Rob Kiyosaki’s Twisted Bitcoin Message Might Impact You More Than His World-Renowned Book Source.

Understanding who he is should be your first step before taking his advice.

Source — YouTube

Have you noticed a disproportionate amount of videos about Robert Kiyosaki popping up on your YouTube and Facebook feeds lately?

If you have, it’s happened to me too.

Kiyosaki has been discussing cryptocurrencies like Bitcoin a lot lately.

If you watch one of his videos, the YouTube algorithm will suggest more and more of them.

Kiyosaki is a businessman who wrote the book “Rich Dad, Poor Dad,” which talks about the difference between assets and liabilities and how poor people tend to buy liabilities.

In contrast, rich people buy assets.

It’s a popular book because it explains financial concepts in a way that’s easy to understand and free of confusing jargon.

In his videos, Kiyosaki often talks about the divide between rich and poor, as if they are two completely different breeds of people.

He creates catchy titles for his videos designed to grab your attention and encourage you to watch until the end, which most likely leads to product sales.

He’s an intelligent marketer who wants to increase his brand exposure, and he’s known for disliking the stock market and the education system.

When asked why some people are poor, he famously replied

Robert Kiyosaki:

“PhD stands for Poor Helpless and Desperate.”

“The riskiest thing you can do is go to school, learn from a fake teacher and put your money with a financial planner, work hard for a lot of fake money and pay a lot of taxes.”

“The fakest teachers are financial planners who tell you to save money and invest in the stock market. Why would you save money when the government is printing money?”

“You look at all the pensions, the teachers, firefighters and the guys with 401 K’s; they’re all bankrupt because everyone’s stolen their money.”

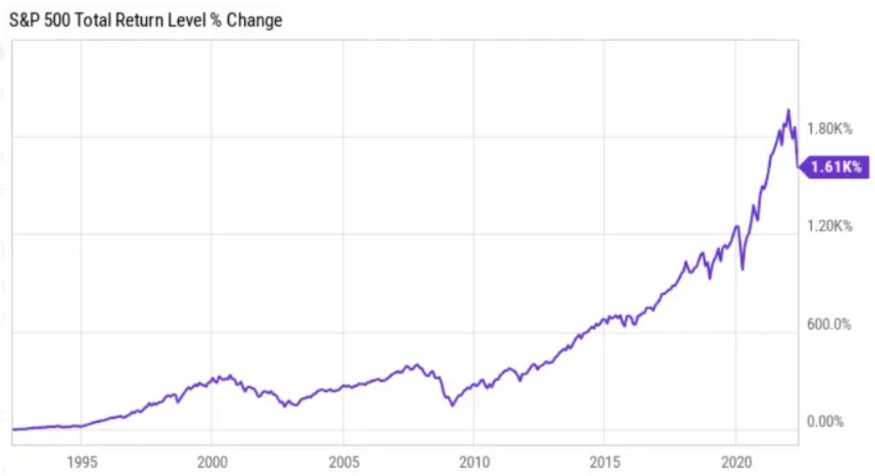

94 Years of Stock Market Data

Like me, you or anyone else can give your opinion, but there is no hiding place for data.

If you had invested $10,000 in the S&P 500 index, a market index of 500 leading publicly traded companies in the U.S., in 1992 and reinvested dividends, you would now have more than $170,000.

This index has shown average yearly returns of 11.82% from 1928 to 2021. Although there have been recent declines due to market volatility, the S&P 500 has generally performed well over the long term.

You’ll see in the below chart that the data contradicts Kiyosaki’s stock market thesis with a steady uptick in performance over the last 30 years.

You Should Take a Deeper Dive Into Kiyosaki’s Business Success. It’s Not Pretty.

You might wonder if Kiyosaki is a good businessman or if he became wealthy by selling aspirational lifestyles to millennials and boomers.

It’s worth noting that Kiyosaki is a clever marketer who often plays off fear to get attention.

