I would have done 25 times better because of the compounding effect.”

Even if you sell the top, you won't put the money back in.

Selling at the market peak and bailing out of Crypto — the fastest-growing asset class since the internet — is a surefire way to lose. Let me explain.

People get weird when money's on the line.

If you toss in $10,000 and it skyrockets to $100,000, then sell everything thinking you're a genius, there's no way you'll reinvest that $100,000. You'll be terrified of losing it. You might dip back in at $20,000, max.

Then, when the market decides to surge again, you'll find yourself scrambling to catch a moving target.

That's why I don't stress about timing the top.

Compounding over time and consistently chipping away at my investments means I get a solid night's sleep and watch my crypto bags grow exponentially.

Uncle Raoul says the Crypto market cap could jump from $2.5 trillion to $15 trillion this cycle and reach over $100 trillion by 2030, so think of the downtrends as a gift to keep adding so you can enjoy the compounding benefits.

Patience is key.

“I just look at the growth of the space, and it grows at 100 and something percent a year, which is twice the speed of the internet because obviously it’s built on internet rails, so it should go quickly.

I just extrapolate that trend out and think, well, it’s a $2.5 trillion space today. If we carry on, by 2032, it’s 100 trillion. I’m like, that’s the largest accumulation of wealth in all human history in the shortest period of time.

Even if I’m wrong by 50%, because I’m a total idiot, it’s the same as 100 years of value creation of the S&P 500 in eight years, right? It’s bananas!

It’s because we can own this adoption layer and all of these businesses selling block space. That’s all it’s about. The best thing is just to try and capture that growth.

If you’re going to do anything in this space, focus on just one thing — capture that leap from $2.5 trillion to $100 trillion, and you’ll be absolutely fine.”

You don't make money through a philosophy.

Realising that I should focus on newer networks each cycle, as they have fewer people, was a game-changer.

If you've got 100 people in a network and one more joins, that's just a 1% increase — not exactly groundbreaking. But if you have 1 person in a network and another joins, suddenly you're looking at a 100% increase, and that starts to become formidable.

So, smaller networks have more significant increases. Caveated with: you're trying to find smaller networks that are being adopted and are the best risk-adjusted investments.

