Ron DeSantis’ Recent Comments About Central Bank Digital Currencies Are the Most Important in History.

Governments are trying to remove your freedom.

Free Commons Image Wiki Media

Ron DeSantis’ most significant problem is his popularity spread like wildfire.

Former President Trump contended that DeSantis pleaded with him for an endorsement during his first run for governor, and if he hadn’t given one, DeSantis would be working in Pizza Hut.

Donald Trump: “Remember this — If it weren’t for me, Ron DeSanctimonious would right now be working probably at a law firm, or maybe a Pizza Hut, I don’t know.”

If Trump attacks you, it’s a sign that you’re a force to be reckoned with and on the right path.

I’ve watched DeSantis in numerous interviews, and while he’s intelligent, diplomatic, and has excellent insights, as the Governor of Florida, he’s pretty vanilla.

He’s also a budget-conscious saver, hoarding away every dollar like a squirrel gathering nuts for winter.

Ron DeSantis opted to sleep in his office instead of renting or buying a house in Washington, D.C. He brought a cot and a sleeping bag to his workspace and even used the congressional gym to shower.

His cost-conscious behaviour came out when a story leaked that he used to cut his own hair while he was a congressman.

According to reports, DeSantis would keep a pair of hair clippers in his office and occasionally give himself a quick trim during breaks in his busy schedule.

Even if it was just for some positive PR narrative, it’s the type of moral, political display you like to see from a politician committed to saving taxpayers’ money.

He has all the personality traits you’d expect from a British politician, except he’s American and has a good chance of winning the next election.

CBDCs have become a hot topic in the crypto world. On a national stage, Presidential hopefuls are using them as a political hockey puck which could become a vital issue for either party’s platform in the 2024 presidential campaign.

Governor DeSantis has expressed concerns about the increasing power of central economic planners over people’s daily lives and the economy.

He thinks it’s a bad idea for President Biden to explore creating a U.S Central Bank Digital Currency (CBDC) controlled by the government and giving them access to everyone’s activities.

The governor is urging the legislature to pass laws that forbid using CBDC as money in Florida’s financial sector due to the potential for government surveillance.

Ron DeSantis — Source

“The danger of the (CB) digital currency is that they (The government) want to make it the sole currency.

They want to get rid of crypto.

If you want to invest in crypto, it’s up to you. You can do it. You can make those decisions.

They don’t like crypto because they can’t control it.

They want everything in a Central Bank Digital Currency, and I guarantee that if they can get away with it, they will impose ESG and social credit scores onto that. That will be a massive reduction in freedom for people in this country.

They haven’t done it yet. Congress would not authorise it.

Still, suppose the fed or the treasury tries to do it unilaterally in Florida. In that case, we’ll have a prohibition against that to ensure your financial independence and ensure we don’t have a financial surveillance state.

The government know every transaction that you’re making. That’s wrong.”

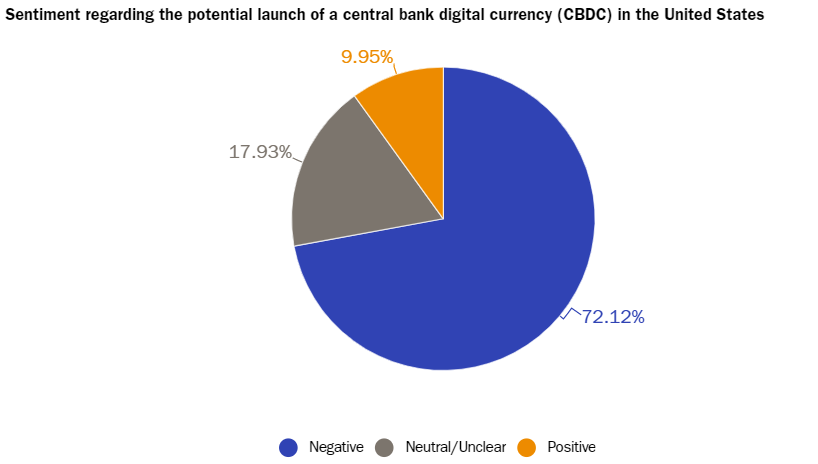

How Americans Feel Is Reflected in the Data.

It’s interesting to see how people’s opinions on central bank digital currencies (CBDCs) differ from those of the government. While governments view CBDCs as the future of money, many Americans are not too keen.

The Federal Reserve request for comment on its CBDC discussion paper received 1,517 comment letters about CBDCs that they released on their website.

Seventy-two per cent of the commenters asked the Fed to stop its plans or showed a negative opinion towards CBDCs.

