Saving Is for Losers; Cryptocurrencies Next Cycle Can Change Your Life.

If you lean into the data, you’ll have a much clearer insight into what’s on the horizon.

Photo by Andre Hunter on Unsplash

Simply saving money is not enough to ensure a secure future.

It’s a trap.

Don’t get me wrong; I’m from the old-school thinking of living within your means and spending less than you make.

Heck, who doesn’t like to have a little pot of savings as an emotional barrier for the ups and downs of life?

You can’t go wrong with not having debt and keeping your ‘powder dry’, but we’re going through the perfect storm of a once-in-a-century opportunity.

A recession is looming, and people are scared sh*tless = Lower cost basis on investments.

You’re starting to see less scepticism about Cryptocurrency = More adoption.

Because of the excessive money printing, currencies as we know it are reaching maturity and debasing faster than you can say CBDC = Floodgates will open for the consumerisation of Crypto.

The phrase “cash is trash” is relevant because governments, businesses and the general public took money straight off the printer and spent it like drunken sailors.

Truisms we once thought were applicable don’t fit in today’s world.

“Save for a rainy day.”

“A penny saved is a penny earned.”

“Save for retirement.”

Your money is sleepwalking to a slow death.

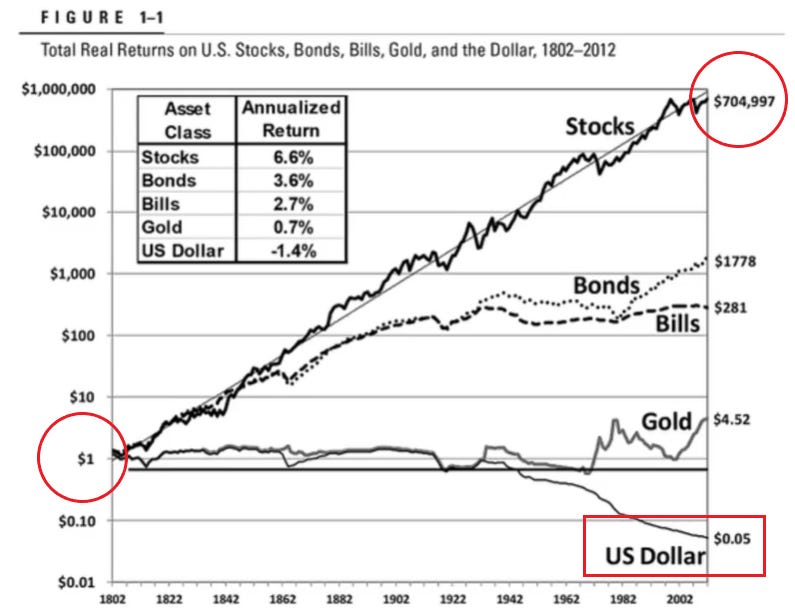

The below chart featured in Jeremy Siegel’s Book “Stocks For The Longrun” is incredibly significant.

It directly compares the stock market’s total actual returns with other asset classes, covering the period from 1802 to 2012 and considering inflation.

One-dollar investment in the stock market would have skyrocketed to over 700 thousand dollars (Estimated to be $ 1.5 million in 2023).

Bonds come second in performance, but their returns are minuscule compared to the astronomical returns from stock.

Even when you account for the infamous stock market crash of 1929 that scared off countless investors from stocks, it’s nothing more than a blip when you look at the bigger picture of the total stock return index. The overall upward trend of stock returns casts a shadow over the bear markets that once instilled fear.

If you held onto one dollar from 1802 until 2012, its purchasing power would have diminished significantly, equivalent to just five cents.

The decline in cash value accelerated after the 1930s and since the “Nixon shock” in 1971. The term “Nixon shock” refers to economic measures implemented by President Richard Nixon in response to rising inflation. These measures included:

Wage and price freeze.

Surcharges on imports.

Removal of the U.S. Dollar from the Gold standard

Your Cash has been slowly marching towards extinction for a hundred years. And the only actual investment vehicle that would give you significant returns would have been the Stock Market.

Recently there’s a fascinating new asset class emerging right under our noses.

Let’s dive into it.

Never Have You Had the Chance To Get 100 x on an Asset Already Up 2 Million Per Cent.

To discover future trends and societal and cultural shifts, you only need to look at what younger people are up to.

Today they’re often more knowledgeable about Cryptocurrency than any other option available regarding investing.

There’s been a growing trend of 20 to 40-year-olds investing in Cryptocurrencies instead of other assets like Gold and Stocks because the new generation of tech-savvy people has grown up with digital assets as a part of everyday life.

Over the next few decades, millennials will become the dominant investor class, so it’s essential to look at what they’re trending towards.

