Rob Kiyosaki: If You Understood the Eye Drop Theory, You’d Realise How Quickly America’s Debt Crisis Will Wipe You and Your Investments Out.

Now is the time to consider investing in hard assets governments can’t control, like Buying Gold, Silver, and Bitcoin.

America is drowning in an ocean of Debt.

According to Robert Kiyosaki, the last few eye drops of water (Debt) are about to overflow into the economy, collapsing everything.

It’s the only way to describe America’s predicament, but people are unaware of how exponentially bad this can get.

Kiyosaki is a controversial no-nonsense businessman who wrote one of the best finance books in history.

Rich Dad, Poor Dad, became a massive success mostly down to its clear and jargon-free message.

What stuck out to me most was not the advice of using Debt to avoid paying taxes or buying assets instead of liabilities. It was the polarising distinction Kiyosaki makes between rich and poor people.

It’s as if the Rich and Poor are two different breeds of human beings. And you never want to be poor.

But credit where it’s due, Kiyosaki is an incredible storyteller. His lead marketing tactic is fear. You see this play out in his online content too.

He’s been sounding the alarm about the fed nuking the dollar for some time now, and now he’s saying it’s all about to play out.

He says to protect yourself; you should be investing in hard assets. Gold, Bitcoin and Silver.

Let’s dive into it.

Imagine You Have a Magic Eye Dropper That Doubles in Volume Every Minute.

In a recent interview with Adam Taggart, Kiyosaki discusses an insightful analogy related to the U.S. debt burden and how quickly it can creep up on you and wipe away your spending and investing power.

Imagine for a second.

You’re in a baseball stadium with a Magic Eye dropper. It can be any stadium.

Now imagine yourself walking to the pitcher’s mound, and you squeeze out a single drop of water on the pitcher’s mound, and that drop of water doubles in volume every minute.

So, minute one, it’s one drop in size.

Minute two, two drops in size.

Minute three, four drops

Minute four, eight drops

Etc.

If you got handcuffed to the topmost bleacher seat in the stadium, how long would you have to escape your handcuffs before the stadium was underwater?

Most people will say, ‘I don’t know, years, months.’ The answer is astonishing.

It’s 45 minutes.

It’s much less time than you might imagine.

That’s because when it doubles, each doubling is bigger than all the increases that came before it.

The fascinating part is the doubling is only noticeable once it starts to have catastrophic effects.

Everything is hunky dory until around minute 40.

So you don’t notice any issues for 90% of the 45 minutes. You’ll see the water building up but think the can is so far down the road.

When you finally see a problem, the stadium’s filled just a few minutes later. When you realise an issue, it’s too late to avoid it.

Your only choice at that point is to manage the impact. And it’s what Kiyosaki is saying about the debt ceiling and borrowing that America has done.

You have to manage the impact.

Let’s dive into what you can do.

America Is Drowning in Debt, and It’s Ugly.

Kiyosaki is a student of history. Anytime you hear him speak, he uses historical references to make his point.

He also goes in-depth with data and highlights a major concern: America has borrowed so much money with inflation increasing and interest rates increasing they only have two options.

Default on their payments in the future

Or print more money into existence.

Both scenarios will result in terrible outcomes, but with political pressure, politicians will likely print more money, increase taxes, and result in less government spending and investments.

Federal Debt has two categories: Debt held by the public and intragovernmental holdings.

Since 2013, the Debt held by the public increased by 114%, while intragovernmental holdings increased by 42%.

People are borrowing more.

The federal government pays interest on borrowed money, just like individuals pay interest on car loans or mortgages.

The amount the government pays in interest depends on the total national Debt and the interest rates on securities. Currently, it costs $530 billion to maintain the Debt, which is 13% of total federal spending as of May 2023.

Over the past decade, the national Debt has increased each year. Despite that, interest expenses have remained stable due to low-interest rates and investors’ confidence in the U.S. Government’s low risk of default.

However, recent increases in interest rates and inflation are now causing an increase in interest expenses.