Most commenters expressed concerns about the risks to financial privacy, financial oppression, and the destabilisation of the financial system.

Given their efforts to monitor criminal activity, the Fed asked whether privacy can be offered without anonymity. In response, over 300 commenters said, “It can’t” or “It won’t”.

Here are some notable comments

Privacy without anonymity is an oxymoron. [A] CBDC will cut off people from the financial system who the government doesn’t like but serve valuable societal roles. — Commenter #406

It can’t [offer privacy without anonymity], and you won’t anyway. This is the absolute reason why this is a bad idea. The “but illicit activities” excuse is too alluring, and you will use it en masse to review every little transaction of every American citizen. — Commenter #134

You cannot have both [privacy and surveillance]. It is better to deal with the cause of the illicit financial activity instead of attacking its financial medium of exchange because that happens to be the same medium used in 99%legitimate uses. — Commenter #282

Handing Power to the Central Bank Is Like Opening a Massive Can of Worms.

DeSantis is worried some states are trying to allow the use of CBDCs through state laws.

He’s asking the Florida legislature to stop CBDCs from becoming part of Florida’s laws to protect citizens’ financial privacy. He thinks that if CBDC becomes law, the central bank will have too much power and use it for its agenda.

Ron DeSantis — Source

“You’re opening up a major can of worms, and you’re handing a central bank huge amounts of power, and they will use that power. If we’ve seen anything over the last four or five years, it’s if they can do their agenda, they will do their agenda in any way they can.

Think about some of the stuff that’s happened with the banking situation.

You know, the deposits are protected by law up to $250,000. Above that, it’s not protected. Congress never changed that law, and yet somehow, the administration, the Fed, the Treasury, they’re removing that cap for some of these banks. And so, the law is not going to impede them.

If they can get the CBDC, they’ll use that to benefit their agenda.

If we can get a groundswell of states to say no, we will not give you this power; ultimately, cash is king. If you can hold it in your hand, you have power over that.

The minute it’s all digitised, somebody else will have control over that, and it’s just a question of whether they will let you live your life. Will they decide to do things to circumvent what you want to do?”

Final Thoughts

Every online payment we make or receive has a level of surveillance.

My crypto taxes were the easiest thing I’ve ever had to complete, I connected my wallet address to some tax software, and every transaction I’ve ever made shows up.

It dawns on you that Blockchains are a public ledger, so privacy is a farce unless you have an anonymous wallet.

But what would happen if you wanted to sell something and have it in cash? You’d go through the standard KYC on a centralised exchange giving up your personal information.

It’s all surveillance.

Ultimately, CBDCs are a better technology to our current banking system; when technology is better, it doesn’t care about people’s feelings or conspiracy theories.

It’s in the government’s interest to use a trusted system to manage our primary method of exchange.

After all, we’re not using Bitcoin and Ethereum as a utility or mode of exchange to buy food. We’re buying it in the hope it goes up in price.

There are some significant drawbacks of CBDCs, such as the potential for surveillance, social credit scores, and payment/purchase restrictions; there are also many significant benefits.

They can facilitate cross-border payments, which can be challenging with traditional fiat money.

CBDCs can provide financial inclusion for those who are currently unbanked or underbanked.

They can provide a digital alternative to cash, making it easier for people to access financial services and participate in the digital economy.

CBDCs can benefit people in developing nations with limited access to traditional banking services.

They can enhance financial transparency and reduce the risk of fraud and money laundering.

CBDCs can enable central banks to better monitor and respond to economic activity.

They can reduce the reliance on physical cash, which can be costly and inconvenient to produce, store, and transport.

You might see Ron DeSantis’ recent political move as brilliant, even a defining moment in history, especially in light of the current government’s extended control following the pandemic, including lockdowns and mandatory travel vaccinations.

A common tactic used to incite fear and rally support is to suggest that the government is taking away people’s liberty and cannot be trusted.

It’s true, and it’s why it’s effective.

As we shift towards a more digital world, governments are taking action to prevent Cryptocurrencies from dominating the market and damaging their countries’ economic stability.

For it to work, they need our trust.

CBDC will put us one step closer to 1984.. oppose by all means.

Fully expect this (CBDC’s) to be a talking point during 2024 debates.

Jerome Powell recently stated that absent legislative changes to the Fed’s mandates, they would not be able to pursue this. He is technically correct.

However, pursuing CBDC’s is a stated desire by the Biden WH per Executive Order.

Here’s the thing - they would likely not be great for consumers, but even worse for the livelihoods of the Nation’s robust community banking system.