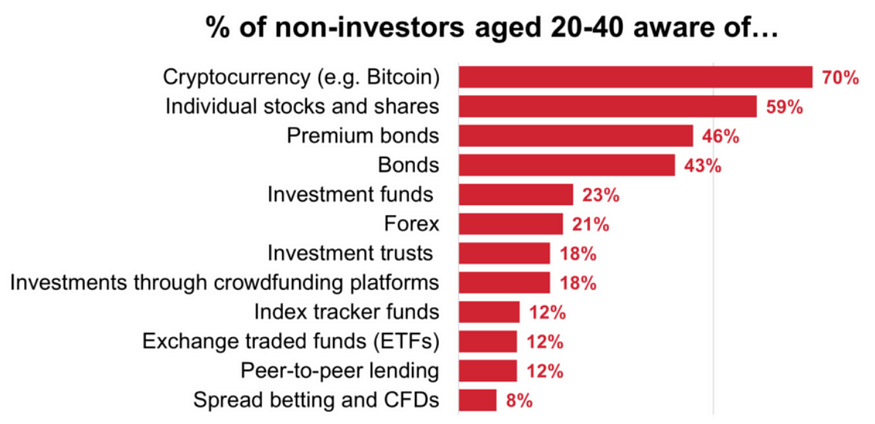

Even among non-investors, millennials without exposure to Crypto are aware of individual Cryptocurrency investments like Bitcoin and Ethereum. According to data from the Association Of Investment Companies, 70% of people in the 20 to 40 category know about ETH and BTC as investment opportunities.

In contrast, only 59% could name individual stocks and shares as investment opportunities.

Bonds were 43%

Forex 21%

Crowdfunding Investments 18%

Index Tracker Funds 12%

ETFs 12%

You’ll Understand What’s on the Horizon if You Know the Crypto Cycles.

It’s only a matter of time before Crypto Explodes.

It already has.

It doesn’t appeal to the younger generation to hold physical assets or settle for a poultry 8% a year in the stock market when they can easily store and self custody digital assets.

Crypto is snowballing so fast it’s expected to reach a Billion people by the end of 2024. Given the potential for massive adoption and explosive growth, getting cryptocurrency exposure is a no-brainer.

But there’s a significant catch.

Crypto markets are cyclical, and the price usually trends in line with liquidity in the market and the Bitcoin halving, which happens every four years. The sentiment is generally positive in the run-up to each halving.

Halving cuts the Bitcoin miners’ rewards in half and halves the rate at which new Bitcoin gets released into circulation — less supply is bullish.

Cycles usually follow a pattern of four stages.

Accumulation phase

Run-Up Phase (Bull Market)

Distribution Phase

Run-Down Phase (Bear Market) *We are here*

When liquidity dries up, people have less money to invest in assets, which leads to boom and bust cycles.

When times are bad, your Monday morning quarterbacks will say Cryptocurrency is a Ponzi scheme, and when prices pump, they’ll most likely be jumping on board during the next cycle.

History has shown that Crypto has a way of bouncing back and proving its worth because behind the volatility is a profound technology.

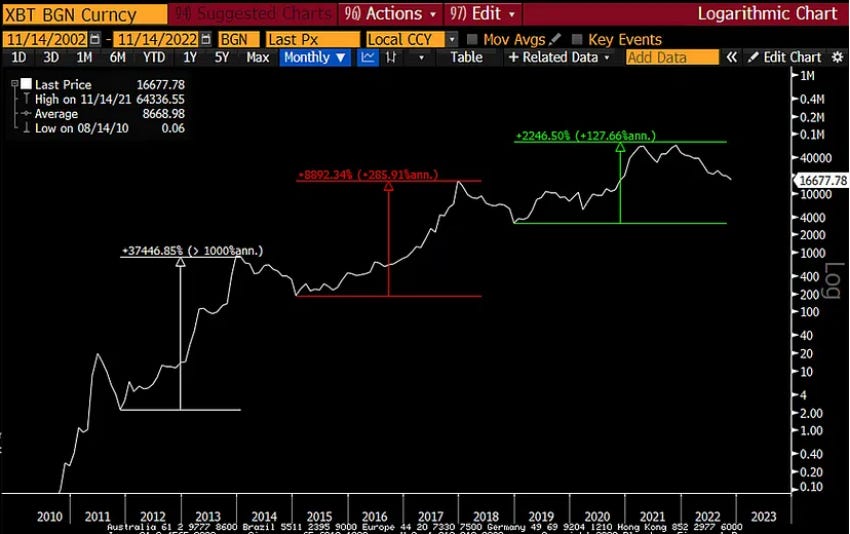

Take the chart below for an asset like Bitcoin, which is still going through its discovery and adoption phase.

Unlike other assets, each new low beats the previous market cycle high, leading to substantial price increases every time. The liquidity always comes back every time, and the network keeps growing.

Final Thoughts.

Protecting yourself from the value destruction of the dying fiat system and your dwindling spending power may seem far-fetched.

Interest rates will increase to bring inflation down, and wage increases will increase to tackle the cost of living.

I have yet to meet someone still alive from 1802, so the $1 price evaluation over 200 years might not seem all that relevant.

The point is all those things are out of your control. You have minimal influence over government policies and what they’ll do in future.

Nothing is guaranteed.

It’s on you to at least educate yourself on Crypto and realise that all new technology since we replaced horses with trackers were considered fads.

No one is coming to rescue your pot of savings.

It’s time to realise there’s a better way.

Spot on!

Money isn't slow walking to death anymore, it's beginning to sprint! And that's with official government numbers, the real numbers are even worse.