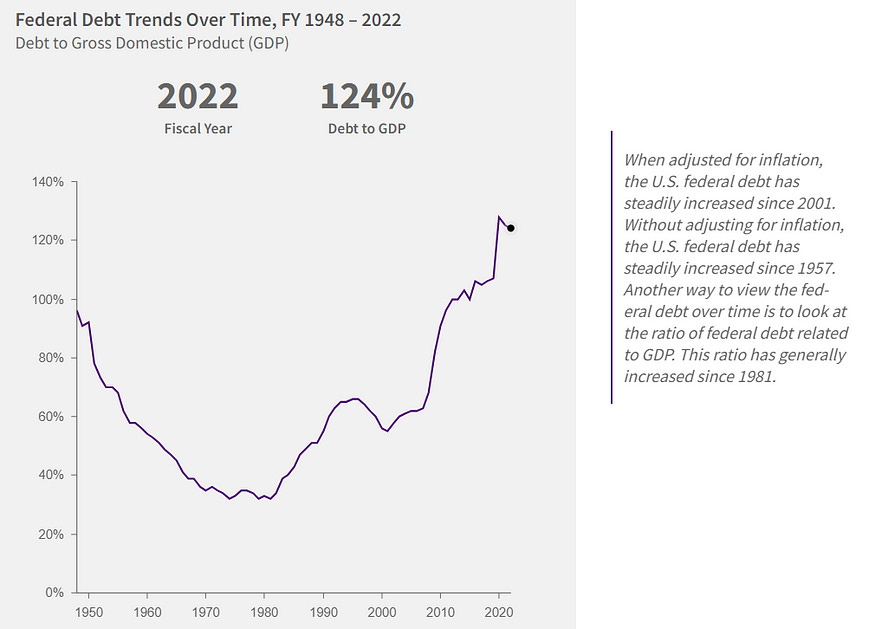

Comparing a country’s Debt to its gross domestic product (GDP) shows its ability to repay the Debt.

It’s an important ratio because it indicates the debt burden relative to the country’s economic output.

The U.S. debt-to-GDP ratio exceeded 100% in 2013 when Debt and GDP were around $16.7 trillion. It’s now at 124%. In other words, Americans borrow more money than their productivity as a country.

This ratio provides a clearer picture of a country’s financial situation compared to looking at the national debt number alone, and it’s f*cking scary.

The Biggest Crash in History Is Here, Ready To Wipe Your Investments Out.

Kiyosaki indulges in doomsday recession porn more than anyone else on the internet.

This time he’s rightly concerned about the plummeting dollar and its devastating effect on your investments.

He says the issue doesn’t lie in the traditional banking system but in the shadow banking system. In 2008, the Federal Reserve had to print an enormous $4.5 trillion to address the crisis.

During the pandemic, the Federal Reserve printed approximately $3.3 trillion in 2020 alone.

As a result of money printing, the dollar’s purchasing power has decreased, leading to its gradual decline.

Now, we face a critical predicament: either inflate it away or restructure it in the worst case. Both options are terrible.

Kiyosaki says there is only one thing left for you to do: invest in hard assets the government can’t control.

Buy Gold, Silver and Bitcoin.

He says you should prepare for a crash in the economy, the likes of which we’ve never seen since 2008 and the great depression.

Robert Kiyosaki — Source

“Greatest Real Estate crash ever. 2008 was the Global Financial Crisis. 2023 will make the 2008 Global Financial Crisis look like nothing.

In 2019 Office Towers in San Francisco were hot. In 2023 same buildings have lost 70% of their value. What will WOKE cities do with office buildings? Homes for the homeless.

Cities are dying. Driving across Phoenix, one of the fastest-growing cities in America, I noticed many small businesses shuttered and out of business. Cities in America are going the way of San Francisco. This happens when America has weak, woke, liberal leaders like Biden.

Sitting in my favourite Japanese restaurant. The food is great, and prices are low. The place is empty on Sat night. Employees do not have to be economists to know something is wrong.

More banks are about to fail. Rumour Mortgage giant Loan Depot is on the ropes. Regional banks and mortgage companies are falling.

Please be smart. Don’t believe Biden, Yellin, Fed.

Prepare for the crash.

Buy Gold, Silver, and Bitcoin.”

Final Thoughts.

The eye drop analogy perfectly illustrates how exponentially bad and quick circumstances can escalate.

If you’ve been following my content, you’ll know that I share the viewpoint of Robert Kiyosaki regarding the importance of investing in Bitcoin to protect your wealth from the devaluation of the dollar resulting from money printing.

Bitcoin operates on a decentralised network independent of any central authority or government manipulation.

Its limited supply and predetermined issuance (21 Million BTC) make it resistant to inflationary pressures that can erode the value of traditional fiat currencies.

While we’re on the same page with Bitcoin, I have no interest in holding physical Gold or Silver in a vault or hanging onto the digital receipt in my email inbox, hoping it’ll increase in price, as Kiyosaki suggests.

He says Gold was around when God created the earth.

And it’ll be about for hundreds more years.

Maybe he’s right.

Make your own choices.