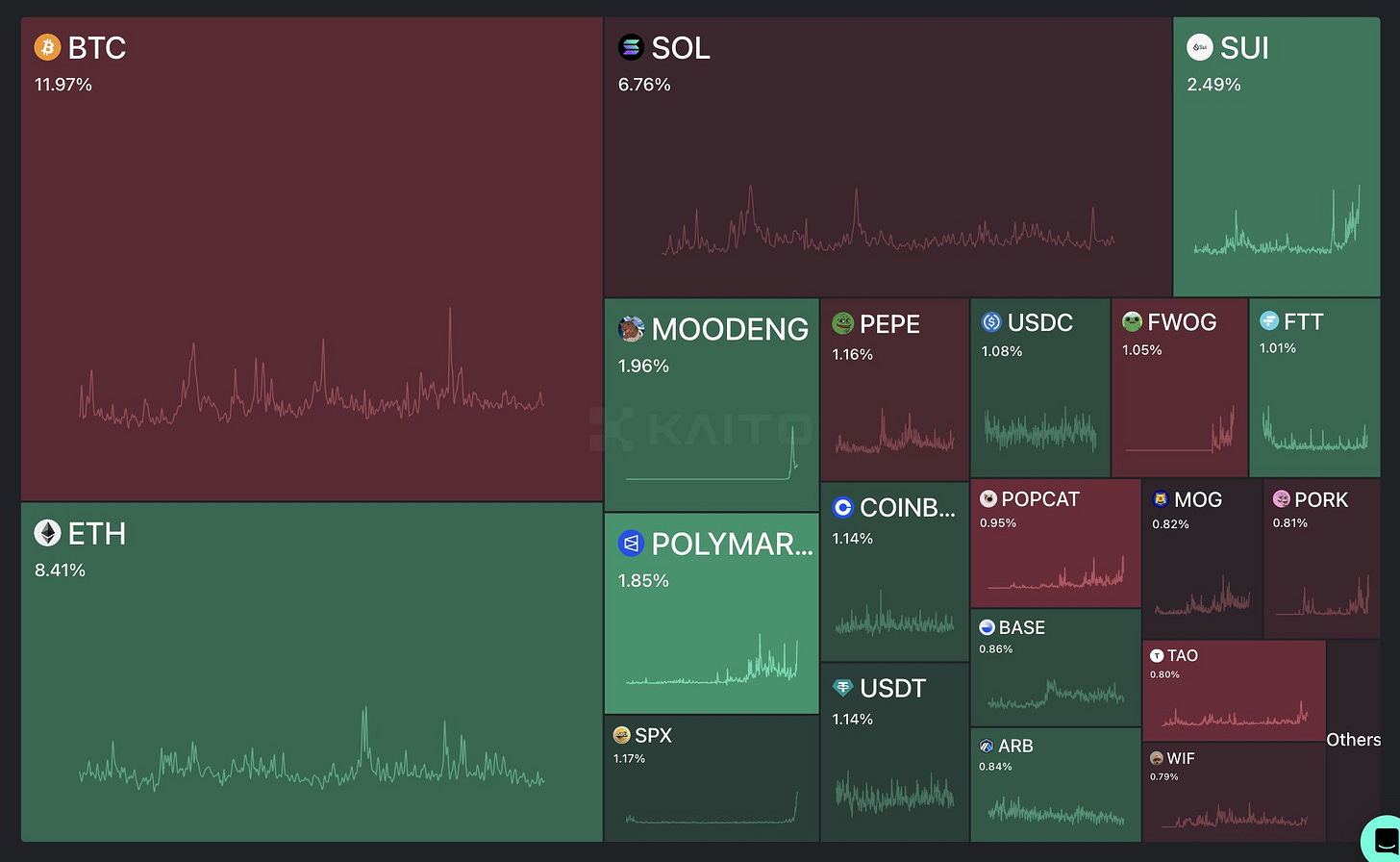

For me, that's Solana because it makes up 60%+ of all crypto transaction volume, its user experience is amazing, and it has a mix of dominant mindshare and small market cap, which is a major sweet spot.

Data based on social media sentiment.

It's climbed into the top three alongside BTC and ETH as the third most adopted network, but its market cap is still a cycle behind ETH's.

ETH hit $600 billion last cycle, while SOL currently sits at around $60 billion. That's a potential 10x from here. I'm not claiming it will happen, but it gives you a sense of the context.

“I try to explain this to people a lot. I don’t care what people’s philosophies are — that’s not how you make money. What you make money on is owning the best-performing asset on a risk-adjusted basis.

What I tend to find is that the mid to upper part of the curve — networks gaining adoption — tend to do best in this cycle. Whoever it’s going to be this cycle, whether it’s Solana or NEAR or whatever it is — we will see but this is the easiest opportunity we get in this space to generate wealth.

If we’re going from $2.5 trillion to $100 trillion, just do that, and you’ll make a lot of money. I filter out as many people as possible. I really only listen to a few voices. If you tweet something, I’ll always read it because you have a high signal-to-noise ratio.

Most people are high noise to signal. I try to observe sentiment and any nuggets, but I filter out as much as possible and just stick with what shows that network adoption isn’t slowing.

So, I capture the trend. I don’t FOMO into the rest. I don’t spread my investments. What I do now is really simple — it’s idiot-proof. I just put said chart against Solana. If something looks like it’s on a sustained trend compared to Solana, I’ll allocate some capital to it.

I’ll only do that with about 10% of my portfolio.”

Final Thoughts.

Most of what Raoul Pal says comes down to managing your thinking.

It's simple yet life-changing advice if you implement it.

Central banks have eliminated left tail risk, making this the perfect opportunity to invest in crypto — but stay concentrated in the mix of the top 3–5 assets.

Be a mercenary with your money and follow the momentum—don't get caught up in mini cohorts of people who say a token is good based on a philosophy.

Set a fixed time horizon to save yourself from making impulsive decisions.

Buy the sell-offs — or, as Raoul says, "Buy the f*cking dip."

Forget the fantasy of timing the top and selling to buy the bottom. Instead, focus on compounding gains over time.

Listen to smart money investors, and again — avoid the echo chambers of nonsense.

The space is headed for $100 trillion, so capture that value by sticking with the top three to five assets.

It's investing advice that defined my journey.

Thank you Jayden once more a brilliant article.

I look forward to the coming ones.

😉🙏🏻✨️