Kiyosaki’s first business idea came from surfing in Hawaii, where he grew up. He noticed surfers needed help with where to put their wallets while surfing, so in 1977, he started a company called Rippers that made the first nylon and Velcro surfer wallets.

This business was successful initially, and Kiyosaki has claimed that it made him a millionaire at age 30, although this is unconfirmed.

Rippers eventually went bankrupt because Kiyosaki failed to get the necessary patents and trademarks for the wallets.

After this business failed, Kiyosaki invested what money he had in property and small-cap stocks, which led him to accumulate over $1 million in debt.

Also slightly contradicting his recent statements about the stock market.

Kiyosaki then started a new company that made t-shirts and hats and licensed other products, but this company also went bankrupt in 1980.

Despite these failures, Kiyosaki didn’t let them deter him.

In 1985, he launched an education company that taught entrepreneurship and investing.

Still, at that point, you needed help to see his necessary experience and success to warrant offering business education to the masses.

You may be wondering what Kiyosaki’s most significant business success was. In 1994, he sold his education company for an unknown amount, which was his first big win.

His most considerable success came later when he self-published the book “Rich Dad, Poor Dad,” which had been rejected by multiple publishers.

The book gained popularity thanks to Kiyosaki’s partnership with Amway, a multi-level network marketing company.

Controversially in 2007, Amway’s business operations in the U.K. were halted by regulators, who claimed that the company had exaggerated income claims and made more money from selling educational materials to distributors than from selling products directly.

Uncovering the Sources of Kiyosaki’s Financial Success.

You might be surprised to learn that most of Kiyosaki’s fortune is not from book sales.

In 1997, he founded Cash Flow Technologies Inc and Rich Global LLC.

He used the popularity of “Rich Dad, Poor Dad” to attract people to his high-priced seminars, where he made most of his wealth.

At first, Kiyosaki held workshops and charged $12k-$50K per person.

Later, Kiyosaki made a deal with a company called Learning Annex to promote his seminars.

Unsurprisingly he failed to pay Learning Annex and secretly made another deal with Whitney International while still in contract with Learning Annex.

Rich Global LLC ended up being Kiyosaki’s third company out of four to go bankrupt after a jury ordered him to pay $24 million to Learning Annex and its founder, Bill Zanker.

The jury ruled that a share of his profits should have gone to Learning Annex for using their platform for speaking engagements.

Don’t Save Your Money, Don’t Buy Bitcoin. Not Yet, anyway.

Although Kiyosaki’s track record as a businessman could be better, he has an unusual talent for explaining complex topics in an easy-to-understand way.

His views on money and investing go against conventional wisdom, and he has gained a reputation for being straightforward and advocating for financial education.

This time he’s saying that if you save money, you’re a loser and should invest in real money.

Bitcoin.

Rob Kiyosaki:

SAVERS ARE LOSERS.

Twenty-five years ago, I stated that savers are losers in RICH DAD POOR DAD.

Today, U.S. debt is in 100s of trillions. REAL INFLATION is 16%, not 7%. Fed raising interest rates will destroy the U.S. economy.

Savers will be the biggest losers. Invest in REAL MONEY. Bitcoin.

His message becomes slightly confusing because he says he’s not buying Bitcoin now.

The reason is that he’s waiting for the FED to pivot its stance on increasing interest rates.

When they do, he thinks we’ll see more upward pressure in the price of Bitcoin.

He says many young people became wealthy through Bitcoin, but when the market changed, they got scared.

They were worried because they got rich by speculating and were lucky enough to buy 10k bitcoin at $1 each, making them multimillionaires.

He says they are afraid Bitcoin will go to zero, and they’ll lose everything.

According to Kiyosaki, you should be excited and buy more Bitcoin when the fed pivots.

Robert Kiyosaki:

“BUYING OPPORTUNITY: if FED continues raising interest rates, U.S. $ will get stronger, causing Bitcoin prices to go lower.

BUY more.

When FED pivots and drops interest rates as England did, you will smile while others cry.

Take care”