Renowned Personal Finance Expert Warns: The Stock Market’s Rug Is About to Be Yanked Out From Under You

Here’s where you should be investing your money.

Photo By Gage Skidmore on Flikr

There’s a reason I referred to Rob Kiyosaki as a World Class Personal Finance Author.

One because he is, he struck Gold with his world-renowned book, Rich Dad, Poor Dad.

And Two, after lengthy research, it’s challenging to see any business success behind him to warrant referring to him as a World Class Business Person, let alone publishing a book on business advice.

Nevertheless, Rich Dad Poor Dad became an international best seller after Kiyosaki appeared on Oprah, an opportunity that nearly didn’t happen because he refused to disclose who Rich Dad was in his book.

Kiyosaki had formidable support before the book’s release as he sold it through the controversial Network Marketing company Amway.

Short for American Way.

U.K. regulators banned Amway from operating in the U.K. after discovering the company made more money selling business education than it did from actual business operations.

Amway’s business style shares a similar theme to Rob Kiyosaki’s business career by maximising profits from people who want to better their lives.

I wrote a lengthy blog on Kiyosaki when he commented about Bitcoin being something you should invest in, and the entire blog is here.

Rob Kiyosaki’s Bitcoin Message to Millennials Has a Greater Impact on You Than His Book

In this blog, we’ll examine Kiyosaki’s perspective on the stock market and assess the credibility of his views.

I’ll save you the mental arithmetic and wading through paragraphs of sentences and give you my opinion immediately.

You don’t earn Kiyosaki’s wealth through luck, but he is an astute marketer who plays off of people’s fear of being Poor and their aspirations of becoming Rich.

If you listen to him speak, it’s almost as if the poor are a different breed of people.

In his mind, it’s Doomsday or a Beverly Hills mansion. There’s no middle ground or semblance of balance in anything he says.

Why? Balance doesn’t appeal to people’s aspirations or hook them into gaining YouTube views, leading to Book sales and sold-out seminars.

Kiyosaki is no fool and has an expert way of explaining complex topics that are easy to understand, perfectly illustrating his book’s global success.

Buckle up, strap yourself in and let’s get into it.

Stock Market.

Kiyosaki says that when he was a kid, no one touched stocks.

The stock market was for gamblers, and everyone preferred government bonds because they received a fixed interest return.

A government bond is a debt obligation issued by a national government to support its spending. It generally includes a commitment to pay periodic interest to people who purchase them.

Lending overtime has got cheaper, but so have the returns on Government bonds. Kiyosaki recalls Bonds giving you 16% return at one time.

Rob Kiyosaki — Source

“When I was a kid, no one touched stocks. Only Gamblers were in the Stock market. Everyone else was in bonds.

Bonds were safer.

So the government devised 401K plans to force the Baby Boomers into the stock market.

And who controls the stock market, the central banks, the treasury and Wall St”.

All these Baby Boomers have been ‘Set Up’ as you and I know the government will pull the rug out from under you.

They are criminals.”

Kiyosaki believes that when the government reduced bond prices and borrowing was cheaper, it raised the stock market prices.

The relationship between bonds dropping and the stock prices increasing was down to people borrowing money to buy back stocks, which increased their stock prices.

Kiyosaki says governments are now stealing people’s pensions.

Rob Kiyosaki — Source

“If the government promised my dad a thousand dollars a month for his pension, they had to give him the thousand dollars a month.

However, in 1974 pensions shifted from a set amount to a defined contribution”.

If you have a defined pension contribution, your monthly payments go into a fund that invests in the stock market.

This fund usually achieves growth over the long term, but its value can fluctuate wildly due to booms and busts in a short time horizon.

Until 2020, the market enjoyed a boom period, and everyone’s pension savings grew faster than ever. Then the coronavirus crisis came along, and the markets suffered their second-biggest loss of all time and have been crashing ever since.

If you are retiring soon, this could be cause for concern, and it’s what Kiyosaki is highlighting.

Kiyosaki Fears The Worst.

He says the companies that borrowed money to buy back their stock will be in trouble if bond prices increase.

Rob Kiyosaki - Source

“These executives borrowed money because it was cheap to borrow and buy back their stock.

100 of the 500 S&P companies are zombies because they have been borrowing money to propel their stock prices.

Their stock market price is so high because they kept borrowing money to prop up the stock market.

If they raise the bond prices, then 100 companies which make up 20% of the S&P500 will crash because they don’t make enough money to pay off the debt they owe”.

Kiyosaki Says Here’s Where You Should Invest Your Money.

Kiyosaki says he doesn’t need to buy stocks, nor should you.

He believes he can create his assets and invest in private companies.

Rob Kiyosaki — Source

“I don’t need to buy a stock because I can create my assets, be an entrepreneur, and make my own companies.

And I only invest in private companies, not public companies”.

Kiyosaki says you must forget about the stock market and invest in the below.

Bitcoin

Gold

Silver

Ethereum

Rob Kiyosaki — Source

“I go on about Gold, Silver, Bitcoin and Ethereum because I do not trust the money markets, the stock markets and the central bank.

There’s a genuine difference between the stock market and Bitcoin”.

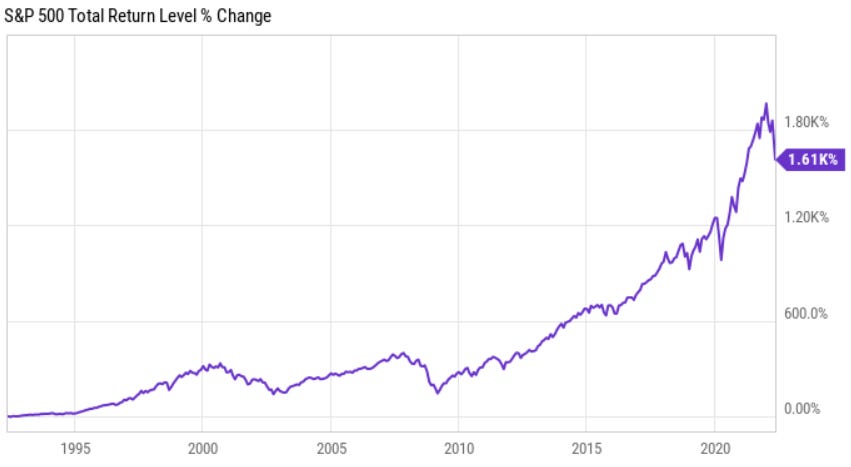

Here is the current performance of the S&P 500, which in the short term proves Kiyosaki’s thesis right.

Granted, other global issues are at play, like record inflation, a war in Europe and excessive gas prices, but this decline is making 2008’s housing crash and subsequent stock market crash look like a bump in the road.

Final Thoughts.

Kiyosaki’s opposing sentiments about the stock market have been a constant theme, so he isn’t just reacting to recent events and trying to gain some “I told you so” popularity vote.

Most of what he says about governments is correct.

It’s hard to trust a financial system where you can’t accurately know what will happen.

His predictions and comparisons of the stock market being a borderline crime syndicate are reaching at best.

If you’re betting on America disappearing, you should probably bet against the stock market.

With the rest of the world, America has been through World Wars and monumental changes in the financial system, a lot worse than we face today, and it’s still around to tell the tale.

The 500 leading publicly traded companies in the U.S. show average yearly returns from 1928 to 2021 of 11.82%.

If you had invested $10,000 in the S&P 500 index in 1992, 30 years ago and reinvested dividends, you’d now have more than $170,000.

Recent volatility aside, the index has proven to be a winner over the long term, somewhat contradicting Kiyosaki’s sweeping statement about the stock market.